Have you finished paying your LIC policy and are wondering how to get the money back? Do you want an easy way to claim your life insurance maturity amount online?

In this blog, we will guide you through the steps on how to claim LIC maturity amount online. You can also check the different types of LIC claims, such as death claims, double accident benefits, and disability benefits, and know the documents required for LIC maturity claim process.

- How to Claim LIC Policy: LIC Maturity Claim Process

- How to Claim LIC Policy| LIC Death Claim Process

- How to Claim LIC Policy After Maturity

- Documents Required for LIC Maturity Claim

- How to Check LIC Maturity Amount

- Guidelines for a Smooth LIC Maturity Claim Process and Online Account Setup

- How to Check LIC Claim Policy Without Registration

- How to Check LIC Maturity Claim Without Going to the Office

- FAQs | LIC Maturity Claim Online

How to Claim LIC Policy: LIC Maturity Claim Process

Life Insurance Corporation of India has laid down a simple LIC maturity claim online process.

For instance, for policies like Endowment, the due amount is paid at the policy’s end. The Branch Office sends a letter two months before payment. They request asking for a completed Discharge Form, Policy Document, NEFT Mandate Form, and KYC requirements.

Next, upon receiving these, the LIC maturity amount is processed in advance for crediting to the policyholder’s bank account on the due date.

However, certain plans, like Money Back Policies, offer periodic payments if premiums are paid up to the due date.

For amounts up to Rs.500,000, payments are released without requiring a Discharge Receipt or Policy Document. Higher amounts necessitate these documents.

How to Claim LIC Policy| LIC Death Claim Process

The death claim amount is payable for policies with up-to-date premiums or deaths within the grace period.

- The Branch Office requires Claim Form A, Death Register extract, proof of age, evidence of estate title, and the original Policy Document.

- You must submit these additional forms, if death occurs within three years from the date of risk/ from the date of revival or reinstatement.

These include:

- Claim Form B (Medical Attendant’s Certificate)

- Claim Form B1 (if treatment in a hospital occurred)

- Claim Form B2 (completed by the Medical Attendant prior to the previous illness)

- Claim Form C (Certificate of Identity and burial/cremation)

- Claim Form E (Certificate by Employer for employed persons)

- Certified copies of the FIR, post-mortem report, and police investigation report in case of accidents or unnatural causes.

LIC Maturity Claim Process For Double Accident Benefit

Double Accident Benefit is an additional life insurance cover. To get this benefit, you pay an additional premium of Rs. 1/- per Rs. 1000/- Sum Assured.

To claim the LIC maturity benefit, you need to provide proof that the accident meets the policy conditions.

Documents required for lic maturity claim here are the FIR and post-mortem reports.

LIC Maturity Claim Process For Disability Benefit

Disability benefit claims involve waiving future premiums and additional monthly payments for total and permanent disability.

To qualify, the disability must be total and permanent. This means that it prevents you from earning any wage, compensation, or profit due to the accident.

How to Claim LIC Policy After Maturity

You can follow these steps to claim LIC policy after maturity:

- Submission of Discharge Form/Discharge Voucher (form 3825)

- Presenting the Original LIC Policy Bond Paper

- Provide a Copy of Identity Proof (PAN card)

- Furnishing a Copy of Address Proof (Aadhar Card, Passport, Driving License)

- Including a Canceled Cheque or a Copy of the Policyholder’s Bank Passbook

- Completing the NEFT Mandate Form (for the direct transfer of maturity proceeds into the policyholder’s bank account)

- Affixing a Revenue Stamp (with the policyholder or person’s signature across the stamp)

Things to Keep in Mind to Claim Your LIC Maturity Amount Online

You must follow these general guidelines:

- Prior to submission, you must make a photocopy of the entire set for your records.

- Please note that the discharge Form and NEFT Mandate Form are available at any LIC branch.

- For Xerox copies, self-attestation is advisable.

- Include your current mobile number and email address to receive LIC maturity claim process status updates via SMS/email.

- You must submit the complete set of documents to your home branch or send them via registered post/courier. The branch will verify the documents and transfer the amount directly to your account.

Documents Required for LIC Maturity Claim

You need to submit various identity, address, and date of birth proof documents, such as:

- Proof of Identity:

Passport

Ration Card

PAN Card

Driving License

Voter ID, etc.

- Proof of Address:

Ration Card

Voter ID

Driving License

Aadhar Card

Electricity Bill

Passport, Bank Statement/Passbook, etc.

- Proof of Date of Birth (DOB):

Passport

SSC Certificate

Birth Certificate

Mark Sheet issued by Government University or Board

PAN Card, etc.

How to Check LIC Maturity Amount

The process varies for new and registered users.

