We want our hard-earned money to be invested in schemes and companies that we can rely on. Doesn’t matter how careful we are when choosing a mutual fund. There is always some risk associated with it. One such mutual fund risk is the chance of mutual fund companies closing. Mutual fund schemes might close for many reasons. In this blog, we will look into how mutual funds work and get a better understanding of aspects of mutual fund company collapse.

How Mutual Funds Work

Let’s say person A wants to invest his money in stocks. But he does not know the stock market. So, he approaches person B. B uses his skills to help A make investment choices. For managing A’s assets, B charges a small asset management fee. Mutual fund companies do what B does but on a large scale.

The companies that run mutual fund schemes are called asset management companies (AMC). As the name itself suggests, these companies manage assets. The investors own the securities, and the mutual fund company only manages the money put in by the investor. They pool money from multiple investors and use that money to invest in a diversified portfolio. These companies make money through the fee they charge for managing your asset, your investment in this case.

How Does A Mutual Fund Company Fail

The chance of a mutual fund company entering liquidation is slim to none. However, it is not impossible. There are instances of companies quitting because of various reasons. When a company quits one of two things happens:

- The company tries to sell its mutual fund scheme to another company. When a new company acquires a mutual fund scheme, usually the old and new schemes are merged and carried on.

- All the stakeholders are allowed to redeem their funds without any extra charge.

The company must contact SEBI before it quits the market. SEBI ensures the smooth transaction of mutual fund schemes from one company to another without it adversely affecting the investor.

A mutual fund company can go into liquidation due to various reasons such as poor management, mismanagement of funds, lack of investor interest, legal and regulatory issues, or market downturns.

Measures That Protect The Investor

Before a company starts a mutual fund scheme, it must register with SEBI. SEBI has guidelines that a mutual fund should strictly adhere to. These guidelines make sure that companies don’t misuse the funds they oversee.

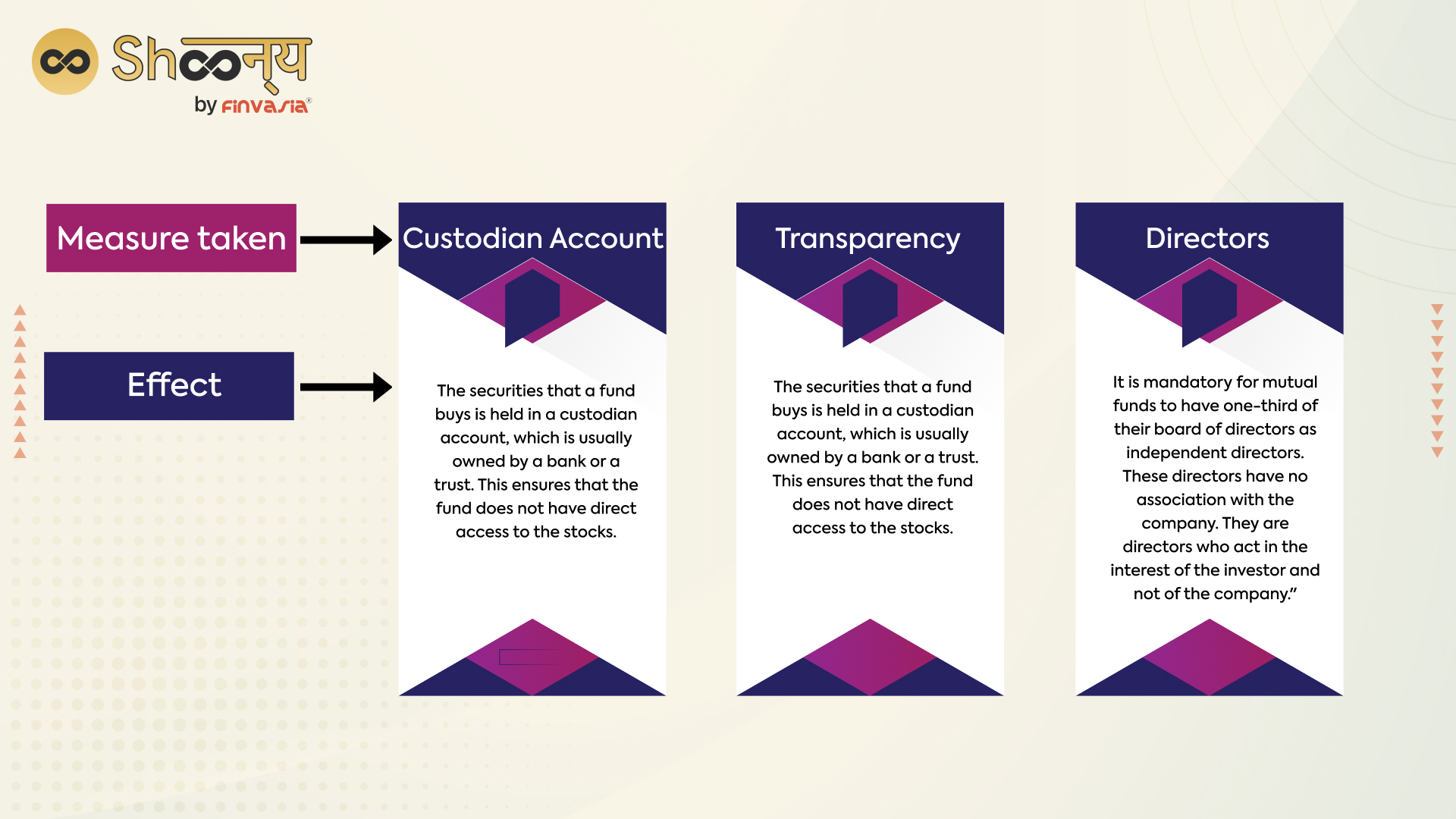

Measures taken to protect investors are:

- Custodian account – The securities that a fund buy is held in a custodian account, which is usually owned by a bank or a trust. This ensures that the fund does not have direct access to the stocks.

- Transparency – Management is very transparent in a mutual fund. Every month they release reports that let you know about the moves the company is making in the market.

- Directors – It is mandatory for mutual funds to have one-third of their board of directors as independent directors. These directors have no association with the company. They are directors who act in the interest of the investor and not of the company.

Conclusion

When a mutual fund company shuts down operations it’s a huge concern for the stakeholders. It is important to keep a clear head and make a rational decision when a company closes. Most of the time a new asset management company takes charge. If you don’t have confidence in the new management, you can always exit with your funds and look for a more promising mutual fund scheme.

Happy investing!