KVP Scheme| Features, Benefits and Kisan Vikas Patra Scheme Interest Rate 2024

Kisan Vikas Patra (KVP) has been a popular savings choice for Indian families, especially the middle class. Many grandparents and parents recall investing in the Kisan Vikas Patra scheme right from their child’s birth. This government-supported savings scheme holds a special place in Indian families.

As the name ‘Kisan‘ suggests, meaning farmers, the scheme was originally designed for farmers, but it quickly gained popularity across all sectors of society.

Have you invested in it yet?

If not, the KVP scheme in post office is the most reliable option.

Today, we will walk you through the Kisan Vikas Patra scheme details.

Kisan Vikas Patra Scheme 2024

In 1988, India Post, under the Ministry of Finance, introduced the Kisan Vikas Patra (KVP) to encourage long-term savings among citizens.

KVP scheme initially thrived, but concerns arose about its potential misuse for money laundering.

Money laundering is when criminals try to hide where their illegal money comes from, making it look like it was earned legally.

Consequently, in 2011, it was temporarily discontinued following recommendations from a government committee led by Ms. Shyamala Gopinath.

However, recognising its constant popularity, the government reintroduced the KVP scheme in 2014 with stricter guidelines.

KVP Scheme 2024

Now, a PAN Card is needed for investments >Rs. 50,000 and income proof for deposits >Rs. 10 lakh to prevent misuse.

The scheme matures in 115 months (9 years, 7 months). You must make a minimum investment of Rs. 1,000. However, there is no maximum limit.

- Adults can buy certificates for themselves, minors, or jointly with another adult.

- Certificates can be transferred with written consent to a Post Office or Bank officer, and the transferee must be eligible.

- Early encashment is possible after 2.5 years in case of death, court order, or forfeiture.

Type of Certificates Issued Under KVP Scheme in Post Office

The Kisan Vikas Patra (KVP) certificates come in the following types:

- Single Holder Type Account:

- An adult can open this account for themselves.

- An adult can open this account on behalf of a minor or a person of unsound mind for whom they are the guardian.

- A minor who has attained the age of ten years can also open this account.

- Joint A-Type Account:

- You can open this account jointly in the names of up to three adults.

- It is payable to all the account holders jointly or to the survivors.

- Joint B-Type Account:

- You can open this account jointly in the names of up to three adults.

- It is payable to any of the account holders or to the survivor or survivors.

Kisan Vikas Patra Scheme Interest Rate 2024

As of April 2024, deposits made in KVP accounts earn an interest rate of 7.5% compounded annually.

The Ministry of Finance regulates/decides the interest rates on KVP investments, which are not subject to market risks. The government also reviews the interest rate every quarter and tweaks it frequently.

