NPS Interest Rates 2023: Explore the Current Rates and Benefits of National Pension Scheme

Planning for your retirement years. NPS- National Pension Scheme is the safest option. But how do you invest in it? Is it actually safe? Today, we will shed light on all the details, ranging from NPS interest rates to NPS benefits and the difference between NPS and PPF so that you can make the right long-term investment choice.

What is the NPS Scheme?

The National Pension System (NPS) is like a savings plan for your retirement. It’s a choice you can make to put money aside for the future, ensuring you have a steady income when you retire. The idea is to help every person in India have enough money to live comfortably after they stop working.

The whole program is looked after by the Pension Fund Regulatory and Development Authority (PFRDA), along with the Government of India.

While making a normal exit from the National Pension Scheme, you have two options.

- You can take the money you saved and buy a life annuity from a special life insurance company approved by PFRDA. This can give you a regular income.

- Or, if you prefer, you can take out part of the money you saved as a lump sum.

NPS: Types of Accounts

There are two types of NPS accounts:

- Tier 1 NPS account: Mandatory for all NPS subscribers, locked in until age 60.

- Tier 2 NPS account: Voluntary savings with unrestricted withdrawals.

Tier-I Account

A tier-I account is like a retirement savings account. Here, you

are allowed to contribute your savings specifically for retirement. It serves as a savings plan with some restrictions on when you can take money out.

However, this account comes with tax benefits, meaning you may be able to save on taxes for the contributions you make, following the current Income Tax rules.

Tier-II Account

Tier-II account is like a personal savings fund that you can use whenever you want. You can anytime withdraw your savings from this account. Unlike the Tier-I account, this one isn’t specifically for retirement. Also, there are no tax benefits on the contributions made here.

Benefits of the NPS Scheme

NPS is considered to be a popular choice among Indian investors due to the attractive NPS interest rates and being a safe option for users.

Low Cost:

- Considered the world’s lowest-cost pension scheme.

- Lowest administrative charges and fund management fees.

Simple:

- Easy account opening through any Point of Presence (POP) at Head Post Offices across India.

- Obtaining a Permanent Retirement Account Number (PRAN) is all it takes.

Portable:

- You can operate the account from anywhere in the country.

- Pay contributions through any POP-SP, even if you change cities or jobs.

- Accounts can be shifted to different sectors like government or corporate models.

Returns/Interest:

- NPS offers equity exposure for potentially higher returns compared to traditional investments.

- Historically delivered 9% to 12% annualised returns.

- Option to change fund manager for better performance.

Risk Assessment:

- Cap on equity exposure reduces with age, minimising risk.

- Investor-friendly measures stabilise the risk-return equation.

Regulated:

- Regulated by PFRDA with transparent investment norms.

- Regular performance reviews and fund manager monitoring by NPS Trust.

Flexibility:

- Subscribers can contribute at any time and adjust subscription amounts.

- Choose investment options and operate the account online from anywhere.

- Continuity is maintained during city or job changes.

NPS Interest Rate 2023

The NPS interest rate is not fixed; it is dependent on the performance of the underlying assets in the NPS fund. The fund is divided into four asset classes: Equity (E), Corporate Bonds (C), Government Bonds (G), and Alternative Assets (A).

Investors can choose their investment proportions in each class or opt for a predefined portfolio based on age and risk profile. Fund managers, each with distinct track records and strategies, manage the NPS fund.

NPS Interest Rate and Asset Classes (As of January 2023) – Tier I:

| Asset Class | Returns (1 year) | Returns (5 years) | Returns (10 years) |

| Equity (E) | 15.33%-18.81% | 13.11%-15.72% | 10.45%-10.86% |

| Corporate Bonds (C) | 12.46%-14.47% | 9.27%-10.15% | 10.05%-10.64% |

| Government Bonds (G) | 12.95%-14.26% | 10.29%-10.88% | 9.57%-10.05% |

| Alternative Assets (A) | 3.98%-16.73% | NA | NA |

NPS Interest Rate and Asset Classes (As of January 2023) – Tier II:

| Asset Class | Returns (1 year) | Returns (5 years) | Returns (10 years) |

| Equity (E) | 15.19%-17.92% | 13.05%-15.83% | 10.35%-10.58% |

| Corporate Bonds (C) | 12.71%-16.36% | 9.55%-10.17% | 9.86%-10.60% |

| Government Bonds (G) | 12.61%-13.42% | 10.40%-12.00% | 9.59%-10.07% |

| Alternative Assets (A) | NA | NA | NA |

Note: Returns are subject to market performance and can vary based on the chosen asset class and duration.

Tax Benefits of NPS

Here are the tax benefits that the National Pension Scheme offers to individuals:

Tax Benefit for Employees

- Employees can enjoy tax benefits on their contributions, with a limit of up to 10% of their Salary (Basic + DA), as per Section 80 CCD(1). It’s important to note that this falls within the broader cap of Rs. 1.50 lacs under Section 80 CCE. This provision allows individuals to make their contributions count towards tax savings, offering a valuable incentive for financial planning.

- Employer’s contribution is eligible for an additional tax deduction, up to 10% of Salary (Basic + DA), beyond the Rs. 1.50 lacs limit under Sec 80 CCD(2).

Tax Benefit for Self-Employed

Self-employed individuals can enjoy a tax deduction of up to 10% of their gross income under Sec 80 CCD(1). This falls within the overall limit of Rs. 1.50 lacs specified in Sec 80 CCE. Additionally, subscribers have the flexibility for an extra deduction under Sec. 80CCD(1) for any additional contribution to their NPS account, capped at a maximum investment of Rs. 50,000 under sec. 80CCD 1(B).

Tax Benefits on Partial Withdrawal from NPS Account

- Qualify for tax exemption on the withdrawn amount, up to 25% of self-contribution, subject to terms specified by PFRDA under section 10(12B).

Tax Benefit on Annuity Purchase

- Entitled to tax exemption on annuity purchase upon reaching age 60 or superannuation under section 80CCD(5). Note that subsequent annuity income is taxable under section 80CCD(3).

Tax Benefit on Lump Sum Withdrawal

- Eligible for tax exemption on a lump sum withdrawal of 60% of accumulated pension wealth upon reaching age 60 or superannuation under section 10(12A).

Tax Benefits for Corporates/Employers

- Qualify for a tax deduction on the employer’s contribution to employees’ NPS accounts, up to 10% of the salary (Basic + DA), treated as a ‘Business Expense’ under section 36(1)(iv)(a) from the Profit & Loss Account.

Note: Tax benefits are subject to the Income Tax Act, 1961 provisions, as amended.

Factors Affecting NPS Interest Rates

There are various factors that affect the overall NPS interest rates in India:

- Fluctuations in the economy’s demand and supply of money influence NPS interest rates. They tend to rise with high demand and fall with increased supply.

- The extent of government borrowing impacts NPS interest rates; higher government borrowing increases demand for money, pushing rates up, while reduced borrowing lowers rates.

- General price increases over time reduce the money’s purchasing power, prompting investors to seek higher NPS interest rates to compensate for inflation-induced value loss.

- The performance of NPS funds invested in equities, corporate bonds, government bonds, and alternative assets is subject to market conditions, affecting overall NPS interest rates.

How Does Asset Allocation Take Place under the National Pension Scheme?

Under the NPS Scheme, how the user wishes to invest money is totally dependent upon the subscriber’s own choice. NPS offers a number of funds and multiple investment options.

Active Choice:

- Allows investors to actively allocate funds across asset classes based on personal preferences and risk tolerance.

- Requires regular monitoring and portfolio adjustments for optimising returns.

- Restrictions include a maximum 5% allocation to Alternative Investment Funds (AIFs) and a maximum 75% equity exposure in NPS.