For New Users

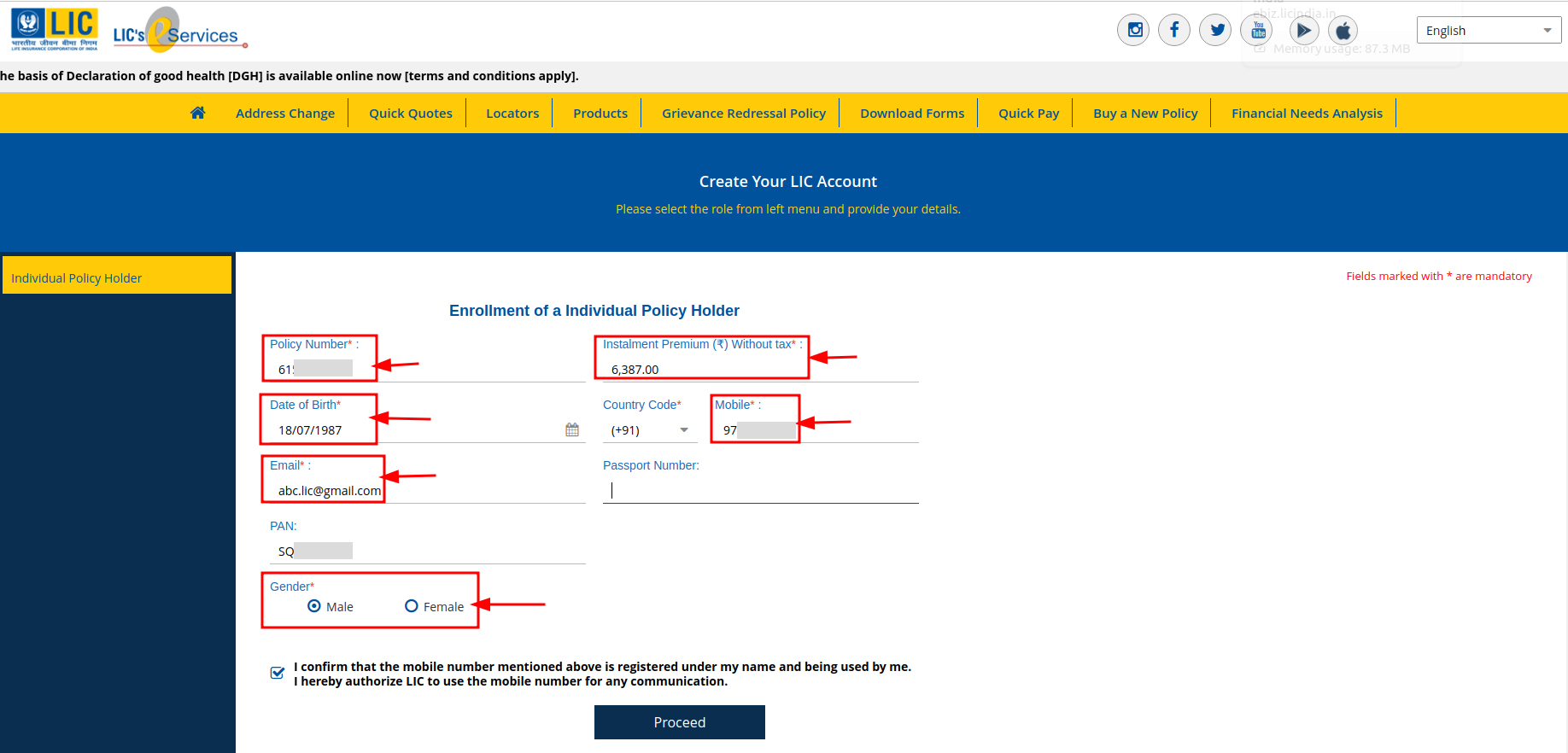

To check your LIC maturity amount online, new users must follow these steps-

