LIC, the renowned Indian insurance company, introduces Amritbaal. It is a traditional savings life insurance plan tailored for children’s higher education needs. LIC Amritbaal policy targets parents aiming to fulfil their children’s educational aspirations. Amidst rising educational costs, LIC’s child education plan aims to fill a crucial gap in long-term financial planning. This traditional endowment plan aims to alleviate the burden of educational expenses.

Let us understand LIC Amritbaal in detail:

What is LIC Amritbaal?

LIC child plan, Amritbaal, has multiple features that aim to make education easy and accessible for children.

LIC Amritbaal is a traditional endowment policy that provides a combination of savings and life cover for your child.

LIC’s Amritbaal (UIN: 512N365V01) is a non-linked, non-participating, individual savings and life insurance plan.

- LIC’s Amritbaal is not linked to any market investments.

- It does not entitle the policyholder to any share in the company’s profits.

- It focuses on savings for the purpose of securing enough funds for their child’s higher education and other important expenses.

LIC’s Amritbaal plan assists in building a savings fund through Guaranteed Addition.

It ensures fixed benefits are paid out in case of death or survival, regardless of actual experience.

Additionally, it does not include any extra benefits like bonuses or shares of surplus profits.

You can acquire this plan offline through licensed agents, corporate agents, brokers, Insurance Marketing Firms, Point of Sales Persons-Life Insurance (POSP-LI), Common Public Service Centers (CPSC-SPV), or online directly via www.licindia.in.

Key Features of LIC Amritbaal

As LIC launches Amritbaal, here are some unique features of this insurance plan for children.

It guarantees an addition of ₹80 per thousand Basic Sum Assured throughout the Policy Term.

