HUF Income Tax: A Complete Guide to Taxation for Hindu Undivided Families

Taxation of income in India has its classifications; one interesting entity under the Income Tax Act is Hindu Undivided Family or HUF. If you are from a Hindu, Jain, Sikh, or Buddhist family and have joint ancestral property, then you can form an HUF of your own and enjoy the tax benefits thereof. But what really is an HUF, and how does HUF income tax work? How can a family legally save taxes through this entity?

With the growing intricacies of income tax laws, many times families remain ignorant of the benefits HUF has in store for them, ranging from taxation separately to additional deductions. In order to maximize the benefits from it, though, one must understand the income tax slabs for HUF for AY 2024-25, tax-saving options, and ITR forms for HUF.

In this blog, we will provide a comprehensive guide on HUF income tax, including the latest Budget 2025 updates, tax slabs, deductions, and the process for filing ITR for HUF.

Let’s explore this tax-saving structure and see how it can help families in a legal way to reduce their tax liability.

What is Hindu Undivided Family in Income Tax?

According to Section 2(31) of the Income Tax Act, 1961, the Hindu Undivided Family is a separate taxable entity. HUF full form stands for the family unit governed under Hindu Law, which comprises persons who are lineal descendants of a common ancestor together with their wives and unmarried daughters.

Interestingly, while Jain and Sikh families are not governed by Hindu Law, they are still considered HUFs under the Income Tax Act and can claim the same tax benefits.

Formation & Recognition of an HUF

An HUF is not created through a contract; it comes into existence automatically in a Hindu family. Once a family starts having joint income from ancestral property or business, an HUF is formed by default.

To be recognized as a taxable entity, an HUF must satisfy two key conditions:

1. Existence of Coparcenership

Coparceners are those relatives who, through birth, have a claim over components of a joint family property. The 2005 amendment gave daughters an equal right as their brothers over the family property within the male HINDU UNDIVIDED FAMILY of their father ﹣ it made them coparceners too. Daughters were brought into the fold of coparceners and now have claims over family property as do sons. Once considered the income of an HUF, unless partitioned by a coparcener, the income of a family will continue as such.

2. Presence of Joint Family Property

For an HUF to be taxed separately, it must own joint family property, which includes:

- Ancestral Property – Property inherited from the father, grandfather, or great-grandfather.

- Property Acquired Using Ancestral Funds – Any assets or investments made using ancestral wealth.

- Property Transferred by Family Members – If a family member transfers property to the HUF, the income generated from it will be taxed as HUF income.

Who Can Form an HUF?

To better understand who qualifies as an HUF, let’s look at different family structures and whether their income from ancestral property will be taxed as HUF income:

- Family of a widow mother and sons (minor or major) – Considered an HUF

- Family of husband and wife (without children) – Considered an HUF

- Family of two widows of deceased brothers – Considered an HUF

- Family of two or more brothers – Considered an HUF

- Family of uncle and nephew – Considered an HUF

- Family of mother, son, and son’s wife – Considered an HUF

- Family of a male and his late brother’s wife – Considered an HUF

*Exception: When a daughter inherits ancestral property, it becomes her absolute property and any subsequent income derived from it will be taxed to her in her own name and not as HUF income. This provision will also apply to any other legal heir who inherits from an HUF as taxable individual income.

Latest Updates for the AY 2026-27: Income Tax for HUF

The Income Tax Bill has just been tabulated by the Finance Minister as an option to simplify tax provisions and also clarify the issue with respect to HUF taxation. Under the new Budget 2025, there have been a few changes in the income tax slabs for HUF that will serve the purpose of families by taking off a bit of burden from taxes overall.

New Tax Slabs for AY 2026-27

The revised income tax slab rates for HUF under the new tax regime for FY 2025-26 (AY 2026-27) are as follows:

| Annual Income | Income Tax Rate |

| Upto ₹4,00,000 | Nil |

| ₹4,00,001 to ₹8,00,000 | 5% |

| ₹8,00,001 to ₹12,00,000 | 10% |

| ₹12,00,001 to ₹16,00,000 | 15% |

| ₹16,00,001 to ₹20,00,000 | 20% |

| ₹20,00,001 to ₹24,00,000 | 25% |

| Above ₹24,00,000 | 30% |

Tax Rebates for HUF (AY 2026-27)

Under the new tax regime, any HUFs with an annual income under ₹12 lakhs will be taxable but benefit from the increased rebate limit of ₹60,000. Well, this will be to consider its own privilege, as ₹25,000 rebate under Section 87A was part of the old tax regime for individuals having their yearly income below ₹7 lakhs. However, there is no rebate for those whose income is taxed at special rates such as capital gains under Section 112A.

