To invest in the Indian stock market, you need to comply with the KYC or Know Your Customer norms. KRA KYC is a mandatory requirement for all investors. There are currently five KRA agencies in India. Let us understand the process of KRA KYC online for each agency in detail.

- KRA KYC Registration Online

- Benefits of KRA KYC Registration Online

- There are five KYC Registration Agencies (KRAs) in India

- CVL KRA Validation

- Karvy KRA Validation

- NDML KRA Validation

- DotEx KRA Validation

- CAMS KRA Validation

- New KYC Validation Rules for Mutual Fund Investors Effective April 1, 2024

- Conclusion

- FAQs| KRA KYC Online

KRA KYC Registration Online

KRA KYC Registration simplifies your entry into the stock market. KRA KYC online is done through a KRA KYC Registration Agency.

KRA is an entity that collects, stores, and updates the KYC information of investors. KYC is a process of verifying your identity and address before you can invest in any securities.

KRA validates the KYC details with official documents, such as Aadhaar, PAN, etc.

By filling out an online form on any of the five KRA KYC registration agencies, you get KYC verified.

There are five KRA service providers in India, namely CVL KRA, CAMS KRA, Karvy KRA, NDML KRA, and DotEx KRA.

Each KRA has its own website where investors can check their KYC status, download their KYC report, and update their KYC details online.

Why is KRA KYC Important?

KRA KYC validation is important for all the investors due to following reasons:

- Regulatory Compliance

KRA KYC online verification is necessary to comply with SEBI’s regulatory guidelines.

- Maintain Updated Investor Information/Data

Ensure accurate and up-to-date contact information for all investors.

- Identity and Investment Protection

KRA KYC online helps protect your identity and investments from unauthorised access or misuse.

This streamlined process ensures a smooth investment journey, providing security for both you and financial institutions.

Benefits of KRA KYC Registration Online

The benefits of KRA validation online for investors in India are:

- Investors only need to complete KYC verification once. This allows them to invest in different securities without doing repetitive paperwork.

- Strict KRA KYC registration online ensures that investments are safe and comply with regulatory rules.

These benefits together streamline and secure the investment process for investors in India’s securities market.

There are five KYC Registration Agencies (KRAs) in India

- CDSL Ventures Limited (CVL KRA)

- Karvy Data Management Services Ltd. (Karvy KRA)

- NSDL Database Management Limited (NDML KRA)

- DotEx International Ltd. (DotEx KRA)

- Computer Age Management Services Pvt. Ltd. (CAMS KRA)

Here are the steps for KRA KYC registration online on each of the KRA agencies in India:

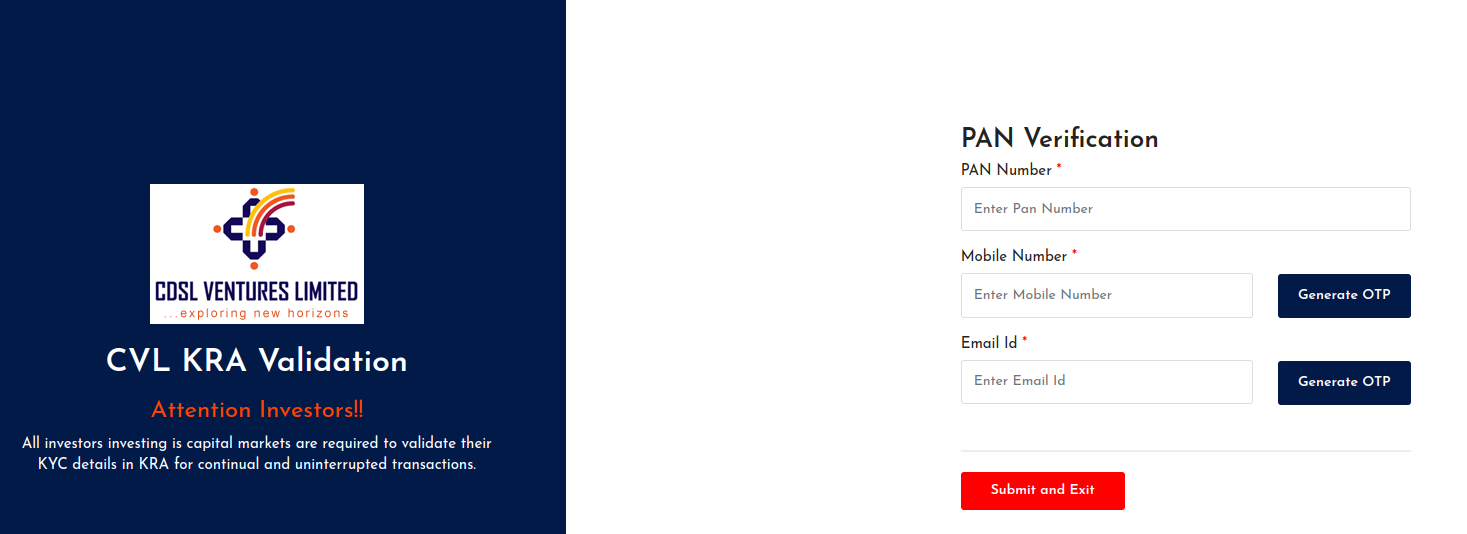

CVL KRA Validation

CDSL, or Central Depository Services Limited, is a leading securities depository in India. It operates CVL KRA, one of the KRA service providers in India.

