We all have been in a situation when urgent money was required, and we felt helpless.

We usually rely on our credit cards when we need to borrow money for smaller expenses. But for larger expenses that go beyond our credit limit, personal loans step in to help. Whether it is a medical emergency, a school trip for your child, a home repair, or an unavoidable expense, we often look for some quick and easy financing options. However, when analysing credit card loans vs personal loans, which is better for urgent needs?

Let’s find out.

What is a Credit Card Loan?

A credit card loan is a type of loan you can get using your credit card. You can either withdraw cash from an ATM using your credit card or transfer money from your credit card to your bank account online.

A credit card loan is also known as a cash advance.

A credit card loan is convenient and fast, as you can get instant access to funds without any documentation or approval process.

However, a credit card loan also comes with some drawbacks, such as

- High-interest rates: A credit card loan usually charges a higher interest rate than a regular credit card purchase.

The interest rate can range from 18% to 40% per annum, depending on your card issuer and your credit score. The interest is calculated from the day you withdraw or transfer the money until you repay the full amount.

- Additional fees: A credit card loan may also incur some additional fees, such as a cash advance fee, a transaction fee, a service tax, and a GST.

These fees can add up to a significant amount, increasing your overall borrowing cost.

- Low limit: A credit card loan has a limit, which is a percentage of your total credit card limit.

For example, if your credit card limit is Rs. 50,000, and your cash advance limit is 40%, then you can only borrow up to Rs. 20,000 as a credit card loan. This may not be enough to meet your urgent needs.

- Impact on credit score: A credit card loan can also affect your credit score negatively, as it increases your credit utilisation ratio.

This is the percentage of your available credit that you are using.

A high credit utilisation ratio indicates that you are relying too much on credit and may lower your credit score.

What is a Personal Loan?

A personal loan is a type of unsecured loan that you can use for any purpose, such as room renovation, your own trip, your kid’s school excursion, etc.

A personal loan is offered by banks, NBFCs, and online lenders based on your income, credit score, and repayment capacity.

A personal loan has some advantages over a credit card loan, such as

- Lower interest rates: A personal loan usually charges a lower interest rate than a credit card loan, depending on your credit profile and the lender.

The interest rate can range from 10% to 24% per annum, saving you a lot of money in the long run.

- Higher limit: A personal loan can offer you a higher loan amount than a credit card loan, depending on your eligibility and the lender.

You can borrow up to Rs. 40 lakhs as a personal loan, which can help you meet your urgent needs.

However, this may not be the case with everyone. There are multiple factors based on which an instant personal loan is issued.

- Flexible tenure: A personal loan also allows you to choose your repayment tenure, which can range from 12 months to 60 months.

You can opt for a shorter tenure to save on interest or a longer tenure to reduce your monthly EMI.

- No impact on credit score: A personal loan does not affect your credit score as much as a credit card loan, as it does not increase your credit utilisation ratio.

However, you still need to pay your EMIs on time and in full to maintain a good credit history.

However, a personal loan also has some disadvantages, such as

- Documentation and approval: A personal loan requires you to submit some documents, such as your identity proof, address proof, income proof, and bank statements, to verify your eligibility and creditworthiness.

You also need to go through an approval process, which can take from a few hours to a few days, depending on the lender and your profile.

This can delay your access to funds, which may not be ideal for your urgent needs.

- Processing charges: A personal loan may also charge some processing fees, such as a loan origination fee, a prepayment fee, a late payment fee, and a GST.

These charges can vary from lender to lender and increase your overall borrowing cost.

Credit Card Loan vs Personal Loan: How to Choose Between Both?