With these changes, HUFs can further optimize their tax savings by taking advantage of different income slabs, deductions, and rebates available under the Income Tax Act, 1961.

What is HUF Income Tax & How HUF is Taxed?

- Taxation and Deductions: Hindu Undivided Families are taxed under the income tax slab rates applicable to an individual and are also eligible for deduction under Section 80C, 80D, etc., in their return of income.

- Insurance: The insurance policies on the members’ lives can be purchased by the HUF, and the premium paid thereon would be allowed as deduction.

- Salary to Members: If the members of an HUF actively contribute toward its functioning and management, the HUF can pay them a salary, which would be treated as a business expense, therefore reducing the overall taxable income of the HUF.

- Investment Returns: HUF can invest in share markets, mutual funds, fixed deposits, or any other financial instruments; any returns or interests on investments made will be chargeable to tax in the hands of HUFs.

These tax benefits and deductions, if rightly availed of, not only provide a higher scope of reducing tax liability but also act as a fair means for tax savings for families coming under Hindu jurisdiction in India.

Tax Slabs for AY 2025-26: Old Tax Regime vs. New Tax Regime for HUF

When it comes to taxation, Hindu Undivided Families (HUFs) have the option to choose between the old tax regime and the new tax regime, just like individuals. The primary distinction between the two lies in the availability of deductions and exemptions.

Old Tax Regime (With Deductions & Exemptions)

Under the old tax regime, HUFs can claim various deductions, such as those under Section 80C, 80D, HRA, and LTA, allowing for significant tax savings. The tax rates remain unchanged in Budget 2025, and the HUF income tax slabs are as follows:

| Annual Income | Tax Rate (for HUFs) |

| Up to ₹2,50,000 | Nil |

| ₹2,50,001 to ₹5,00,000 | 5% |

| ₹5,00,001 to ₹10,00,000 | 20% |

| Above ₹10,00,000 | 30% |

For senior citizens (60-79 years) and super senior citizens (80+ years) in an HUF, the basic exemption limits are higher, at ₹3,00,000 and ₹5,00,000, respectively.

New Tax Regime (Without Deductions & Exemptions)

The new tax regime, introduced to simplify taxation, has lower tax rates but eliminates most deductions. HUFs earning below ₹4,00,000 (AY 2026-27) are exempt from tax, and the rates increase progressively.

| Annual Income | Tax Rate (for HUFs) |

| Up to ₹3,00,000 | Nil |

| ₹3,00,001 to ₹7,00,000 | 5% |

| ₹7,00,001 to ₹10,00,000 | 10% |

| ₹10,00,001 to ₹12,00,000 | 15% |

| ₹12,00,001 to ₹15,00,000 | 20% |

| Above ₹15,00,001 | 30% |

Tax Slabs for HUF Under New Regime (AY 2026-27)

| Annual Income | Tax Rate |

| Up to ₹4,00,000 | Nil |

| ₹4,00,001 to ₹8,00,000 | 5% |

| ₹8,00,001 to ₹12,00,000 | 10% |

| ₹12,00,001 to ₹16,00,000 | 15% |

| ₹16,00,001 to ₹20,00,000 | 20% |

| ₹20,00,001 to ₹24,00,000 | 25% |

| Above ₹24,00,001 | 30% |

Which Tax Regime Should an HUF Choose?

For any HUF claiming several deductions and exemptions, the old tax regime is where the benefit lies, while the new one is simple, involves fewer deductions, and lower tax rates. The choice boils down to the type of income and the tax-saving investments of the HUF.

Important Note: HUFs earning business or professional income cannot switch between the old and new tax regimes every year. If an HUF with business or professional income opts out of the new regime and reverts to the old one, it can only do so once. After returning to the new regime, it cannot go back to the old one again.

