Income Tax for Local Authority in India: Comprehensive Guide for AY 2025-26

Local bodies are crucial to the functioning and administration of different parts of India. They are responsible for the provision of civic services as well as the construction of infrastructure in their Regions. Constructing an understanding of income tax for Local Authority is important due to their distinct financial structure and responsibilities linked to effective tax compliance and financial control.

Navigating through tax obligations is imperative in order for local authorities to prevent incurring liability and guarantees accountability from tax exemptions to ITR forms and audits. This document aims to clarify income tax for Local Authority and shed light on recent changes, important deductions, filing guidelines, and tax compliance guidelines.

What is a Local Authority?

Income tax for Local Authorities applies to earnings from various sources, just like any other entity. However, certain types of income have specific taxation rules.

Local Authorities earn income from:

- Property Rentals & Land Leasing – Income from renting out government buildings, municipal shops, or public spaces.

- Capital Gains – Earnings from the sale of properties, land, or municipal assets.

- Other Sources – This includes interest from bank deposits, fines, penalties, or government grants.

- Business & Commercial Activities – If a Local Authority is involved in trade or business, such as running public transport services, markets, or waste management services, the income generated is taxable. However, revenue from essential services like water and electricity supply is often treated differently for tax purposes.

Who is Considered a Local Authority?

The term Local Authority includes government bodies that manage municipal and public services at the local level. According to the Indian Constitution, a Local Authority refers to:

- Panchayats – Rural governing bodies responsible for village administration.

- Municipalities – Urban local bodies managing towns and cities.

- Municipal Committees & District Boards – Organizations responsible for civic amenities and public welfare.

- Cantonment Boards – Bodies managing areas under military administration, as defined in the Cantonments Act, 1924.

Each of these authorities plays a crucial role in governance, infrastructure development, and public welfare, making it essential for them to comply with income tax regulations.

Latest Updates for the AY 2025-26: Income Tax for Local Authorities and Non Company Taxation

According to the Union Budget of 2025-26, there were no specific changes made for Local Authorities for any income tax provisions. The income tax rules applicable for Panchayats, Municipalities, Municipal Committees, District Boards, and Cantonment Boards have remained constant as per the existing law. However, there is a continuing requirement for the entities under this non-company taxation to keep adhering to the prescribed regulations so as to abide by the income tax laws.

- Flat Tax Rate: Local Authorities continue to be taxed at 30% on their total income.

- Surcharge: 12% if net income exceeds ₹1 crore (with marginal relief).

- Health & Education Cess: 4% on income tax plus surcharge.

- No Option for New Tax Regime: Local Authorities do not have the flexibility to choose between old and new tax regimes. They are taxed under a fixed structure without progressive slabs.

Although Budget 2025-26 did not introduce any new taxation rules for Local Authorities, they must comply with the existing Income Tax Act, 1961, which governs their tax liabilities and exemptions.

Tax Slabs for AY 2025-26: Old Tax Regime vs. New Tax Regime

Local Authorities do not have the option to choose between the old and new tax regimes. Unlike individuals and companies, they are subject to a fixed tax structure under the Income Tax Act, 1961.

Fixed Tax Structure for Local Authorities

- Flat Tax Rate: 30% on total income.

- Surcharge: 12% if net income exceeds ₹1 crore (with marginal relief).

- Health & Education Cess: 4% on income tax plus surcharge.

- No Progressive Slabs: Local Authorities are taxed at a uniform rate, irrespective of income levels.

- No Option for the New Tax Regime: Unlike individuals and businesses, Local Authorities cannot opt for lower concessional rates under the new tax system.

While this taxation system ensures uniformity, Local Authorities can still avail of certain deductions and exemptions applicable to public welfare activities and grants.