NPS interest rates are intricately tied to asset allocation, with four key asset classes involved, each serving a specific purpose:

| Asset Class | Asset Type |

| Class G | Government Bonds |

| Class E | Equities |

| Class C | Corporate Bonds |

| Class A | Real Estate Investment Trusts (REITs), alternative investment funds, and Commercial mortgage-backed securities |

Auto Choice:

- Involves automatic fund allocation based on a predetermined strategy, typically considering age, risk tolerance, and investment goals.

- It is commonly used in retirement accounts, where funds are automatically allocated based on age and expected retirement date.

NPS Auto Choice

Offers three Life Cycle Funds with varying asset allocations based on age:

i) LC75 – Aggressive Life Cycle Fund:

Starts with a 75% exposure to Equity Investments until age 35 and gradually reduces based on the subscriber’s age.

ii) LC50- Moderate Life Cycle Fund:

Begins with a 50% exposure to Equity Investments until age 35, adjusting gradually with the subscriber’s age.

iii) LC 25- Conservative Life Cycle Fund:

Starts with a 25% exposure to Equity Investments until age 35, decreasing progressively with the subscriber’s age.

NPS Fund Managers in India

| Fund Manager | Performance and Returns | Notable Schemes |

| SBI Pension Funds Pvt. Ltd. | Manages both government and non-government sector schemes. Highest returns: 8.20% (NPS Central Government Scheme), 8.18% (NPS State Government Scheme). | Offers good returns for non-government sector schemes, especially Scheme E (equity) and Scheme C (corporate debt). |

| LIC Pension Fund Ltd. | Manages both government and non-government sector schemes. Second-highest returns: 8.18% (NPS Central Government Scheme), 8.11% (NPS State Government Scheme). | Decent returns for non-government sector schemes, especially Scheme G (government securities) and Scheme A (alternative assets). |

| UTI Retirement Solutions Ltd. | Manages both government and non-government sector schemes. Third-highest returns: 8.09% (NPS Central Government Scheme), 8.08% (NPS State Government Scheme). | Competitive returns for non-government sector schemes, especially Scheme E (equity) and Scheme C (corporate debt). |

| HDFC Pension Management Co. Ltd. | Manages only non-government sector schemes. Best returns: 13.67% (Scheme E – equity). | Good returns for Scheme C (corporate debt) and Scheme G (government securities). |

| ICICI Prudential Pension Fund Management Co. Ltd. | Manages only non-government sector schemes. Second-best returns: 13.64% (Scheme E – equity). | Decent returns for Scheme C (corporate debt) and Scheme G (government securities). |

These fund managers are considered famous in India for 2023 based on their performance and returns. Choosing the best NPS fund manager for yourself depends on factors such as risk appetite, investment horizon, and retirement goals.