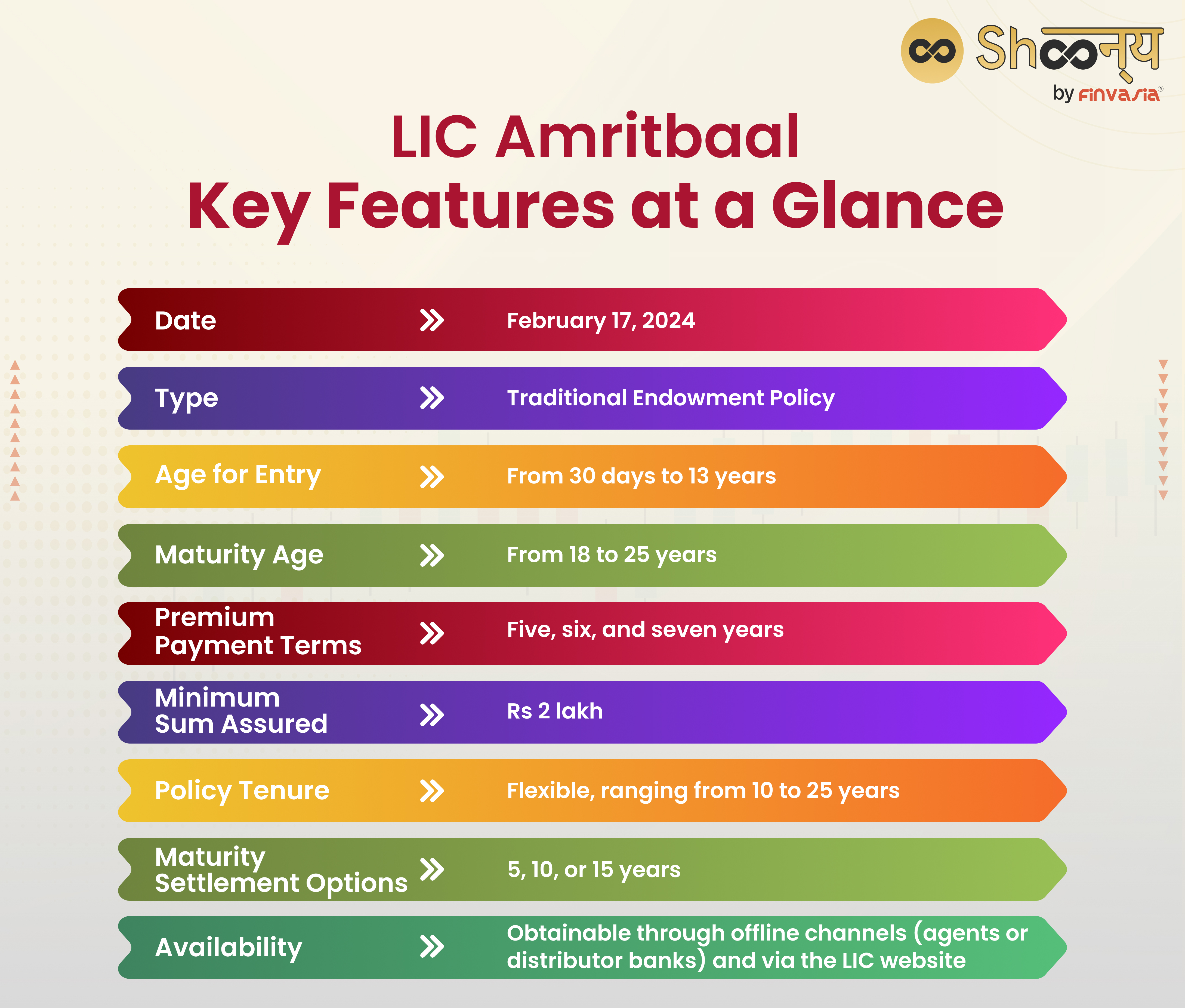

LIC Amritbaal: Key Features at a Glance

- Date of Announcement: February 17, 2024

- Type of Policy: Traditional Endowment Policy

- Target Audience: Parents aiming to build a corpus for their children’s higher education

- Age Range for Entry: From 30 days to 13 years

- Maturity Age Range: From 18 to 25 years

- Key Features

- Guaranteed additions at the rate of Rs 80 per thousand basic sums are assured at the end of each policy year.

- Shorter premium payment terms of five, six, and seven years.

- The minimum sum assured is Rs 2 lakh with no maximum cap mentioned.

- Flexible policy tenure ranging from 10 to 25 years.

- Option for receiving maturity amount through settlement options in instalments over five, 10, or 15 years.

- Availability: Offered through offline channels (agents or distributor banks) and directly through the LIC website.

- Loan Facility: Policyholders can avail loans under the policy.

What is the Eligibility For LIC Amritbaal?

The eligibility criteria and premium rates of LIC Amritbaal are as follows:

I. Entry Age:

- Minimum: 0 years (must have completed 30 days)

- Maximum: 13 years (as of the last birthday)

ii. Maturity Age:

- Minimum: 18 years (as of the last birthday)

- Maximum: 25 years (as of the last birthday)

iii. Policy Term:

- Limited Premium Payment: Minimum of 10 years

- Single Premium Payment: Minimum of 5 years

iv. Maximum Policy Term:

- Limited Premium Payment: Maximum of 25 years

- Single Premium Payment: Maximum of 25 years

- Policies procured through POSP-LI/CPSC-SPV: Maximum of 20 years

v. Premium Payment Term:

- Limited Premium Payment: Options of 5, 6, & 7 years

- Single Premium Payment: Single Pay

Benefits of LIC Amritbaal

Some of the benefits of Amritbaal-the LIC policy for children are:

- Saving for Education: This plan helps parents save money specifically for their child’s education.

So, when your child is ready for college or higher studies, you’ll have some money set aside to help pay for it.

- Guaranteed Additions: Every year, some extra money gets added to the savings you’ve put aside.

This extra money is guaranteed, so you can count on it being there when you need it.

- Flexible Payments: You can choose how long you want to pay into the plan. It could be for 5, 6, or 7 years, or you could make one big payment all at once.

- Maturity Options: When the plan matures, meaning it’s time to use the money for your child’s education, you can choose how you want to receive it.

You might get it all at once or spread out over a few years.

- Life Insurance: Along with saving for education, this plan also provides life insurance.

So, if something happens to the parent who bought the plan, the child will still get the money saved for their education.

- Easy to Get: You can buy this plan through different ways, like from a licensed agent or even online.

Conclusion

LIC Amritbaal is a way for parents to save money for their child’s education while also making sure they’re protected with life insurance.

It’s like a safety net for your child’s future!

Source- icindia.in/documents/20121/1016835/amritbaal-brochure.pdf

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.