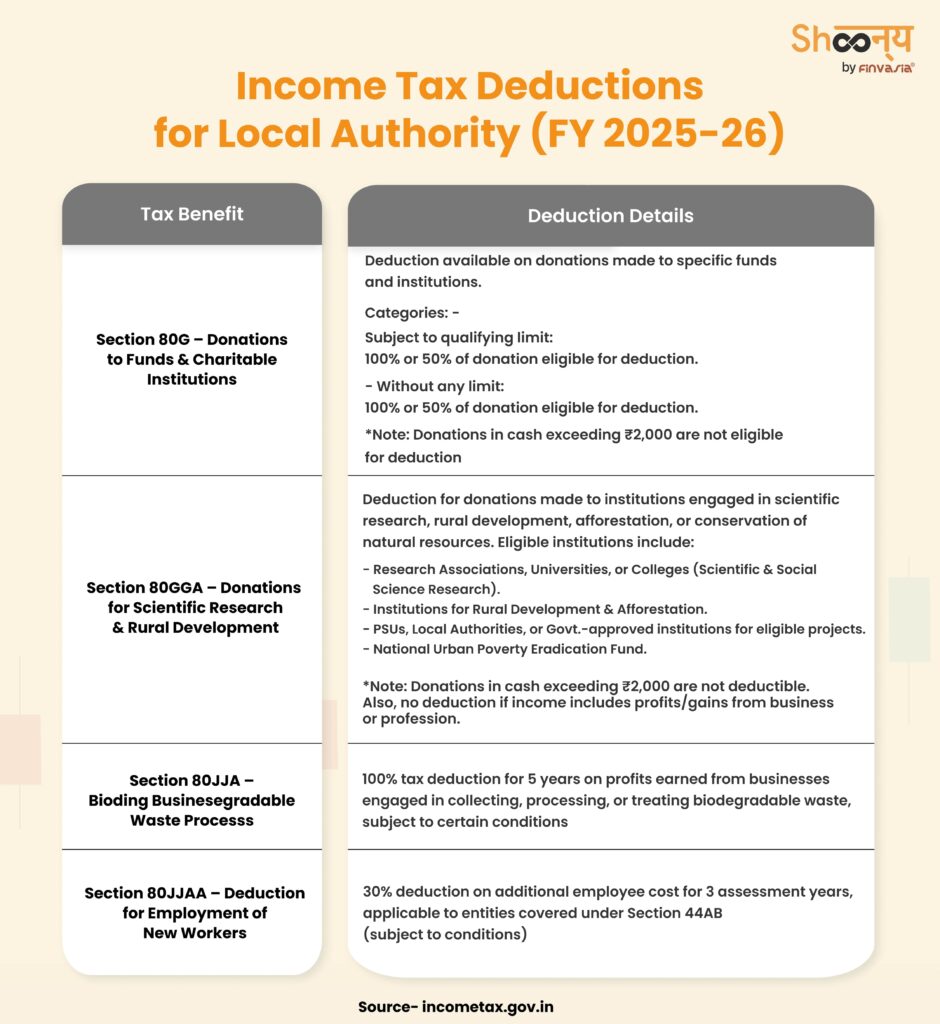

Tax Saving Options for Local Authority (FY 2025-26)

While Local Authorities are subject to a flat tax of 30%, they still have several options for tax savings under Chapter VI-A of the Income Tax Act. Such deductions allow certain taxpayers to contribute towards charity, scientific research, rural development, and employment generation, along with environmental sustainability. The good use of these provisions duly taken can benefit Local Authorities in minimizing their taxable income along with planning finances in a manner that redresses social and economic welfare. The following table illustrates: the salient points of tax-saving opportunities on offer:

| Tax Benefit | Deduction Details |

| Section 80G – Donations to Funds & Charitable Institutions | Deduction available on donations made to specific funds and institutions. Categories: – Subject to qualifying limit: 100% or 50% of donation eligible for deduction. – Without any limit: 100% or 50% of donation eligible for deduction. *Note: Donations in cash exceeding ₹2,000 are not eligible for deduction. |

| Section 80GGA – Donations for Scientific Research & Rural Development | Deduction for donations made to institutions engaged in scientific research, rural development, afforestation, or conservation of natural resources. Eligible institutions include: – Research Associations, Universities, or Colleges (Scientific & Social Science Research). – Institutions for Rural Development & Afforestation. – PSUs, Local Authorities, or Govt.-approved institutions for eligible projects. – National Urban Poverty Eradication Fund. *Note: Donations in cash exceeding ₹2,000 are not deductible. Also, no deduction if income includes profits/gains from business or profession. |

| Section 80JJA – Biodegradable Waste Processing Business | 100% tax deduction for 5 years on profits earned from businesses engaged in collecting, processing, or treating biodegradable waste, subject to certain conditions. |

| Section 80JJAA – Deduction for Employment of New Workers | 30% deduction on additional employee cost for 3 assessment years, applicable to entities covered under Section 44AB (subject to conditions). |

These deductions not only help Local Authorities reduce their tax liability but also encourage investments in public welfare, environmental sustainability, and employment generation.

