Non-Convertible Debentures: Basics, Features & How To Buy

Are you seeking an investment avenue that can outshine traditional options like bank fixed deposits? Must have heard about bonds and debentures? We have an additional famous investment category that is non-convertible debentures (NCDs), which is a good investment instrument that offers the potential to outperform FD interest rates while maintaining liquidity and capital security.

In today’s blog, we will shed light on NCDs in the debt market, the features of Non-convertible bonds, the process of buying debentures and more!

Basics of Non-Convertible Debentures

What are Non-Convertible Debentures (NCDs)?

Non-convertible debentures, or NCDs, are debt instruments with a predetermined interest rate and maturity period. As the name implies, these instruments do not allow you to convert them into equities. Depending upon the terms and conditions of the issuance, NCDs in the debt market offer interest that can be payable monthly, quarterly, or yearly.

With NCD investment, you can diversify your portfolio and tap into fixed-income opportunities, enjoying steady returns while mitigating risks.

Features of Non-Convertible Debentures

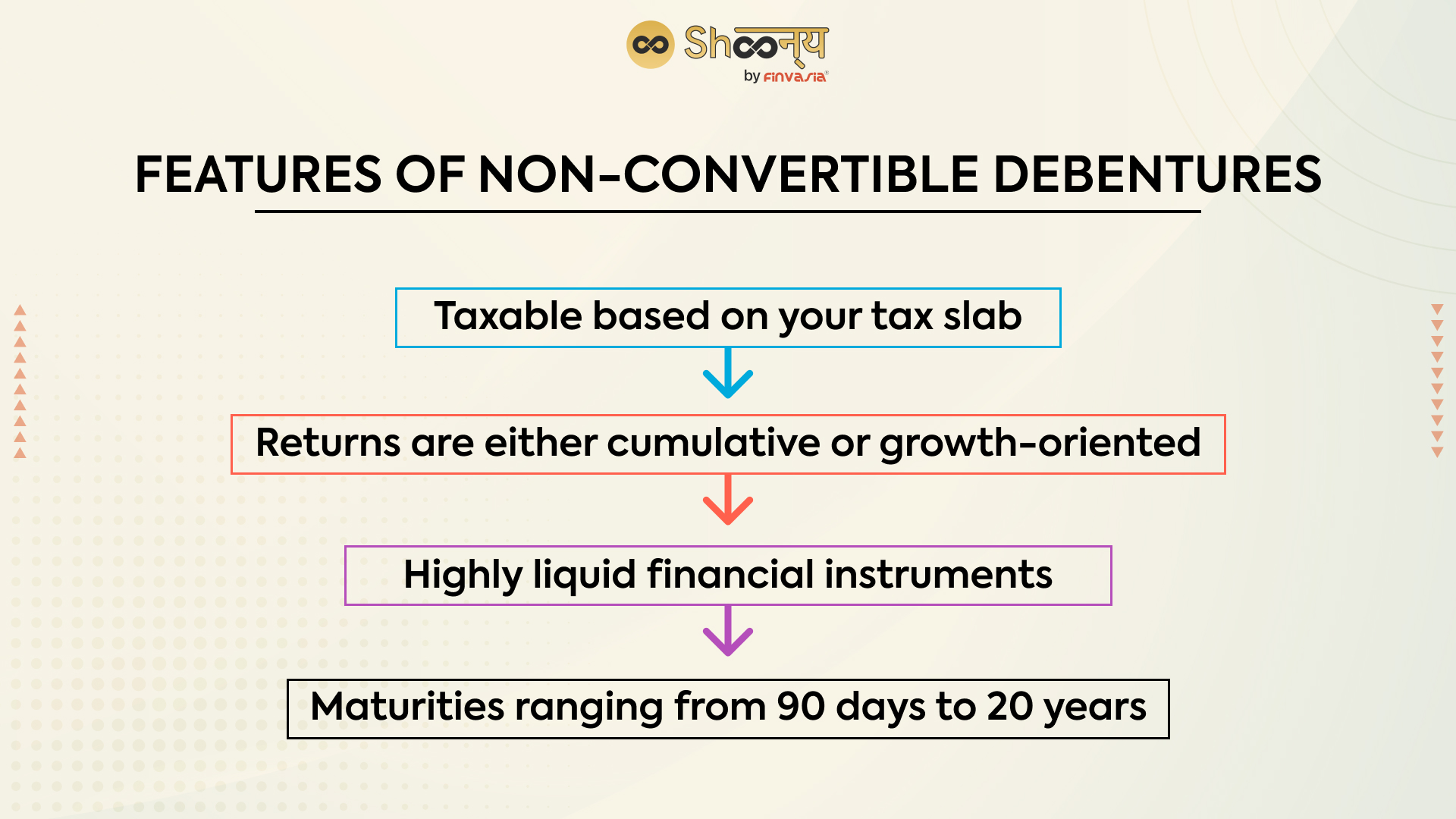

- Taxation: NCD interest earnings are taxable based on your tax slab. Apart from that, if you redeem your NCDs in less than a year, you will be subject to a short-term capital gain tax based on your income’s slab rate. If you sell them after a year, you will have to pay a 20% long-term capital gains tax with indexation. Indexation is a method of adjusting the purchase price of an investment with inflation.

