Introduction to Equity and Derivatives

Equity and Derivatives- Basics

Equity refers to ownership in a company, represented by stocks or shares.

Derivatives are financial instruments whose value is derived from an underlying asset, such as a stock, bond, commodity, or currency. Examples include options, futures, and swaps.

What is an Underlying Asset?

Underlying assets are the assets that serve as the basis for the value of a financial instrument, such as a futures contract, an option, or a structured product. These assets can be stocks, bonds, currencies, commodities, real estate, or indexes, and their value often influences the value of the financial instrument being traded.

For example, an option on a stock may have a specific stock as its underlying asset, while a futures contract may have a commodity, such as gold or oil, as its underlying asset.

Note- Understanding the underlying assets of a financial instrument is important for investors, as changes in the value of the underlying assets can affect the value of the financial instrument.

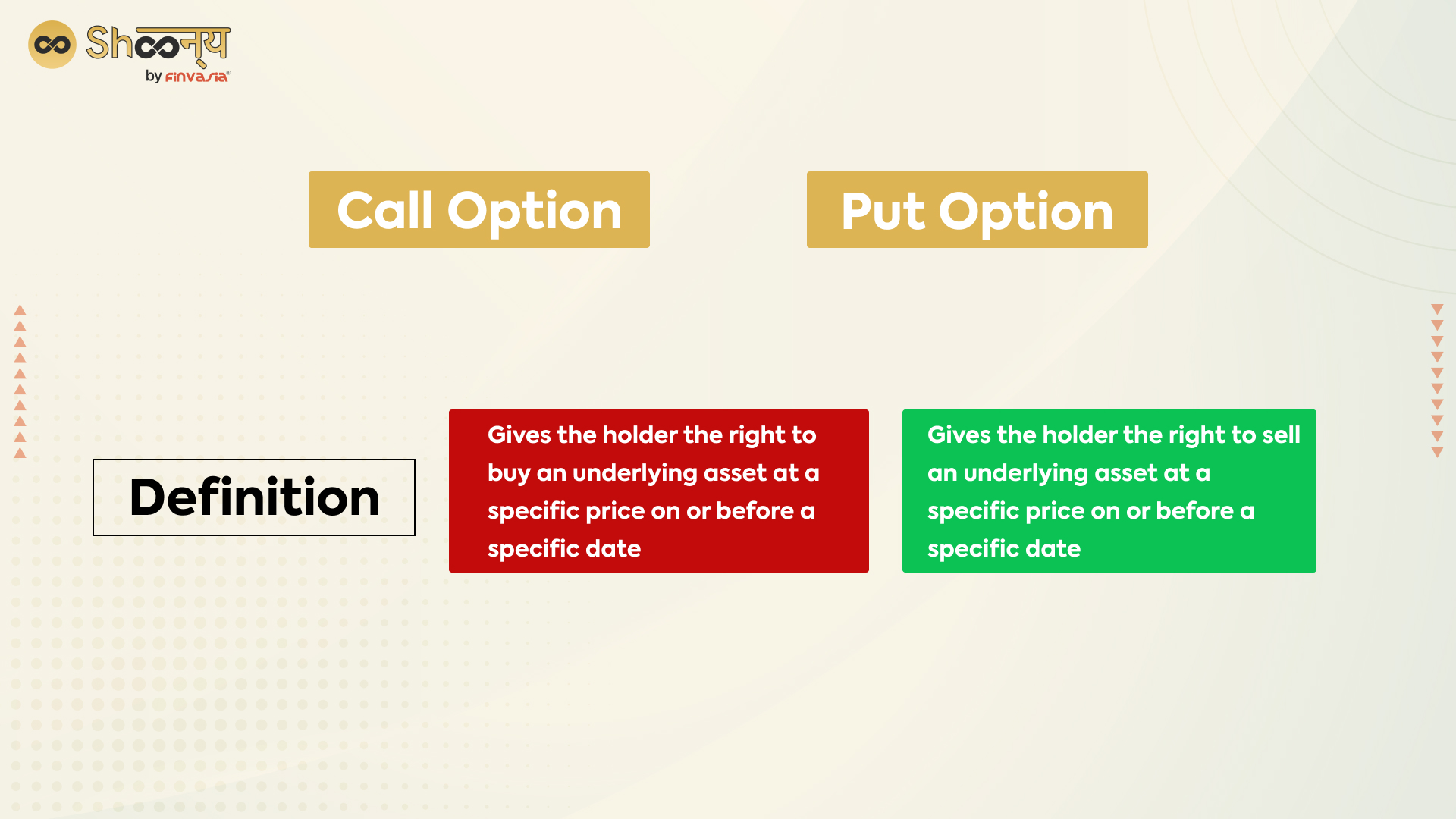

- Options: A financial instrument that gives the holder the right, but not the obligation, to buy or sell an underlying asset at a certain price on or before a certain date.

