Navigating Budget 2024: Key Insights, Implications, and Impact

Union Budget for 2024-25 has been announced by Finance Minister Nirmala Sitharaman yesterday 23 July 2024. This was one of the most awaited budgets as this is the first after the unexpected election results. The budget focused on the economic growth of the country through upskilling and better lifestyle of people. The total expenditure as anticipated in this Union budget is around ₹ 48.21 lakh crore, while the receipts excluding borrowings estimated at ₹ 32.07 lakh crore. To understand the 2024-25 budget, let’s dig deeper.

Key Highlights

- Union Budget Focus: The primary focus of the government as indicated by this budget is generating more opportunities for the people of India. The government will be focusing on nine key areas to achieve its goal of ‘Vikshit Bharat by 2047’. These nine areas include better productivity and resilience in the agricultural sector, followed by developing skills and making the youth employable, inclusive human resource development and social justice, boosting manufacturing and service sectors, energy security, urban development, infrastructural progress, research and development, innovation, and advanced reforms to uplift and develop India.

- Financial Sector: This Union Budget has been a game changer for the entire financial market. There is something or other for banks brokerage houses, to other financial services. For instance, the Mudra loan limit has been doubled in this budget from ₹ 10 lakhs to ₹ 20 lakhs (provided they have repaid their earlier loans). Housing Finance companies applauded the budget as the government announced ₹ 10 lakh crore support for middle-class housing facilities. FM has also announced that the government will be coming up with a Financial Sector Vision and Strategy Document for the next five years soon. The document will have the objectives for meeting the financial needs of the economy. It will have guidelines and agendas for financial institutions, regulators, market participants, and government for the next five years.

