With the advent of technology, opening a demat account and trading in the stock market has become easier. But who ensures the protection of your demat account? It is the depositories that hold your securities, like stocks, mutual funds, bonds, ETFs, etc, in electronic form. CDSL and NSDL are two depositaries in India. However, they are not the same. They have some differences in their features, operations, and market share. In this blog, we will understand the difference between CDSL and NSDL.

First, let’s grasp what these depositaries do before we jump to the difference between CDSL and NSDL.

- What is a Depository?

- What is DP- Depository Participant?

- Exploring the Difference Between CDSL and NSDL

- Crucial Role of Depositories in Dividend Distribution

- Benefits of CDSL and NSDL

- CDSL vs NSDL- Similarities

- Services Offered by CDSL and NSDL

- Conclusion: CDSL vs NSDL

- FAQs| Difference Between CDSL and NSDL

What is a Depository?

A depository is a place where securities like stocks, bonds, and mutual fund units are held in electronic form.

It’s like a digital safe for investors’ assets.

How Many Depositories are there in India?

In India, there are two main depositories:

The National Securities Depository Limited (NSDL) and the Central Depository Services Limited (CDSL).

- National Securities Depository Limited (NSDL)

Established in December 1995, NSDL was the first to offer trading in electronic format. It’s the oldest and largest depository in India. - Central Depository Services India Limited (CDSL)

Founded in February 1999, CDSL aims to provide convenient, dependable, and secure depository services.

The Securities and Exchange Board of India (SEBI) regulates these depositories to ensure proper functioning and adherence to regulations.

Let us now take a detailed look at the difference between CDSL and NSDL.

What is NSDL?

NSDL, short for National Securities Depository Limited, is one of the two main depositories in India.

It acts as a digital repository for various financial securities, making it easier for investors to buy, sell, and hold these assets.

What is CDSL?

CDSL, or Central Depository Services Limited, is the other major depository in India. Like NSDL, it holds securities electronically and helps transfer them among investors.

NSDL and CDSL both play vital roles in the Indian financial market. They ensure smooth electronic trading and securities holding.

The primary functions of NSDL and CDSL depositories in India include:

- They keep securities in electronic form, including stocks, bonds, mutual funds, and ETFs.

- NSDL and CDSL make trading and transfers of securities between accounts seamless.

- Depositories ensure swift settlement of trades, enhancing market efficiency.

They provide a centralised system for maintaining and updating investor holdings, ensuring accuracy and transparency.

DP or Depository participants act as intermediaries between investors and depositories, helping investors open Demat accounts for trading.

What is DP- Depository Participant?

A Depository Participant (DP) is like a bridge between investors and the depository. They help investors open and maintain accounts to hold securities in electronic form.

Active Role of Depository Participants in the Indian Securities Market

Depository Participants (DPs) actively contribute to the Indian securities market as intermediaries between the depositories and investors.

- Role of DPs:

- DPs bridge the gap between depositories and investors, facilitating the holding and trading of securities in dematerialised form.

- DPs aid in dematerialisation (converting physical certificates to electronic forms), rematerialisation, and executing trade settlements.

- Registration Process:

- Eligible entities, including financial institutions, banks, stockbrokers, and custodians, must meet SEBI’s criteria regarding net worth and other requirements.

Upon meeting all criteria, SEBI grants a certificate of registration to the entity, allowing it to function as a DP.

- Services Offered:

- DPs open Demat accounts for investors to hold and trade securities in electronic form.

- They facilitate dematerialisation, converting physical share certificates into electronic form for easy trading.

- DPs can also rematerialise electronic securities back into physical certificates if required.

- They assist in the settlement of trades executed on stock exchanges by transferring securities between accounts.

- DPs may offer services where investors can take loans against their securities held in the Demat account.

- Investors can pledge their securities held in the Demat account to avail of loans or for other purposes.

Overall, DPs play a vital role in ensuring the smooth functioning of the securities market, providing accessible and secure investing services.

Demat accounts, abbreviated for ‘dematerialised accounts,’ play a vital role in trading on the Indian stock market.

Here’s why they matter:

- Demat accounts have eliminated the risk of loss or damage by converting shares into electronic records.

- Trading through Demat accounts is much faster and more efficient.

- Demat accounts provide a secure way to hold and track investments.

