LIC Maturity Claim Online: How to Claim LIC Maturity Amount by Policy Number

Have you finished paying for your LIC policy and are wondering how to get the money back? Do you want an easy way to claim your LIC maturity amount online or offline?

In this blog, we will guide you through the steps on how to claim the LIC maturity amount online.

LIC Maturity Amount Online and Offline Process

My LIC policy is matured how to claim online?

If your LIC policy has matured and you are confused about the next step, do not worry. The process is simple. You need to fill out the LIC maturity claim form and submit a few basic documents.

You can submit the LIC claim in three ways.

- You can apply online through the LIC customer portal.

- You can email scanned documents to your servicing LIC branch.

- You can also visit the LIC branch in person.

- Get the LIC Maturity Claim Form (Form No. 3825)

The LIC maturity claim form is also called the discharge form on maturity.

You can collect this form from your nearest Life Insurance Corporation of India branch.

You can also download it from the official LIC of India website after logging in to your account.

If you prefer, you can request the form through your LIC agent as well.

- Documents Required for LIC Maturity Claim

Along with the completed LIC maturity claim form, the following documents must be submitted:

Documents to Attach With LIC Form No. 3825

| Type of Proof | Acceptable Documents |

| Proof of Identity | Passport, PAN Card, Driving Licence, Voter ID, Ration Card |

| Proof of Address | Aadhaar Card, Passport, Driving Licence, Voter ID, Ration Card, Electricity Bill, Bank Statement or Passbook |

| Proof of Date of Birth | Passport, Birth Certificate, SSC Certificate, Mark Sheet issued by a Government University or Board, PAN Card |

If the policy has been assigned or pledged, such as to a bank or financial institution, a letter of assignment or a No Objection Certificate from the assignee must also be attached.

LIC Maturity Form Fill up- Policy, Personal, and Bank Details

Enter the policy number, plan details, sum assured, and maturity date as mentioned on the policy bond. Fill in the personal details exactly as per LIC records, and provide the correct bank account details, including the IFSC code, for NEFT credit.

Sign Declaration and Get Witness Signature

Read the declaration carefully, sign the LIC maturity claim form, and get one witness signature with name, address, and date.

Submit the LIC Maturity Claim (Choose Any One Method)

1. LIC Maturity Claim Online by Policy Number (Portal Method)

LIC login portal- To claim LIC maturity online, register on the LIC Customer Portal using your policy details, then log in to upload the required documents for verification and processing. This method allows you to submit your LIC maturity claim online by policy number and track the claim status digitally.

2. LIC Maturity Claim Form: Email submission to the LIC branch

If you are not using the portal, send scanned copies of all documents in PDF or JPEG format (file size under 5 MB) to the servicing branch email ID in the format claims.bo[branch_code]@licindia.com. Mention the policy number in the email subject line.

3. LIC Maturity Claim Form: Physical submission at the LIC branch

You may also submit the completed LIC maturity claim form and original documents directly to the LIC branch where your policy is serviced.

Track LIC Maturity Claim Status

After submission, collect an acknowledgement if submitted at the branch. For online or email submission, you can check LIC claim status through the LIC login or by contacting the servicing branch.

How LIC Maturity Payments Are Processed

Endowment Policies

For endowment plans, LIC sends a maturity intimation letter at least two months before the maturity date. The policyholder must submit the discharge form, original policy bond, bank account details with proof, and KYC documents. Once submitted, payment is processed in advance, so the maturity amount is credited to the bank account on the due date.

Money Back and Survival Benefit Policies

For Money Back policies, survival benefits are paid periodically if the LIC premium payment is up to date. If the payable amount is up to Rs. 5,00,000, LIC releases payment without asking for the discharge form or policy bond. For Jeevan Anand policies, survival benefits up to Rs. 2,00,000 sum assured are also released without these documents. For higher amounts, both the policy bond and discharge form are mandatory.

Online Claim Option

If you are searching for LIC maturity claim online by policy number or an LIC policy maturity claim online, note that document submission is still required at the branch. However, LIC premium payment online, LIC policy status, and claim tracking can be completed through the LIC portal.