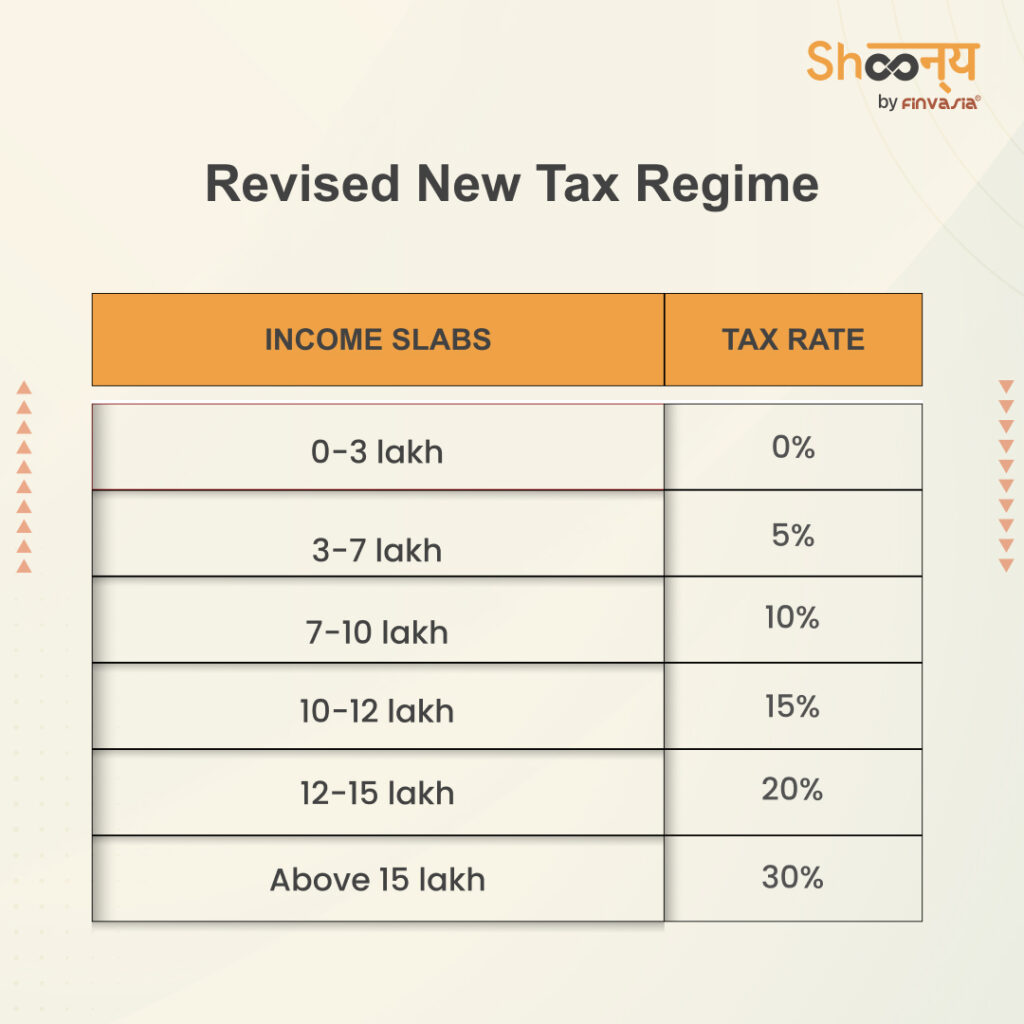

- Taxation: This budget has simplified the IT Act, of 1996, easily understandable by everyone. Then the standard deduction for salaried employees has been increased to ₹ 75000 from ₹ 50000 earlier, provided the taxpayer is opting for the new tax regime. Even for the pensioners, the deduction limit has been increased to ₹ 25000 from ₹ 15000 earlier. Apart from the increase in deductions, the tax slabs have been altered too. Now salaried people opting for the new tax regime can save ₹ 17500 against ₹ 12500 earlier.

Revised New Tax Regime

| Income Slabs | Tax Rate |

| 0 – 3 Lakh rupees | NIL |

| 3 – 7 Lakh rupees | 5% |

| 7 – 10 Lakh rupees | 10% |

| 10 – 12 Lakh rupees | 15% |

| 12 – 15 Lakh rupees | 20% |

| Above 15 Lakh rupees | 30% |

While people are rejoicing about the revised tax slabs, and increased deduction limits, the capital gain taxes on the other hand have been increased. The long-term capital gain tax has been raised to 12.5% from 10% earlier; however, the minimum profit limit has also been raised to ₹ 1.25 lakh against ₹ 1 lakh earlier. This applies to all non-financial and financial assets. For listed financial assets, a long-term capital gain will be considered if held for more than 1 year. For all other assets, the holding period is 24 months, after which LTCG can be levied on profits, if investor redeem the investment. The short-term capital gain taxes have also been raised to 20% from 15% previously. This is though for certain financial assets.

- Green Initiatives: Sustainability and green initiatives have been a crucial point in this budget. Since the interim budget of 2024, under PM Surya Ghar Muft Bijli Yojana, more than 1.28 crore registrations have been done, with more in the pipeline. In line with the interim budget, FM announced 300 units of free electricity under this scheme. Apart from these, the finance minister also announced that the government is working on the roadmap to achieve its net zero target, especially on shifting the industries that add most to the carbon emissions.

- Social Impact: This 2024-25 budget has been a social budget as the focus is on generating employment opportunities for the youth of the nation. FM announced three schemes for employment and skill development which are –

- First-time employees registered under EPFO will receive a direct benefit of a one-month salary maximum of up to ₹15000 in three installments.

- Both the employee and the employer will receive direct incentives for new employees for the first four years of employment.

- Employers are to receive reimbursement on their EPFO contribution up to ₹ 3000 per month for the first two years of employment of each additional employee.

- While the above three schemes are announced to directly boost employment, the government will introduce a skilling program as well. For instance, 1000 it is will be upgraded, and different collaborations to take place state-wise to make people employable as per industry needs.

- FM Nirmala Sitharaman has also announced internship opportunities for one crore youth. Top companies to offer internship opportunities for five years.

- Government internship opportunity – The Prime Minister’s Internship has also been announced. This will be a 12-month-long internship opportunity with a monthly stipend of ₹ 5000.

- Model Skill Loan Scheme will also be revised and 25000 students every year can benefit from the same. Under this scheme, the government with its guarantee will facilitate loans up to ₹ 7.5 lakh.

- For developing the northeast region of the country, more than 100 Indian post-payment bank branches will open.

- For women and girls, schemes worth ₹ 3 lakh crore have been announced.

- Economic Growth: This 2024-25 budget is expected to boost the manufacturing and agricultural sector, especially the MSMEs with increased Mudra loan limits and other schemes and benefits. The upskilling programs can bring holistic economic growth to the country. The government has lowered its fiscal deficit for FY25 as well to 4.9% of the GDP and allocated 3.4% of the GDP for Capital expenditure. However, as the STT and capital gain taxes have been raised, the rupee fell to a new intraday low of ₹ 83.72 against each US Dollar.

- Other Highlights

- PM AWAS Yojana Urban 2.0 to facilitate housing for one crore poor and middle-class families with an investment of ₹ 10 lakh crore

- A Venture Capital Fund of ₹ 1000 crore is to be created to expand the Space Economy by five times.