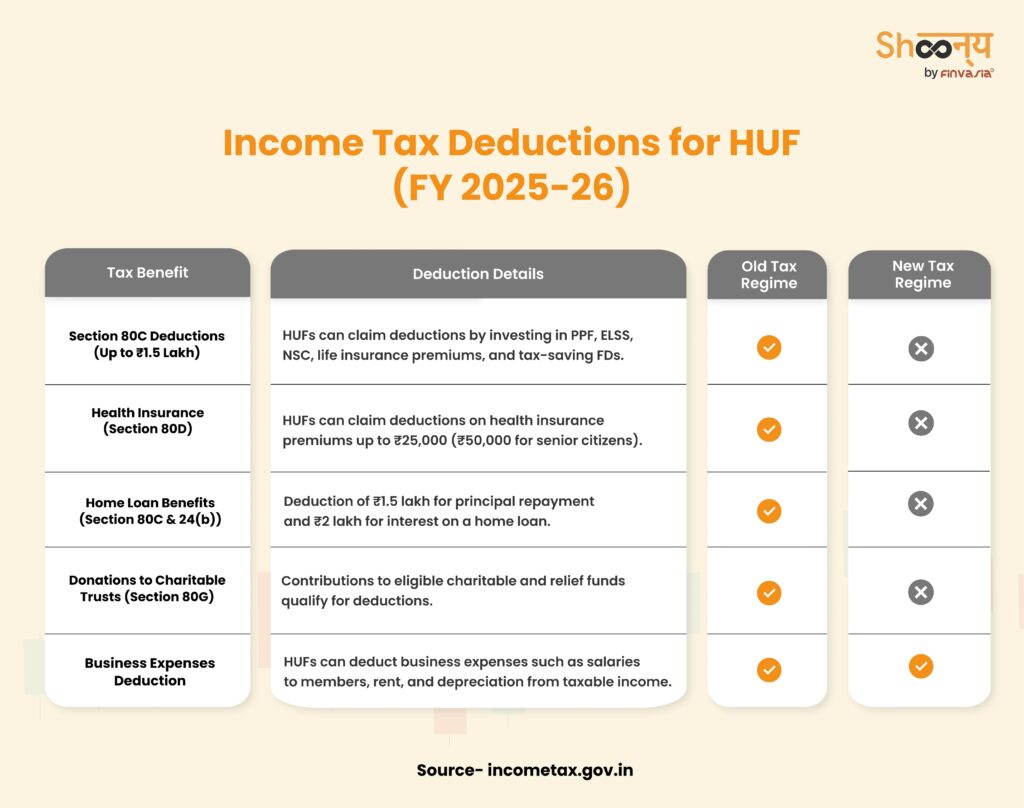

Income Tax Deductions for HUF (FY 2025-26)

An HUF can adopt the plan of making use of all applicable deductions and exemptions as provided under the Income Tax Act to reduce the tax liability incredibly. Because an HUF is considered an independent unit for tax purposes, it can enjoy tax reliefs regardless of the income that the members earn. The following are some additional deductions that an HUF can claim that offer assistance in other ameliorating strategies of tax mitigation:

Let’s understand how an HUF can reduce its tax liability with a practical example.

Mr. Amit Verma decides to create a HUF with his wife, son, and daughter as members. He has a salary income of ₹25 lakh per year, and the HUF owns a commercial property inherited from his father, which earns an annual rental income of ₹9 lakh. By forming an HUF, Mr. Verma can legally split the income and claim additional deductions, leading to substantial tax savings.

| Income from Various Sources | Before HUF Formation (Individual’s Return) | After HUF Formation (Mr. Verma’s Return) | HUF’s Return |

| A) Salary Income | ₹25,00,000 | ₹25,00,000 | – |

| B) Rental Income from Property | ₹9,00,000 | ₹9,00,000 | |

| C) Standard Deduction on House Property (30% of ₹9,00,000) | (₹2,70,000) | (₹2,70,000) | |

