GST vs VAT – What is the Basic Difference between GST and VAT

GST and VAT are two common terms that you hear every day, but do you really know what they mean?

Both GST and VAT are indirect taxes, but they have some key differences. One of the main differences between GST and VAT is that GST is a destination-based tax, while VAT is an origin-based tax. This means that GST is levied at the point of consumption, while VAT is levied at the point of origin.

Now, why should you invest your time in understanding these tax systems? The answer lies in the tangible impact they have on your finances. From the way they affect the cost of goods and services to their influence on international trade, is significant. Being equipped with the right knowledge can make all the difference.

GST stands for Goods and Services Tax, which is a comprehensive tax on the supply of goods and services. VAT stands for value-added tax, which is a consumption tax on the value added at each stage of production and distribution of goods.

Today, we will explore the basic difference between GST and VAT and take a look at the reasons why GST overtook the VAT system.

VAT vs GST: How do they differ?

GST and VAT are two types of indirect taxes that are levied on the supply of goods and services in India.

GST full form- Goods and Services Tax.

VAT full form- Value-added tax.

Both taxes have their own advantages and disadvantages, and they differ in terms of their scope, rates, structure, and administration.

What is GST?

GST is a comprehensive, destination-based tax that is imposed on the manufacture, sale, and consumption of goods and services across India. GST was introduced in 2017, replacing multiple central and state taxes, such as excise duty, service tax, VAT, CST, etc.

GST aims to simplify and harmonise the indirect tax regime, eliminate the cascading effect of taxes, improve competitiveness, and increase tax compliance.

What is the cascading effect of tax?

The cascading effect of tax refers to the situation where the tax paid by one entity becomes a cost for another entity, and this cost is passed on to the next entity in the value chain.

GST has four components: CGST, SGST, IGST, and UTGST.

- CGST is the central GST collected by the central government on intra-state supplies.

- SGST is the state GST collected by the state governments on intra-state supplies.

- IGST is the integrated GST collected by the central government on inter-state supplies and imports.

- UTGST is the union territory GST collected by the union territories on intra-UT supplies.

Background of Goods & Services Tax (GST)

The idea of GST was first proposed in 2006, and the Empowered Committee of State Finance Ministers, in collaboration with the central government, developed a roadmap and design for its implementation, seeking input from various stakeholders. The first discussion paper on GST was released in November 2009 to initiate a debate and gather feedback. The tax base was fragmented, services were not appropriately taxed, and cascading effects in the tax structure led to economic distortions.

Relevance of GST & The Way Forward

The introduction of GST is crucial in the evolving economy to replace the complex multiple tax structures of both the Centre and States.

With increasing globalisation and free trade agreements, a nationwide transparent taxation system is needed for Indian industries to compete internationally and domestically.

GST Rates

GST has five tax slabs: 0%, 5%, 12%, 18%, and 28%.

Different goods and services are taxed at different rates, depending on their classification. Some essential items, such as food grains, milk, eggs, etc., are exempt from GST, while some luxury and sin goods, such as tobacco, alcohol, automobiles, etc., are taxed at the highest rate of 28%.

The standard tax rate is 18% for most supplies.

GST also has a special rate of 3% for gold and precious stones.

Notably, certain categories like vehicles and aerated beverages, as specified by the government, attract compensation cess under the GST framework.

Benefits of GST

- Elimination of Cascading Effect: GST eliminates the cascading effect of tax by bringing indirect taxation under one umbrella, contributing to a more efficient tax system.

- Lowered Tax Burden and Increased Consumption: GST’s efficiency in reducing tax barriers and eliminating the tax on tax helps lower prices for consumers, stimulating increased consumption.

- Easy Compliance and Uniformity of Tax Rates: GST offers easy compliance and ensures uniformity of tax rates and structures across different goods and services, simplifying the overall tax process.

What is VAT?

VAT is a consumption tax that is levied on the value added to a product at each stage of production and distribution. It was introduced in April 2005. VAT and service tax in India are two types of indirect taxes that were levied before the introduction of GST.

VAT was a state-level tax introduced to replace sales tax and applied to the sale of goods within a state, while service tax was a central-level tax that applied to the provision of services across India.

VAT full form in GST

VAT- Value-added tax is now a component of GST- Goods and Services Tax, which is charged on the supply of goods and services at the final stage of consumption.

GST has two components:

Central GST (CGST) and State GST (SGST), or Integrated GST (IGST) for inter-state transactions. CGST and SGST are based on the VAT principle, where the input tax credit is available for the tax paid on inputs.

The implementation of VAT aimed to transform India into a cohesive and unified market by establishing a standardised tax rate for both goods and services. Nonetheless, the taxation structure faced challenges when numerous indirect taxes were in place, which ultimately led to them being amalgamated into the GST system.

Disadvantages of VAT

- Taxes piling up: VAT leads to a situation where taxes stacked up on each other, causing a chain reaction of increased costs.

- No benefit for service tax: VAT didn’t allow businesses to get back the service tax they paid, which was a disadvantage.

- Varying rates across states: Different states in India had different VAT rates, making it complex for businesses that operated in multiple locations.

- Confusing laws: Each Indian state had its own set of VAT laws, adding complexity and confusion for businesses trying to comply.

- Incompatibility of CST and VAT: The input tax paid for Central Sales Tax (CST) cannot be offset against VAT and vice versa, leading to inefficiencies in the tax system.

Owing to multiple disadvantages, VAT was replaced by Goods and Services Tax, all over India from 1 July 2017.

