An initial public offering (IPO) process is when a privately-held company becomes publicly traded by issuing shares to the public for the first time. When demand for a company’s shares exceeds the number available for sale, the offering is said to be “oversubscribed.” The scenario can happen for several reasons, but generally, it indicates strong investor interest in the company.

One notable example of an oversubscribed IPO stock in India is the IPO of HDFC Asset Management Company (HDFC AMC) in 2018. The IPO was open for subscription from July 25th to July 27th, 2018. The company had intended to raise Rs 2,800 crore but received subscriptions worth Rs 1,71,000 crore. As a result, the IPO was oversubscribed by over 83 times.

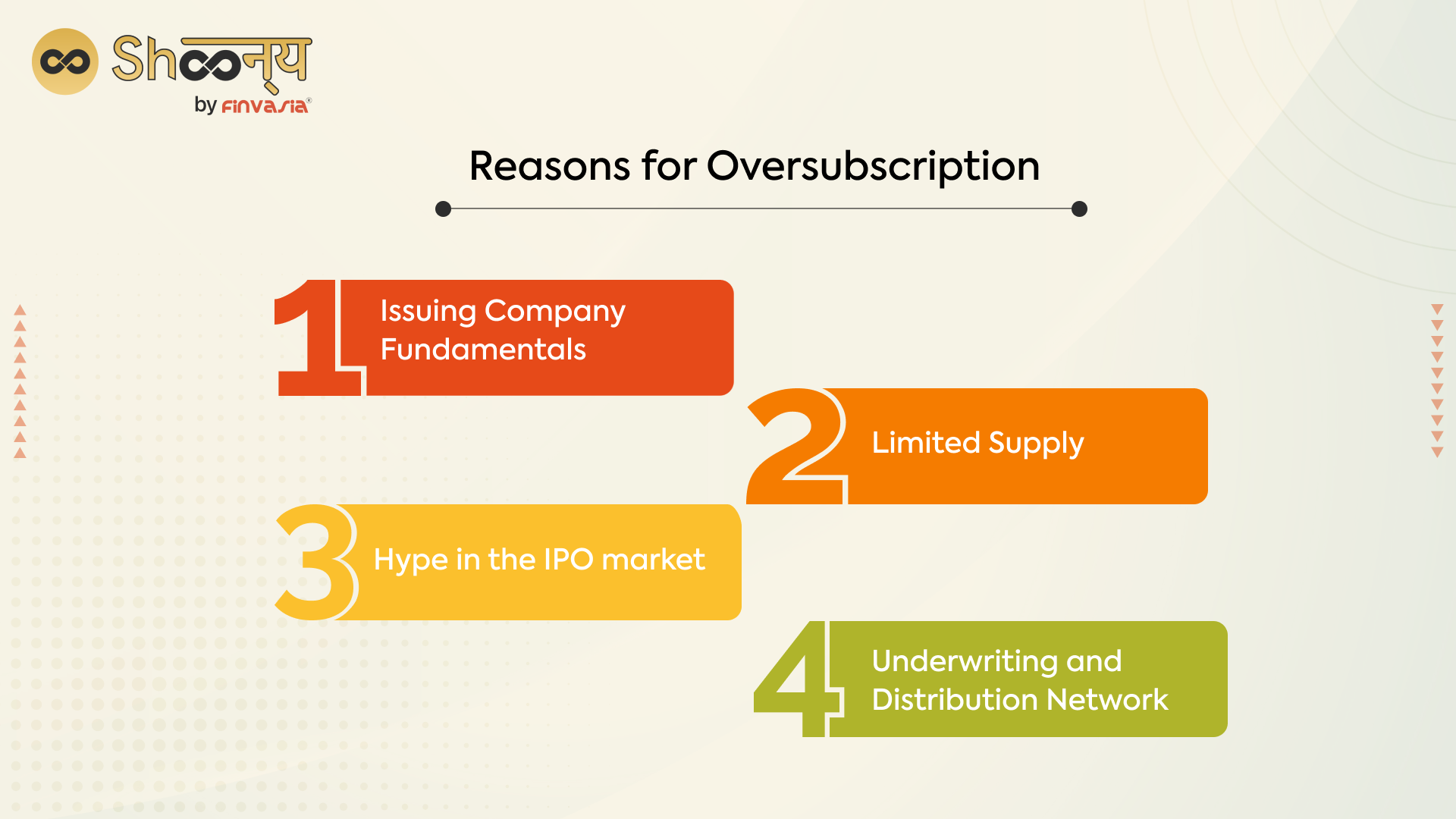

Reasons for IPO Oversubscription

1. Issuing Company Fundamentals

One of the main reasons for oversubscription is the company’s solid financial performance and growth potential. Investors are more likely to buy shares in a company making a consistent profit, has a strong track record, and is expected to continue growing.

2. Limited Supply

Another reason for oversubscription is the limited number of shares available for sale. If a company only issues meagre shares, investors may bid up the price to secure a piece of the action.

3. Hype

In some cases, the hype surrounding an IPO can drive demand for the stock, even if the company’s fundamentals are not particularly strong. This can lead to oversubscription, as investors rush to buy shares before the price goes up.

4. Underwriting and Distribution Network

The quality of the investment bank and the distribution network also plays a role in oversubscription. A solid investment bank and an efficient distribution network can help to generate interest in an IPO and increase demand for its shares.

Consequences of Oversubscription

- Higher share prices: When an IPO is oversubscribed, it can lead to higher share prices. Investors are willing to pay more for the shares, which can drive up the price.

- More capital: A company that has an oversubscribed IPO can raise more capital than it had planned. The scenario can be great for the company, as it can use the extra funds to expand its operations or pay down debt.

- Increased liquidity: When a company goes public, it increases the liquidity of its shares. That means investors can buy and sell the shares more easily, contributing to increased demand and higher prices.

- Minimal risk: Going public can also reduce the risk for investors. When a company is privately held, it can be difficult for investors to value the company or sell their shares. When a company goes public, it becomes easier for investors to value the company and sell their shares.

- More transparency: Public companies are required to disclose financial information to the public. This increased transparency can make it easier for investors to evaluate the company’s performance and make investment decisions.

Oversubscription can be negative for investors as artificially high prices due to oversubscription may result in unrealistic expectations and lower profits. Additionally, “lock-up” restrictions on insiders selling shares during oversubscription can make it difficult for investors to exit, causing stock prices to decline.

Conclusion

Oversubscription shows strong investor interest, leading to higher share prices and more capital for the company. However, it can also harm investment returns. Consider the company’s financials, growth potential, investment bank, and distribution network before investing.