CDSL KYC verification helps maintain KYC records for investors, allowing users to check their KRA KYC online, anytime.

Here’s how you can complete your CVL KRA KYC:

1. Visit the CVL KRA KYC portal.

2. Provide your PAN card number; it will then retrieve your mobile number and email address.

3. Click on the boxes- ‘generate OTP’ for an email address and your mobile number.

4. As you receive the OTP, fill it in and click on ‘verify’.

5. Once both email and mobile are verified, click on ‘submit and exit’.

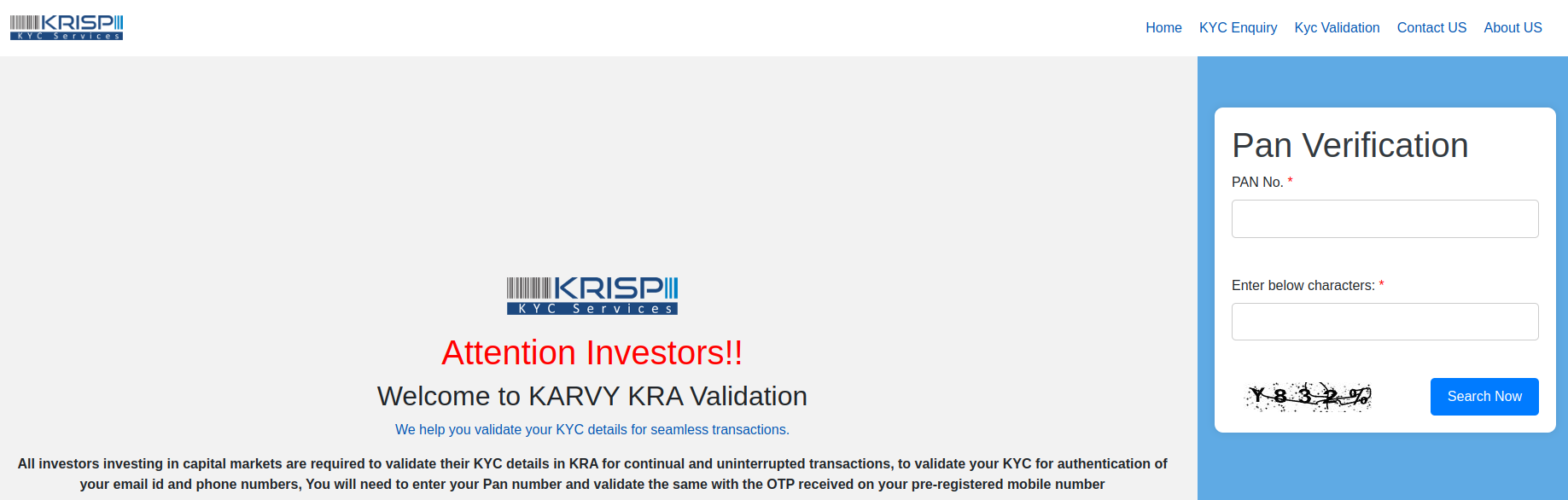

Karvy KRA Validation

Karvy KRA provides validation services for KYC registration, enabling investors to verify their identity and comply with regulatory requirements efficiently.

Here is how you can complete your Karvy KRA Validation:

- Visit the KARVY KRA KYC Portal.

- Enter your PAN and Captcha. Click on ‘search now’.

- Next, you will see your registered mobile number & email address on your screen. Click on ‘Validate’ to receive OTP on both.

- Enter both OTPs and submit.