- Investors can access their Demat accounts online, making it easier to manage and track their portfolios from anywhere at any time.

- A Demat account can hold a variety of securities like stocks, bonds, mutual funds, and ETFs, making it a versatile tool for investors.

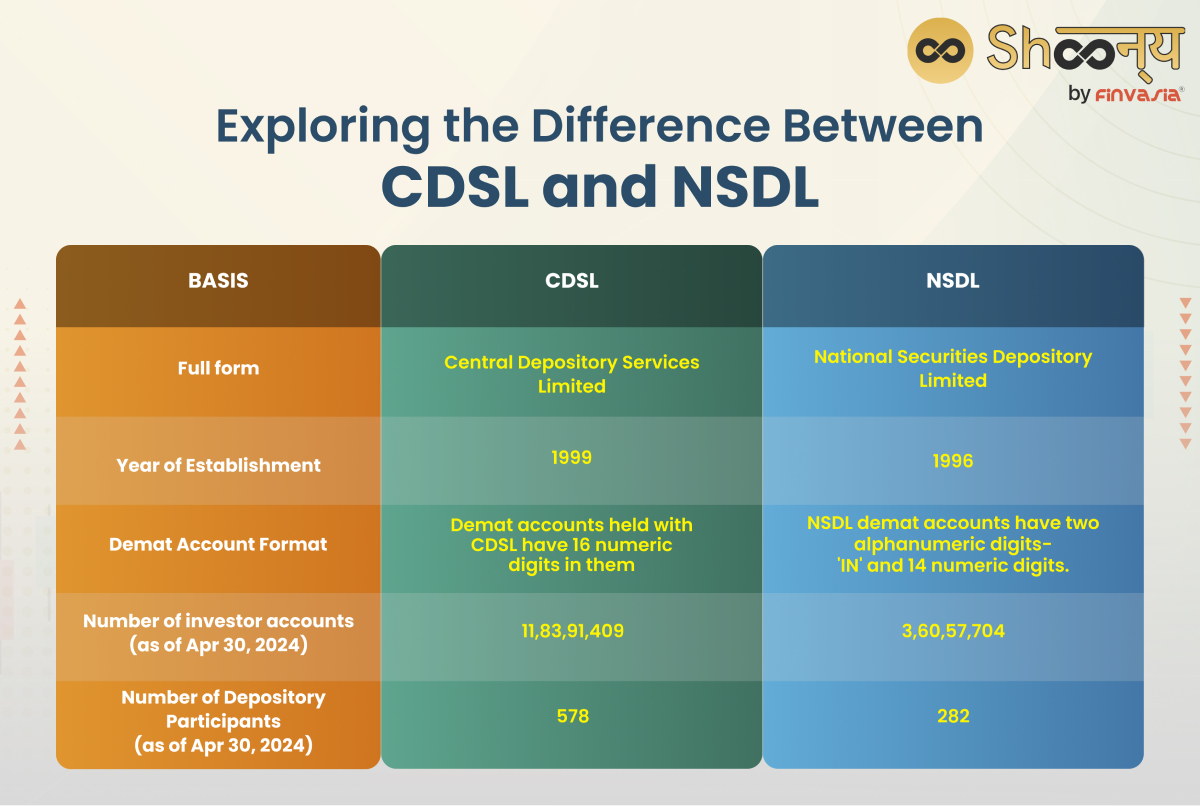

Exploring the Difference Between CDSL and NSDL

| Basis | CDSL | NSDL |

| Full Form | Central Depository Services Limited | National Securities Depository Limited |

| Year of establishment | 1999 | 1996 |

| Demat Account Format | Demat accounts held with CDSL have 16 numeric digits in them | NSDL demat accounts have two alphanumeric digits- ‘IN’ and 14 numeric digits. |

| Number of Investor Accounts (as of April 30, 2024) | 11,83,91,409 | 3,60,57,704 |

| Number of Depository Participants (as of April 30, 2024) | 578 | 282 |

Difference Between CDSL and NSDL

CDSL

- Full form: Central Depository Services Limited

- Year of establishment: 1999

- Primary stock exchange: Bombay Stock Exchange (BSE)

- Promoters: BSE Ltd., along with other banks and financial institutions

- Demat Account Format: 16 numeric digits

NSDL

- Full form: National Securities Depository Limited

- Year of establishment: 1996

- Primary stock exchange: National Stock Exchange (NSE)

- Promoters: IDBI Bank Ltd., Unit Trust of India, and NSE Ltd., along with other banks and financial institutions

- Demat Account Format: Two alphanumeric digits ‘IN’ and 14 numeric digits

Crucial Role of Depositories in Dividend Distribution

Depositories ensure companies possess accurate shareholder information, which is crucial for dividend distribution. They maintain comprehensive records of shareholders and their holdings, tracking ownership changes resulting from sales, purchases, or transfers of securities. This ensures the company’s shareholder list remains current.