Policy Details Required in the LIC Maturity Claim Form

When submitting an LIC maturity claim, accuracy in the form is essential. Even small errors can slow down the settlement process. Below are the key details that must be filled correctly in the LIC maturity claim form.

Policy Number

This is the unique number assigned to your insurance policy. It helps Life Insurance Corporation of India identify and process your maturity claim.

Name of the Policyholder

The name entered must exactly match the name printed on the policy bond and LIC records.

Date of Maturity

Mention the maturity date as stated in the original policy document.

Bank Account Details

Provide accurate bank account information, including account number and IFSC code, to ensure the maturity amount is credited directly without issues.

Policyholder’s Signature

The signature on the form should match the signature available in LIC records.

Witness Signature

A witness signature is usually required to authenticate the policyholder’s declaration.

Things to Keep in Mind to Claim Your LIC Maturity Amount Online

You must follow these general guidelines:

- Prior to submission, you must make a photocopy of the entire set for your records.

- Please note that the discharge Form and NEFT Mandate Form are available at any LIC branch.

- For Xerox copies, self-attestation is advisable.

- Include your current mobile number and email address to receive LIC maturity claim process status updates via SMS/email.

- You must submit the complete set of documents to your home branch or send them via registered post/courier. The branch will verify the documents and transfer the amount directly to your account.

How to Check LIC Maturity Amount

You can check your LIC maturity amount either by estimating it online or by viewing it directly through LIC services. Below are the easiest and most commonly used options provided by Life Insurance Corporation of India.

Online Methods (Most Convenient):

LIC Customer Portal

Verifying LIC Maturity Amount Online – Once you are registered successfully. You can proceed with the following steps:

- Visit licindia.in.