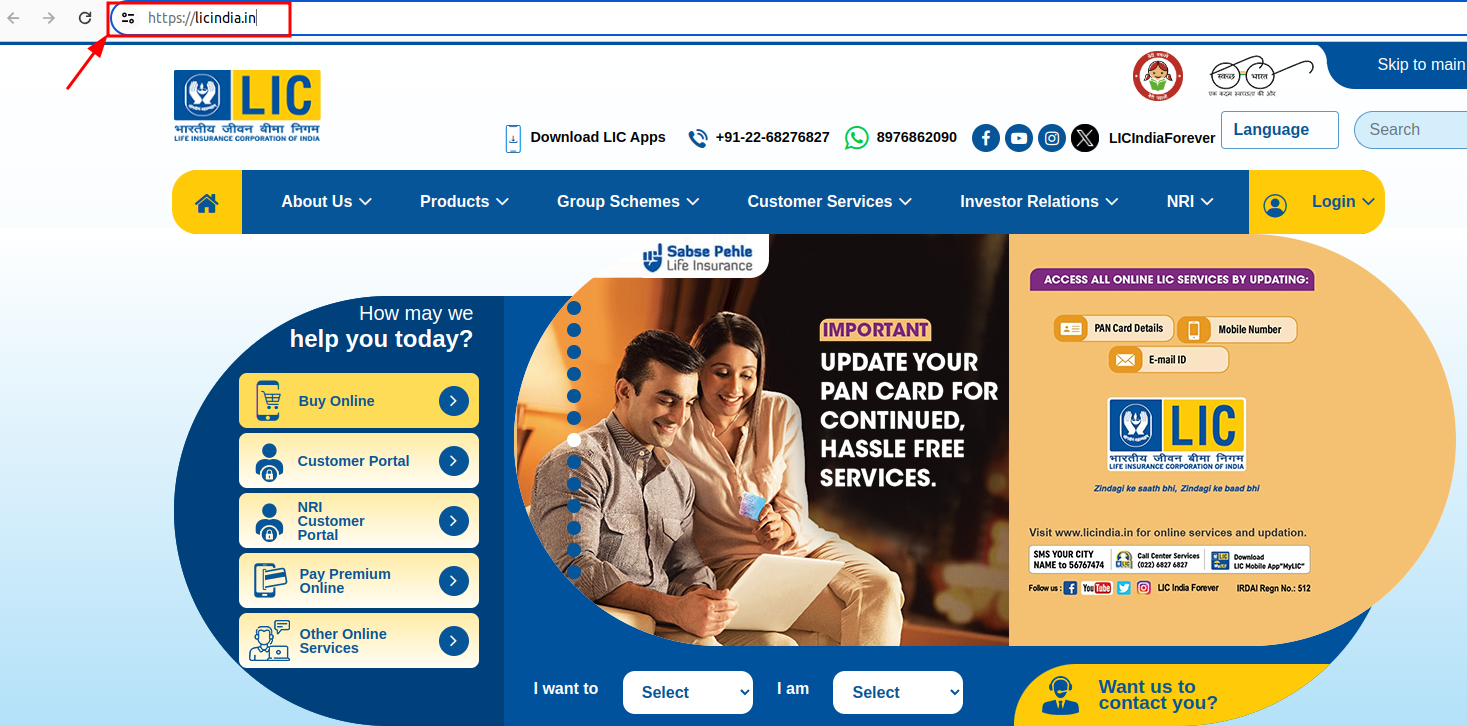

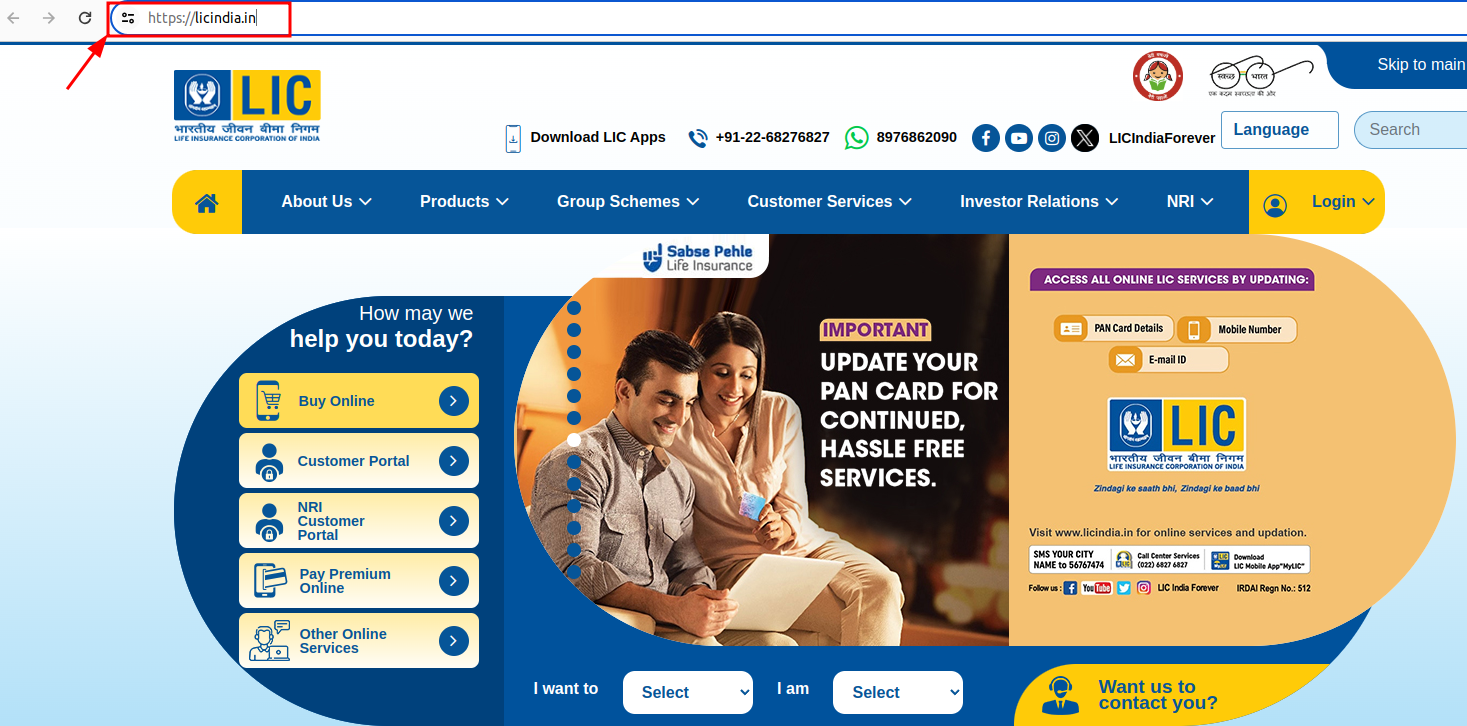

- Visit licindia.in.

