The two key indices representing the Indian stock market are the Nifty and the Sensex. They significantly impact the Indian economy, serving as crucial barometers for investors and policymakers alike. They have further contributed to the growth of the Indian stock market and played a vital role in creating a transparent and well-regulated financial ecosystem. In addition, the indices have led to increased participation of retail investors in the stock market, creating a vibrant and dynamic financial market.

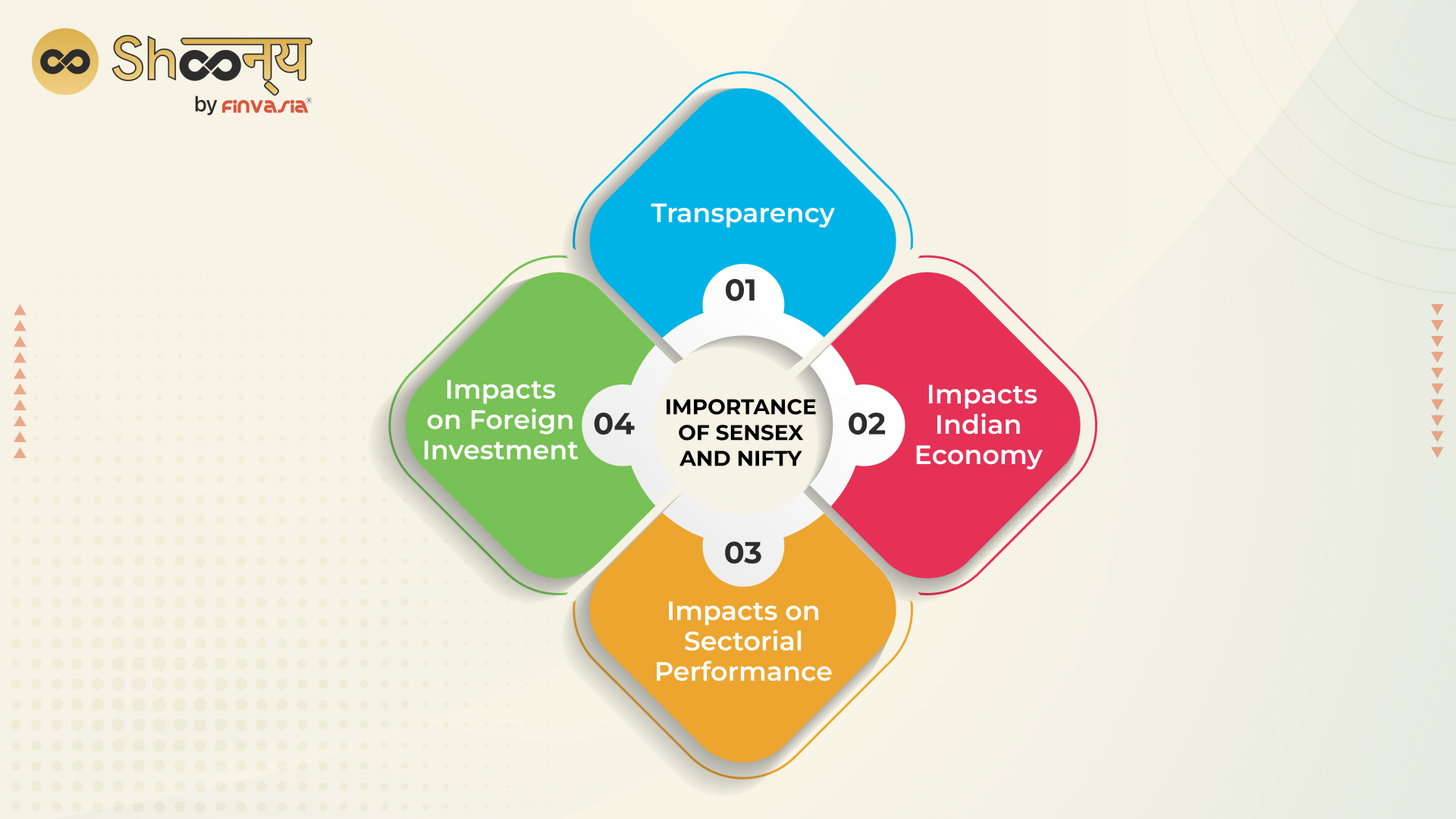

Importance of Sensex and Nifty

1. Transparency

The Nifty and the Sensex are known for their transparency, providing unbiased views of the stock market’s direction. These indices are regularly updated to represent current market conditions, serving as a reliable source of information for investors. Additionally, reviewing their historical performance can help inform trading strategies.

2. Impacts Indian Economy

The performance of the Nifty and the Sensex has a direct impact on the Indian economy. When the stock market is doing well, it creates a positive sentiment, leading to increased investments, job creation, and economic growth. On the other hand, when the market is in a downturn, it leads to a drop in investments, job losses, and a slowdown in economic growth.

