Everything You Need to Know About Taxation For Investors

Understanding how taxes work can help you optimize your returns and keep more money in your pocket. This article will provide an overview of the investment tax basics and some tips for investors to ensure they are paying the proper tax on investments and Taxation for Investors.

Investment Tax Basics in India

The first thing to understand is that any income generated from investments, such as dividends or capital gains, is subject to taxation. You must report this income on your tax return and pay taxes on it. In India, the Investment Tax Basis is divided into three categories:

- Short-term capital gains tax

- Long-term capital gains tax

- Securities transaction tax

Short-term capital gains are any profits made from investments held for less than a year before being sold. Your income tax bracket determines the rate of taxation for this type of gain. It is only applicable when you buy and sell the stock within 12 months or 1 year. You will have to pay a 15% tax on your total profit in that financial year.

Suppose you bought 100 shares of ABC Ltd. at ₹100 per share in February 2022 and sold them in November 2022 at ₹150 per share.

Profit made = (150 x 100) – (100 x 100)

Profit made = 15,000 – 10,000

Profit made = 5,000

So, you have to pay a 15% short-term capital gains tax on your ₹5,000 profit, which equals ₹750.

Long-term capital gains refer to profits from investments held for more than a year before selling them off; these are taxed at a lower rate than short-term capital gains. It is only applicable when you buy and sell the stock after 12 months of holding it. A total of 10% tax is levied if you have made a profit of over ₹1,00,000 in that financial year.

Securities Transaction Tax (STT) is an additional levy that applies when you buy or sell stocks or equity derivatives through exchanges. For example, when you purchase stock through the National Stock Exchange (NSE), STT is applicable.

If you’re willing to start investing in tax saver instruments, Shoonya by Finvasia is the right platform. It allows you to invest in mutual funds and stocks with zero brokerage fees and provides a seamless, hassle-free investing experience.

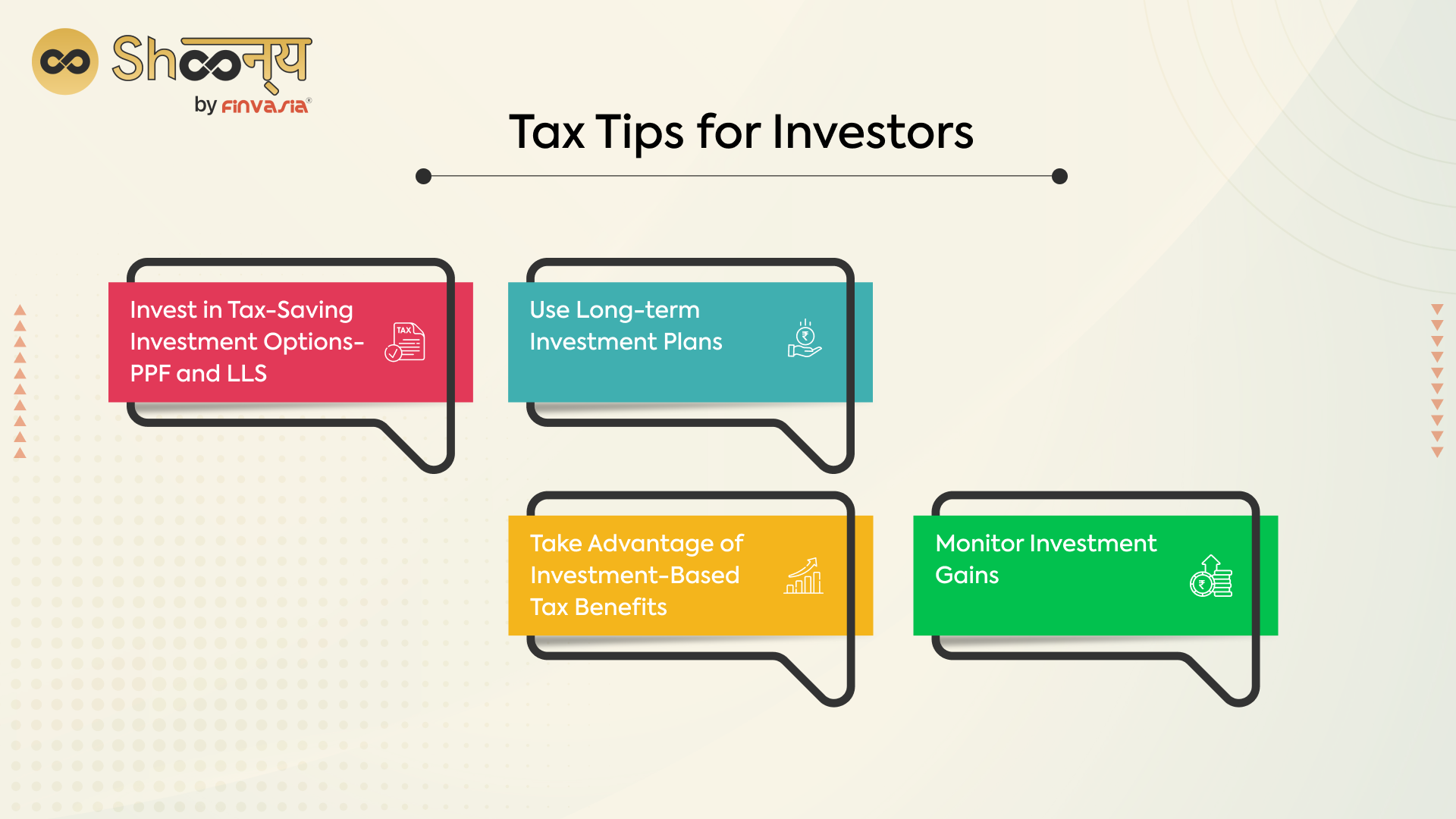

Tax Tips for Investors

- Invest in Tax-Saving Investment Options: Several investment options in India offer tax benefits, such as Public Provident Fund (PPF) and Tax-Saver Mutual Funds (ELSS). These can be great options for investors looking to minimise their tax burden.

- Use Long-term Investment Plans: Holding onto stocks or mutual fund investments for more than a year before selling them will qualify you for LCGT, which is taxed at a lower rate.

- Take Advantage of Investment-Based Tax Benefits: Look into ways to take advantage of investment-based tax benefits such as Capital Gains Exemption (CGE) and Investment-Based Section 80C Deductions. These can help you reduce your taxable income and save on taxes.

- Monitor Investment Gains: Track your investments closely and keep an eye out for any changes in the market that could affect your gains so you can adjust your portfolio accordingly. This will help you avoid any surprises when it comes time to pay taxes on your investments.

Conclusion

Online trading and investing are great ways to start your investment journey, but they can be confusing. So, research is important.