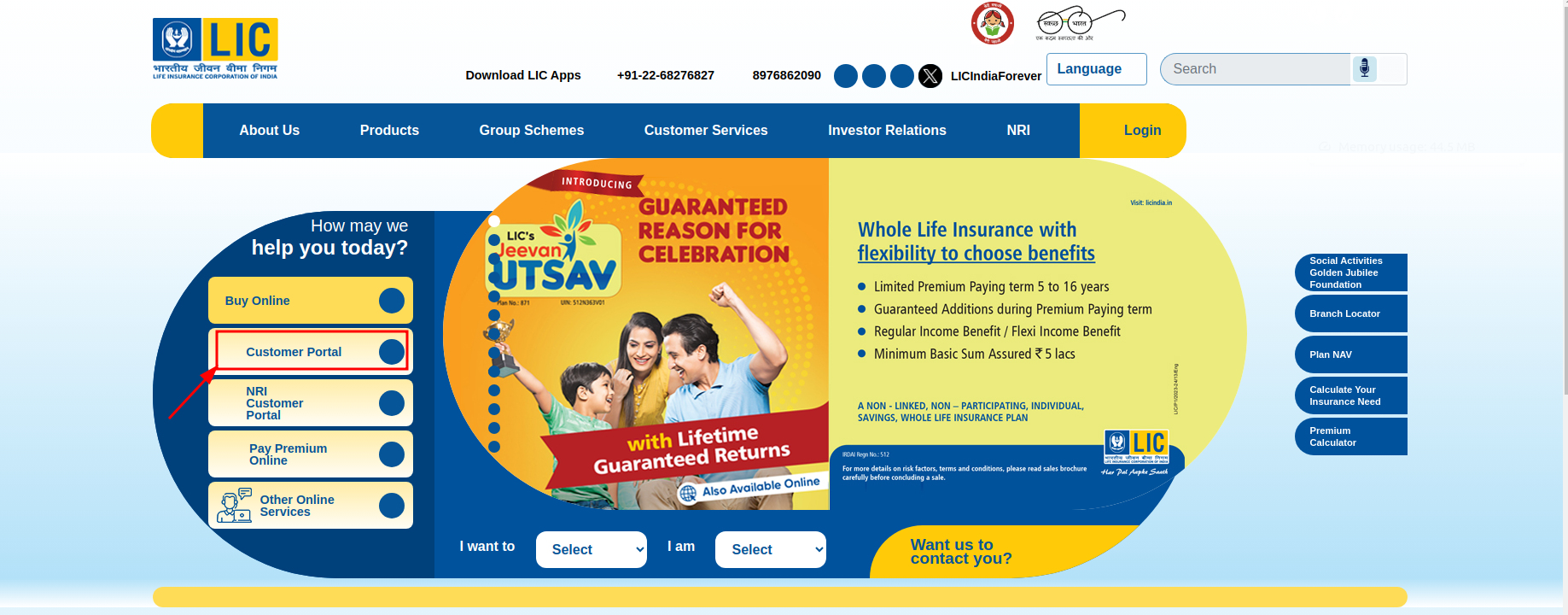

2. On the tabs visible on the left-hand side of your screen, click “Customer Portal.”

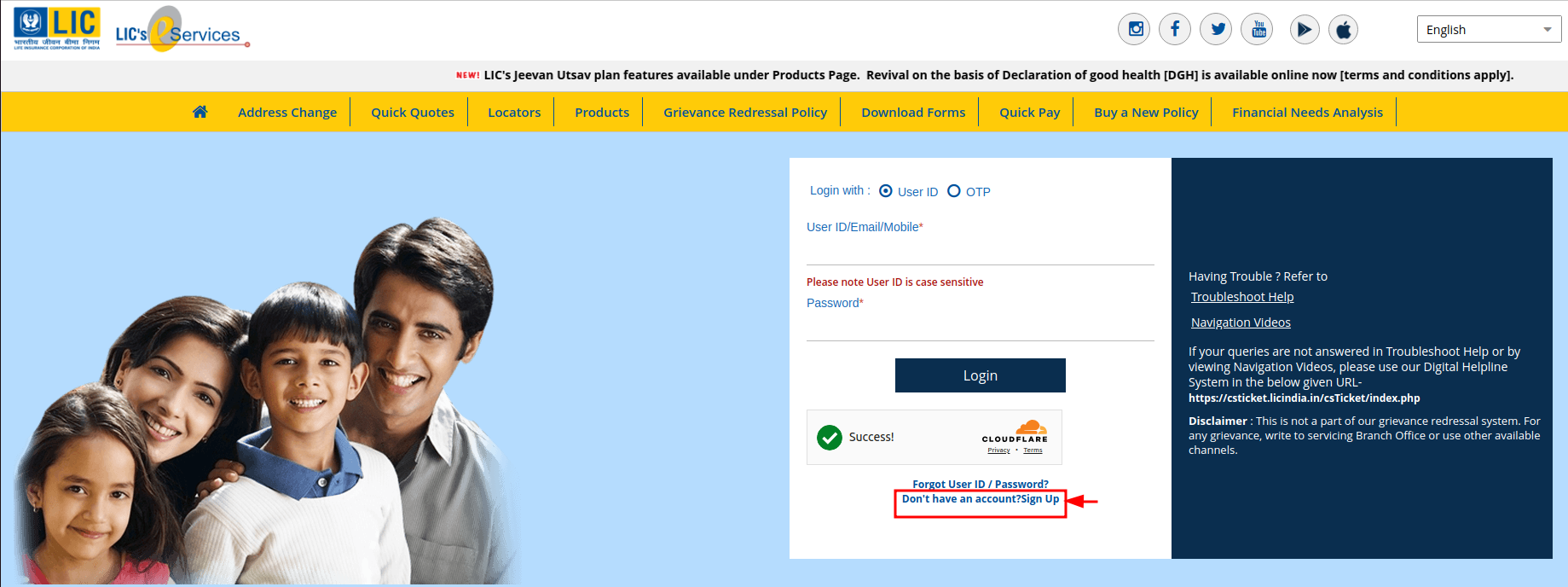

3. On the Customer Portal Login Page, Select the “Sign Up” option.

4. A new sign-up page pops up; add in all the mandatory details, including your policy number (printed in the policy bond), instalment premium (printed in the policy bond), date of birth (matching the policy bond), mobile number, passport number, PAN, select your gender, and fill in your email ID.

