What is ISIN in Stock Market: Know the History of ISINs

In the stock market, thousands of transactions take place every second. With so many securities like stocks and mutual funds, how are these transactions tracked? Ever wondered how the stock market keeps everything organised? That’s where ISINs come in. It acts more like a unique barcode for every security.

So, what is ISIN, and what is the full form of ISIN in stock market?

Let us understand it today!

What is ISIN: Know the Basics

ISIN Full Form- ISIN stands for International Securities Identification Number.

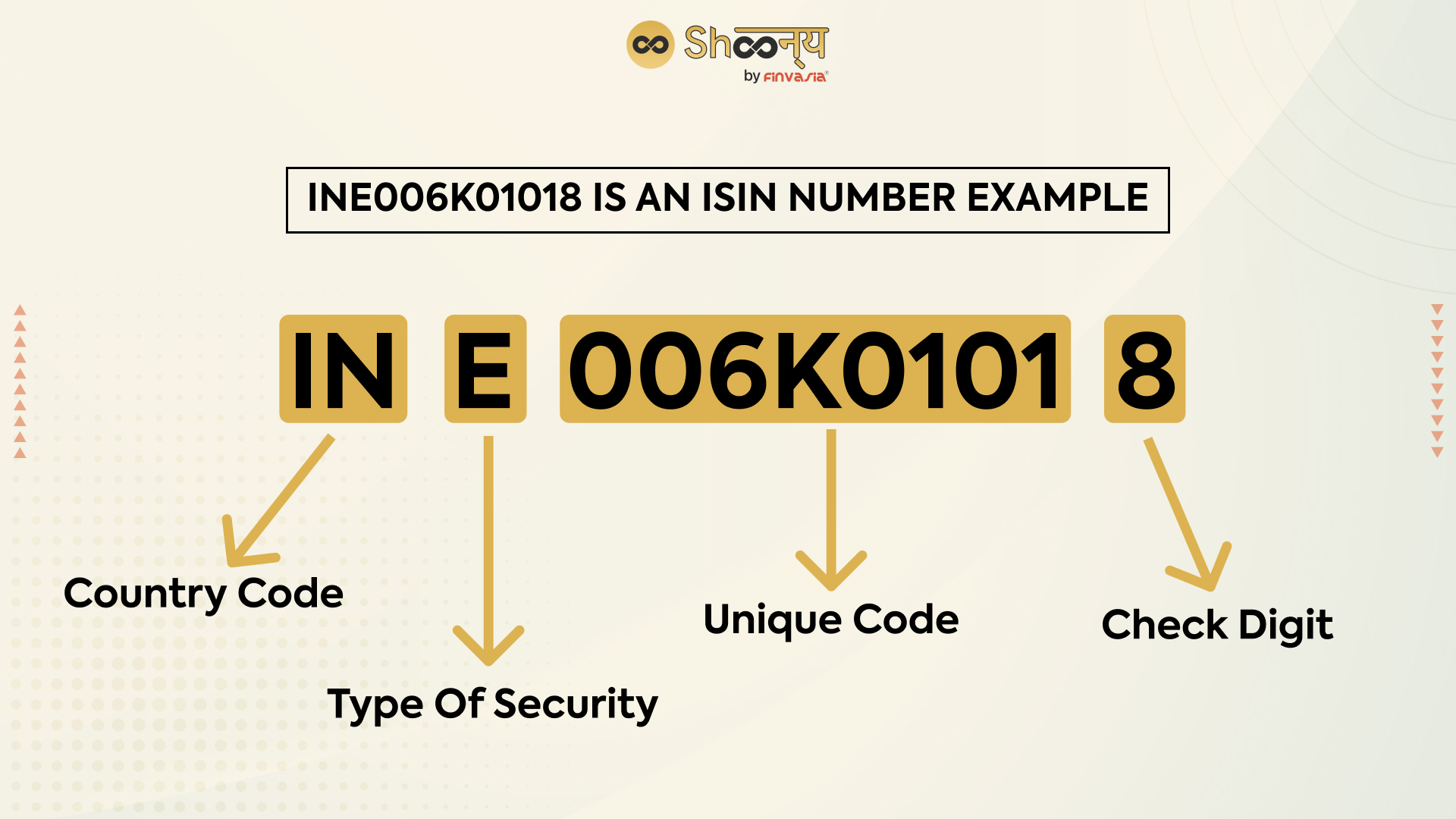

An ISIN is a 12-character alphanumeric code assigned to a specific security. It starts with a country code (e.g., IN for India), followed by a unique identifier, and ends with a check digit for accuracy. ISINs make it easier to track and trade securities and reduce confusion and errors in trading and settlement processes.

