Difference Between Futures and Options: Meaning, Features, Types

How can you diversify your portfolio beyond stocks and mutual funds? Have you heard about Futures and options? They are two types of contracts that allow you to speculate on the future price movements of various assets, such as stocks, indices, commodities, currencies, and more. They also enable you to protect your investments from adverse price fluctuations by locking in a predetermined price and date for buying or selling the underlying asset. But what are the key differences between futures and options, and which one should you choose?

Let us take a look!

Understanding Futures and Options

Futures and options are two types of financial derivatives. They allow investors to trade an underlying asset at a predetermined price & date in the future.

Before we jump to the difference between futures and options, you need to know these basics.

What is a Futures Contract?

A futures contract is like making a deal to buy something in the future at a price agreed upon today.

Imagine you’re a farmer, and you want to sell your crop when it’s ready.

But you’re worried the price might drop by harvest time.

So, you make a futures contract with a buyer.

You agree to sell, let’s say, 100 bushels (units) of corn to the buyer for ₹500 each when the corn is ready for harvest in three months.

This contract locks in the price, so even if the market price drops later, you’ll still sell your corn for ₹500 per bushel.

Conversely, if the market price rises, you’re still bound to sell at ₹500 per bushel, missing out on potential profit.

That’s the basic idea behind a futures contract.

- In the Indian market, futures are standardised contracts traded on NSE- National Stock Exchange / BSE- Bombay Stock Exchange.

- When you purchase a futures contract, you are bound to buy the underlying asset at the agreed-upon price at the expiration date.

- Similarly, when you sell a futures contract, you are obligated to sell the asset at the agreed-upon price.

Futures contracts have an unlimited profit potential but also carry unlimited risk, as you are required to fulfil the contract regardless of the market price at expiration.

What is an Options Contract

An options contract offers the holder the right but not the obligation. You can purchase (call option) or sell (put option) an underlying asset at a predetermined price (strike price) within a specified period.

- You pay a premium for the right to buy/ sell at the strike price before the expiration date when you purchase an options contract.

However, you are not obligated to exercise this right if it is not profitable.

- Options provide more flexibility and limited risk compared to futures.

Your possible loss is only limited to the premium paid for the option contract.

Types of Options Contracts

- Call Option

A call option gives the buyer the right, but not the commitment, to buy the underlying asset at a predetermined price (strike price) within a defined period (until expiration).

- For example, if you buy a call option for shares of ABC company with a strike price of ₹50, you have the right to purchase those shares at ₹50 each, regardless of whether the market price goes up to ₹60 or ₹100 per share.

- Put Option

A put option gives the buyer the right, but not the duty, to sell the underlying asset at a predetermined price (strike price) within a defined period (until expiration).

- For example, if you buy a put option for shares of XYZ company with a strike price of ₹80, you have the right to sell those shares at ₹80 each, regardless of whether the market price drops to ₹70 or ₹50 per share.

Now, let’s look at the difference between call and put options.