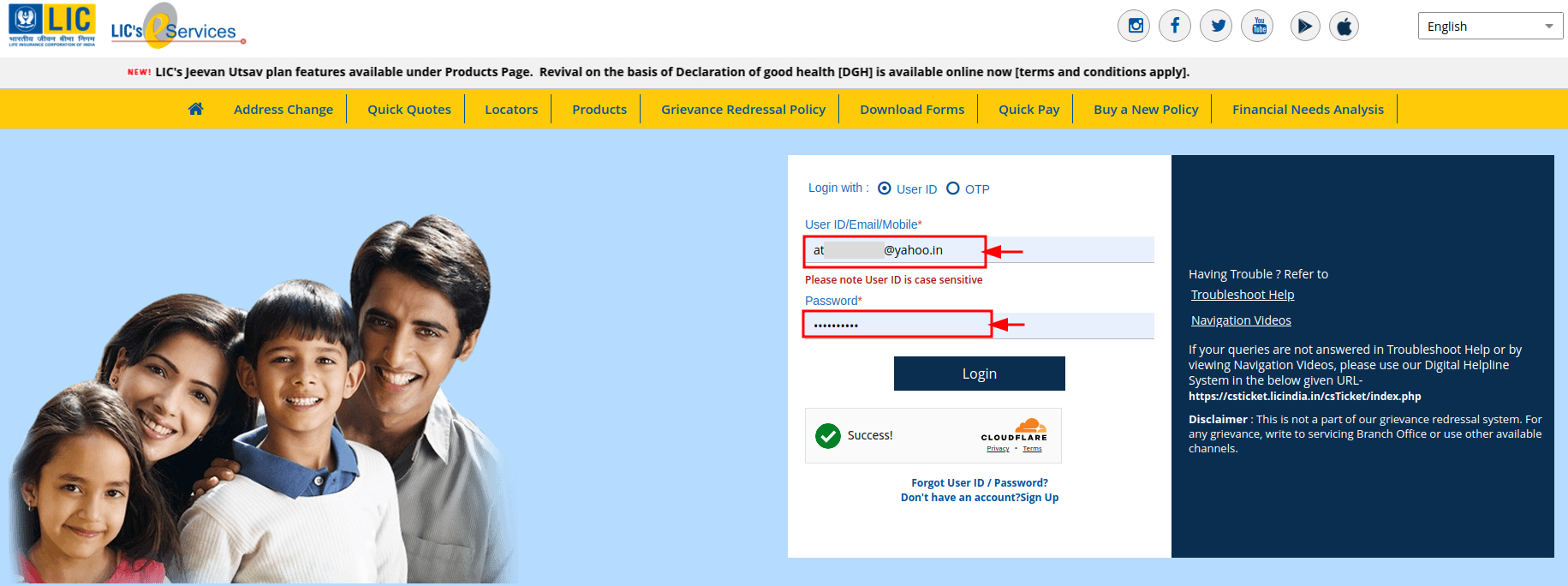

2. Enter your User ID/EMAIL/MOBILE and password to access your account.

