6 Important Financial Ratios: Are You Using These to Evaluate Your Investments?

How Do Succesful Investors Decide Which Stocks to Buy?

Successful investors rely on more than just their gut feelings and emotions! They assess a company’s financial health with just a few key numbers.

What are these numbers?

Let us say there is a stock that everyone seems to be talking about! But before you invest, how do you know if a stock is really a good purchase and will fetch you good returns?

Financial ratios are these numbers that ensure your stock picks are built on solid ground.

Mr Mathur is an experienced investor who thought of investing in a tech company everyone was excited about! The media, social platforms and even his colleagues were talking about it. It seemed like a sure win.

Did he buy its stocks?

No!

Instead of jumping in, Mr Mathur examined some key financial ratios.

What did he discover?

Despite the hype, the company had high debt and shrinking profits. By using these important financial ratios, Mr Mathur avoided the market hype!

He invested in a different company with stronger financials. That choice paid off well.

There are 6 types of ratios in financial accounting. Understanding the importance of financial ratio analysis is crucial for smart investing. These key financial ratios reveal a company’s true health beyond the headlines and trends. They help you see if a company is truly strong or just all show.

For example, if Mr Mathur had not seen the tech company’s financial ratios, he would have suffered, too!

It’s important to note that no single method fits all when analysing a company.

However, these six types of financial ratios are a must-know for every investor!

Let us introduce them to you!

Financial Ratio Analysis: Your Guide to Understanding Company Health

Financial ratio analysis is a must-do step if you’re planning to pick any stock!

By learning this, you can make decisions based on facts, not just hype.

You must check the three main statements for that:

- The Balance Sheet

- Income Statement

- Cash Flow Statement

What is the Importance of Financial Ratio Analysis?

Understanding a company’s financial health is crucial. Just like you thoroughly check a mango before buying it, you should carefully check a stock before investing in it! Financial ratio analysis gives you a clear overview of a company’s performance.

It helps investors, analysts, and stakeholders evaluate its financial stability, profitability, and efficiency. By using financial ratios, you can compare different companies.

What’s more?

You can recognise their strengths and weaknesses and make smarter investment choices.

What are Financial Ratios?

Financial ratios are like quick snapshots of a company’s financial health. Imagine you’re at a doctor’s office, and they check your temperature, blood pressure, and heart rate. These numbers tell the doctor how well your body is functioning. Similarly, financial ratios are numbers that tell us how well a company is doing.

These ratios are calculated using information from a company’s financial statements, like the income statement and balance sheet. They help us understand important things about a company, such as:

- How are they performing financially (profitability)

- How much debt they have and how are they managing it (leverage)

- How efficiently they are using their assets to generate revenue (efficiency)

It acts like a report card on how strong and stable a company is before deciding to invest your money in it.

Different Types of Financial Ratios – What they Reveal

Each type of ratio provides unique insights into various aspects of a company’s performance. Let’s break down what these ratios can tell you:

1. Liquidity Ratios

Liquidity ratios tell us how well a company can meet its short-term financial obligations using its most liquid assets.

In other words, they show if the company has easily convertible assets to pay off its immediate debts.

Example: Current Ratio = Current Assets / Current Liabilities

If the current ratio is above 1, it means the company has more assets than liabilities.

This generally indicates good short-term financial health.

2. Leverage Ratios

Leverage ratios assess how much-borrowed money a company is using to finance its operations. They help you understand the level of risk that may be involved.

If there is more debt, it can mean higher risk, especially if the company faces financial difficulties.

Example: Debt-to-Equity Ratio = Total Debt / Total Equity

A higher debt-to-equity ratio suggests that the company relies more on borrowed money. This can be risky if the company struggles to pay off its debt.

3. Efficiency Ratios

Efficiency ratios will help you measure how well a company uses its assets to generate revenue. They give insight into how effectively the company is running its operations.

Example: Asset Turnover Ratio = Net Sales / Average Total Assets

A higher asset turnover ratio means the company is using its assets efficiently to make sales.

4. Profitability Ratios

Profitability ratios reveal how well a company is generating profit compared to its revenue, assets, or equity. They reflect the overall financial health and performance of the company.

Example: Return on Equity (ROE) = Net Income / Shareholder’s Equity

A higher ROE means that the company is effectively using shareholders’ money to generate profit.

5. Market Value Ratios

Market value ratios show how the company’s stock is valued in the market. They provide insights into whether the stock might be undervalued or overvalued.

Example: Price-to-Earnings (P/E) Ratio = Market Price per Share / Earnings per Share

A lower P/E ratio might suggest that the stock is undervalued and could be a bargain. On the flipside, a higher P/E ratio could mean the stock is overvalued.

6. Coverage Ratios

Coverage ratios are used to evaluate a company’s ability to meet its debt obligations and interest expenses with its earnings. They show how well the company can handle its debt.

Example: Interest Coverage Ratio = Earnings Before Interest and Taxes (EBIT) / Interest Expense

For an instance, a higher interest coverage ratio could mean the company can easily cover its interest expenses with its earnings.