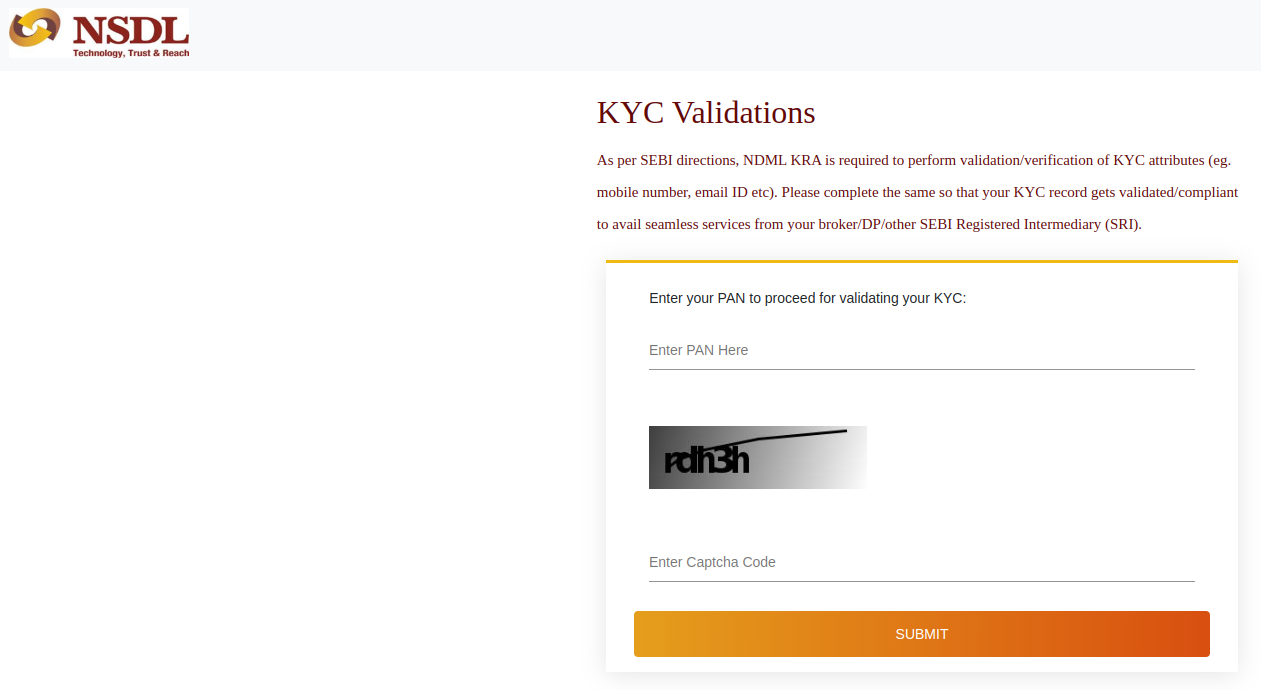

NDML KRA Validation

NDML KRA facilitates the validation of KYC documents and maintains investor records securely, ensuring compliance with SEBI regulations and industry standards.

The procedure for NDML KRA validation is similar to Karvy KRA validation.

- You must visit the official site to complete your NDML KRA KYC Registration online- NDML KRA KYC Validation.

- You need to enter your PAN card number and Captcha. Click on ‘Submit.’

DotEx KRA Validation

DotEx KRA offers validation services for KYC registration, assisting investors in verifying their credentials and maintaining accurate records across financial transactions.

Here’s how you can complete your Dot- EX KRA KYC:

1. Visit the Dot-EX KRA KYC portal.

2. Input details such as ‘type of KYC’, your PAN card number, and captcha.

CAMS KRA Validation

CAMS KRA facilitates KYC validation processes, allowing investors to verify their identity and update their KYC details seamlessly through its online platform.

- You must visit – CAMSKRA portal for quick CAMS KRA Validation.

- Please enter your PAN number followed by the captcha, then click on ‘Submit.’

New KYC Validation Rules for Mutual Fund Investors Effective April 1, 2024

Starting from April 1, 2024, new KYC rules classify individuals into three categories: “KYC Validated,” “Verified,” and “On-Hold.” Here’s what each category means for mutual fund investors:

KYC Validated: Investors with this status do not need to take any action.

They can continue all their transactions as usual.

Verified: Investors in this category can continue with their existing investments without any change.

However, they need to submit their KYC documents again if they want to make new investments.

On-Hold: Investors with this status cannot carry out any transactions until they complete the KYC process again using PAN and Aadhaar.

These rules ensure that investors maintain updated KYC statuses to facilitate smooth transactions in mutual funds.

Conclusion

KRA KYC online is a simple and convenient way to verify your email and mobile number with the KRA agency. By doing so, you can ensure that your KYC details are updated and accurate. With this, you can continue investing in the stock market smoothly.

FAQs| KRA KYC Online

There are five KRA KYC registration agencies in India, namely CVL KRA, CAMS KRA, Karvy KRA, NDML KRA, and DotEx KRA.

KRA stands for KYC Registration Agency. It is an agency registered with SEBI under the Securities and Exchange Board of India (KYC Registration Agency) Regulations, 2011. It sustains KYC records of the investors centrally.

SEBI, or the Securities and Exchange Board of India, is the regulator of the KYC registration agency KRA. SEBI issues guidelines and norms for the functioning of the KRA and monitors their compliance.

Source- economictimes.indiatimes.com

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.