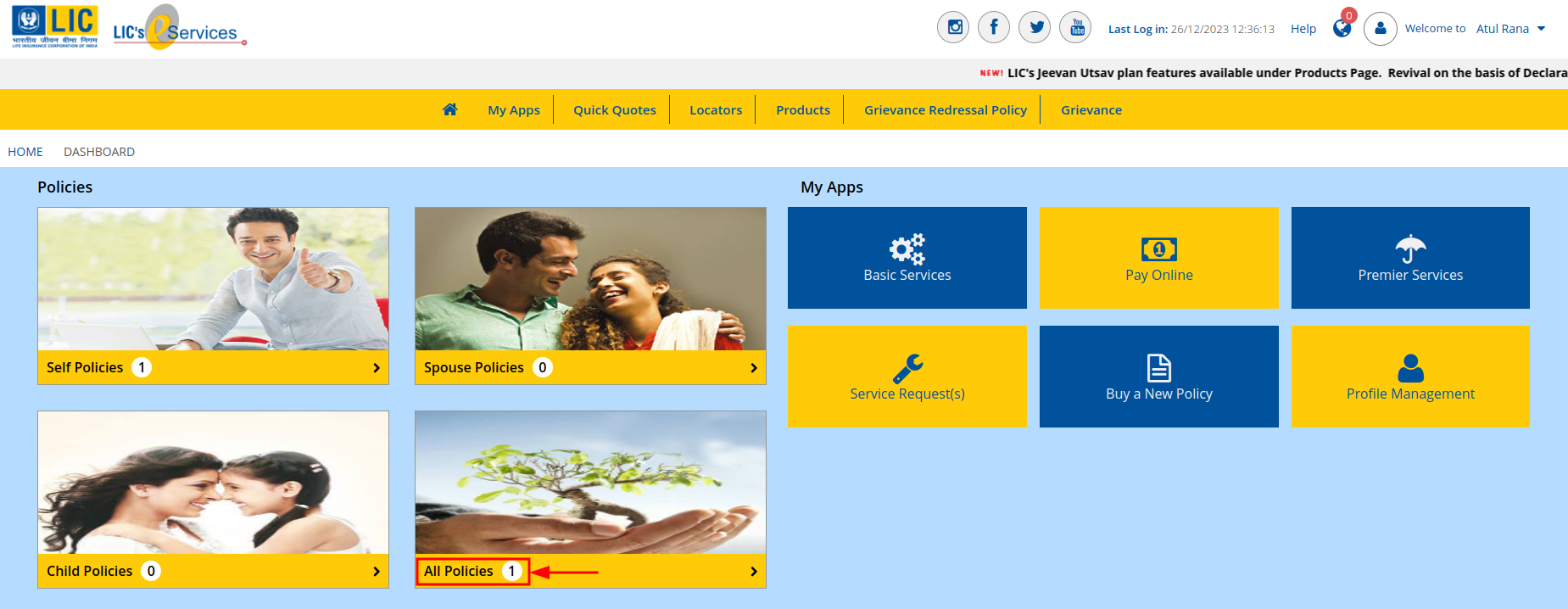

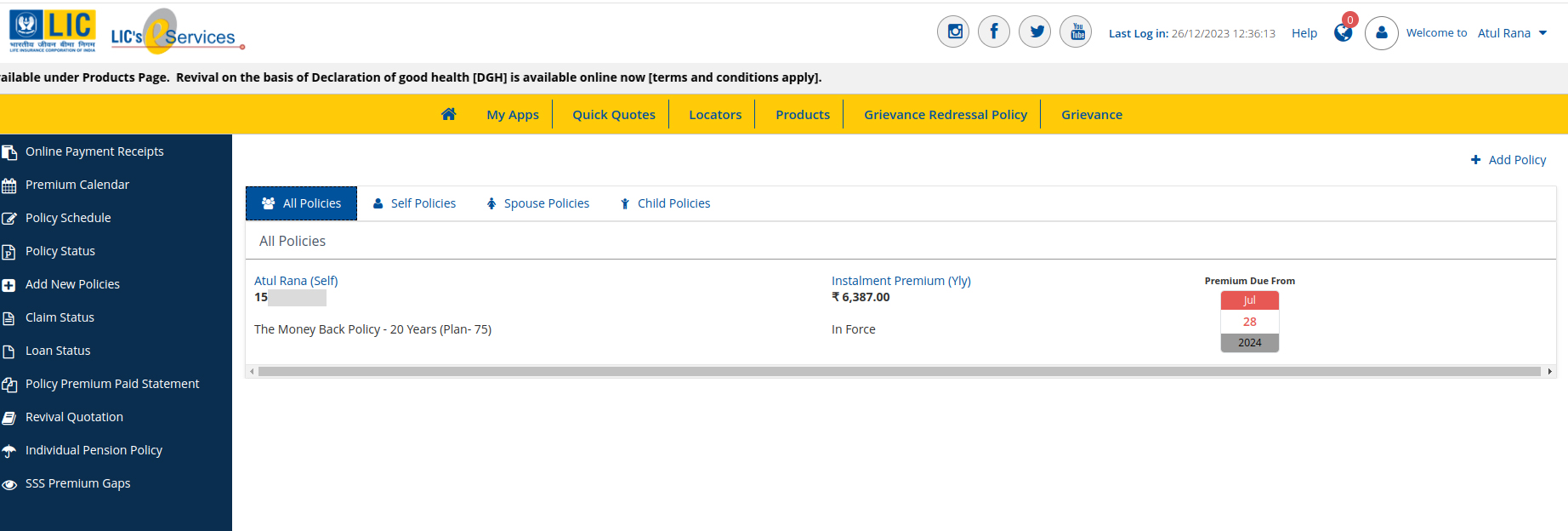

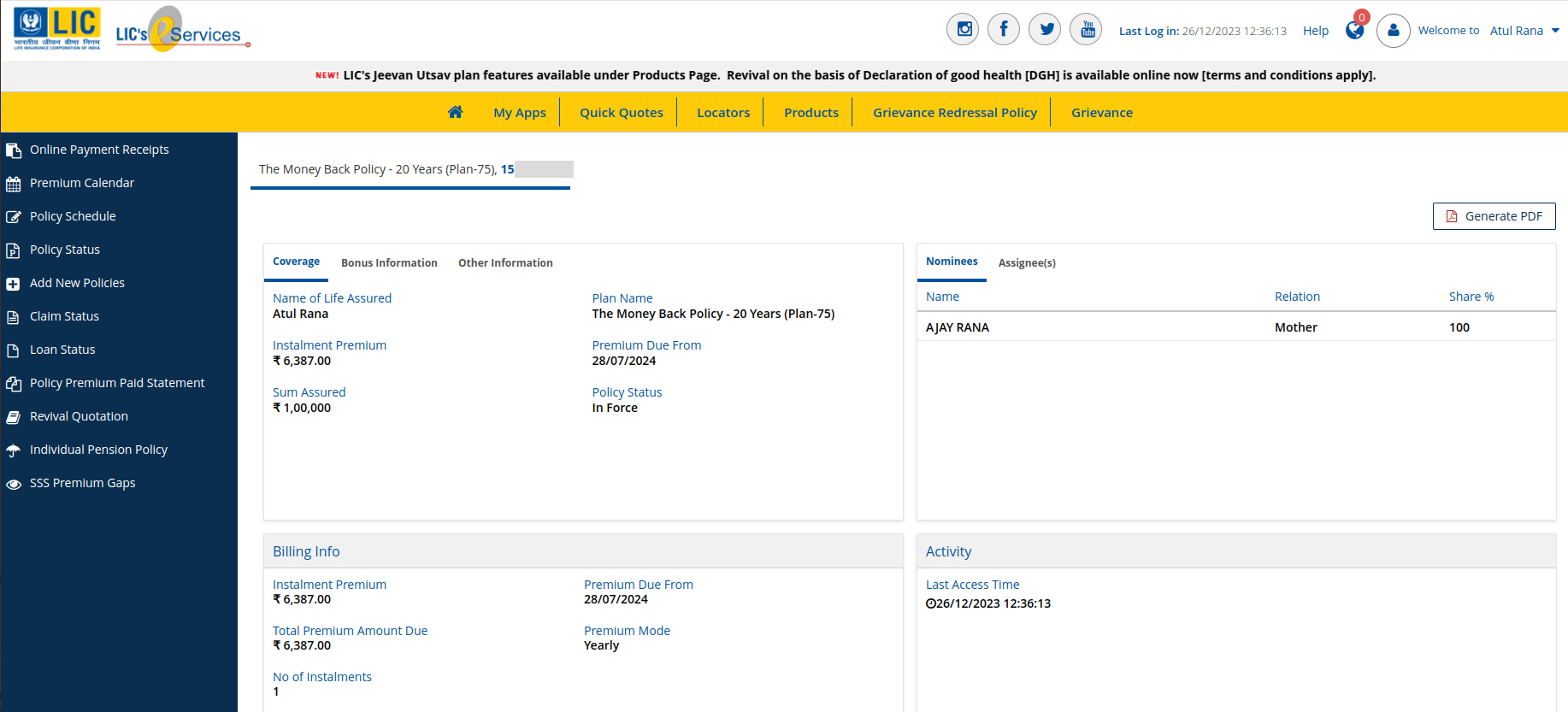

3. Upon successful login, you will enter the homepage. From the multiple service tabs visible on your screen, click on the ‘All Policies’ tab.