- Futures: A contract to buy or sell an underlying asset at a certain price on a certain date in the future.

- Swaps: An agreement to exchange one set of payments for another based on the movement of an underlying asset. This can include exchanging interest payments on a loan or exchanging the cash flows of two different investments.

Let’s take a look at this example

Imagine you own a small piece of a company, like a slice of pie. This slice represents your ownership in the company, and it’s called shareholder’s equity. You can buy and sell slices of pie (or equity) just like you can buy and sell other things, like a car or a house. This is called equity trading.

You can also look at-Tips for entering into the Equity Market.

Now, let’s say you’re not sure what the price of the pie (or equity) is going to be in the future. You might want to make a bet on what you think the price will be. That’s where derivatives come in.

Derivatives are like bets on the future price of something. They’re called “derivatives” because their value is derived from something else, like the price of the pie. For example, you might make a bet with a friend that the price of the pie will go up in the next month. If it does go up, you win the bet, and your friend has to pay you. If it goes down, your friend wins, and you have to pay them. This is similar to how derivatives work in the stock market.

- If you’re new to the stock market, it’s important to understand how the derivative market works before you start trading derivatives.

- One way to learn is to study how different types of derivatives, such as options and futures, are bought and sold.

As we proceed, you will certainly be able to understand how to choose the best stocks for derivatives trading.