ITR Forms for Local Authority for AY 2025-26: Choosing the Right ITR Form for Non-Company Taxpayers

Local Authorities in India are defined as a person for taxation purposes under Section 2(31) of the Income Tax Act. Although some income of Local Authorities might get exempt under Section 10(20), Local Authorities are still required to file income tax returns (ITRs) with the Assessing Officers concerned based on their financial operations. To select the correct ITR form is essential for compliance, smooth taxation filing, and for avoiding penalties.

Below is a breakdown of the ITR forms applicable to Local Authorities for AY 2025-26:

1. ITR-5

This form is applicable to Local Authorities falling under clause (vi) of Section 2(31). It is used by various entities, including:

- Local Authorities

- Firms & LLPs

- Association of Persons (AOP) & Body of Individuals (BOI)

- Artificial Juridical Persons (AJP)

- Representative Assessee under Section 160(1)(iii) or (iv)

- Cooperative Societies & Societies registered under Societies Registration Act, 1860

- Trusts (except those eligible for ITR-7)

- Estate of a deceased person or an insolvent individual

- Business Trusts & Investment Funds covered under Sections 139(4E) & 139(4F)

Who cannot use ITR-5?

Entities that are mandated to file returns under Sections 139(4A), 139(4B), or 139(4D) cannot use this form.

2. ITR-7

Local Authorities whose income is exempt under Section 10 but still opt to file returns can use ITR-7. It is also applicable for entities required to file under:

- Section 139(4A) – Income from charitable or religious trusts.

- Section 139(4B) – Return filing by Political Parties’ CEOs.

- Section 139(4C) – Various exempt entities like Research Associations, News Agencies, and Educational Institutions.

- Section 139(4D) – Universities, Colleges, or Institutions referred to under Section 35 of the Income Tax Act.

Who can use ITR-7?

- Entities with unconditionally exempt income under Section 10 who are not mandatorily required to file returns under Section 139.

- Local Authorities that choose to voluntarily file their returns despite tax exemptions.

Selecting the correct ITR form is crucial for Local Authorities to ensure compliance with tax laws while availing exemptions where applicable. If a Local Authority derives taxable income or voluntarily wishes to file returns, they must carefully assess whether ITR-5 or ITR-7 is the appropriate form.

Key Income Tax Forms & Their Purpose for Local Authority Taxation: Understanding Non-Company Taxation

Local authorities in India are subject to specific tax compliance and reporting requirements. The following table outlines the key Income Tax Forms applicable to Local Authorities, their purpose, and the information they contain.

| Form | Provided/Submitted By | Purpose & Details |

| Form 26AS | Income Tax Department (Available on e-Filing Portal: Login > e-File > Income Tax Return > View Form 26AS) | A consolidated tax statement that provides details of Tax Deducted at Source (TDS), Tax Collected at Source (TCS), Advance Tax, and Self-Assessment Tax paid by or on behalf of the local authority. Helps in reconciling tax credits before filing returns. |

| AIS (Annual Information Statement) | Income Tax Department (Available on e-Filing Portal: Login > e-File > AIS) | Offers a comprehensive summary of the taxpayer’s TDS, tax payments, refund status, SFT transactions, GST details, foreign income, and pending/completed proceedings. It now includes several details previously available in Form 26AS. |

| Form 3CA-3CD | Local Authority (if accounts are subject to audit under Section 44AB) | Audit report for local authorities required to get their accounts audited. Must be submitted one month before the ITR filing deadline under Section 139(1). Contains details of financial transactions and tax compliance. |

| Form 3CB-3CD | Local Authority (if accounts are audited under Section 44AB, but not under any other law) | Similar to Form 3CA-3CD but applicable when audit is not mandatory under any other law. To be submitted one month before the ITR filing deadline under Section 139(1). |

| Form 16A | Deductor (e.g., Contractors, Financial Institutions) to Deductee (Local Authority) | TDS Certificate issued quarterly, detailing the TDS deducted on non-salary income such as contract payments, rent, or interest. Used for tax reconciliation and compliance. |

Local authorities must adhere to specific tax reporting requirements to ensure compliance with the Income Tax Act, 1961. These forms help in tracking tax deductions, audits, and financial transactions, ensuring transparency and accuracy in tax filings.