| D) Taxable Rental Income (B – C) | ₹6,30,000 | ₹6,30,000 | |

| Total Taxable Income (A + D) | ₹31,30,000 | ₹25,00,000 | ₹6,30,000 |

| E) Section 80C Deduction | ₹1,50,000 | ₹1,50,000 | ₹1,50,000 |

| Net Taxable Income (D – E) | ₹29,80,000 | ₹23,50,000 | ₹4,80,000 |

| Tax Payable (As per Old Regime + 4% Cess) | ₹7,02,600 | ₹5,20,200 | ₹10,400 |

| Total Tax Paid (Before HUF) | ₹7,02,600 | ||

| Total Tax Paid (After HUF Formation) | ₹5,30,600 | ||

| Tax Saved by Forming an HUF | ₹1,72,000 |

How HUF Helped in Tax Savings?

- Rental income was transferred to the HUF, reducing Mr. Verma’s individual taxable income.

- Both Mr. Verma and HUF claimed Section 80C deductions separately, lowering taxable income.

- The HUF paid tax separately on its income, benefiting from lower slab rates.

- By forming an HUF, Mr. Verma legally saved ₹1,72,000 in taxes.

Thus, a Hindu Undivided Family (HUF) is an effective tax-saving entity, allowing families to split income, invest in tax-free instruments, and optimize deductions under various sections of the Income Tax Act.

ITR Forms for Hindu Undivided Family for AY 2025-26

For Hindu Undivided Families (HUFs), choosing the right Income Tax Return (ITR) form is crucial. Here’s a simplified breakdown of applicable returns for HUF tax filing:

1. ITR-2 (For HUFs Without Business Income)

- Applicable to HUFs that do not have business or professional income.

- Not eligible for ITR-1.

2. ITR-3 (For HUFs With Business/Professional Income)

- Applicable to HUFs earning income from business or profession.

- Not eligible for ITR-1, ITR-2, or ITR-4.

3. ITR-4 (Sugam) (For Small Businesses Under Presumptive Taxation)

- For resident HUFs with total income up to ₹50 lakh.

- Income should be from business/profession taxed under presumptive scheme (Sec 44AD/44ADA/44AE).

- Other income sources can include salary, one house property, interest, family pension, or agricultural income up to ₹5,000.

*ITR-4 Not Applicable If:

- The HUF’s total income exceeds ₹50 lakh.

- The HUF has a company directorship or holds unlisted equity shares.

- The HUF has foreign assets, foreign income, or signing authority in a foreign account.

- Deferred ESOP tax or brought forward losses exist.

Please note that ITR-4 is optional – HUFs can choose it only if eligible for presumptive taxation. Otherwise, they should file ITR-3.

Key Income Tax Forms & Their Purpose for HUF Taxation

| Form | Provided/Submitted By | Purpose & Details |

| Form 16A | Deductor to Deductee | TDS certificate for income other than salary. Shows TDS amount, nature of payment, and TDS deposited with the Income Tax Department. |

| Form 26AS | Income Tax Department | Available on e-Filing Portal (Login > e-File > View Form 26AS). Shows TDS/TCS, tax payments, demand/refund status, and additional financial information. |

| AIS (Annual Information Statement) | Income Tax Department | Accessed via Income Tax e-Filing Portal (Login > e-File > AIS). Includes TDS/TCS, SFT transactions, tax payments, refunds, GST details, and foreign-reported data. |

| Form 15G | Resident Individual (< 60 years), HUF, or Other Non-Corporate Entities | Declaration to banks for non-deduction of TDS on interest income if total income is below the basic exemption limit. |

| Form 67 | Taxpayer | Statement for income earned outside India and claiming Foreign Tax Credit. Must be filed before the ITR due date (u/s 139(1)). |

| Form 3CB-3CD | Taxpayer (if audit required u/s 44AB) | Audit report & financial statement details for taxpayers subject to tax audit. Must be filed one month before ITR due date. |

| Form 3CEB | Taxpayer (if involved in international or specified domestic transactions) | Report from Chartered Accountant on cross-border or specified domestic transactions (u/s 92E). Must be filed one month before ITR due date. |