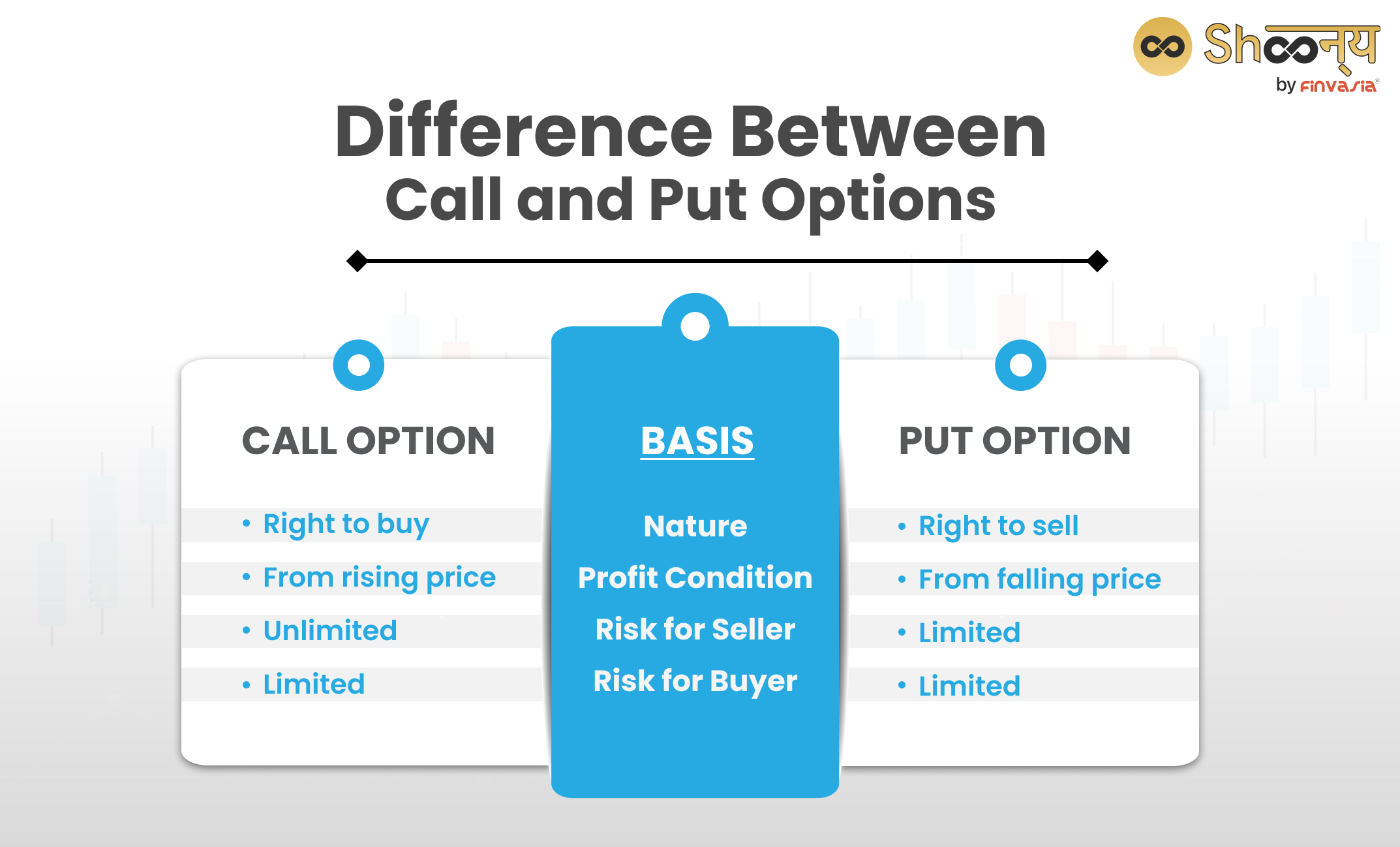

Difference Between Call and Put Options

Here are the basic differences between call and put options in trading.

Difference Between Call and Put Options

| Basis | Call Option | Put Option |

| Nature | Right to buy | Right to sell |

| Profit Condition | From rising price | From falling price |

| Risk for Seller | Unlimited | Limited |

| Risk for Buyer | Limited | Limited |

Direction of Profit

Call Option: Profit is made when the market price (MP) of the underlying asset is more than the strike price.

Put Option: Profit is made when the market price (MP) of the underlying asset is less than the strike price.

Market Outlook

Call Option: Used when the investor expects the price of the underlying asset to rise.

Put Option: Used when the investor expects the price of the underlying asset to fall.

Obligation

Call Option: The buyer has the right to buy the asset at the strike price but is not obligated to do so.

Put Option: The buyer has the right to trade the asset at the strike price but is not obligated to do so.

In summary, call options are used when investors anticipate a rise in the market price of the underlying asset, while put options are used when investors expect a decline.

Futures and Options Example

Let us say that you decide to buy a futures contract for XYZ company at ₹100 per share, expiring in one month.

This means you’re agreeing to buy the shares for ₹100 each in one month, regardless of their actual price then.