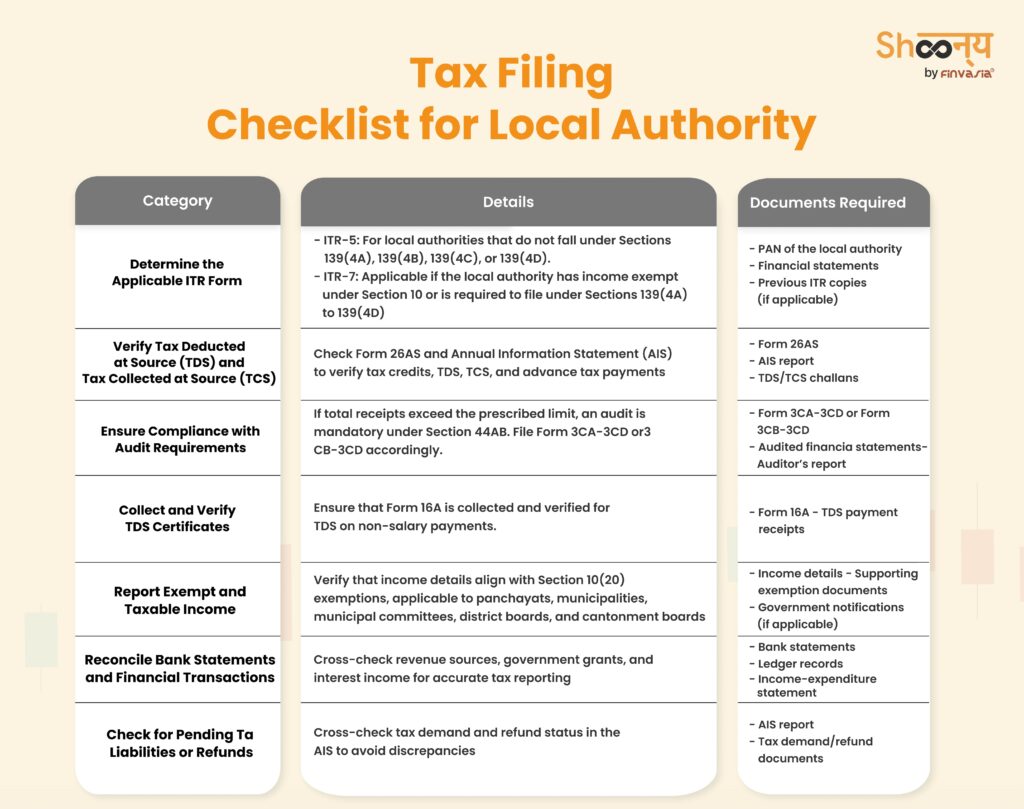

Checklist for Local Authority ITR Filing: Ensuring Compliance with Income Tax for Local Authority

Local authorities must comply with income tax regulations while filing their Income Tax Returns (ITR) under the category of non-company taxation. Since local authorities are not classified as companies under the Income Tax Act, they must follow specific filing requirements based on their structure and sources of income.

Filing ITR for a local authority requires meticulous documentation and compliance with non-company taxation rules. Ensuring accurate reporting and timely submission helps avoid penalties and maintain financial transparency.

How to File ITR for Non-Company/ Local Authority: A Guide to Non-Company Income Tax Compliance

1. Login to the Income Tax Portal

- Visit www.incometax.gov.in and log in using the local authority’s credentials.

2. Select the Appropriate ITR Form

- Choose ITR-5 or ITR-7, depending on the local authority’s income classification.

3. Fill in the Required Details

- Provide income details, exemptions, deductions, and tax computation.

4. Attach Required Documents

- Upload supporting financial documents like balance sheets, income statements, and tax computation sheets.

5. Verify the Return

- Use Digital Signature Certificate (DSC) or Aadhaar OTP for verification.

6. Submit and Acknowledge

- Submit the return and download the acknowledgment (ITR-V) for records.

Common Mistakes to Avoid While Filing Local Authority Income Tax Returns

When filing income tax for Local Authority, it is crucial to ensure accuracy and compliance with tax regulations. Below are some common errors that can lead to rejection, penalties, or unnecessary tax liabilities:

1. Using the Wrong ITR Form – Selecting the incorrect ITR form for Non Company entities, such as ITR-5 or ITR-7, can result in return rejection. Ensure the right form is chosen based on income sources and exemptions under Local Authority income tax regulations.

