Difference Between FERA and FEMA: Full Forms and Key Differences

The Indian stock market functions under a regulatory framework that includes two key acts: FERA and FEMA. Now, you may be curious about FERA and FEMA full form. FERA stands for Foreign Exchange Regulation Act, which was enacted in 1973 and repealed in 1999. On the other hand, FEMA stands for Foreign Exchange Management Act, which replaced FERA and is still in force today. However, there is a huge difference between FERA and FEMA in terms of their objectives, scope, provisions, and penalties.

In this blog, we will explain the major differences between FERA and FEMA and share insights on what is FERA and FEMA.

What is FERA Act?

The FERA Act- Foreign Exchange Regulation Act was enacted in 1973 and repealed in 1999.

The FERA Act introduced stringent rules for specific payments, foreign exchange and securities transactions, and dealings. These indirectly influenced foreign exchange, as well as the import and export of currency.

The result?

It was a hindrance to the smooth economic development of the nation.

Key Things You Need to Know About FERA Act

- Full Name: Foreign Exchange Regulation Act.

- Enacted in 1973, repealed in 1999.

- Strict rules on certain payments, foreign exchange dealings, and transactions indirectly affect foreign exchange, currency import, and export.

- Presumed that all foreign exchange earned by Indian residents belonged to the Government and had to be surrendered to the Reserve Bank of India (RBI).

- Treated all offences related to foreign exchange as criminal, with possible imprisonment and fines.

Impact on Economic Growth

FERA’s strict rules were seen as a roadblock to India’s economic growth. It made it harder for foreign investments to enter the country. FERA limited foreign exchange transactions, which slowed down economic development. Under FERA, the Reserve Bank of India (RBI) had a central role in controlling foreign exchange transactions. It required permission from the RBI before most foreign transactions could happen. This control was meant to prevent money from leaving the country and keep the economy stable. However, this made the process slow and difficult. In 1999, FEMA replaced FERA and adopted a more flexible approach.

With FEMA, the RBI’s role shifted. Now, foreign exchange transactions are more flexible, and businesses can operate without needing RBI approval for every deal. This change has helped make foreign investments easier and faster.

Now, what exactly is the FEMA and FERA difference?

Let’s understand the basics of the FEMA Act first.

What is FEMA Act?

The FEMA Act- Foreign Exchange Management Act replaced the FERA Act in 1999 and is still in force.

The main goal of FEMA is to make foreign trade and payments smoother. It also aims to help develop and maintain a healthy foreign exchange market in India. This shift was important because it helped India connect better with the global economy.

FEMA helped remove many restrictions on foreign transactions, making the economy more open and liberal.

Some Basics About FEMA Act

Under FEMA, there are two types of transactions:

- Capital Account Transactions: These involve investments and changes in assets.

- Current Account Transactions: These include trade of goods, services, and income between countries. These transactions reflect how money flows in and out of a country in a year.

A balance of payment keeps track of all financial dealings between countries, split into:

- Current Account: Trade of goods and services, income exchange, etc.

- Capital Account: Investment and financial movements.

The Foreign Exchange Management Act (FEMA) in India comprises 49 sections. These sections are organised into seven chapters, with 12 sections focusing on the operational aspects and the remaining covering contravention, penalties, adjudication, appeals, enforcement directorate, and other related matters.

FEMA applies not only to India but also to Indian businesses and citizens living abroad (NRIs). The law covers several areas:

- Foreign exchange (money from other countries).

- Foreign securities (investments in foreign assets).

- Import and export of goods and services.

- Banking and financial services.

- NRI-owned businesses abroad (if they own more than 60%).

The law is enforced by the Enforcement Directorate based in New Delhi.

FEMA vs FERA: Why was FEMA Introduced?

The need for the Foreign Exchange Management Act (FEMA) arose due to the limitations and challenges posed by the Foreign Exchange Regulation Act (FERA).

When FERA was introduced in 1973, India faced a critical situation with extremely low foreign exchange reserves.

In an effort to boost these reserves, the government adopted a strict approach. As a result of this, all foreign exchange earned by Indian residents, whether living in India or abroad, belonged to India’s government and had to be surrendered to RBI.

However, the intended effects of FERA did not materialise as expected, and the Indian economy faced ongoing challenges.

FEMA addressed the shortcomings of FERA and adapted to the changing needs of the Indian economy.

