Before talking about NIFTY and Sensex, let us understand a Stock Market Index.

What is a Stock Market Index?

A stock market index is a statistical measure of the performance of a group of stocks or a stock market as a whole. The Nifty 50 and the S&P BSE Sensex are both stock market indexes in India that measure the performance of a selected group of stocks and are widely followed as gauges of the performance of the Indian stock market.

Nifty and Sensex are like the pulse of the Indian stock market. They are like barometers that measure the health of the economy by tracking the performance of the top 50 and top 30 publicly traded companies, respectively. Think of them as the stock market’s equivalent of a thermometer – they give you a snapshot of the market’s temperature at any given moment.

Understanding NIFTY and NIFTY Index

Nifty is a stock market index in India that represents the performance of the top 50 companies listed on the National Stock Exchange of India Limited (NSE). The NSE publishes the Nifty index, which is calculated using the free-float market capitalization-weighted methodology.

Why is NIFTY Index called NIFTY 50?

The Nifty index is called Nifty because it represents the performance of the top 50 companies listed on the National Stock Exchange of India Limited (NSE). The name “Nifty” is derived from the combination of the words “National” and “Fifty,” which refers to the fact that the index represents the top 50 companies listed on the NSE.

The NSE is one of the leading stock exchanges in India and is known for its transparent and efficient market operations.

The Nifty index is considered to be a good indicator of the overall performance of the Indian stock market and is widely followed by investors, market analysts, and the media. It is also used as a benchmark for investment portfolios and mutual funds.

The Nifty index is composed of a diverse range of companies across various sectors of the economy, including finance, banking, technology, healthcare, and consumer goods, among others. An index’s level represents the total market value of all the stocks in it relative to a particular base period. The index is calculated and published on a real-time basis and is updated continuously throughout the trading day.

How is NIFTY calculated?

In the Indian stock market, the Nifty index is calculated using the following formula:

Nifty index = (Total market capitalization of the 50 companies / Index divisor) x Base value

Where:

- The total market capitalization of the 50 companies is the sum of the market capitalization of each of the 50 companies included in the index. The market capitalization of a company is calculated by multiplying the price of the company’s stock by the number of shares outstanding.

- An index divisor is a number used to adjust the level of the index to reflect the actual market capitalization of the index. The index divisor is adjusted periodically to ensure that the index level reflects the actual market capitalization of the index.

- The base value is the value of the index relative to a particular base period. The base value is usually set to 1,000 or 100, depending on the level of the index.

But, how do I invest in NIFTY?

HERE- Take a look at our Guide to invest in NIFTY

The first question to address is: What are the different ways to start investing in NIFTY?

- Nifty Index Fund: A Nifty index fund is a type of mutual fund that tracks the performance of the Nifty index. Nifty index funds aim to replicate the performance of the Nifty index by investing in the stocks included in the index in the same proportion as the index.

If you are planning to invest in the Nifty Index Fund, we have some more information for you. Check these out: Best Nifty Index Funds to Invest.

- Nifty ETFs: Exchange-traded funds (ETFs) that track the Nifty index are another option for investing in the Nifty. ETFs are traded on stock exchanges and can be bought and sold like individual stocks.