2. Incorrect PAN or Financial Data – Errors in PAN details, financial statements, or TDS credits can cause mismatches with the income tax calculator and lead to processing delays or scrutiny. Double-check all data before submission.

3. Failure to Claim Applicable Deductions – Many tax-saving options for Local Authority exist under the Income Tax Act. Not claiming eligible exemptions (e.g., Section 10(20) for Panchayats, Municipalities, and District Boards) can lead to a higher Non Company income tax burden.

4. Late Filing of Returns – Delays in how to file ITR for non-company entities can result in penalties and interest. Ensure compliance with filing deadlines to avoid unnecessary financial losses.

5. Mismatch Between GST and ITR Data – Discrepancies between GST filings and income tax for non-company returns can trigger tax department scrutiny. Cross-check income declarations, tax credits, and GST details to maintain consistency.

For accurate tax filing and to optimize benefits under the Non Company tax slab, consult professionals such as Chartered Accountants, e-Filing intermediaries, or tax consultancy firms.

Assisted ITR Filing for Local Authorities: Navigating Income Tax for Non-Company Entities

For local authorities facing complexities in tax filing, professional assistance can be sought through:

- Chartered Accountants (CAs) – Experts in tax planning, compliance, and audit requirements. They ensure accurate filing, minimize tax liabilities, and assist in handling assessments, tax notices, and audits under Section 44AB.

- Income Tax e-Filing Intermediaries – These are government-registered professionals authorized to assist taxpayers in preparing and submitting returns through the Income Tax Department’s online portal. They help navigate digital filings, verify tax credits, and ensure compliance with the latest tax laws.

- Tax Consultancy Firms – Specialized firms offering end-to-end tax filing solutions, including advisory services on tax exemptions, deductions, and regulatory compliance. They assist in maintaining accurate financial records, ensuring proper documentation, and optimizing tax benefits for local authorities.

These professionals play a crucial role in non-company taxation by ensuring that local authorities meet their tax obligations while leveraging all available exemptions and deductions.

Income Tax Calculator: How to Use It

The Income Tax Calculator is a helpful tool that allows local authorities to estimate their tax liability.

Steps to Use the Income Tax Calculator

- Visit the official Income Tax Calculator portal.

- Select the applicable financial year (AY 2025-26).

- Choose the tax regime (Old or New).

- Enter the taxable income details.

- Apply deductions and exemptions.

- Calculate the final tax liability.

Benefits of Filing ITR for Local Authorities & Non-Company Taxation

1. Compliance with Income Tax Laws – Avoid penalties and legal issues.

2. Eligibility for Government Grants & Loans – Many funding programs require proof of tax compliance.

3. Transparency & Financial Management – Filing ITR ensures proper documentation of income and expenses.

4. Avoidance of Interest & Penalties – Timely filing prevents unnecessary financial burdens.

5. Smooth Audits & Financial Planning – Proper tax filing ensures hassle-free audits and fund allocation.

Conclusion: Local Authority Income Tax Overview

Income tax compliance for local authorities is a crucial aspect of financial governance. With the latest tax updates from Budget 2025-26, it is essential to understand tax slabs, exemptions, and the filing process. By leveraging deductions, using tax calculators, and avoiding common mistakes, local authorities can optimize tax liabilities while ensuring legal compliance.

ITR Forms & Income Tax for Non-Company Entities | FAQs

Local authorities are taxed at a flat rate of 30% under the old regime, while the new regime follows a progressive slab system.

Most local authorities should file ITR-5, while some may require ITR-7 if they fall under specific exemption categories.

Yes, under Section 10(20), certain types of income, such as municipal taxes and water charges, may be tax-exempt.

Local authorities can face penalties ranging from ₹1,000 to ₹5,000, depending on the delay. Interest may also be applicable.

By claiming deductions on municipal taxes, infrastructure investments, employee welfare contributions, and renewable energy projects.

They can e-file through the Income Tax Department’s official portal by selecting the appropriate ITR form, filling out details, and verifying via DSC or Aadhaar OTP.

GST may apply to services provided by local authorities unless specifically exempt under GST laws.

Source- Incometax.gov.in

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.