Foreign investment is a vital engine for global economic growth. It includes Foreign Institutional Investors (FII), Foreign Direct Investment (FDI), and Foreign Portfolio Investment (FPI). These international capital flows complement Domestic Institutional Investors (DII). Thus,

creating a dynamic financial ecosystem where cross-border investments drives overall market expansion. Now, what exatcly is the difference when we talk about FII vs DIIs.

Let us take a look!

FII vs DII: How Do They Differ

FII, or Foreign Institutional Investors, are the sophisticated players at the investment table. These are large financial institutions like pension funds, insurance companies, and mutual funds from abroad. They focus their investments primarily on the Indian stock market.

FIIs have a keen interest in specific sectors or companies they believe will yield substantial returns.

In contrast, DII, or Domestic Institutional Investors, include Indian financial institutions such as mutual funds, insurance companies, and banks. DIIs play a pivotal role in the domestic financial market by investing in various asset classes within India.

Here is the simple difference between FII and DII:

- FII- These investors have a focused approach. FIIs target specific sectors or companies within the Indian market. They bring significant capital and expertise, influencing market sentiments and stock movements.

- DII: DIIs take a broader approach, investing across various asset classes within India. They often stabilise the market, balancing out fluctuations caused by foreign investors.

The primary distinction between FII and DII lies in their origin and investment strategies:

FII

- Origin: Foreign institutional investors.

- Focus: Targeted investments in Indian markets based on sectoral or company-specific analysis.

- Influence: Can impact market movements and sentiments due to significant capital deployment.

DII

- Origin: Domestic institutional investors.

- Focus: Diversified investments across various asset classes within India.

- Influence: Provides stability to the market by balancing out foreign investment flows.

Based on the data as of April 9th, 2024, the gross purchase and sales figures for Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) are as follows:

- Foreign Institutional Investors (FIIs):

- Gross Purchase: ₹87,693 crores

- Gross Sales: ₹92,806 crores

- Domestic Institutional Investors (DIIs):

- Gross Purchase: ₹80,933 crores

- Gross Sales: ₹72,505 crores

These figures reflect the sentiment of institutional investors in the Indian financial markets.

FII in India

Foreign institutional investors (FIIs) are institutional investors that invest in assets of a country different from where these organisations are based.

FIIs are institutional investors from outside India who invest money in the Indian financial markets. FIIs particularly invest in stocks (equities) and bonds.

Now, who are FIIs actually?

These could be mutual funds, pension funds, hedge funds, or other large investment entities based outside India.

When FIIs invest in Indian markets, they bring in foreign capital.

How does it help India?

The inflow of capital provides liquidity and drives Indian stock market activity. This investment can have a significant impact on stock prices and market trends.

FIIs analyse various factors such as:

- Economic policies

- Corporate performance

- Market conditions before making investment decisions

The presence of FIIs in India reflects international confidence in the country’s financial system.

Now comes the DIIs.

DII in India

DII full form is domestic institutional investors. These operate within the country.

They aim to earn money by investing in the Indian stock market.

DIIs play a crucial role in shaping the Indian stock market.

They invest primarily in domestic financial assets. This can include stocks, bonds, government securities, etc.

However, political and economic factors impact their investment choices.

Consequently, domestic institutional investors (DIIs) can affect overall investment flows in the economy.