ISIN Example

Let’s look at the ISIN for Reliance Industries Limited:

- ISIN: INE002A01018

- ISIN Description: RELIANCE INDUSTRIES LIMITED EQ

- Name of Issuer: RELIANCE INDUSTRIES LIMITED

- Security Type: EQUITY SHARES

- ISIN Status: ACTIVE

Here is what each of the above means:

- ISIN: This is a unique 12-character code used to identify the security.

- ISIN Description: This tells you that the ISIN is for Reliance Industries Limited’s equity shares.

- Name of Issuer: This is the company that issued the security, which is Reliance Industries Limited.

- Security Type: This describes the type of security, in this case, it is equity shares.

- ISIN Status: This indicates that the ISIN is currently active and in use.

History of ISIN: The Evolution and Importance of ISIN

The International Securities Identification Number (ISIN) system has an interesting history:

The history of ISINs dates back to the 1980s. It was officially introduced in 1981 by the International Organization for Standardization (ISO) under the standard ISO 6166. However, in 1989, the Group of 30 (G30), a group of international financial experts, recommended its implementation.

By the late 1990s and early 2000s, the use of ISINs became widespread.

Understanding ISIN in Stock Market

The issuance and registration process of ISIN in stock market involves several steps:

- Application

The issuer or their authorised representative applies to the National Numbering Agency (NNA) in their country for an ISIN. The application includes details about the security, such as the name, security type, issuer, etc.

- Verification

The NNA reviews the application and verifies the details. They may request additional documentation or clarification to ensure the accuracy.

- Allocation

Once the NNA is satisfied with the information, they assign a unique 12-character ISIN to the security.

- Registration

The NNA registers the ISIN with the International Organization for Standardization (ISO).

Features of ISIN (International Securities Identification Number)

Each ISIN acts as a 12-character code that uniquely identifies a specific security.

- Standardised Format:

- Country Code: The first two characters show the country of the issuer (e.g., IN for India).

- National Securities Identifying Number (NSIN): The next nine characters uniquely identify the security.

- Check Digit: The last character is a check digit that verifies the ISIN’s validity.

- Universal Recognition: ISINs are used worldwide.

- Versatility: ISINs apply to various securities, including stocks, bonds, mutual funds, and derivatives.

- Enhanced Tracking: ISINs help track and manage securities. This makes it simpler for investors to monitor their holdings across different markets.

ISINs in India

In India, the National Securities Depository Limited (NSDL) issues ISINs for different securities. The Securities and Exchange Board of India (SEBI) oversees the whole process. However, for government securities, the Reserve Bank of India (RBI) regulates the assignment of ISIN codes.

Types of Securities Identified by ISIN

ISINs are used for a wide range of securities. These include:

- Equities: Shares and units of companies.

- Debt Instruments: Bonds, treasury bills, and other debt securities.

- Derivatives: Options, futures, and other derivative contracts.

- Other Financial Instruments: Commodities, currencies, and indices.

What is ISIN Number in Demat Account?

An ISIN (International Securities Identification Number) in a demat account helps you electronically and uniquely identify each security that you hold in your demat account.

Now, what is ISIN code in mutual funds?

The ISIN code for Mutual Funds plays a crucial role in distinguishing between different fund units. Each fund class, series, and option is assigned a unique ISIN. This ensures that you can track the specific fund units you hold, which helps make portfolio management and reporting more efficient.

ISIN vs. Ticker Symbol: What’s the Difference?

One common misconception is that ISIN is the same as a ticker symbol. However, they serve different purposes. A ticker symbol is a shorter abbreviation used primarily on stock exchanges to identify a security quickly. In contrast, an ISIN is a universal identifier. It is recognized globally.

Conclusion

ISINs are not just a combination of characters. They ensure seamless trading, clearing, and settlement of securities. Understanding ISINs in the stock market is important for investors.

FAQs| ISINs in Stock Market

Not all companies have ISINs. Only companies whose securities are traded or need to be identified in the financial markets are assigned ISINs.

The National Numbering Agency (NNA) creates an ISIN. In India, this role is fulfilled by the NSDL.

Yes, ISINs are mandatory for all securities that are traded or need to be identified in the financial markets.

No, each security has only one unique ISIN.

The ISIN number in India is a 12-character code that uniquely identifies securities. It helps investors and regulators distinguish different financial instruments.

An ISIN code for shares is a unique 12-character alphanumeric identifier that distinguishes specific shares.

Source- nsdl.co.in/

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.