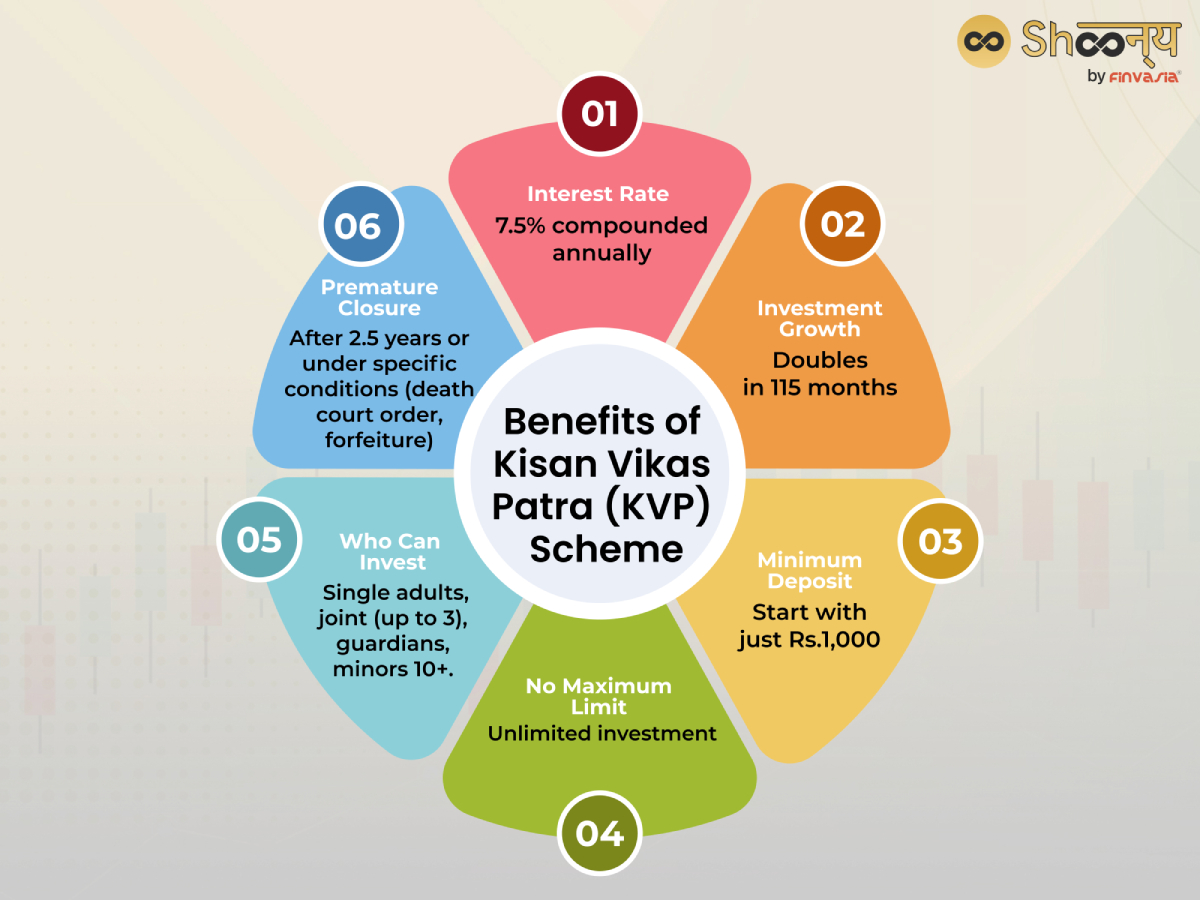

Benefits of Kisan Vikas Patra (KVP) Scheme

The KVP scheme offers multiple benefits:

- You earn an interest rate of 7.5% compounded annually on your investment.

- Your invested amount doubles in 115 months (9 years and 7 months).

- There is no limit to how much you can deposit.

- You can open an account at any post office or authorised bank.

- You can transfer your KVP to another person or from one post office to another.

- You can encash your KVP after 2 ½ years from the date of investment at the specified rates.

Eligibility Criteria for the KVP Scheme in Post Offices

Wondering if you could invest, too.

KVP scheme in the post office doesn’t have any age limit. Thus, it provides a great investment opportunity even for seniors!

- Any individual who is a resident of India, and is above 18 years can avail of the benefits under the scheme.

- A parent or guardian can invest on behalf of a minor or a person of unsound mind.

- Minors must be at least 10 years old. (They can invest with the help of a parent/guardian)

Deposits Required for the Kisan Vikas Patra (KVP) Scheme

- You can deposit a minimum of ₹1000 and any amount in multiples of ₹100 in an account.

- There is no maximum limit for deposits in an account or across accounts held by an account holder.

- You can open any number of accounts.

How much do you earn when KVP matures?

Payment on Maturity

If you opened your account between December 12, 2019, and March 31, 2020, your money will double when you withdraw it in 9 years and 5 months.

- For accounts opened on or after April 1, 2020, your money doubles in 10 years and 4 months upon withdrawal.

The time it takes for your money to double depends on the kisan vikar patra scheme interest rate when you open your account.

How Can You Apply to the KVP scheme?

You can only do it offline.

Here’s the process:

- You must visit your nearest Post Office Branch or designated bank.

- Fill out the application form available at the counter or download it from the official website.

- Attach all required documents.

- Complete the declaration and nomination details.

- Submit the filled application form along with your initial investment amount.