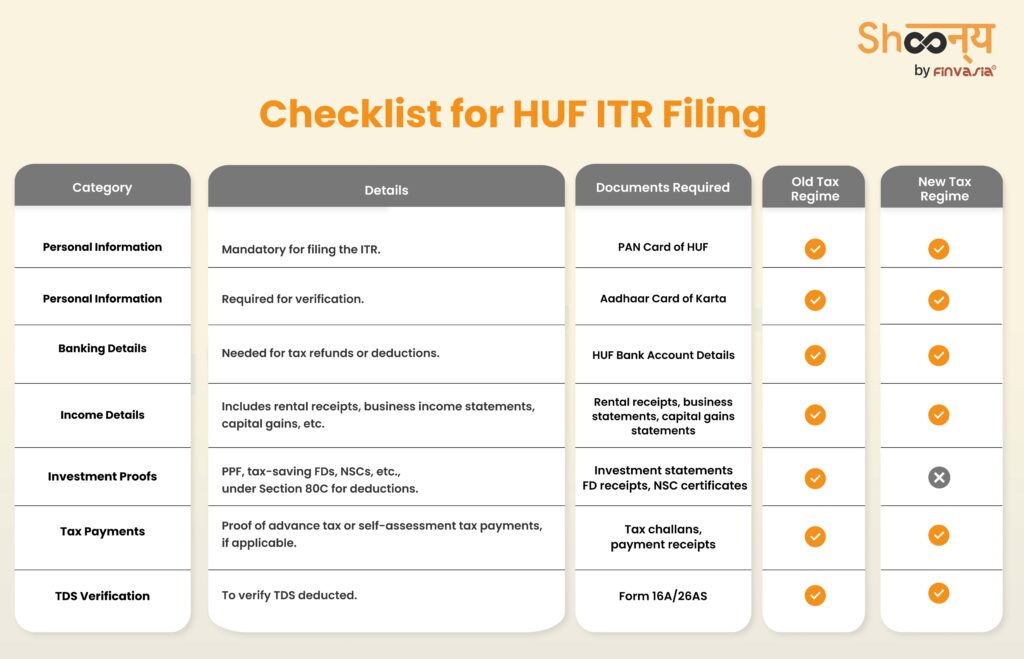

Checklist for HUF ITR Filing

How do you file an income tax return online for HUF?

Filing ITR for an HUF is similar to individual taxpayers but requires additional steps:

- Visit the Income Tax e-Filing Portal – Go to www.incometax.gov.in.

- Login with HUF Credentials – Use the PAN of the HUF as the user ID.

- Select the Appropriate ITR Form – Choose ITR-2, ITR-3, or ITR-4 as applicable.

- Fill in the Required Details – Enter income details, deductions, and exemptions.

- Verify Pre-Filled Data – Ensure all income sources are correctly mentioned.

- Calculate Tax Liability – Use the income tax calculator to confirm tax dues.

- Upload the ITR Form – Submit the completed return and verify using Aadhaar OTP, DSC, or net banking.

- E-Verify – Ensure verification to avoid defective return notices.

Common Mistakes to Avoid While Filing ITR for HUF

1. Incorrect Selection of ITR Form – Filing the wrong form (e.g., ITR-1 instead of ITR-2, ITR-3, or ITR-4) can lead to processing delays or rejection.

2. Not Reporting All Incomes – HUFs must disclose all sources of income, including rental income, interest from investments, capital gains, and business income, to avoid scrutiny and penalties.

3. Claiming Deductions Meant for Individuals – Certain deductions like Section 80E (Education Loan Interest) are meant for individuals and cannot be claimed by HUFs.

4. Failing to E-Verify – Filing is incomplete until e-verification is done via Aadhaar OTP, Net Banking, or sending a signed ITR-V to CPC Bengaluru. Unverified returns are treated as not filed.

5. Ignoring Advance Tax Payments – If the HUF’s total tax liability exceeds ₹10,000 in a financial year, advance tax must be paid in installments (June 15, Sept 15, Dec 15, and March 15) to avoid interest under Section 234B & 234C.

6. Mismatched Bank & PAN Details – Ensure that HUF’s bank account and PAN details are correct to prevent issues in refund processing or tax notices.

Tip: Cross-check all details before filing to avoid notices, penalties, or delayed refunds!