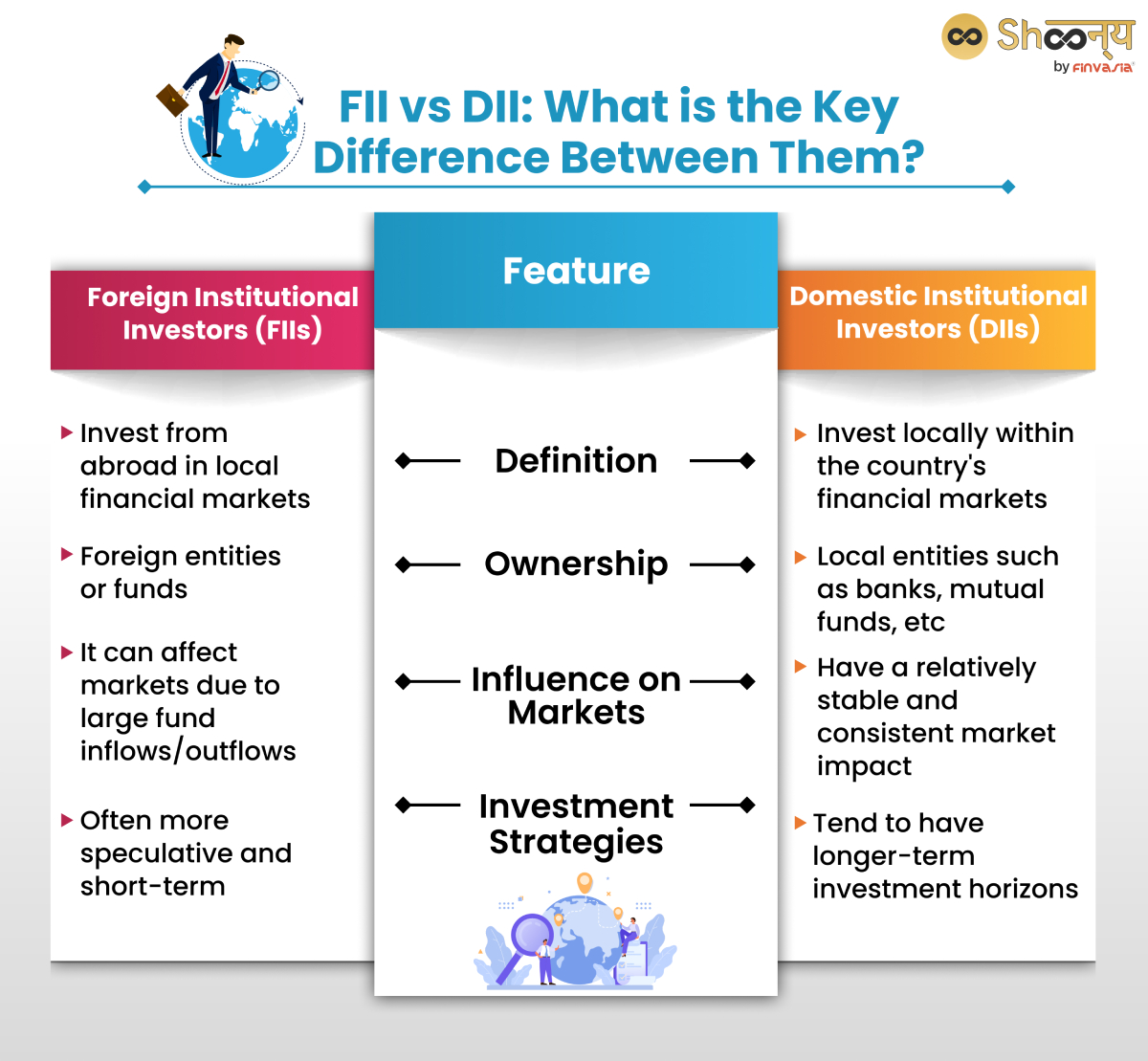

FII vs DII: What is the Key Difference Between Them?

| Feature | Foreign Institutional Investors (FIIs) | Domestic Institutional Investors (DIIs) |

| Definition | Invest from abroad in local financial markets | Invest locally within the country’s financial markets |

| Ownership | Foreign entities or funds | Local entities such as banks, mutual funds, etc. |

| Influence on Markets | It can affect markets due to large fund inflows/outflows | Have a relatively stable and consistent market impact |

| Investment Strategies | Often more speculative and short-term | Tend to have longer-term investment horizons |

When analysing FII vs DII, they differ mainly in their origin and investment focus.

FIIs often have a more global investment strategy, seeking opportunities across various countries.

DIIs primarily concentrate on investments within their own country’s financial markets.

FII vs DII: Types

FIIs, such as hedge funds and pension funds, invest across borders.

On the flip side, DIIs such as mutual funds and banks invest domestically.

FII vs DII: Benefits

FIIs enhance market liquidity and global integration.

DIIs contribute to market stability and support local economic growth through sustained investment.

FII vs DII: Cons

FIIs can introduce market volatility with quick capital movements.

DIIs may be overly concentrated in the domestic market, affecting diversification.

Exploring the In-Depth Differentiation Between FII and DII

- Investment Focus:

- FIIs

Typically, they have a broader international investment focus. They are often seeking opportunities in various countries. The decision to invest relies on global market conditions and investment trends.

- DIIs

Primarily focus on investing within their own country’s financial markets.

- Regulatory Compliance:

- FIIs

FIIs must register with the Securities and Exchange Board of India (SEBI) and follow its rules.

- DIIs

Governed by domestic regulations by SEBI and policies applicable to institutional investors within India.

- Impact on Markets:

- FIIs

FIIs can cause significant market volatility due to their ability to quickly move large sums of money in and out of the market.

- DIIs

Play a key role in the stability and liquidity of domestic markets.

Types of DII in India

- Mutual Funds

They invest in stocks, bonds, and other financial instruments.

- Insurance Companies in India

These invest a portion of their funds, called policyholder funds. They can do it in various assets like stocks and bonds to generate returns.

- Banks and Financial Institutions

Banks and financial institutions invest in the stock market. The amount invested is part of the institution’s earnings from banking services.

- Pension Funds

These manage retirement savings by investing in stocks, bonds, and other assets. The aim is to secure future income for pensioners.

Types of FII in India

Foreign Institutional Investor (FII) in India:

- Hedge Funds

Private funds use diverse strategies to generate active returns for their investors.

- Pension Funds

Investment pools that distribute retirement benefits.

- Mutual Funds

Investment vehicles that pool funds from multiple investors to buy securities.

- Investment Banks

Financial intermediaries aiding in capital raising, securities trading, and corporate M&A management.

- Insurance Companies

Organisations provide risk management via insurance policies for individuals and businesses.

- Sovereign Wealth Funds

State-owned investment funds that invest in various assets like stocks, real estate. This can also be alternative investments such as private equity or hedge funds.

Conclusion

Understanding the difference between FIIs and DIIs is essential for investors. While FIIs bring in foreign capital, DIIs play a crucial role in stabilizing the domestic financial markets. Both types of investors contribute to market liquidity and price discovery, influencing overall market sentiment.

FAQs| FII vs DII

FIIs are international investors in a country’s financial markets, while DIIs are domestic institutions investing within their own nation.

The main difference in India is that FIIs bring foreign capital and have investment limits, whereas DIIs invest local capital without such restrictions.

FIIs include hedge funds, pension funds, mutual funds, and other large investors based outside of India.

FIIs provide significant capital inflow, enhance market liquidity, and contribute to the global integration of financial markets.

Source– sebi.gov.in

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.