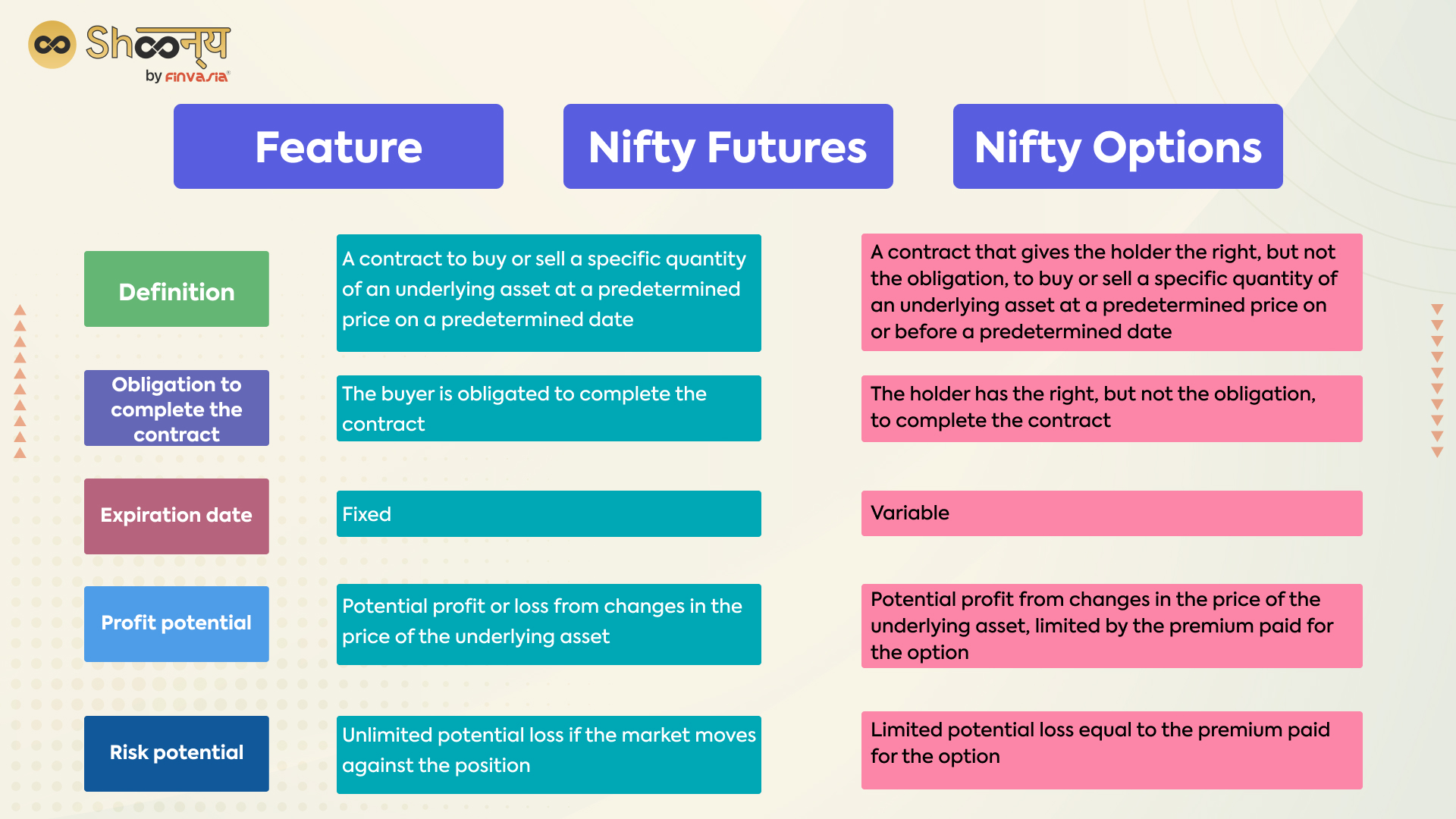

- Nifty Futures and Options: Investors can also trade Nifty futures and options, which are financial instruments that allow investors to speculate on the future direction of the Nifty index.

- Nifty Future Stocks: They are typically large, well-established companies that are widely followed and traded in the market and represent the top 50 companies listed on the NSE and are chosen based on their market capitalisation and liquidity.