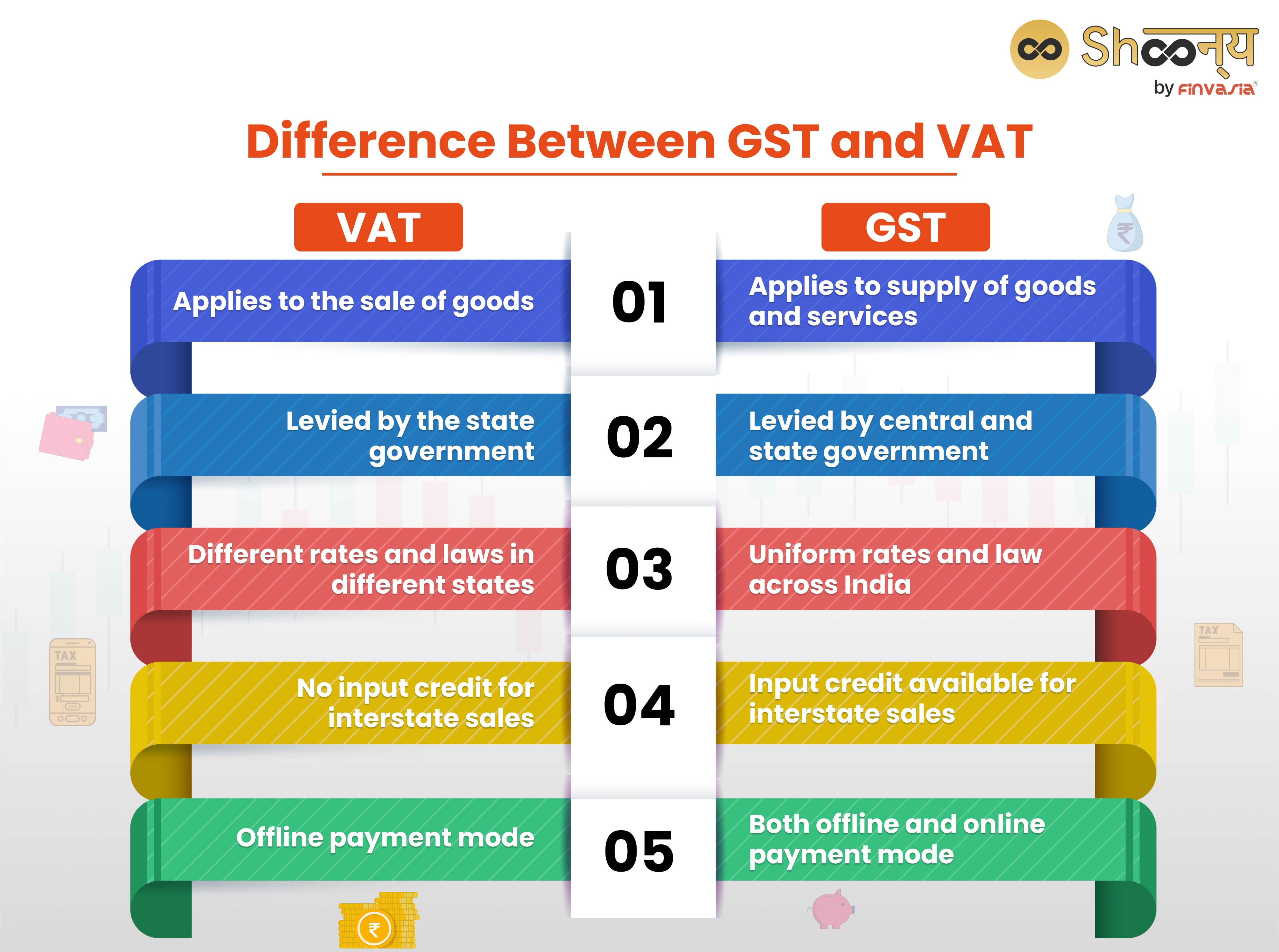

VAT vs GST: Comparison

Explore the difference between GST and VAT

| Basis | GST | VAT |

| Point of taxation | Supply of goods and services | Sale of goods |

| Destination or origin | Destination-based tax | Origin-based tax |

| Tax credit | Allows input tax credit across the value chain and across states | Allows input tax credit only within the state and only for goods |

| Tax rates | Uniform tax rates across the country | Different tax rates across states |

| Administration | Single and online system for registration, returns, and payments | Multiple and offline systems for different states |

| Advantages | Removes tax-on-tax effect | Reduces tax evasion |

| Disadvantages | Increases tax burden on some sectors | Creates tax disparity |

Conclusion

GST and VAT are two important indirect taxes that have a significant impact on the Indian economy and consumers. The core difference between GST and VT is that GST is a more comprehensive and uniform tax system and helps prevent the cascading effect of tax, as was the case in the VAT.

FAQs| GST vs VAT

The difference lies in VAT being a specific tax on value added to goods and services at each stage, while tax amount is the general term for money collected by the government.

VAT is calculated by subtracting input tax (tax paid for raw materials) from output tax (tax received from sales). The formula is VAT = Output Tax – Input Tax.

The new tax system aimed to fix problems found in VAT, like the cascading effect where tax on a product was applied at each sale step. This meant the end consumer had to pay tax on top of the tax already paid.

GST benefits customers by eliminating tax cascading, simplifying the tax system, lowering tax rates, and creating a uniform and transparent market. Source Source.

A GST number (GSTIN) is a unique 15-digit code assigned to GST-registered taxpayers, facilitating tax collection, input tax credit claims, compliance, and access to GST-related benefits.

Source- dor.gov.in

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.