Mahila Samriddhi Yojana (MSY)| Features, Benefits and Eligibility

In India, many women entrepreneurs face significant barriers to starting their businesses. This applies especially to those from economically and socially backward backgrounds. The Mahila Samriddhi Yojana (MSY) is a government initiative that offers accessible micro-financing solutions for women.

What is the Mahila Samriddhi Yojana Scheme, and what are the benefits of Mahila Samriddhi Yojana?

This initiative encourages women entrepreneurship among underprivileged communities in India.

Imagine transforming a dream into reality—this scheme is designed to make that possible for women!

Let us take a closer look at MSY!

Mahila Samriddhi Yojana Scheme Provides Essential Funding for Women Entrepreneurs!

Mahila Samridhi Yojana Launch Date- The Mahila Samridhi Yojana was launched as a micro-finance policy to uplift rural women on October 2nd, 1993

The Mahila Samriddhi Yojana (MSY) empowers women entrepreneurs. It helps those from economically disadvantaged backgrounds. It was launched by the Ministry of Social Justice under National Backward Classes Finance and Development Corporation (NBCFDC). The scheme supports women through micro-finance. This support is given directly or through Self-Help Groups (SHGs). The scheme is available nationwide with various partners. It identifies women who can benefit from loans for their businesses.

Who are the Target Beneficiaries of this Government Scheme?

Mahila Samriddhi Yojana is designed to empower:

- Self-Help Groups (SHGs): The scheme strengthens SHGs focused on women. These groups often include economically disadvantaged members.

- Women from Backward Classes: It specifically helps women from Scheduled Castes (SC) and Scheduled Tribes (ST).

What are the Objectives of the Mahila Samriddhi Yojana?

The Mahila Samriddhi yojana is launched in 1993 with multiple goals in mind:

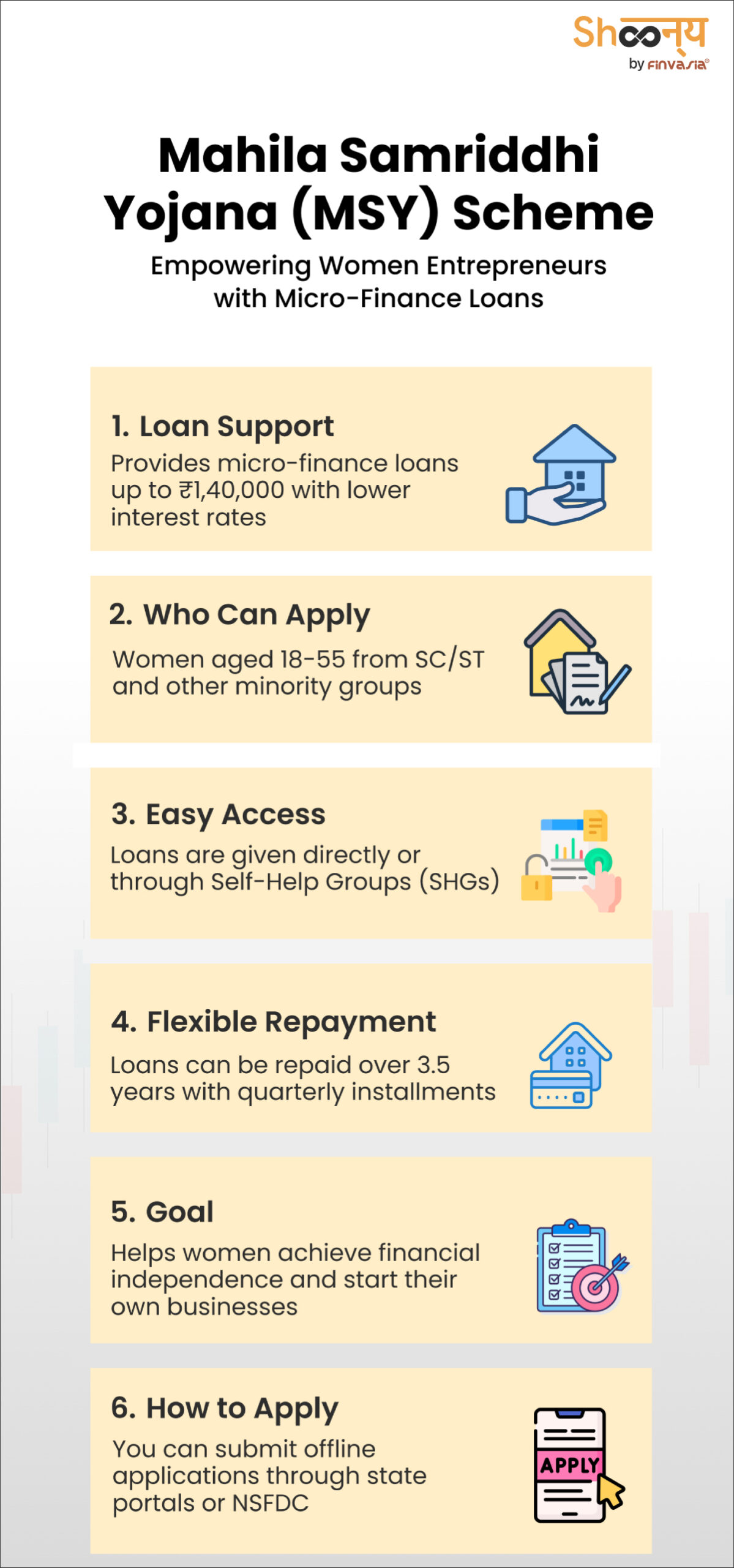

- To encourage women from minority and rural backgrounds to embrace entrepreneurship.

- To provide micro-finance loans at reduced interest rates, helping women achieve their business goals.

- To support women from SC, ST, and other minority communities in pursuing their aspirations.

- To promote financial independence and fight social barriers.

- To assist women who face challenges in starting their businesses due to a lack of financial resources.

This initiative also offers a rebate on interest rates.

Benefits of the Mahila Samriddhi Yojana

Why should you consider this government scheme?

Here are its benefits:

- Financial Assistance: The scheme provides financial support of up to ₹1,40,000.

- Repayment Period: Loans are repayable within 3.5 years. You can make repayments made in quarterly instalments. This practically starts from the date of disbursement, including a moratorium period.

- Further Loan Opportunities:

Do you know?

Eligible beneficiaries can access additional loans under the National Scheduled Castes Finance and Development Corporation (NSFDC) scheme upon successful repayment.

Who is Eligible for the Mahila Samriddhi Yojana?

Let us see!

Eligibility Criteria for Mahila Samriddhi Yojana

You can enjoy the benefits of this scheme if:

- You are between 18 and 55 years old.

- You are a woman from an economically and socially backward class, as specified by the Central or State Government from time to time.

Now, how can you apply to the Mahila Samriddhi Yojana scheme?

Application Process

You can only follow the offline procedure to apply under the Mahila Samriddhi Yojana scheme.

- You must visit the official NSFDC website.

Alternatively, you can also access your state government portal to access the application form for the Mahila Samriddhi Yojana.

- You can download the form directly at https://nskfdc.nic.in/en/node/add/loan-application.

Once you have done so, fill out the application form with all the details. This would include your age, name, contact information, and the amount requested.

- Submit the completed form along with the required documents.

Loans are provided to eligible women from the targeted groups (Scheduled Castes with an annual family income of up to ₹3.00 lakhs) through various Channel Partners of NSFDC.

Here’s how the process works:

- You must submit your loan application to the District Offices of the State Channelizing Agencies (SCAs).

- These District Offices will review and forward the applications to their Head Offices for further processing.

- Eligible applicants can also submit loan applications to other Channelizing Agencies associated with NSFDC.

You can do this at:

- Regional Rural Banks

- Public Sector Banks, or NBFC-MFIs, with which NSFDC has agreements.

After accepting the terms and conditions, funds are released.

SCAs, RRBs, or Nationalized Banks receive these funds. NSFDC handles fund disbursement after agency requests.

What are the Documents Required for Mahila Samriddhi Yojana?

To apply for the Mahila Samriddhi Yojana, you will need to submit the following documents:

- Address Proof

- Identity Proof

- Self-Help Group (SHG) Membership ID (if applicable)

- Caste Certificate (if applicable)

- Income Certificate from a competent authority

- Aadhaar Card

- Bank Account Details

- Recent Passport Size Photographs

You may also want to know the Pradhan Mantri Ujjwala Yojana 2.0

FAQs| Mahila Samriddhi Yojana (MSY) Scheme

Women aged 18 to 55 from economically and socially backward classes can apply for the Mahila Samriddhi Yojana. It’s designed to support those who need financial assistance to start their own businesses.

The Mahila Samiti scheme, also known as the Mahila Samriddhi Yojana offers loan to women to from backward classes to encourage entrepreneurship.

The Mahila Shakti Kendra Scheme, initiated in 2017, promotes community engagement through college student volunteers in aspirational districts.

Any woman or the guardian of a minor girl can open a Mahila Samman Savings Certificate account.

In the new budget, the Mahila Samman Savings Certificate has been introduced as a two-year savings scheme for women. It offers a fixed interest rate of 7.5% with a maximum deposit limit of ₹2 lakhs, making it a beneficial choice for women investors.

Source- https://www.myscheme.gov.in/schemes/mssc

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.