Minimum Amount to Invest in the Nifty

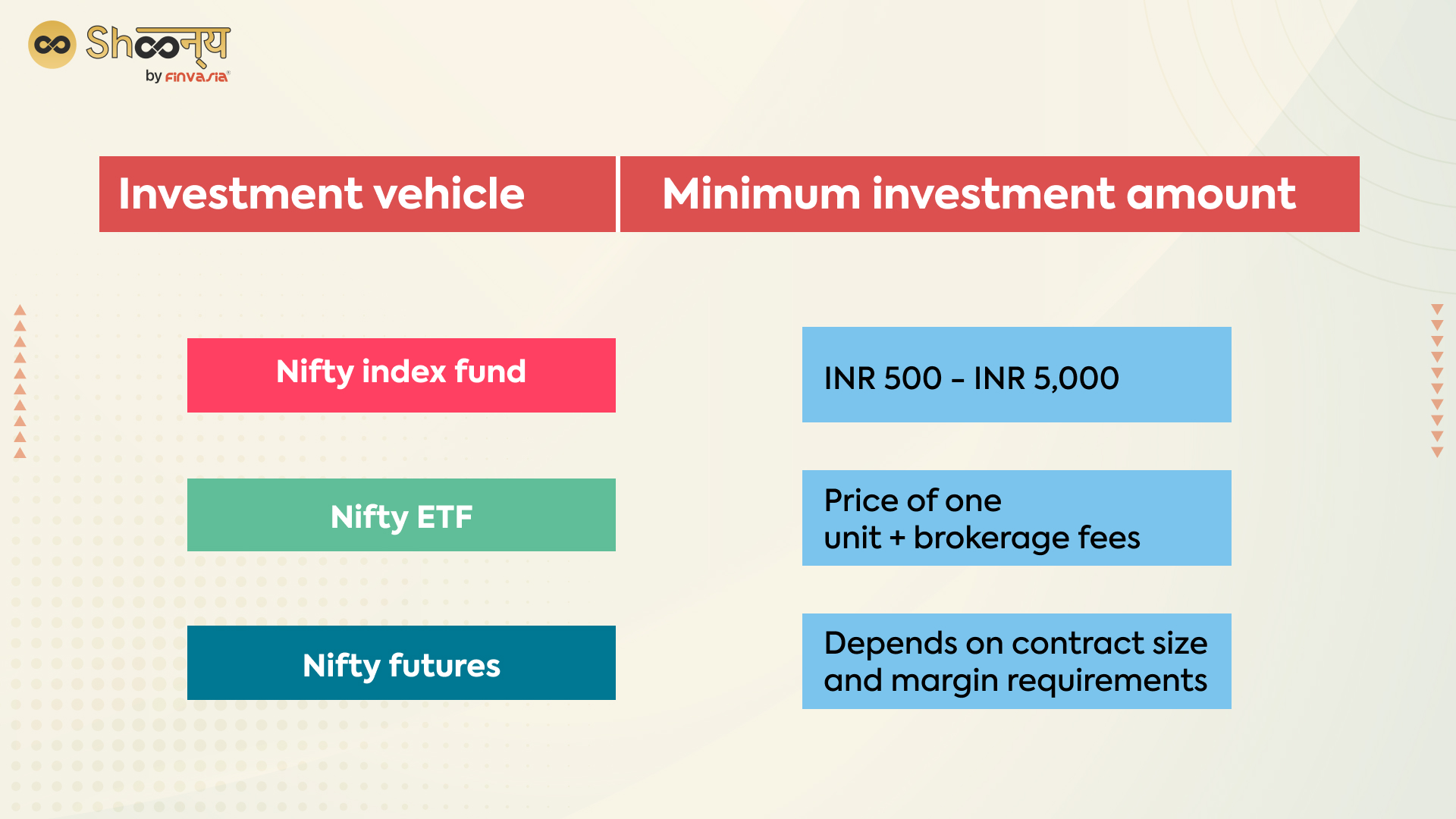

The minimum amount required to invest in the Nifty index depends on the investment vehicle you choose. Here are some options for investing in the Nifty index and the minimum amounts required:

- Nifty Index Fund: The minimum investment amount for a Nifty index fund typically ranges from INR 500 to INR 5,000, depending on the fund house and the investment plan. Some fund houses may also have a minimum monthly or quarterly investment amount.

- Nifty ETF: The minimum investment amount for a Nifty ETF depends on the price of the ETF and the brokerage fees charged by your broker. Typically, the minimum investment amount for an ETF is the price of one unit of the ETF, plus any brokerage fees.

Tip: You can save your brokerage fees by trading on Shoonya App. Our multi-asset trading platform offers zero-brokerage services for a lifetime.

- Nifty Futures: The minimum investment amount for Nifty futures depends on the contract size and the margin requirements set by the exchange. The contract size for Nifty futures is currently INR 50 per index point, and the margin requirements vary depending on the broker and the risk profile of the investor.