3. Impacts on Sectorial Performance

The Nifty and the Sensex also impact various sectors of the economy differently. For instance, the banking sector has a significant weightage in both indices, and a rise or fall in the indices can impact the banking sector’s performance. Similarly, the technology sector has a significant weightage in the Nifty, and any changes in the index can influence the technology sector’s performance.

4. Impacts on Foreign Investment

Another critical aspect of the Nifty and the Sensex is their influence on foreign investments. The Indian economy is highly dependent on foreign investments, and any fluctuations in the stock market can directly impact foreign investments. As you are aware, both of these indices are extremely sensitive to political movements. A favorable government supporting private companies and relaxing investment regulations results in positive Nifty and Sensex performance, which can lead to increased foreign investments and economic growth.

Sensex: The Stock Market Barometer

The Bombay Stock Exchange (BSE) Sensex, often referred to simply as Sensex, is one of India’s oldest and most well-known stock market indices. It represents a basket of the largest and most actively traded stocks on the BSE. Sensex is often considered the barometer of the Indian stock market, reflecting its overall health and performance.

Nifty: The Benchmark for NSE

On the other hand, the National Stock Exchange (NSE) Nifty 50, commonly known as Nifty, is another major stock market index. Nifty comprises 50 stocks representing various sectors of the Indian economy. It serves as a benchmark for the NSE and provides insights into the performance of large-cap Indian companies.

Why Sensex and Nifty Matter

1. Market Performance Indicator

Both Sensex and Nifty act as key performance indicators of the Indian stock market. They offer a snapshot of how stocks are performing on a given day, providing investors with valuable information.

2. Portfolio Management

For investors, these indices serve as crucial benchmarks for evaluating the performance of their portfolios. By comparing their own returns to those of Sensex and Nifty, investors can gauge the effectiveness of their investment strategies.

3. Economic Health Check

Sensex and Nifty are often used to assess the broader health of the Indian economy. When these indices rise, it’s generally seen as a positive sign for economic growth.

4. Investment Decision Making

Many investment decisions, including stock selection and asset allocation, are influenced by the trends and movements of Sensex and Nifty. Investors often adjust their portfolios based on the performance of these indices.

The Historical Significance

Sensex and Nifty have a rich history dating back several decades. The Sensex, launched in 1986, has witnessed India’s economic liberalization and growth. Nifty, introduced in 1996, has evolved alongside India’s modern economy.

These indices have weathered economic crises, market crashes, and global events. Yet, they have consistently shown resilience and have been instrumental in attracting domestic and foreign investments.

Expanding Horizons

Sensex and Nifty are continually evolving. Nifty, for example, now includes sector-specific indices, offering even more insights into various segments of the Indian economy.

Global Recognition

These indices are gaining recognition on the global stage. Nifty 50 futures and options are traded on several international stock exchanges, opening doors for global investors to participate in the Indian growth story.

Innovation in Financial Products

The popularity of Sensex and Nifty has led to the creation of exchange-traded funds (ETFs) and index funds that track these indices. These financial products offer investors diversified exposure to the Indian market.

What are the downsides of the Nifty and the Sensex?

Despite their advantages, the Nifty and the Sensex have their limitations. One of the most significant limitations is that they represent a relatively small proportion of the Indian stock market. The Nifty and the Sensex are comprised of only 30 and 50 companies, respectively, and do not represent the stock market’s overall performance. For example, if you invest in an IT industry stock that is not part of NIFTY or Sensex, any movement in these indices cannot be used as a base to decide when to exit your holdings.

There are also instances where the market conditions do not reflect the economy’s actual health, leading to a mismatch between the economy’s growth and the stock market’s performance.

Conclusion

Sensex and Nifty are not just indices; they are the pulse of the Indian financial market. Understanding their importance and how they function can empower Indian investors to make informed decisions and navigate the dynamic world of finance. Whether you’re a seasoned investor or just starting your investment journey, keeping an eye on Sensex and Nifty can be a valuable practice that contributes to your financial success.

FAQs

Both indices use market capitalization-weighted methodologies, but they have different base years and criteria for stock selection.

While you can’t invest directly in the indices, you can invest in ETFs and index funds that replicate their performance.

Both indices are reviewed semi-annually to ensure they accurately represent the market.

Yes, dividends from constituent stocks are included in the total return calculations of these indices.

Historical performance data is readily available and can be accessed through financial publications and online resources.

Global economic and geopolitical events can influence these indices. For instance, international trade tensions can affect the performance of export-oriented Indian companies.

While they are not direct investment options, they can guide long-term investment strategies by providing insights into market trends and performance.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.