Documents Required to Invest in KVP Scheme

Here are the documents you’ll need to submit for your KVP Certificate application:

- You must provide a recent passport-sized photograph.

- Submit a copy of your Aadhaar Card.

- Include a copy of your PAN Card.

- Attach a Birth Certificate as proof of age.

For identification and address proof, the following documents are accepted:

- Passport

- Driving License

- Voter’s ID Card

- Job card issued by NREGA signed by a State Government officer

- Letter issued by the National Population Register that should contain details of name and address

These documents are officially recognised for verifying your identity and address.

What are the Payment Methods?

You can pay for your KVP Scheme account in the following ways:

- Cash

- Locally executed cheque, demand draft, or pay order made out to the Post Master.

- Withdrawal from a Savings Account at the same Post Office or Bank, using a signed withdrawal form or cheque with your passbook.

Issuance of Certificates

If you pay in cash, your Certificate will be issued immediately with the payment date as its issue date.

If you are paying by cheque, demand draft or pay order, the KVP certificate will be issued after the payment is cleared, with the payment date as the issue date.

Premature Closure of Your KVP Account

You can close your KVP scheme in the post office account early under certain conditions, such as:

- Death of the account holder (single or joint account)

- Forfeiture by a Gazetted Officer

- Court order

- After 2 years and 6 months from the date of deposit.

Upon closure, you’ll receive the principal amount and simple interest calculated as per the prevailing rate.

Can you Transfer Your KVP Account?

You can transfer your account under specific circumstances:

- Death of the account holder (single or joint account)

- Court order

- Pledging

- In case of death of one or more account holders in a joint account, the account can be transferred to the surviving holder(s).

KVP Scheme| Payment on Account Holder’s Death

In the event of the account holder’s death, the deposit is payable to the nominee or legal heir(s) if nominated.

If there are surviving nominees or legal heirs, they can choose to continue the account or receive the deposit with interest upon maturity.

If the account is not continued, it will be closed, and the deposit, along with interest, will be repaid.

Should You Invest in Kisan Vikas Patra Scheme (KVP)

Investing in Kisan Vikas Patra (KVP) can be beneficial if you prefer low-risk options and have surplus money you won’t need soon. It’s simple to buy at post offices and doubles your investment over about 10 years.

The Kisan Vikas Patra (KVP) is a popular savings scheme that doubles the investment over a period of time.

However, if you’re looking for tax savings, here are a few more options that offer secure investment opportunities with attractive returns:

• Public Provident Fund (PPF): A long-term investment option with a tenure of 15 years, extendable in blocks of five years.

It offers an interest rate of 7.1% per annum.

• National Savings Certificate (NSC): A fixed-income investment scheme that you can open with any post office.

It’s a low-risk savings product with an interest rate of 7.7% per annum.

• Senior Citizen Savings Scheme (SCSS): Specifically designed for senior citizens, this scheme offers a high interest rate of 8.2% per annum with quarterly interest payouts.

• Post Office Monthly Income Scheme (POMIS): This scheme provides a steady monthly income with an interest rate of 7.4% per annum.

• Sukanya Samriddhi Account (SSA): Aimed at the girl child’s future education and marriage expenses, offering an interest rate of 8.2% per annum.

• Mahila Samman Savings Certificate: A special savings certificate for women, offering an interest rate of 7.5% per annum with quarterly compounding.

These schemes are backed by the Government of India and are considered safe investments. They are available through post offices and some public sector banks.

Don’t forget to assess your financial goals and risk tolerance before deciding.

FAQs| KVP Scheme in Post Office

To open a Kisan Vikas Patra (KVP) account, you must visit a Post Office or designated bank branch and submit your application in person or through an authorised agent of small savings schemes.

PPF offers tax benefits and generally higher interest rates, making it better for long-term savings. KVP is a fixed-return scheme without tax advantages. It is suitable for those seeking a guaranteed amount after a set period.

A Kisan Vikas Patra (KVP) account has a tenure of 115 months, which equals 9 years and 7 months.

Source– myscheme.gov.in, indiapost.gov.in

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.