Here is a table showing the minimum amounts required to invest in the Nifty index through different investment vehicles:

Note– It’s worth noting that the minimum investment amounts shown above are approximate and may vary depending on the fund house, broker, or exchange. It is also advisable to consult with a financial advisor or professional before making any investments.

Tip- You can download Shoonya App or check our website to use more than 100 technical indicators that help you check across multiple assets and choose the best one for yourself. Shoonya operates as a zero-commission trading platform and promises zero-lifetime brokerage.

What is Sensex? How does it work?

The S&P BSE Sensex, also known simply as the Sensex, is a stock market index in India that represents the performance of the 30 largest and most liquid companies listed on the Bombay Stock Exchange (BSE).

It is calculated using the free-float market capitalization-weighted methodology, which means that the level of the index mirrors the total market value of all the stocks in the index relative to a certain base period, taking into consideration the free float of each stock.

The Sensex is named after the Standard & Poor’s BSE Sensex, which is an index of the BSE. The name “Sensex” is derived from the combination of the words “sensitivity” and “index,” which reflects the sensitivity of the index to market movements.

How to calculate the Sensex index for Indian stock market analysis?

Here is the formula for calculating the Sensex:

Sensex = (Sum of the market capitalisation of all stocks in the index) / (Index base value) * 100

In this formula,

the “sum of the market capitalisation of all stocks in the index” refers to the total market value of all the stocks included in the Sensex, and the “index base value” is a reference value used to calculate the index level.

The Sensex is calculated and published on a real-time basis and is updated continuously throughout the trading day to reflect the changing market values of the stocks included in the index.

Factors affecting SENSEX and How they impact the Indian Stock Market.

There are several factors that can affect the Sensex, including economic indicators, company-specific news, market sentiment, global economic and political events, and market reforms and regulations.

- Economic indicators such as gross domestic product (GDP) growth, inflation, employment, and interest rates can have a significant impact on the performance of the stock market and the Sensex.

- Company-specific news and developments can also impact the index, as can the overall sentiment of the market and global economic and political events.

- Changes in market reforms and regulations can also affect Sensex.