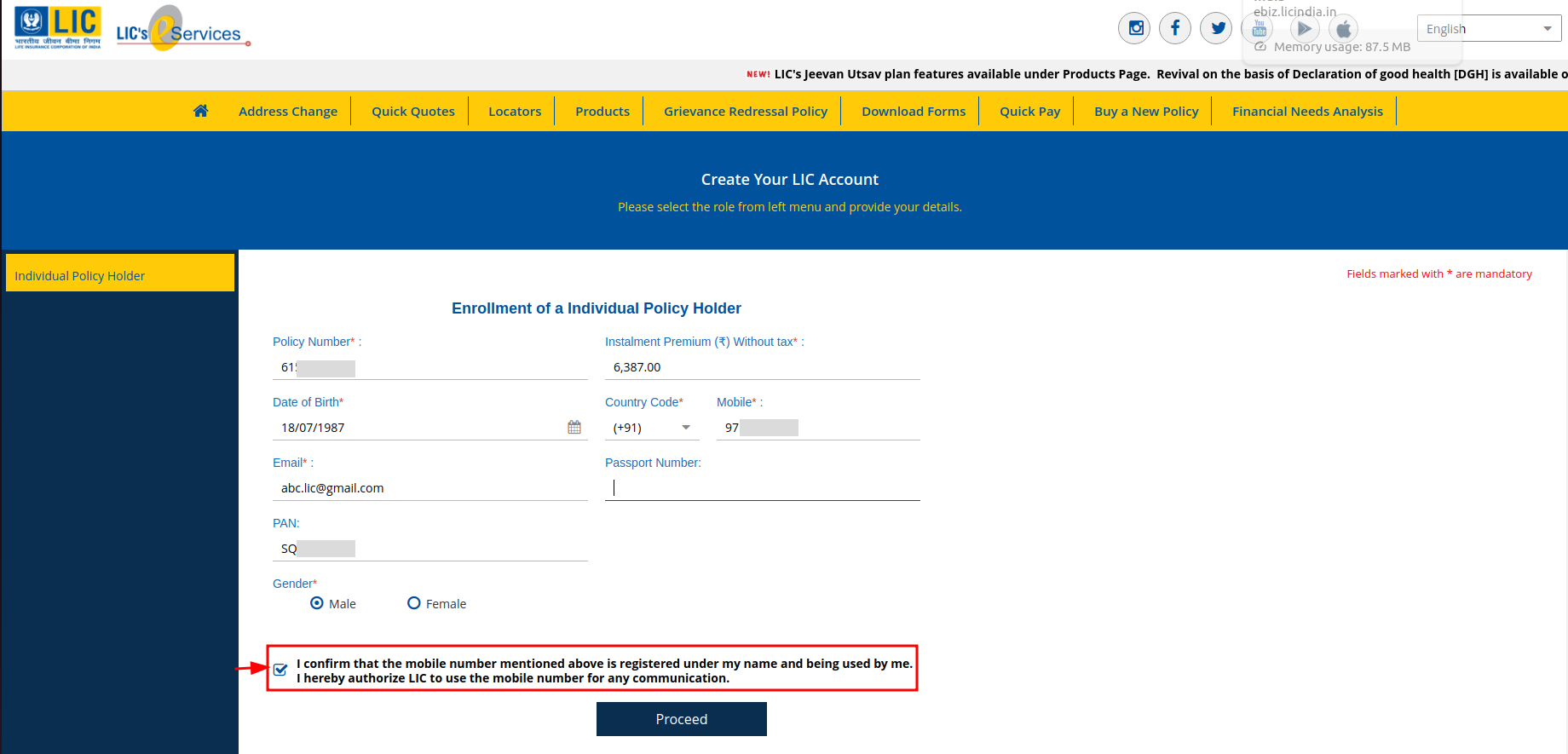

5. Tick the confirmation message on display.

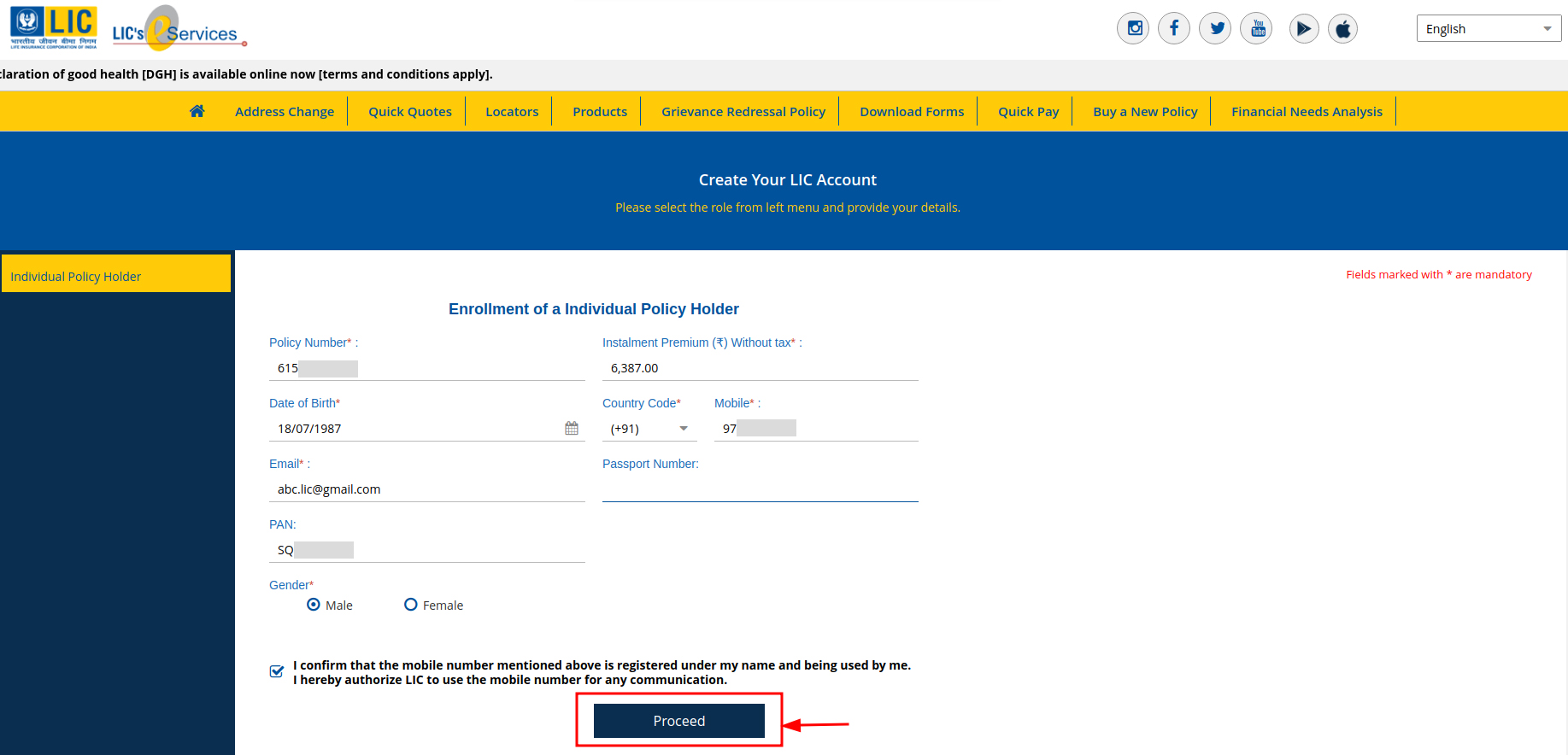

6. Next, click on ‘proceed.’

Once registered, you can access the customer portal to retrieve information about your LIC policy. At any point of time, you can check:

- LIC online premium payment

- Online loan requests

- Online mode change, NEFT registration, address change, policy status, bonus information, and more.

Note- You can re-verify the details by clicking on the verification link sent to your Email ID after completion of registration.

For Registered Users

Verifying LIC Maturity Amount Online – Guidelines for those who are already registered. You can proceed with the following steps:

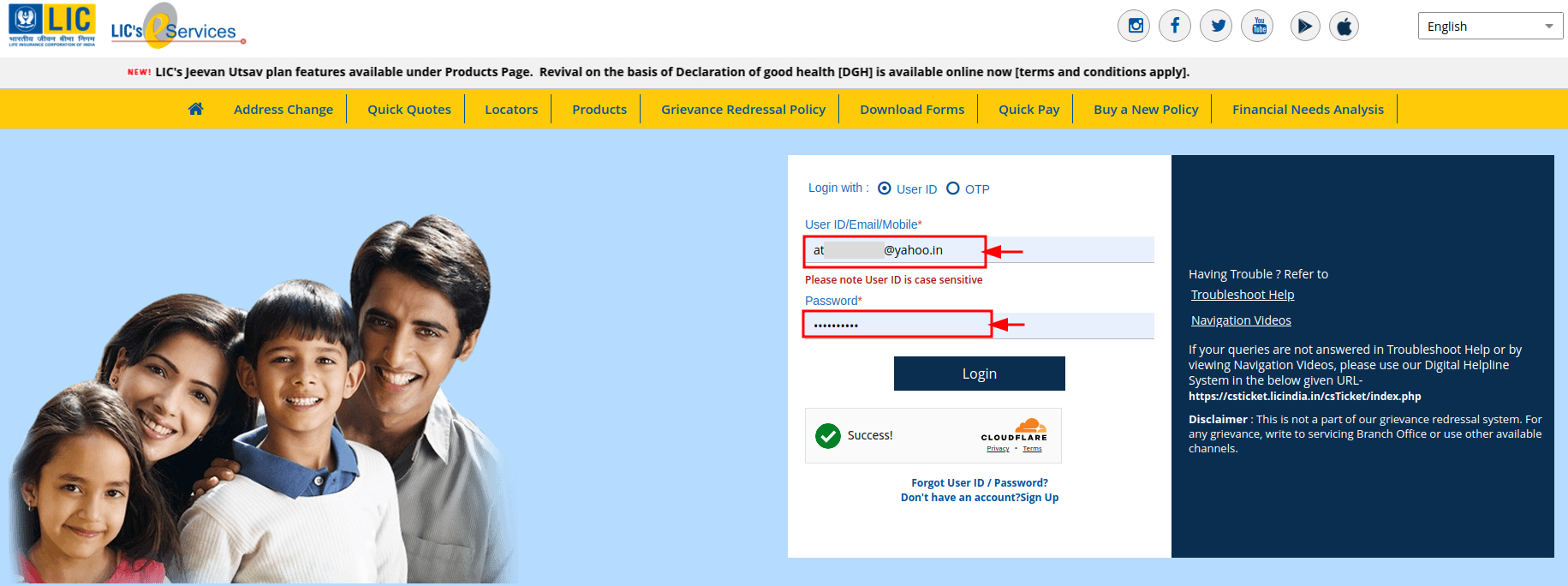

- Visit licindia.in.