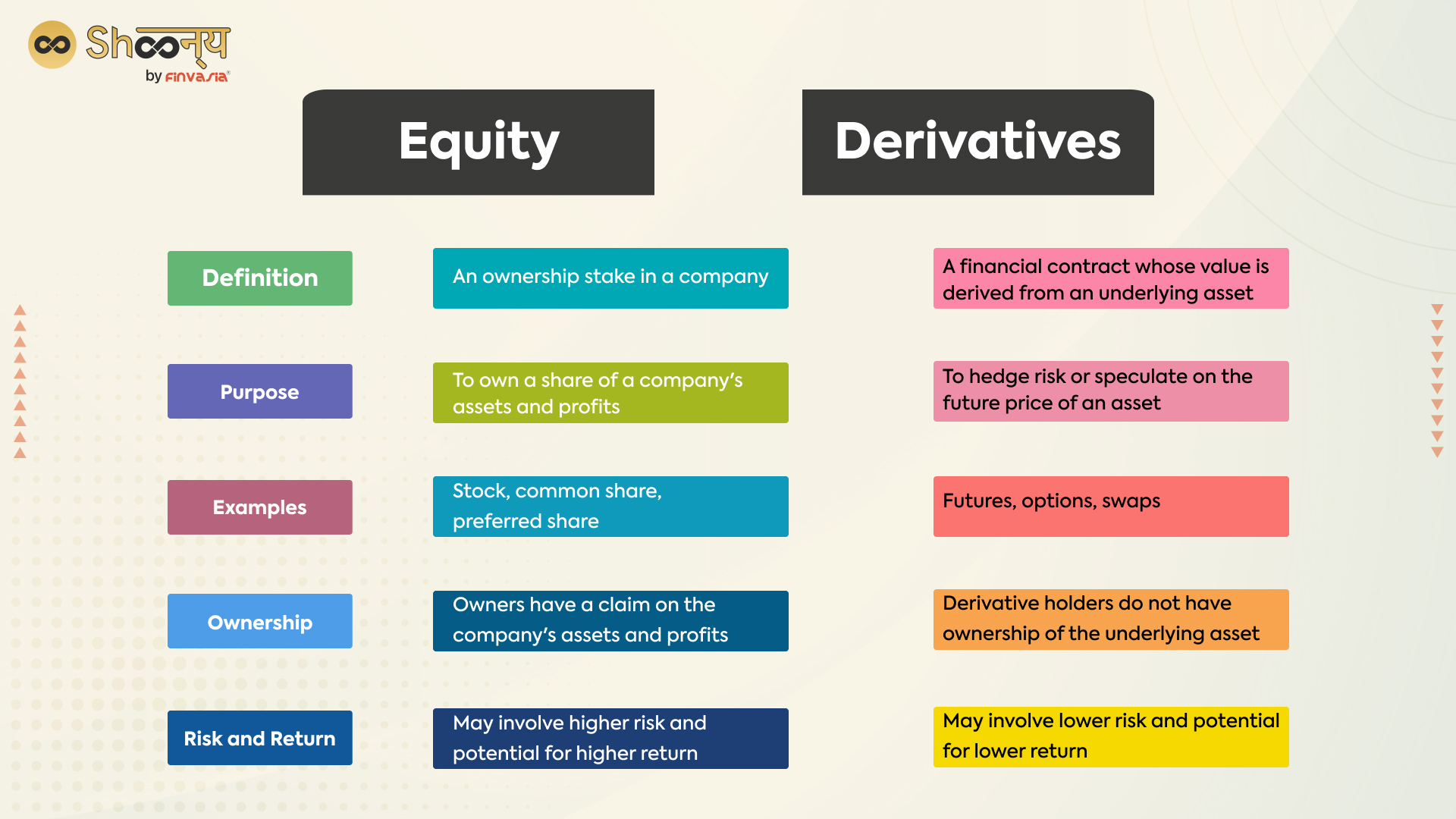

Equity vs Derivatives

First, let us look at the key differences between equity and derivatives.

- Equity represents ownership in a company, while derivatives are simply contracts that derive their value from an underlying asset.

- Equity is typically bought and held for the long term, while derivatives are often used for shorter-term speculation or as a hedge.

- Equity trading involves buying and selling stocks or shares in a company, while derivatives trading involves buying and selling derivatives contracts.

Equity Market Overview

Shareholder equity, also known as stockholders’ equity or owners’ equity, refers to the portion of a company’s assets that are owned by its shareholders. It is calculated by subtracting a company’s liabilities from its assets.

Let’s say a company has assets worth 50,000 rupees and liabilities worth 30,000 rupees. In this case, the shareholder equity would be 20,000 rupees, calculated as follows:

Shareholder equity = Assets – Liabilities

= 50,000 rupees – 30,000 rupees

= 20,000 rupees

Margin vs Equity: Know the Difference

Margin and equity are terms that are commonly used in the stock market and refer to the amount of money that a trader has available to trade.

In the context of trading, margin refers to the amount of money that a trader must deposit in order to open a leveraged position. To margin in trading means that the trader is borrowing money in their brokerage account to trade a larger position than they would be able to with just their own equity.

Equity is the total amount of money available to a trader, including any margin borrowed.

Types of Equity Market

- Primary market: A market where new securities are issued and sold to the public for the first time. Benefits of the primary market include the ability to raise capital for companies and the opportunity for investors to buy securities at the initial offering price.

- Secondary market: A market where securities that have already been issued and sold in the primary market are bought and sold among investors. Benefits of the secondary market include liquidity, which allows investors to buy and sell securities easily, and price discovery, which helps to determine the value of securities based on supply and demand.

Key Benefits of Investing in Equity, or Stocks:

- Potential for high returns: Because equity represents ownership in a company, it has the potential to provide higher returns than other investments, such as bonds or cash.

- Diversification: By owning a diverse portfolio of stocks, you can spread risk across different industries and sectors, helping to minimise the impact of any one company’s performance on your overall portfolio.

- Professional management: When you invest in a mutual fund or exchange-traded fund (ETF) that holds a variety of stocks, you benefit from the expertise of professional money managers who research and select individual stocks to include in the fund.

- Potential for dividend income: Some companies pay dividends to shareholders, providing a source of regular income in addition to any appreciation in the value of the stock.

Investing in the Stock Market during Inflation

Investing in the stock market during times of inflation can be a good way to protect against the erosion of purchasing power, as stocks have the potential to provide returns that outpace inflation. When prices are rising due to inflation, companies that are able to raise their own prices may see an increase in profits, which can lead to an appreciation in the value of their stocks. Thus, you can gain profits in inflation.