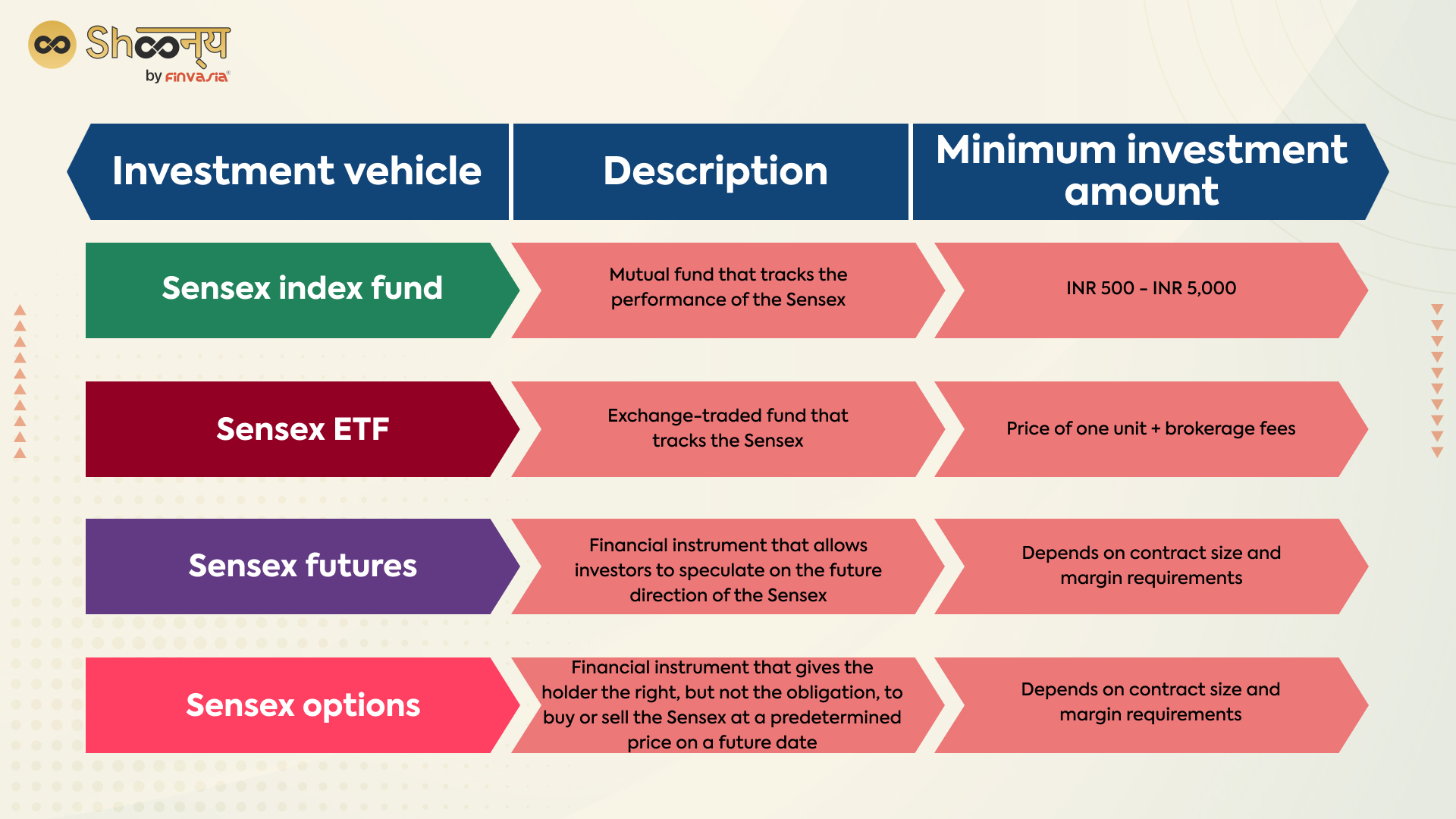

Here is a table showing different ways to invest in the Sensex, which is a stock market index in India that represents the performance of the 30 largest and most liquid companies listed on the Bombay Stock Exchange (BSE):

Sensex vs Nifty

In addition to their use as benchmarks for investment portfolios and mutual funds, the Sensex and the Nifty are widely followed by investors, market analysts, and the media as gauges of the Indian stock market’s performance.

Let’s talk about some similarities before discussing the Difference Between Sensex And Nifty.