2. Enter your User ID/EMAIL/MOBILE and password to access your account.

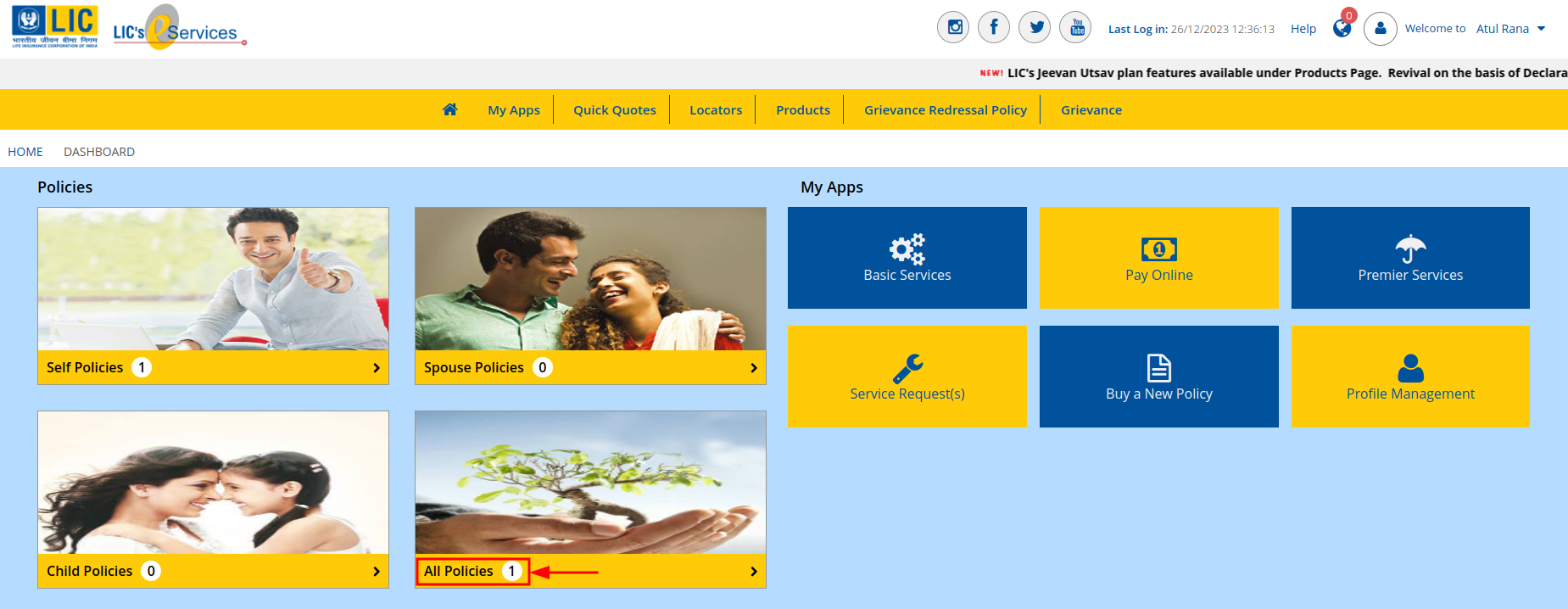

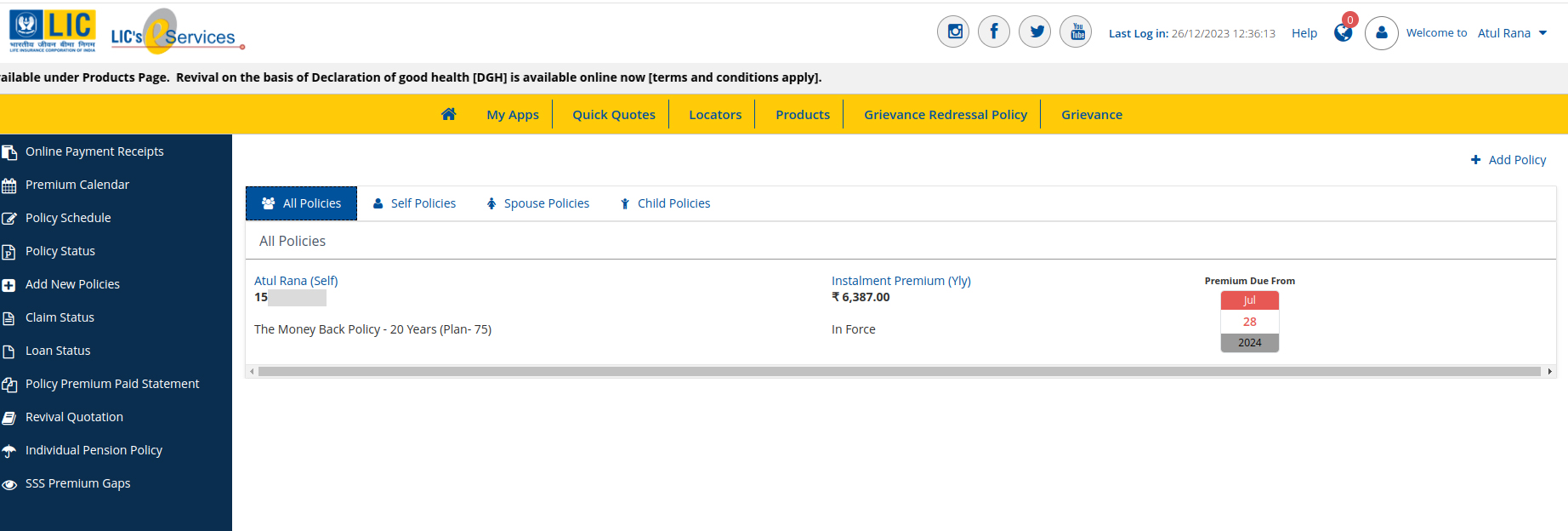

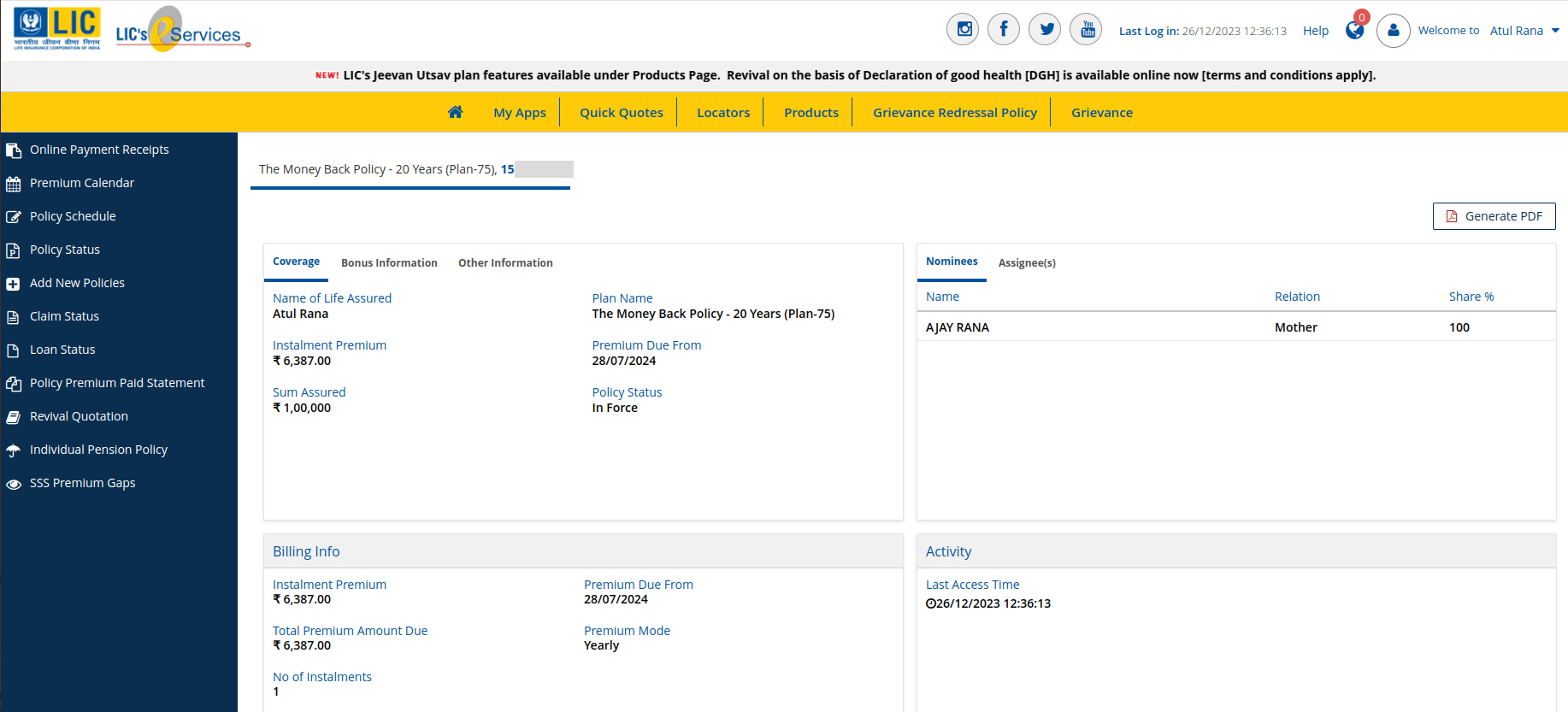

3. Upon successful login, you will enter the homepage. From the multiple service tabs visible on your screen, click on the ‘All Policies’ tab.

