Different Factors Affecting Nifty

Anything or everything that happens in the Indian Capital market has relevance to one or the other factors. Similarly, Nifty is an index benchmark of the Stock market that is affected by various factors. Some might be momentous, and some are fixed time factors.

To decide on investment and trading based on the Nifty Index, investors need to have a thorough understanding of the influential factors of Nifty. Let’s help you to understand them.

What is Nifty?

Nifty serves as the benchmark index for the Indian stock market on the NSE (National Stock Exchange). It displays the list of the top-performing 50 companies. That’s why it is also known as “Nifty-Fifty” or “Nifty-50”.

Features of Nifty-50

Nifty has established its own strong base in the market for being used as an indicator for an investment decision.

- Year of establishment: Nifty was established on 22 April 1996.

- Meaning: Nifty combines two words- National Stock Exchange and Fifty.

- Ownership: An NSE subsidiary, Index and Services and Products Limited (IISL), owns and manages it.

- Base year: The base year for Nifty is 1995.

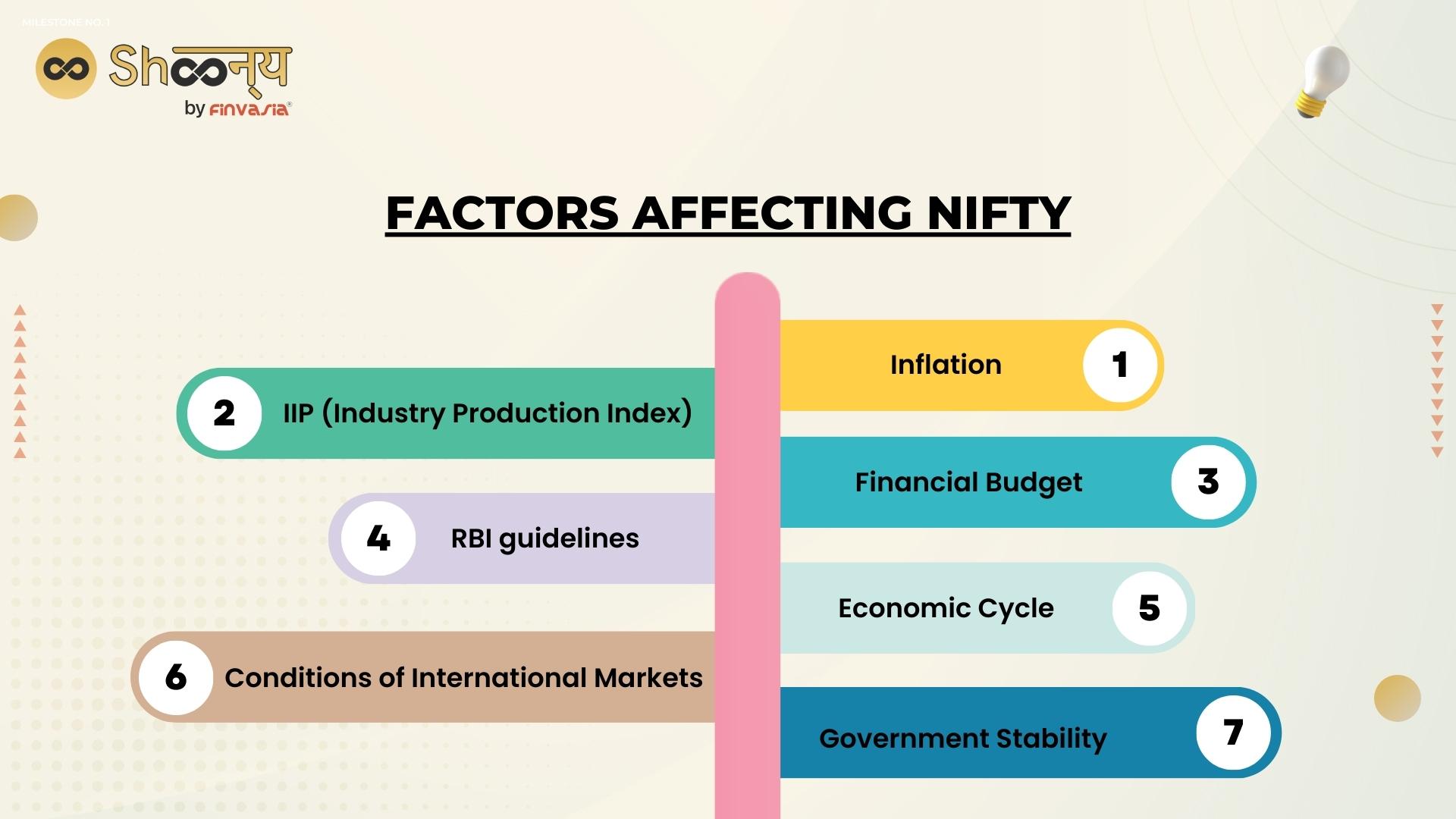

Factors Affecting Nifty

Numerous factors affect Nifty- some of them are noteworthy occurrences, and others are variables with higher magnitude.

Let’s discuss them one by one to get more clarity in detail.

- Government Stability: The decisions and the changes of rules and regulations by the current political party in power affect the fluctuations in the capital market.

- IIP (Industry Production Index): It is the overview of Industrial growth. When IIP goes up, Nifty also takes a swing. If IIP falls, Nifty also comes down.

- Financial Budget: The allocation of funds to different sectors of the economy also has a major impact on Nifty.

- RBI guidelines: The Reserve Bank of India (RBI) sets the Repo rate, which is the interest rate at which it lends money to commercial banks, and the reverse Repo rate, which is the interest rate at which it borrows money from commercial banks in the country. These rates have a significant impact on the financial strength of the economy for the public.

- Economic Cycle: In the market, the economic cycle has two extremities- boom or recession. In the boom, the Nifty also boomed up; in the recession, the Nifty took a slide to fall.

- Conditions of International Markets: Any change in the economic aspects, even in the International economies, can affect our economy. For example, the China-Russia war’s impact had been seen in our economy with the fall of the Nifty50.

- Inflation: Data on inflation determines the course of future interest rates that affects the left income for spending in the hands of an individual that directly affects economic growth. The stock markets are also the biggest economic indicators, as was already mentioned.

Conclusion:

To conclude it can be said that Nifty is one of the major indexes for the stock market. Once you understand all the details about Nifty, check out the Shoonya app for trading, where you can add four more indexes other than Nifty.

FAQs

Indicators for Bank Nifty include moving averages, RSI, MACD, and Bollinger Bands, all helping traders analyze trends and price movements.

Traders predict Bank Nifty movement using technical analysis, fundamental analysis, and sentiment analysis to make informed decisions.

The best strategy for Bank Nifty depends on a trader’s preferences, but common approaches include trend following, range trading, and option trading.

The best indicator for Bank Nifty varies with market conditions and trader preferences. Moving averages, RSI, MACD, and Bollinger Bands are among the popular choices.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.