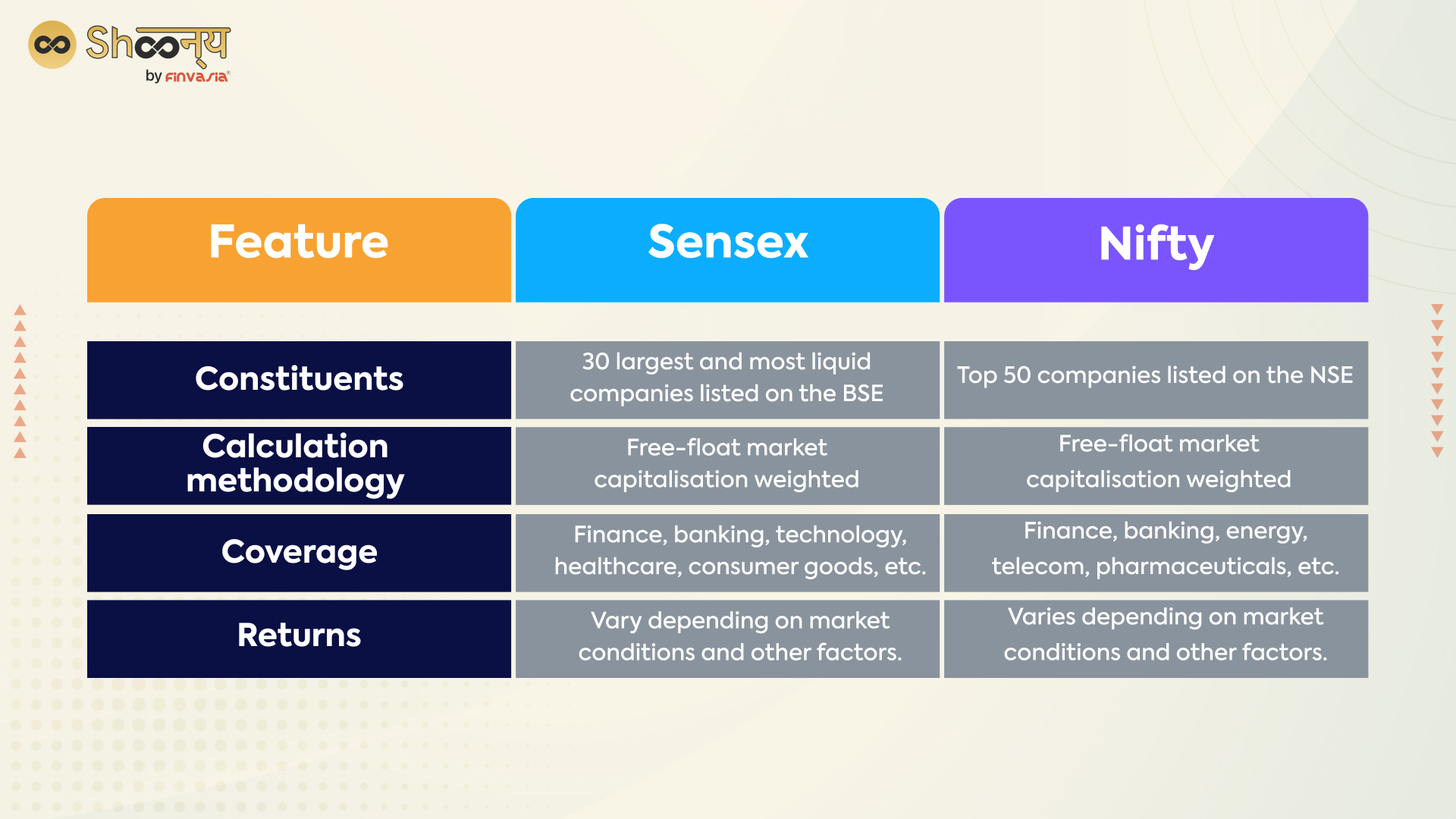

Here are the points of comparison between the Sensex and the Nifty:

- Index base value: The Sensex has a base value of 1978-79, while the Nifty has a base value of 1995. This means that the level of the Sensex is calculated relative to its base value of 1978-79, while the level of the Nifty is calculated relative to its base value of 1995.

- Historical performance: The Sensex has been in existence since 1979, while the Nifty has been in existence since 1996. This means that the Sensex has a longer track record of performance than the Nifty.

- Market representation: The Sensex is composed of companies listed on the BSE, while the Nifty is composed of companies listed on the NSE. This means that Sensex represents the performance of companies listed on the BSE, while Nifty represents the performance of companies listed on the NSE.

- Sector representation: The Sensex and the Nifty both cover a broad range of sectors of the economy, but the specific sectors represented in each index may differ. For example, the Sensex may have a greater representation of technology companies, while the Nifty may have a greater representation of energy companies.

Here is a comparison of the Sensex and the Nifty in the form of a table:

FAQs

You can’t invest directly in these indices, but you can invest in mutual funds and ETFs that mirror their performance.

Both have their merits; Nifty offers more diversification, while Sensex focuses on fewer blue-chip stocks. Consider your investment goals.

They are reviewed semi-annually to ensure they reflect the evolving stock market.

Nifty and Sensex include companies from various sectors, including finance, information technology, healthcare, consumer goods, and more. The sectors may evolve over time to reflect changing market dynamics.

Yes, corporate actions like stock splits and bonuses are factored into the calculation of Nifty and Sensex to maintain their accuracy and relevance.

You can monitor Nifty and Sensex in real-time through financial news websites, stock market apps, and by watching business news channels.

Eager to know more? Check these out:

What is Sensex? How does it work?

How Nifty and Sensex are calculated?

What are the types of Mutual Funds?

Stock Market Basics