Everything about Commodity Trading in the Stock Market

This article shall provide a brief overview of what commodities trading is and how it works. This blog won’t make sense if you don’t take a quick understanding of What is a commodity?

For all the starters of the stock market, here is a layman’s view of the commodity market and commodity trading.

A commodity is a basic good traded in the stock market and used to produce other goods or services. Commodities can be either physical (e.g. gold, oil, crops, wheat) or financial (e.g. currencies, bonds) and are traded on a stock exchange. For example, oil, gold, and wheat can be traded as commodities on a stock exchange. Some examples include:

| Commodity Market | Description |

| Agricultural Commodity Markets | These markets deal with the trade of agricultural products such as grains, pulses, oilseeds, spices, and cotton. |

| Metal Commodity Markets | These markets deal with the trade of metal commodities such as gold, silver, copper, aluminium, and steel. |

| Energy Commodity Markets | These markets deal with the trade of energy commodities such as crude oil, natural gas, and coal. |

| Bullion Commodity Markets | These markets deal with the trade of precious metals such as gold and silver. |

| Financial Commodity Markets | These markets deal with the trade of financial instruments such as F&O on commodities. |

Commodity Trading History in Depth

Commodity markets and commodities trading history do exist. They have rather played a crucial role in the global economy. They serve as a platform for producers of commodities to sell their products and for consumers to buy them. They also provide a way for traders and investors to speculate on the future price movements of commodities.

Commodity markets operate through standardised contracts, known as futures contracts, which specify the quantity, quality, and delivery date of a particular commodity. These contracts are traded on commodity exchanges, which act as clearing houses for the transactions.

Commodity markets can be classified into two main categories: physical markets, where the actual physical commodity is traded and delivered, and financial markets, where financial instruments, such as futures and options, are traded.

- Physical commodity markets: These markets involve the physical trade of commodities, such as wheat trading at a grain exchange.

- Futures markets: These markets involve the trading of futures contracts, which are agreements to buy or sell a specific commodity at a future date at a predetermined price.

- Options markets: These markets involve trading options, which are financial instruments that give the holder the right (but not the obligation) to buy or sell a specific commodity at a specific price on or before a certain date.

Commodity Exchanges in India- Role and Functions

In India, commodities are primarily traded on commodity exchanges, which are regulated by the Securities and Exchange Board of India (SEBI). These exchanges offer a platform for buyers and sellers of commodities to come together and trade in a transparent and organized manner.

But, you may wonder which stock exchange to use if you want to trade commodities in the Indian Stock Market. Before, taking a leap into commodities like crops, Agri products, metals, etc, you should at least know about the top commodities exchanges of India.

There are several commodity exchanges in India that facilitate the trading of various commodities, including agricultural products, metals, and energy products. Some of these are

- National Commodity and Derivatives Exchange (NCDEX): This is a leading commodity exchange in India that offers trading in various agricultural and industrial commodities, including cereals, pulses, oilseeds, spices, fibres, and energy products.

- Multi Commodity Exchange of India (MCX): This is one of the largest commodity exchanges in India, with a nationwide presence. It offers trading in a wide range of commodities, including bullion, base metals, energy, and agricultural products.

- National Multi Commodity Exchange of India (NMCE): This exchange offers to trade in agricultural commodities, bullion, and energy products.

- Indian Commodity Exchange (ICEX): This exchange is focused on trading agricultural commodities, including cereals, pulses, oilseeds, and spices.

- National Agricultural Cooperative Marketing Federation of India (NAFED): This is a cooperative exchange that facilitates the trading of agricultural commodities, including cereals, pulses, oilseeds, and spices.

- ACE Derivatives and Commodity Exchange (ACE): This is a regional commodity exchange that operates in the western part of India and offers to trade in agricultural and industrial commodities.

These exchanges operate under the regulatory oversight of the Securities and Exchange Board of India (SEBI) and follow standardized trading and settlement processes.

Traders and investors can begin commodity trading through various channels, including online platforms, brokers, and commodity trading advisors.

- They can also engage in commodity futures trading, where they agree to buy or sell a commodity at a predetermined price on a future date.

- Commodity options trading where the buyer has the right but not the obligation to buy or sell a commodity at a predetermined price on or before a certain date, is also possible in India.

Strategies to Trade in Commodities in India

Traders and investors can adopt various strategies while trading in commodities, such as trend following, range trading, and spread trading. They can also use various technical and fundamental analysis techniques to make informed trading decisions.

- Trend following is a trading strategy that involves following the general direction of the market. This strategy involves buying an asset when it is trending upwards and selling it when it is trending downwards. The idea is to profit from the overall trend in the market, rather than trying to predict specific price movements.

- Range trading is a strategy that involves buying an asset when it reaches the lower end of a price range and selling it when it reaches the upper end of the range. The idea behind this strategy is to take advantage of the natural oscillation of the price within a defined range.