- To boost startup investments, the Angel Tax has been abolished in this budget for all classes of investors.

- To invite foreign investments, corporate tax on foreign companies has been reduced to 35% from 40%

- Custom duty reduced on 25 critical minerals.

Impact on Stakeholders

- Investors: As STT and capital gain taxes have been raised, the investors and the traders face the consequences. STT on futures has been raised from 0.0125% to 0.02%, and on options, it has been increased to 0.1% from 0.0625% previously. The Nifty and Sensex and other market indices plunged more than 1% yesterday and today it has decreased further. Higher STT and capital gain taxes mean a higher cost of trading and more taxes on gains from your investments. Long-term capital gain tax has been raised to 12.5% from 10% while short-term capital gain tax raised to 20%, 15% earlier.

- Common Man: This budget was for the common man. The employment and skilling schemes, internship programs, social welfare schemes, increase in Mudra loan limit, lower taxes, and higher standard deduction can help people better their financial and living conditions. TDS structure has also been changed which can help the common man in different ways –

- TDS paid on rent is to be slashed to 2% against the present 5% as proposed in the Finance Bill yesterday

- Now TCS deducted from the minor’s income can be claimed by the parents only if the minor’s income is clubbed with the parents’ income. earlier, parents couldn’t claim TCS deducted from the minor’s income.

- Salaried employees can alsl claim credit of TCS collected from 1 October 2024. All TCS collected, or TDS deducted will be clubbed within TDS deduction as anounced in the budget.

These changes in the TDS will help people retain more money in their hands. This in turn help them save and invest more, and also boost consumer demand.

Platinum, Gold and silver prices to drop whcih can boost the consumer demand. These most demanded metals will be now less expensive for common man.

New Custom Duties on your favourtie metals

| Metal | Previous Customer Duty | Current Custom Duty |

| Gold | 15% | 6% |

| Platinum | 15.4% | 6.4% |

| Silver | 15% | 6% |

Apart from revising tax rates, there are some other changesin this budget whcih can simplify income tax for common man.

- Now one can open reassessment of ITR beyond three years provided the escaped income is over and above Rs. 50 lakhs. The reaassessment can be done within five years from the end of the assessment year.

- Vivad Se Vishwas Scheme will help reduce income tax disputes and offer faster resolution.

- From 10 years to 6 years – time limit reduced for search cases

Sectoral Impact

- Agriculture: For the agriculture sector, ₹ 1.52 lakh crore has been allotted in this budget. The government will introduce 109 high-yielding and climate-resilient crops. This can help the farmers produce more variety and quantity as well, which can boost the overall sector. The push towards natural farming can help reduce the harmful effects of pesticides and fertilizers and help secure the natural quality of the lands. The initiative to establish 10000 need-based bio input resource centers can boost the natural farming goals. Initiatives for becoming self-sufficient in the production of oil seeds can help reduce imports.

- Real Estate: The real estate sector and housing finance sector have been positively impacted by the announcement of ₹ 10 lakh crore housing projects under PM AWAS Yojana for poor and middle-class living in urban areas.

- Manufacturing: this sector gets a great push with the increase in Mudra loan limit, especially the MSMEs operating in the sector. Also setting up of E-commerce export hub can enhance productivity and increase profitability.

- Infrastructure: This sector rejoiced the budget 2024-25 as ₹ 1111111 crore has been allocated for capital expenditure. Central government to offer ₹ 1.15 lakh crore provision for a long-term interest-free loan to state governments for infrastructural development. Road connectivity projects worth ₹ 26000 crore have been announced which has given the sector another push.

- Technology and Innovation: The space Economy has got a major boost from yesterday’s budget as ₹ 1000 crore was sanctioned for setting up a venture capital fund for the next ten years to boost the space economy by five times. To boost private sector research and innovation, ₹ 1 lakh crore investment was granted.

Changes in GST

Apart from eye-catching changes in direct taxes, this budget also altered different provisions of goods and services tax (GST). For dealing with ambiguities in GST payments and refunds, Section 74A has been introduced. Then section 11A has been included to assist the government regularise non-levy or short levy of central tax due to any general practice. Apart from these, there are other GST amendments which we will be discussing in our next blog

Conclusion

The budget of 2024-25 is expected to bring some significant changes in the economy and the market. With a primary focus on the job creation and skill development, the economy can grow significantly in the long term. Most of the schemes and plans of the government announced in this budget have long-term positive effects. However, an increase in the capital gain taxes and STT took a toll on the currency valuation and the stock market.

Source: https://pib.gov.in, https://energy.economictimes.indiatimes.com

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.