- If the price rises to ₹120 per share by the expiration date, you still buy them for ₹100 each, making a profit of ₹20 per share.

- But if the price falls to ₹80 per share, you still have to buy them for ₹100 each, resulting in a loss of ₹20 per share.

Alternatively, you could purchase a call option for XYZ company at ₹100 per share, expiring in one month.

This gives you the right, but not the obligation, to buy the shares for ₹100 each within the next month.

- If the price goes up to ₹120 per share, you can exercise your option and buy them at ₹100, making a profit of ₹20 per share.

- But if the price drops to ₹80 per share, you can simply let the option expire and avoid buying the shares, limiting your loss to the premium you paid for the option.

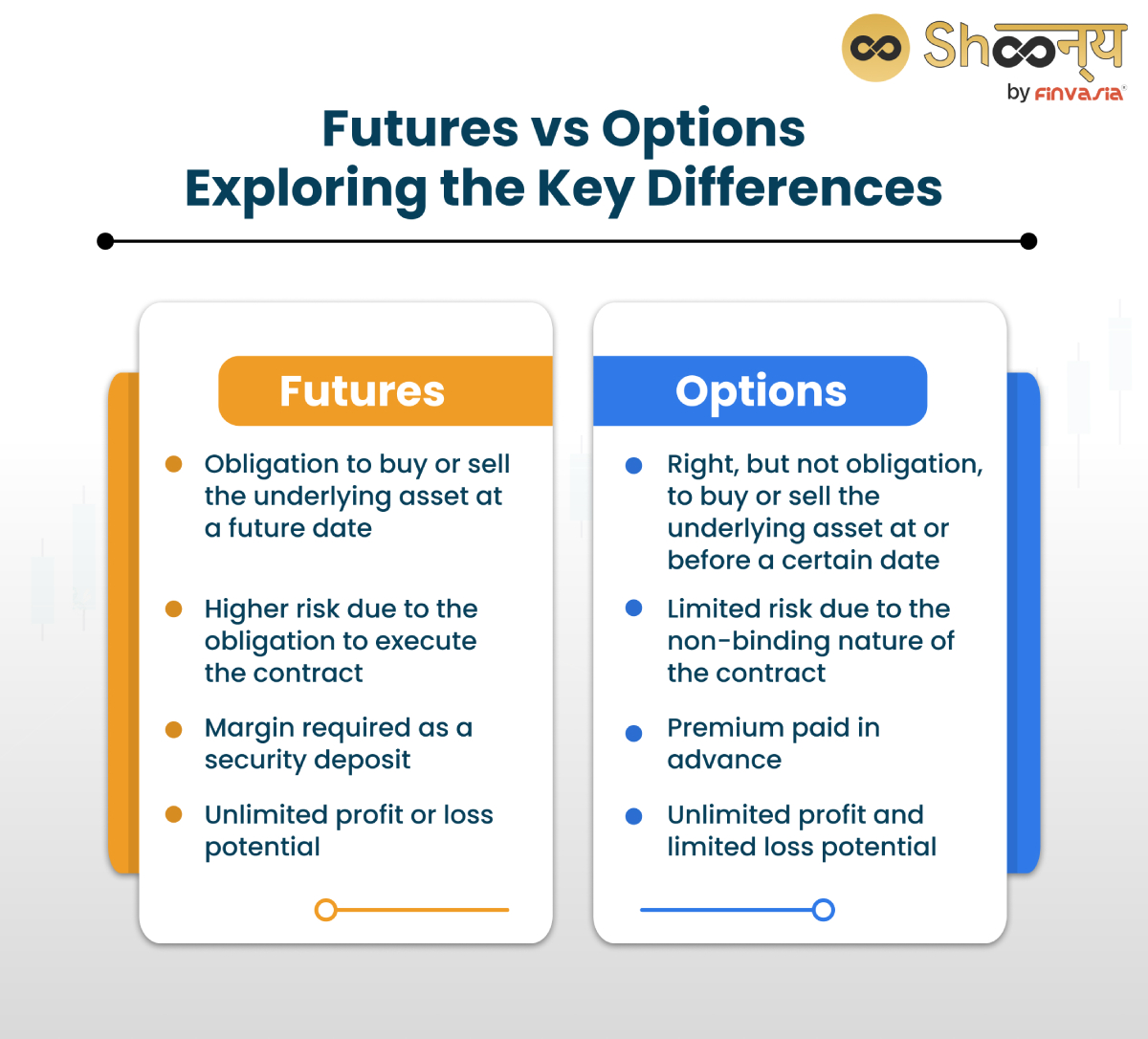

Futures vs Options: Exploring the Key Differences

| Basis | Futures | Options |

| Obligation | Both parties are obligated to fulfil contract terms. | The buyer has the right to exercise. The seller must fulfil if exercised. |

| Flexibility | Limited flexibility until expiration. | Buyers can choose to exercise or not. |

| Risk | High risk with potentially unlimited losses. | Limited risk, buyer’s loss limited to the premium. |

| Profit Potential | Unlimited profit potential. | Potentially unlimited for the buyer, the seller’s profit is capped at a premium. |

| Cost | Lower upfront costs may require a margin. | Requires premium payment upfront. |

What is the Key Difference Between Futures and Options

Let us explore the difference between futures and options in detail.

Obligation

Futures contracts require both parties to fulfil the agreement.

The buyer must buy, and the seller must sell the asset at the agreed price and date.

Options give the buyer the right, but not the obligation, to buy (call option) or sell (put option) the asset. The seller must fulfil the contract if the buyer exercises their right.

Flexibility

Futures contracts offer limited flexibility. Both parties must adhere to the contract’s terms until it expires.

Options provide more flexibility. The buyer can choose whether or not to exercise the option based on market conditions.

Risk

Futures involve high risk. Both parties face potentially unlimited losses if the market moves against them.

Options carry limited risk. The buyer’s potential loss is confined to the premium paid for the option contract.

Profit Potential

Futures offer unlimited profit potential. Both parties can profit from significant price movements.