- Returns: NCD returns can be either cumulative or growth-oriented (interest option). If you choose the former, the interest tax on cumulative NCD is added to the capital, and you earn interest on interest the following year. If you select the growth option, you will receive an interest rate ranging from 7% to 9% on a monthly, quarterly, semi-annual, or yearly basis.

The interest rate on NCDs can vary depending on various factors, such as the credit rating of the issuer, prevailing market conditions, and the duration of the investment.

- Credit rating: Credit rating agencies such as CARE assign ratings to NCDs in the debt market ranging from AAA to D. They decide on this parameter after reviewing the issuing company’s credit behaviour, such as debt level, interest coverage ratio, and capital adequacy. Companies with poor credit ratings are more likely to default on investor payments.

- Liquidity: NCDs are highly liquid financial instruments. If you need money immediately, you can sell it on the secondary market via an online trading platform.

Tenure: They are available on the market with maturities ranging from 90 days to 20 years.

NCD Investment: Who Can Participate?

NCD investments are open to individuals, banking companies, primary dealers, other corporate entities registered or incorporated in India, and unincorporated bodies.

Key Features of NCD Investments

1. Easily Tradable

NCD investments are listed on open stock markets and exchanges, providing investors with the flexibility to buy or sell as per their preferences.

2. Direct Bank Credit

Interest on NCD investments is directly credited to investors’ bank accounts, streamlining the income distribution process.

3. Digitalized

Issuance and trading of NCD investments occur in demat form only, ensuring efficient and secure transactions.

4. Lower Risk

Secured NCDs are issued only by companies with a good credit rating, reducing the risk associated with your investments.

How Can You Buy Debentures in India

Debentures are financial instruments issued by companies to raise capital from the public. They provide a fixed interest rate and are often secured by the issuer’s assets. In India, you can buy debentures through several avenues:

1. Primary Market:

- In the primary market, companies issue debentures for the first time.

- Investors can apply for debentures through various channels, including online platforms, brokers, or directly from the issuer’s website.

- To participate, investors must have a Demat account where the debentures will be electronically credited.

- Additionally, they need to submit the required application funds and cover any associated charges or taxes.

- The allocation of debentures depends on the supply and demand dynamics of the offering.

2. Secondary Market:

- Debentures become tradable in the secondary market after their initial issuance.

- Investors can purchase and sell debentures through stock exchanges such as BSE or NSE or through over-the-counter (OTC) markets.

- To engage in secondary market trading, investors require both a trading account and a Demat account, where debentures will be transferred.

- Brokerage fees and any applicable charges or taxes must also be paid.

- The price of debentures in the secondary market is influenced by market conditions and the credit rating of the issuer.

3. Market-Linked Debentures (MLDs):

- MLDs are specialised debentures with returns linked to specific market indices or instruments, such as government bonds or stock indices.

- They may or may not provide principal protection, meaning that investors could incur losses if the linked market index performs poorly.

- Companies or financial institutions issue MLDs, and they are listed on stock exchanges.

- Investors can buy and sell MLDs via online platforms or brokers.

- Similar to other debentures, owning a Demat account and a trading account is essential for MLD transactions.

- Transaction fees and any relevant charges or taxes apply.

Prior to investing in debentures in India, it is imperative for investors to assess their risk tolerance, investment horizon, and financial objectives.

What are the different types of Non-Convertible Debentures?

- Secured NCDs: These NCDs have the backing of the issuing company’s assets. If the issuer fails to pay the investors, the latter has the right to liquidate the pledged assets and recoup their losses. Secured NCDs offer a slightly lower interest rate because of the capital security it provides.

- Unsecured NCDs: These NCDs are not collateralised. Investors have no choice but to wait if the company defaults or delays payment. Given the higher credit risk, unsecured NCDs offer higher interest rates to attract subscribers

For instance,

With Shoonya, you can open a zero-commission stock trading account or a DEMAT account in five minutes and start investing in bonds, stocks, mutual funds, etc.

In Conclusion

NCDs are an attractive investment option. They provide higher returns and allow you to redeem them easily during times of financial stress. However, before you make an NCD investment in India, carefully examine the company’s credit rating and debt levels to ensure minimal default risk.

FAQs

There are multiple benefits of non-convertible debenture, such as regular fixed interest payments, lower risk, and priority in repayment at the time of company liquidation.

Non-convertible debentures can be sold in the secondary market before maturity, providing liquidity to investors.

You cannot withdraw Non-convertible debentures before maturity. However, you can sell them in the secondary market.

Non-convertible debentures are generally not tax-free. If you see non-convertible debentures within 12 months, the gains are treated as short-term capital gains and taxed at the applicable income tax rate. However, if you sell them after 12 months, the gains are assumed long-term capital gains and taxed at a lower rate of 10% without indexation.

_____________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.