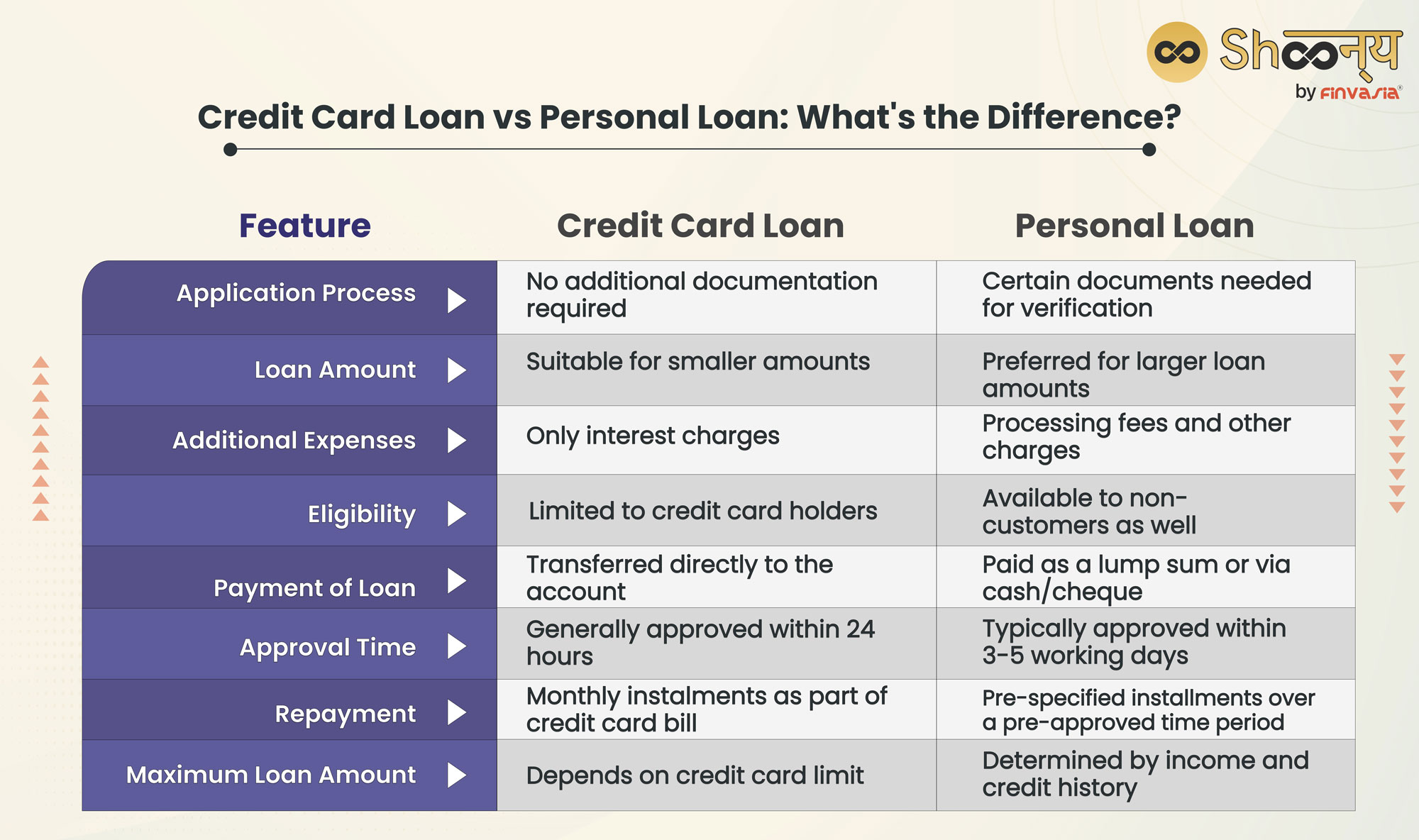

| Basis | Credit Card Loan | Personal Loan |

| Nature of Credit | Revolving line of credit | Fixed loan amount |

| Interest Rates | Typically higher | Typically lower |

| Repayment Terms | No fixed term, payment flexibility | Fixed-term, fixed monthly payments |

| Access to Funds | Instant access to funds | Disbursed in a lump sum |

| Security | Usually unsecured | Can be secured or unsecured |

| Payment Structure | Minimum monthly payments | Fixed monthly payments |

| Debt Management | Potential for high debt accumulation | Helps manage debt more effectively |

| Credit Utilization Impact | This can lead to high credit utilisation | Less impact on credit utilisation |

Credit card loan vs personal loan

In the choice of credit card loan vs personal loan, the decision depends on several factors, such as

- Your loan amount: If you need a small amount of money, such as Rs. 10,000 or Rs. 20,000, then a credit card loan may be a better option, as it can offer you instant access to funds without any hassle.

However, if you need a large amount of money, such as Rs. 50,000 or Rs. 1 lakh, then a personal loan may be a better option, as it can offer you a lower interest rate and a higher loan amount.

- Your repayment capacity: If you can repay the loan amount within a short period of time, such as a few days or a few weeks, then a credit card loan may be a better option, as it can save you from paying a lot of interest.

However, if you need more time to repay the loan amount, such as a few months or a few years, then a personal loan may be a better option, as it can offer you a flexible tenure and a fixed EMI.

- Your credit score: If you have a good credit score, such as above 750, then a personal loan may be a better option, as it can offer you a lower interest rate and a higher loan amount.

However, if you have a low credit score, such as below 600, then a credit card loan may be a better option, as it does not require any credit check or approval process.

Role of Credit Scores in Personal Loans

Credit scores play a crucial role in personal loans.

A good credit score demonstrates your reliability to lenders, increasing your chances of obtaining a larger loan with lower interest rates.

To ensure a healthy credit profile, avoid unnecessary borrowing, whether it’s through a credit card or a personal loan.

Consider your needs carefully when deciding between the two: a credit card loan vs a personal loan.

For smaller amounts that you can repay quickly, using a credit card may be preferable.

However, for larger sums that require a longer repayment period, opting for a personal loan is advisable.

Know how to get a personal loan with a low credit score.

Conclusion

Credit card loans vs personal loans is a common fix for many people who need urgent money. Both options have their pros and cons, and the best choice depends on your situation and preferences. You should compare the interest rates, fees, limits, tenures, and impact on the credit score of both options before making a decision. You should also consider your financial goals and budget before borrowing money.

Remember, borrowing money is easy, but repaying it can be hard.

So, borrow wisely and responsibly.

FAQs| Credit Card Loan vs Personal Loan

The choice depends on factors like your financial situation and borrowing needs. Personal loans typically offer lower interest rates and fixed repayment terms, while credit cards provide flexibility and rewards. Before deciding, compare the costs and benefits of each option.

The cost of EMI varies based on factors like interest rates and loan tenure. Personal loans generally have lower interest rates, resulting in lower EMIs. However, credit cards may offer zero or lower-interest EMI schemes for specific purchases. Be sure to check the terms before making a decision.

Both options carry risks, such as affecting credit scores and accumulating debt. Credit cards, with their higher interest rates and variable terms, may pose greater risks than personal loans, which offer fixed rates and terms.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.