When a company declares dividends, depositories directly credit dividend payments to shareholders’ accounts. This helps in streamlining the process and reducing the risk of lost or delayed payments.

Depositories support seamless dividend payments, enhancing trust and efficiency in financial markets.

They serve as intermediaries between companies and shareholders, facilitating smooth profit transfers to investors.

Benefits of CDSL and NSDL

The depository system facilitates ownership and transfer of securities through electronic book entries.

This eliminates the risks of handling paper certificates, benefiting investors in several ways.

For example,

- Elimination of bad deliveries

- Immediate transfer and registration of securities

- Faster disbursement of non-cash corporate benefits

- Reduction in paper handling

- Periodic status reports

- Simplified procedures for change of address and transmission of demat shares

- Simplified selling of securities on behalf of a minor

- Ease in portfolio monitoring

These benefits make investing and managing securities easier, safer, and more efficient for investors using CDSL and NSDL services.

CDSL vs NSDL- Similarities

CDSL (Central Depository Services Limited) and NSDL (National Securities Depository Limited) share numerous similarities:

- Both CDSL and NSDL hold securities like stocks, bonds, and mutual funds in electronic form.

- They offer similar services such as:

- Dematerialisation (converting physical certificates to electronic form)

- Rematerialisation (the reverse process)

- Maintaining investor holdings

- Facilitating transactions.

- The Securities and Exchange Board of India (SEBI) regulates both.

- They both work with various depository participants DPs.

- CDSL and NSDL provide a robust infrastructure for the seamless transfer of securities and settlement of trades, contributing to the overall efficiency of the market.

Investors should focus on their broker’s services and affiliation with either CDSL or NSDL. The choice between the two depositories usually doesn’t matter much.

Services Offered by CDSL and NSDL

CDSL and NSDL offer essential services for managing securities electronically

- Account Maintenance: Records and updates investors’ demat accounts.

- Dematerialisation: Converts physical securities into electronic form.

- Rematerialisation: Converts electronic securities back into physical form.

- Market Transfer: Facilitates safe transfer of securities ownership through stock exchanges.

- Off-Market Transfer: Enables direct transfer of securities outside of stock exchanges.

- Pledge: Allows using securities as collateral for loans or credit facilities.

- Margin Pledge: Enables using securities as collateral for margin trading.

- Nomination: Facilitates appointing nominees for inheriting securities.

- These services simplify electronic securities management and transactions for investors.

Conclusion: CDSL vs NSDL

Choosing between CDSL and NSDL depends on investor preferences and needs. Both provide reliable services in India’s securities market.

Investors should evaluate their DP’s reputation and the required stock market trading services. You must understand your trading preference with the associated stock exchange (NSE or BSE).

Remember that user satisfaction is the top thing to keep in mind when making a choice between CDSL and NSDL.

FAQs| Difference Between CDSL and NSDL

CDSL, or Central Depository Services Limited, keeps securities in electronic form safe for investors. It helps with easy trading, transferring, and settling of securities.

NSDL, or National Securities Depository Limited, does similar work to CDSL. It lets investors hold and trade securities electronically. Additionally, it manages demat accounts and provides participant services.

Yes, you can transfer shares from CDSL to NSDL. You can do it digitally with CDSL Easiest, but it requires a digital signature. Alternatively, you can do it offline in a physical form.

Both NSDL and CDSL are regulated by SEBI, the market regulator in India. They also have their own boards of directors with representatives from various organisations.

You can find out if you have NSDL or CDSL by checking your demat account number. NSDL numbers start with “IN” followed by 14 digits, while CDSL numbers start with 16 digits.

Source- nsdl.co.in cdslindia.com

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.