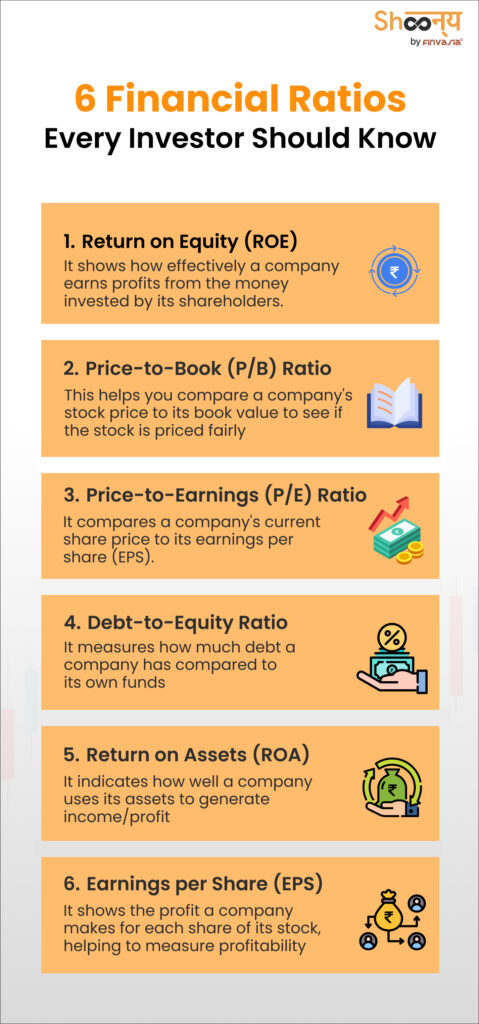

6 Important Financial Ratios with Formulas

Here’s a table that shows some key financial ratio formulas and what they reveal about a company’s financial health.

Let us explore each of these!

| Financial Ratio | Formula | What Does it Reveal |

| Return on Equity (ROE) | ROE = Net Income / Shareholder’s Equity | ROE shows you how a company generates profit from shareholders’ equity. |

| Price-to-Book (P/B) Ratio | P/B Ratio = Market Price per Share / Book Value per Share | It helps you compare the stock price to the company’s book value to assess valuation. |

| Price-to-Earnings (P/E) Ratio | P/E Ratio = Market Price per Share / Earnings per Share | It shows you how much investors are willing to pay for each unit of earnings. |

| Debt-to-Equity Ratio | Debt-to-Equity Ratio = Total Debt / Total Equity | It evaluates the level of a company’s debt relative to its equity. |

| Return on Assets (ROA) | ROA = Net Income / Total Assets | It will show you how efficiently a company uses its assets to generate profit. |

| Earnings per Share (EPS) | EPS = (Net Income – Dividends on Preferred Stock) / Average Outstanding Shares | This reflects the profit earned for each share of stock. |

Beyond the Financial Ratios – What Else to Consider

While financial ratios are crucial, they don’t show you the whole picture.

Here are some other important factors you must consider while buying any stock:

- Management Quality: Good leadership can significantly impact a company’s performance. You must have a look at the track record of the company’s executives and their strategic vision.

- Market Position: Understand the company’s position in the market. Is it a leader in its industry, or is it struggling to compete?

A strong market position often means a competitive edge that can lead to better financial performance.

- Industry Trends: For instance, trends like technological advancements or regulatory changes can affect performance. You must stay updated on industry news to understand how these trends might impact the company you’re interested in.

Key Financial Ratios: Turning Numbers into Smarter Investments

Now that you know how to read financial ratios, here are a few more things to keep in mind:

Where to Find Ratios

You can find financial ratios in a company’s financial statements, like its annual report or quarterly earnings reports.

Seeking Professional Advice

If you’re unsure about interpreting the data or need deeper insights, you can always take the help of a financial advisor or a professional.

Conclusion

Financial ratios are essential instruments for assessing a company’s financial health. They can help you understand profitability, debt levels, asset efficiency, market valuation, etc. You must Keep learning and applying these ratios to enhance your investment decisions.

The more you understand, the better you’ll be at spotting great investment opportunities.

FAQs| Types of Ratios in Financial Accounting

Financial ratios are calculations from financial statements that show how well a company is performing. You can check the profitability, debt, and overall financial health.

The four key financial ratios are liquidity, profitability, leverage, and efficiency ratios. They assess a company’s ability to pay for expenses, make money, manage debt, and use assets.

The five types of financial ratios are liquidity, leverage, efficiency, profitability, and market value ratios.

The five most common financial ratios are the current ratio, quick ratio, debt-to-equity ratio, return on equity (ROE), and net profit margin.

Financial ratio analysis compares numbers from financial statements to evaluate a company’s performance.

The different types of financial analysis include vertical, horizontal, trend, liquidity, solvency, profitability, efficiency, cash flow, and valuation analysis.

The five key accounting ratios are current ratio, quick ratio, debt-to-equity ratio, gross margin, and return on assets (ROA).

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.