- Spread trading is the practice of taking a long position in one asset and a short position in another. The aim of this strategy is to profit from the difference in the price movements of the two assets. For example, a trader may take a long position in crude oil and a short position in gasoline, hoping to profit from the difference in the price movements of the two commodities.

- Technical analysis is a procedure of evaluating securities by analyzing statistical trends derived from trading activity, such as past prices and volume. To identify buying or selling opportunities, technical analysts use charts, graphs, and other tools.

- Fundamental analysis is a technique of evaluating securities by analyzing the underlying factors that can affect their value, such as a company’s financial health, industry conditions, and macroeconomic factors. Fundamental analysts use financial statements, company reports, and other data to assess the intrinsic value of a security.

It is important to note that these methods are not foolproof and traders and investors should carefully evaluate the risks and potential returns before making any investments.

It is also important to note that commodity trading carries inherent risks and traders and investors should carefully evaluate the risks and potential returns before making any investments. They should also be aware of the regulatory framework governing commodity trading in India and the tax implications of such investments.

Commodity Exchanges Regulation, Management, and Legislation Framework

SEBI oversees the operations of commodity exchanges and ensures that they comply with the relevant regulations and standards.

The Commodity Futures Market Regulation Act (CFMRA) is the primary legislation governing commodity trading in India. The CFMRA provides the legal framework for the establishment, regulation, and supervision of commodity futures markets in India. It also lays down the rules for the conduct of futures trading, settlement of futures contracts, and the role of intermediaries such as brokers and clearing corporations.

Commodity exchanges in India also have to comply with the SEBI (Commodity Derivatives) Regulations, 2012, which prescribe the rules for the conduct of trading, clearing, and settlement of commodity derivatives. These regulations cover various aspects of the commodity market, including the eligibility criteria for market participants, margin requirements, and risk management measures.

Tax Implications on Commodity Trading

To trade commodities in India, you must know that In terms of tax implications, the profits or losses from commodity trading are taxed as capital gains or capital losses in India. Capital gains from commodity trading are taxed at different rates depending on the holding period of the asset.

- Short-term capital gains– gains from the sale of an asset held for less than 36 months, taxed according to the existing rate as the individual’s income tax slab.

- Long-term capital gains– from the sale of assets held more than 36 months and are taxed at a lower rate of 20% along with indexation.