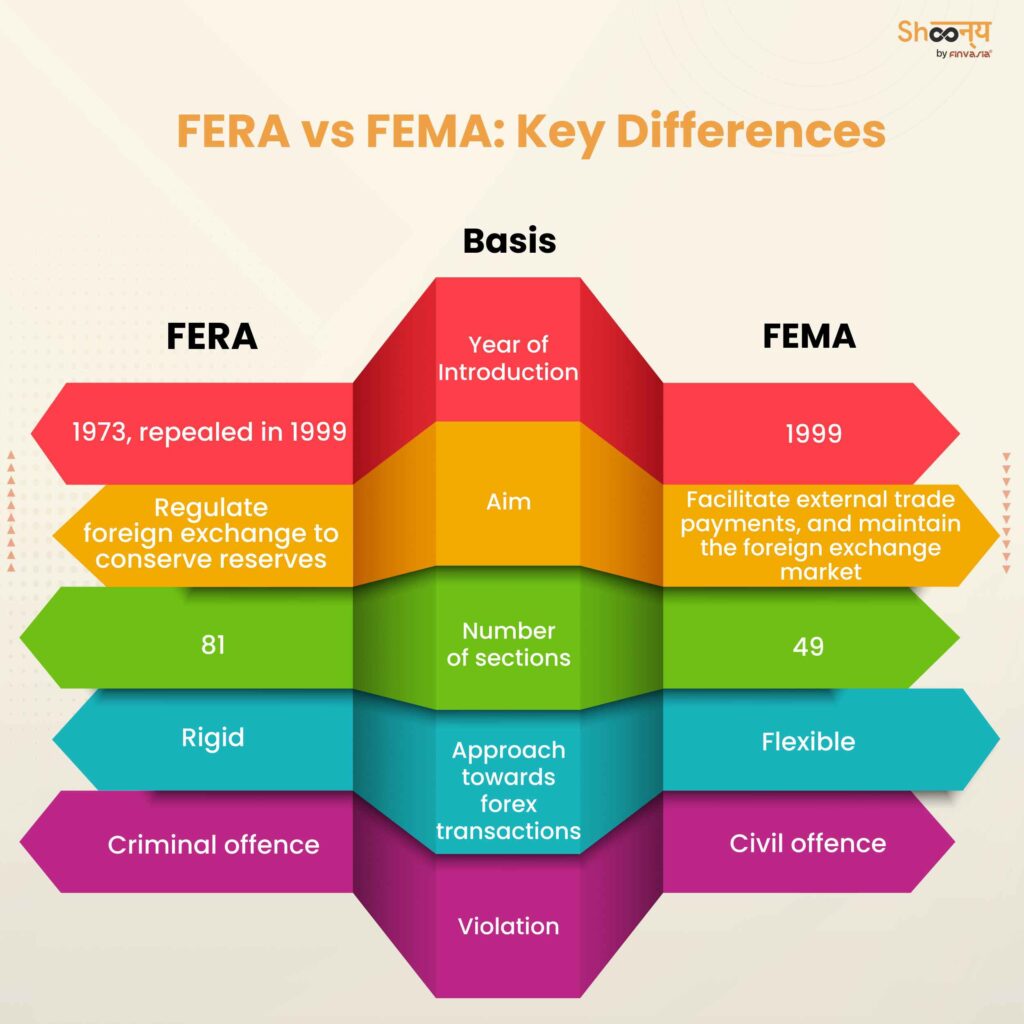

Key Differences Between FERA and FEMA

Both acts have had an impact on how India manages its foreign exchange, but FEMA is the current law. It focuses on facilitating trade and maintaining a stable foreign exchange market.

Definition and Origin

- FERA: Enacted in 1973, FERA was designed to regulate foreign payments in India

- FEMA: Introduced in 1999, FEMA focuses on promoting the orderly management of foreign exchange and payments

Regulatory Style

- FERA: Known for its conservative approach with many restrictive regulations

- FEMA: Embraces a more liberal regulatory style, providing transparency and flexibility

Management of Foreign Exchange

- FERA: Focused on regulating payments and foreign exchange and treated foreign exchange as a scarce resource

- FEMA: Geared towards the orderly management of foreign exchange, offering a transparent and efficient system

Evolution Over Time

- FERA: Predominant in the early years but replaced by FEMA to adapt to changing economic dynamics

- FEMA: Active and more relevant in today’s globalised financial environment.

Conclusion

The Indian stock market is influenced by the foreign exchange market and the transactions involving foreign currency. Therefore, it is important for investors and traders to be aware of the laws and regulations that govern the foreign exchange market in India. By knowing the differences between FERA and FEMA, one can understand the evolution and development of the foreign exchange market in India.

FAQs | Difference Between FERA and FEMA

The shift from Fera to FEMA happened because Fera was a strict and inflexible law that didn’t align with the Government of India’s post-liberalization policies. FEMA was introduced to ease controls on foreign exchange, encouraging foreign trade and payments.

Fera stands for Foreign Exchange Regulation Act, enacted in 1973 to regulate payments and foreign exchange in India. It imposed strict restrictions on specific transactions involving foreign currency and securities. Fera was replaced by FEMA in 1998.

FEMA stands for Foreign Exchange Management Act. It’s a set of regulations empowering the Reserve Bank of India and the Central Government to make rules related to foreign exchange in line with India’s foreign trade policy.

Fera was replaced by FEMA in 1999. FEMA was enacted on December 29, 1999, and became effective from June 2000.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.