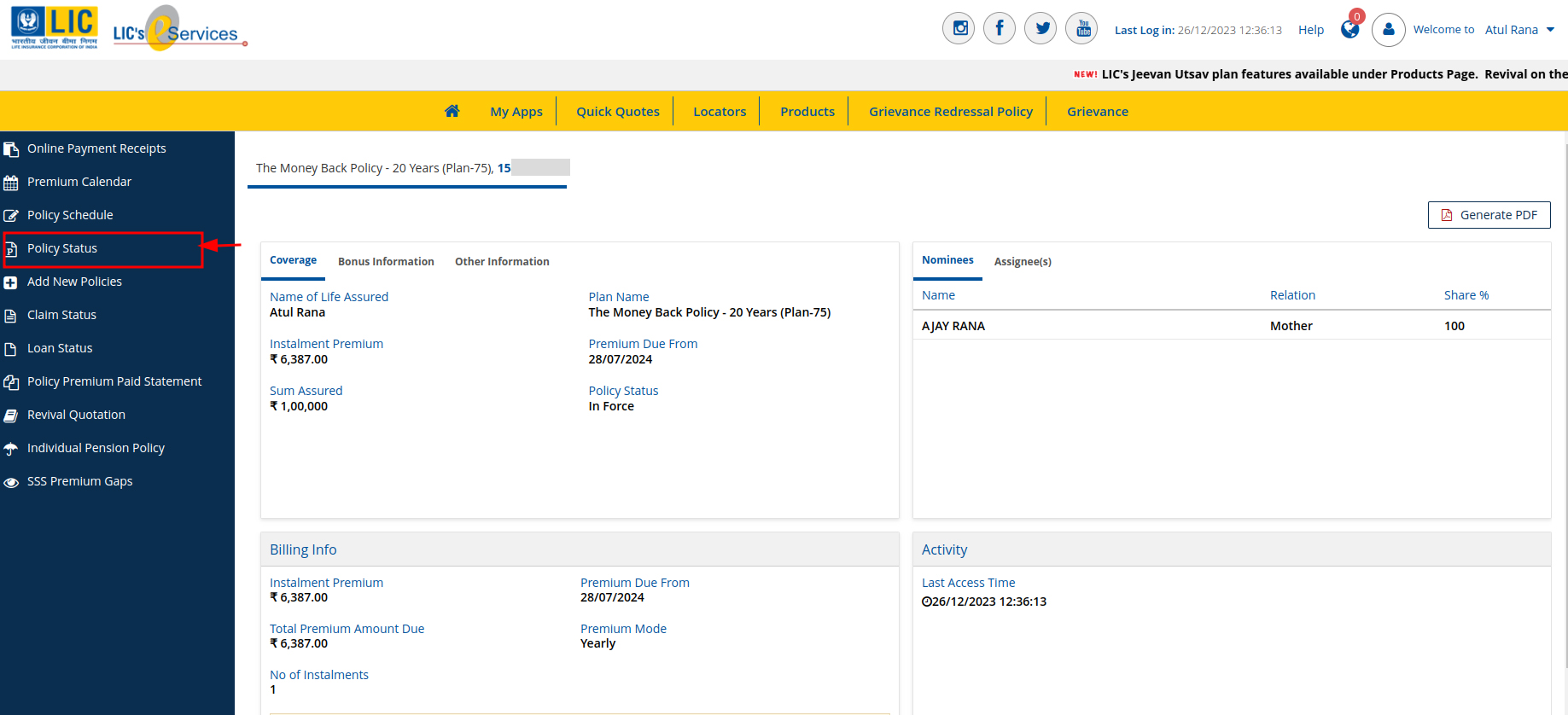

4. Next, you must click on the ‘Policy Status’ tab from the left side menu of your screen.

5. Explore the available plans within your account.

6. At this stage, you can review your LIC maturity amount along with additional details, including the policy name, premium payment date, policy term, and more.

LIC Maturity Calculator

LIC also offers an online maturity calculator to estimate your payout.

After logging in, select your policy to see an approximate maturity value based on sum assured and accumulated bonuses. This is useful for planning, but the final amount may vary.

LIC Digital App

1. Download the LIC Digital App from the Google Play Store or Apple App Store.

2. Register using your policy number and registered mobile number.

3. After login, open the Policies section to check the maturity value, bonuses, and premium details.

SMS Method (Quick Check)

Send the following SMS from your registered mobile number:

ASKLIC <Policy Number>

Send it to 56767877.

You will receive basic policy and maturity-related information by SMS.

Customer Care Option

For direct assistance, call the LIC IVRS customer care number at +91 22 6827 6827. Keep your policy number ready for faster support.

LIC Maturity Claim Online – FAQs

You can check it by sending an SMS from your registered mobile number in the format ASKLIC <Policy Number> to 56767877 or 9222492224.

Log in to the LIC Customer Portal, select the maturity claim option, and upload scanned copies of the required documents for processing.

Visit the official website of Life Insurance Corporation of India, open the Customer Portal, and log in using your User ID and password or OTP through your mobile number and date of birth.

Log in to the LIC Customer Portal or LIC Digital App and check the details under Policy Status or Policy Summary for your policy.

Submit the completed discharge form, original policy bond, and bank details to LIC so the amount can be credited through NEFT.

It is best to submit it at the servicing branch, but LIC also accepts claims at other branches or through the online portal.

The process includes intimation by LIC, submission of documents, verification of details, and payment of the amount to the bank account.

The standard maturity claim or discharge form is Form No. 3825, which is used in most maturity cases.

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.