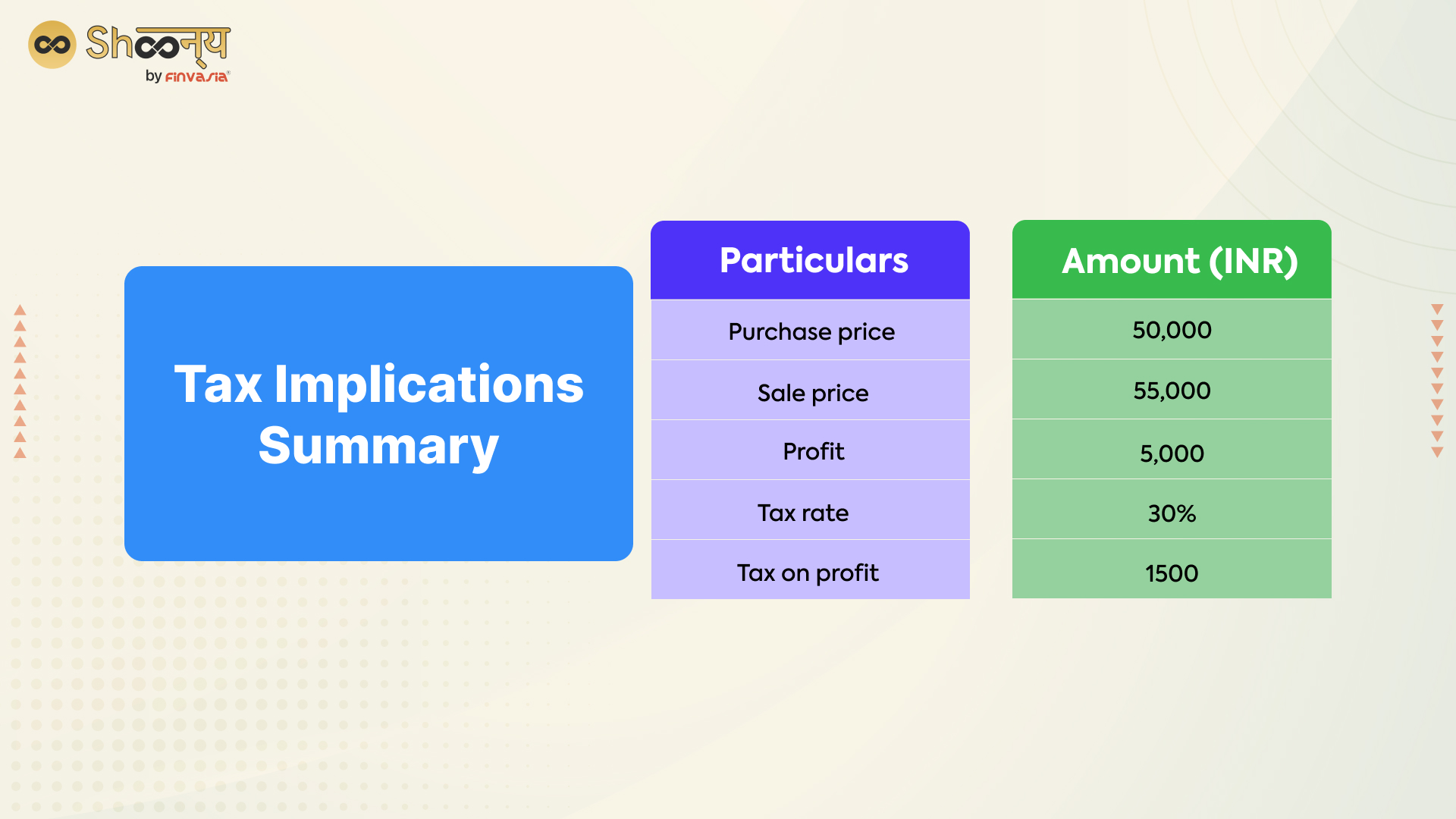

Here is an example of the tax implications of commodity trading in India:

Assume that an individual buys 1 contract of crude oil futures on the Multi Commodity Exchange of India (MCX) for a price of INR 50,000. After holding the contract for 18 months, the individual sells the contract for a price of INR 55,000.

The profit from the sale of the contract is INR 5,000 (55,000 – 50,000). Since the holding period is less than 36 months, the profit is considered to be a short-term capital gain.

If the individual’s tax slab is 30%, the tax on the short-term capital gain will be INR 1,500 (5,000 x 30%).

It is important to note that this is just an example and the actual tax implications may vary depending on the individual’s tax slab and other factors. Traders and investors should consult with a financial advisor or a tax professional to understand the specific tax implications of their trades.

Now, when you know the basics of all types of commodities.

Which one should I choose: Agri, metal, or energy?

Feeling anxious about choosing among three options? Agri, metal, or energy?, or energy?

It is difficult to determine which type of commodity (agricultural, metal, or energy) is the “best” to trade, as each commodity’s performance depends on various factors, such as market demand, supply, and global economic conditions. Additionally, the suitability of a particular commodity for trading also depends on an individual’s financial goals, risk tolerance, and knowledge of the market.

That being said, here are some factors to consider when choosing a commodity to trade:

- Agricultural commodities: These commodities, such as wheat, corn, and soybeans, are often influenced by weather conditions, global demand for food, and trade policies. Agricultural commodities can be volatile and may be more suitable for experienced traders.

- Metal commodities: These commodities, such as gold, silver, and copper, are often influenced by global economic conditions, industrial demand, and investor sentiment. Metal commodities can be more stable and may be suitable for long-term investors.

- Energy commodities: These commodities, such as oil, natural gas, and electricity, are often influenced by global demand, geopolitical events, and technological developments. Energy commodities can be highly volatile and may be suitable for experienced traders who can manage risk effectively.

In terms of the best commodity to trade in India, it is important to consider the regulatory environment, economic conditions, and market demand in the country.

In the Multi Commodity Exchange (MCX), some popular commodities to trade include gold, silver, copper, crude oil, and natural gas. It is important to carefully research and analyse the market conditions and trends before choosing a particular commodity to trade in the MCX or any other exchange.

Ultimately, the best commodities to trade will depend on an individual’s specific investment goals and risk tolerance. It is important to conduct thorough research, seek the advice of a financial professional, and carefully consider the potential risks and rewards before making any investment decisions.

Wondering which is better? Commodity Trading or Stock Trading?

It is not possible to say definitively whether commodity trading is better or worse than stock trading, as it depends on an individual’s specific financial goals and risk appetite. Both commodity trading and stock trading have their own unique characteristics and carry inherent risks.

Commodity trading involves buying and selling physical commodities, such as agricultural products, metals, and energy products, for delivery at a future date. Commodity markets are driven by factors such as supply and demand, weather conditions, geopolitical events, and economic conditions. As such, the prices of commodities can be volatile and subject to significant price swings.

Stock trading, on the other hand, involves buying and selling shares of publicly traded companies listed on a stock exchange. Stock markets in India are driven by a variety of factors, such as a company’s financial performance, economic conditions, and market sentiment. The prices of stocks can also be volatile and subject to significant price movements.

Both commodity trading and stock trading can offer potential returns, but they also carry inherent risks. It is important for traders and investors to carefully evaluate the risks and potential returns before making any investments. They should also diversify their portfolio to mitigate the risks associated with any single investment.

In summary, whether commodity trading or stock trading is better for an individual, it is important to consult with a financial advisor or a professional to understand the specific risks and potential returns of both types of trading and make informed decisions.