Assisted ITR Filing For HUF Taxation

The Income Tax Department has introduced several enhancements on the e-Filing portal to simplify tax filing:

- ITR Selection Wizard – Helps choose the correct ITR form

- Pre-filled ITRs – Reduces manual entry and errors

- Offline Utility – Offers a user-friendly filing experience

- Chatbot & Guides – Provides step-by-step assistance with manuals and videos

- Assisted Filing – Allows taxpayers to seek help from a CA, ERI, or Authorized Representative

Ready to Explore the Indian Market? Get Your Free Demat Account!

Who Can Assist You?

1. Chartered Accountant (CA)

A CA, a qualified professional under ICAI, assists with ITR filing and tax compliance.

- Taxpayers can add, assign, or remove a CA via the ‘My CA’ service on the portal.

2. e-Return Intermediary (ERI)

An ERI is an authorized entity that files ITRs and performs tax-related functions.

- Taxpayers can add, activate, or remove an ERI via the ‘My ERI’ service.

- ERIs can also register taxpayers and add them as clients with consent.

3. Authorized Representative (AR)

An Authorized Representative (AR) acts on behalf of taxpayers in specific situations.

| Taxpayer Type | Reason for Appointment | Authorized Person |

| Individual | Absent from India | Resident Authorized Person |

| Individual | Non-Resident | Resident Agent |

| Individual | Other reasons | Resident Authorized Person |

| Company (Foreign Entity) | Foreign director without PAN & DSC | Resident Authorized Person |

Taxpayers can assign an AR via the e-Filing portal to manage tax filings on their behalf.

Income Tax Calculator for Quick & Easy Tax Estimation

The Income Tax Calculator helps individuals, professionals, and businesses estimate their tax liabilities based on income, deductions, and tax regimes. The Income Tax Department offers an official calculator on its e-filing portal, allowing users to compare tax liabilities under the Old and New Regimes.

How to Use It?

- Access the Calculator → Visit the e-filing portal > Quick Links > Income and Tax Calculator

- Choose Calculator Type →

- Basic Calculator: Quick estimate based on income and deductions

- Advanced Calculator: Detailed breakdown by income sources, deductions, and TDS/TCS

- Enter Details → Input AY, taxpayer category, income, deductions

- Review Tax Liability → View total tax & interest payable

This tool ensures accurate tax estimation and better financial planning.

Benefits of Filing ITR for HUF

HUF Tax Benefits: A Hindu Undivided Family (HUF) provides several tax advantages, making it an effective tool for tax planning and financial management.

1. Separate Taxation – HUF enjoys independent tax treatment, reducing the family’s total tax burden.

2. Tax-Free Wealth Accumulation – Income earned by HUF is taxed separately, allowing savings on personal taxation.

3. Deductions and Exemptions – HUFs can claim various deductions under Sections 80C, 80D, and 80G.

4. Loan Approvals – A properly filed ITR strengthens loan applications for business or property purchases.

5. Avoiding Penalties – Filing ensures compliance with tax laws and prevents legal issues.

Conclusion

It is extremely essential that the families understand how to compute HUF income tax. By making use of tax slabs, selecting the proper ITR form for HUF and avoiding the pitfalls of popular filing errors, HUFs can readily keep themselves aware of their tax obligations. With budget 2025 introducing increased exemptions and modified tax slabs, it is crucial to remain updated and take maximum tax-saving strategies.

Income Tax Calculation & Filing for HUF Account|FAQs

A Hindu Undivided Family (HUF) is a distinct taxable entity under Indian law consisting of members from a common ancestor, including their spouses and children.

Under the Old Regime, HUFs follow the same slabs as individuals. Under the New Regime, the revised slabs offer higher exemptions and reduced tax rates.

No, HUF accounts are not eligible for Section 80TTB, which provides deductions on interest income for senior citizens. This benefit is exclusively available to individuals aged 60 and above.

HUFs can file ITR-2 (if no business income), ITR-3 (if engaged in business), or ITR-4 (for presumptive taxation).

An HUF account is a separate bank account in the name of the HUF used to manage the family’s income and financial transactions independently from individual members.

Yes, an HUF can claim interest deductions on home loans under Section 24(b) and principal repayment under Section 80C.

An HUF is taxed separately from its members, allowing families to distribute income efficiently and reduce the overall tax burden.

Source: Incometax.gov.in

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.