However, it’s important to remember that the stock market carries its own set of risks, such as the possibility of losing money if the value of a company’s stock declines. As with any investment, it’s important to carefully consider your risk tolerance and financial goals before deciding whether investing in the stock market is right for you.

Derivatives Overview- All about Derivatives Trading

Buying and selling derivative contracts involve speculating on the value of underlying assets, such as stocks, bonds, commodities, and currencies. Derivative contracts are traded over the derivatives securities market.

Now, you might be thinking about how the derivative market works.

The derivative market allows traders to buy and sell contracts that derive their value from an underlying asset. Trading derivatives on exchanges or over-the-counter (OTC) markets is possible. In the Indian Stock Market, the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) offer a range of derivative products, including futures and options.

OTC markets in India are used for trading more complex or customised financial instruments that may not be listed on an exchange, such as exotic options, swap options, and structured products. These markets are typically used by financial institutions and large corporations, although some retail investors may also participate through brokers or other intermediaries.

Tip: If you are looking for a hassle-free trading experience, try our App (Shoonya), download it from the play store or apple store and start your trading journey at a zero brokerage.

Derivatives and Volatility on Indian Stock Markets

Derivatives can affect stock prices by providing a way for traders to speculate on the future direction of the stock or to hedge against potential price movements.

Let’s say that a trader believes that the stock of Company XYZ is likely to experience significant price fluctuations in the coming months. The current stock price is 1,000 rupees per share. The trader could buy call options on Company XYZ stock with a strike price of 1,200 rupees and an expiration date of three months from now. The cost of the options contract is 50 rupees per share.

If the stock price goes up to 1,300 rupees within the three-month period, the trader could profit from the appreciation in the value of the options.

On the other hand, if the trader is concerned about potential price declines, they could buy put options with a strike price of 800 rupees as a way to hedge against potential price declines. If the stock price does decline to 800 rupees or lower, the trader could exercise the put options and sell the stock at the higher strike price of 800 rupees, potentially limiting their loss.

Derivatives in the Stock market

Let’s understand how derivatives can be used in Stock Market

- To speculate on potential price movements: Traders can buy call options on a stock as a way to profit from potential price increases, or they can buy put options as a way to profit from potential price declines.

- To hedge against potential price declines: Traders can buy put options on a stock as a way to protect against potential price declines.

- To speculate on the direction of an index: Traders can buy futures contracts or options on an index, such as the S&P 500 or the Nifty 50, as a way to speculate on the direction of the index.

- To hedge portfolios: Investors can use derivatives to hedge their portfolios against potential losses in specific sectors or markets.

- To manage risk: Derivatives can be used to manage risk in a variety of ways, such as by hedging against currency or interest rate fluctuations.

A little extra about Derivatives

- Are derivatives a good investment

- Derivatives and capital markets products—overview

- Who Should Invest in Derivatives?

- Equity Mutual Funds and Direct Equity, which one to choose?

Which is better for me: Equity or Derivatives?

It’s difficult to say which is better: equity or derivatives, as it ultimately depends on an investor’s goals and risk tolerance. Both equity and derivatives have their own unique characteristics and can be used in different ways to achieve different objectives. Looking at the key difference between equity and derivatives, we can only say that it depends on every individual investor’s choice.

Equity refers to ownership in a company, and investing in equity typically involves buying and holding shares of stock in a company. Equity investing can offer the potential for long-term growth and dividends but also carries the risk of loss if the company’s performance deteriorates.

Conversely, derivatives are financial instruments that derive their value from an underlying asset, like a share, bond, commodity, or currency. Derivatives can be used to hedge risk, speculate on price movements, or obtain leverage, but they also carry the risk of loss if the underlying asset performs poorly.

In general, equity investing may be more suitable for long-term investors who are looking for potential growth and are willing to accept the risk of loss. Derivatives may be more suitable for short-term traders or investors who are looking to hedge risk or speculate on price movements but should be used with caution due to their complex nature and the potential for significant losses.

Now, what have you decided?

If you wish to step into Derivatives Trading, check this out – Prerequisities for Derivatives Trading.

But, if you want to try Equity, don’t forget to click on this- Tips for entering into the equity Market.