Options present potentially unlimited profits for the buyer (depending on market movement), while the seller’s profit is restricted to the premium received.

Cost

Futures generally have lower upfront costs since no premium is paid initially. However, margin requirements may apply.

Options require payment of a premium upfront, representing the maximum potential loss for the buyer.

In summary, futures contracts require both parties to fulfil the agreement, offering limited flexibility and higher risk.

Options provide more flexibility, limited risk, and potentially unlimited profits for the buyer, while the seller’s profit is capped at the premium received.

What are Stock Futures

Stock futures are futures contracts that have an individual stock as the underlying asset. They are similar to stock options, except that they obligate the buyer to purchase and the seller to sell the stock at the agreed price and date.

Stock futures can be used for various purposes, such as:

• Speculating on the price movements of the stock by taking a long or short position in the futures contract.

• Hedging the price risk of the stock by taking a position opposite to the one held in the spot market.

• Arbitraging the price difference between the futures and the spot market, by buying low and selling high or vice versa.

Conclusion

Futures and options are useful tools for speculating, hedging, and arbitraging in the financial markets. Futures contracts are more suitable for high-risk and short-term trading. On the flipside, option contracts are more suitable for risk-limitation and long-term trading. The choice between the two certainly depends upon your risk-taking capability.

FAQs | Difference Between Futures and Options

The choice depends on goals, risk tolerance, and market conditions. Generally, futures suit those okay with high-risk and short-term investments, while options suit those seeking risk limitation and long-term gains.

Traders engage in scalping, day trading, swing trading, and position trading. Scalping means quick, small-profit trades. Day trading includes opening and closing positions within a day. Swing trading holds positions for days/ weeks. Position trading holds for months or years.

Futures contracts allow for more leverage compared to options. The liquidity and lower spreads in futures markets contribute to this advantage.

Futures and options are contracts for trading assets like stocks or indexes at preset prices on future dates. They help protect investors from future stock market fluctuations.

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.