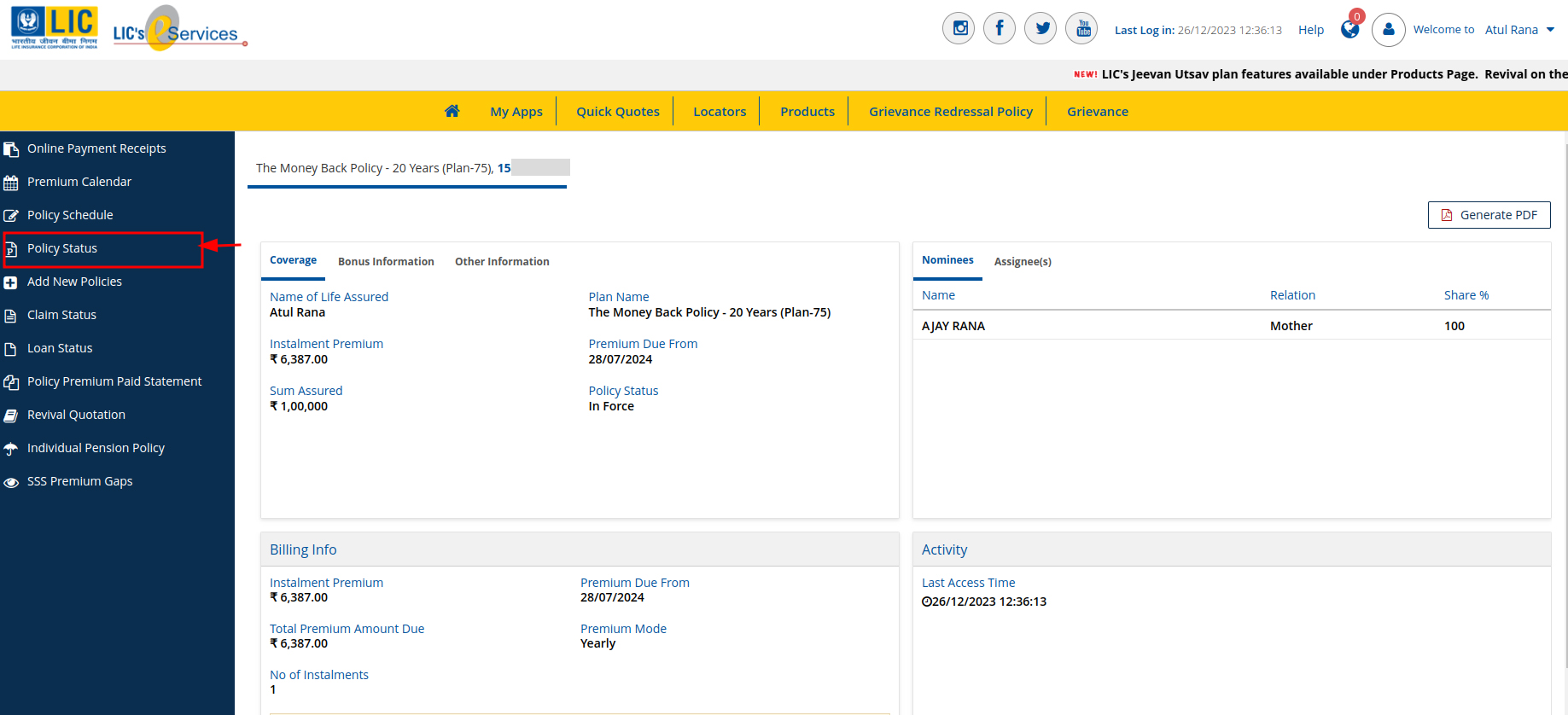

4. Next, you must click on the ‘Policy Status’ tab from the left side menu of your screen.

5. Explore the available plans within your account.

6. At this stage, you can review your LIC maturity amount along with additional details, including the policy name, premium payment date, policy term, and more.

Guidelines for a Smooth LIC Maturity Claim Process and Online Account Setup

Don’t forget to follow these:

- Have the details of your LIC policy ready for submission during the LIC claim process.

- Select a user ID of your choice during the online account creation, using a combination of numbers, letters, and special characters.

- Ensure that your account password is between 8 to 30 characters. It must be easy to remember and kept confidential to prevent fraudulent activities.

- When creating the account, fill in all the mandatory fields marked with an asterisk(*) for a successful account opening.

- Provide a valid email ID for easy communication and message conveyance.

- Choose a unique user ID for registration, as duplicate IDs may result in a lack of notifications.

Remember, you can also check the LIC maturity amount offline by visiting the nearest LIC branch if preferred.

How to Check LIC Claim Policy Without Registration

To Check LIC Policy Without Registration

Steps

- Policy Status via SMS

Send SMS “ASKLIC<policy number>STAT” to 56767877 from your registered phone number.

- Policy Status

– Policy Status: Send an SMS to 56677 from your registered phone number.

- Premium Amount

– Know Your Premium: Type ‘ASKLIC PREMIUM’ and send the SMS to 56677 from your registered phone number.

- Policy Lapsed Information

– Policy Lapsed: Text ‘ASKLIC REVIVAL’ and send it to 56677 from your registered mobile number.

These methods allow you to access information about your LIC policy or plan status without the need for online registration.

How to Check LIC Maturity Claim Without Going to the Office

To check your LIC policy maturity amount without visiting the office, LIC of India offers convenient options.

You can utilise the SMS Enquiry service for various services such as:

- Annuity Amount

- Status of the existing plan or policy

- Release date of the last annuity

- Cheque return information

- Existence certificate due.

- For Annuity Amount:

Send an SMS with the format: “ASKLIC<Policy Number>AMOUNT” to 56767877.

- For the Status of the existing plan or policy:

Send an SMS with the format: “ASKLIC<Policy Number>STAT” to 56767877.

- For the Release date of the Last Annuity:

Send an SMS with the format: “ASKLIC<Policy Number>ANNPD” to 56767877.

- For Cheque return information,

Send an SMS with the format: “ASKLIC<Policy Number>CHQRET” to 56767877.

- For the Existence certificate due:

Send an SMS with the format: “ASKLIC<Policy Number>ECDUE” to 56767877.

For all the above inquiries, you can also use the number 56767877. Simply SMS your query today.

Alternatively, you can SMS “LICHELP <policy number>” to 9222492224.

FAQs | LIC Maturity Claim Online

Yes, you can claim the LIC maturity amount online by registering and logging into the official LIC website, where you can submit your claim. Additionally, you can check your policy’s maturity amount and initiate the claim process through the LIC customer portal.

For the LIC policy maturity claim, you need the original policy document, identity proof, proof of your address and proof of your date of birth.

To claim life insurance after maturity, you must align all the documents including your policy doc, address proof and identity proof and follow the online or offline process to file your claim. The company will verify the details and documents before paying the claim amount.

To check your LIC policy maturity date online, you must sign up/register on the LIC website. From the Customer Services tab, log in with your user ID, password, and date of birth. Choose the specific policy (Self, Spouse, or Child), click on the policy number, and you can check the maturity date of your policy.

Source- licindia.in, licbharosa

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.