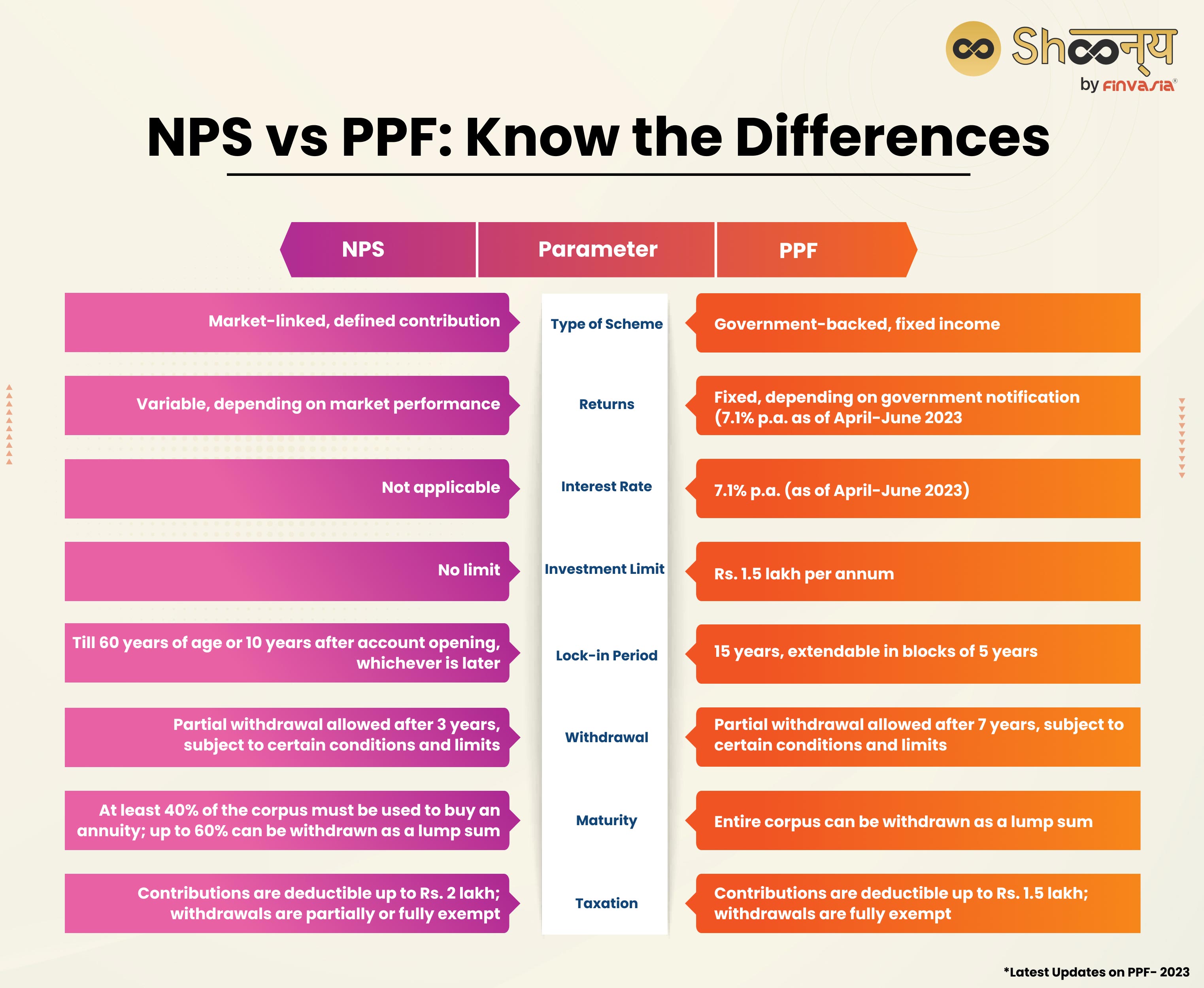

NPS vs PPF: Key Differences

NPS and PPF are both investment schemes offering retirement savings and tax benefits, yet they differ significantly.

PPF is a popular investment scheme that offers guaranteed returns and tax benefits. It stands for Public Provident Fund, and it is a government-backed, fixed-income scheme that encourages long-term savings. You can open a PPF account with any of the authorised banks or post offices and make deposits up to Rs. 1.5 lakh per annum. The interest rate on PPF is 7.1% p.a. (as of April-June 2023), and the maturity period is 15 years, extendable in blocks of 5 years. You can also withdraw partially from your PPF account after 7 years, subject to certain conditions and limits.

NPS (National Pension System)

- Type of scheme: Market-linked, defined contribution.

- Returns: Variable, dependent on market performance.

- Investment limit: No limit.

- Lock-in period: Till age 60 or 10 years after account opening, whichever is later.

- Withdrawal: Partial withdrawal is allowed after 3 years, subject to conditions.

- Maturity: At least 40% must be used to buy an annuity; up to 60% can be withdrawn as a lump sum.

- Taxation: Contributions deductible up to Rs. 2 lakh; withdrawals partially or fully exempt.

PPF (Public Provident Fund)

- Type of scheme: Government-backed, fixed income.

- Returns: Fixed, dependent on government notification (7.1% p.a. as of April-June 2023).

- Interest rate: 7.1% p.a. (as of April-June 2023).

- Investment limit: Rs. 1.5 lakh per annum.

- Lock-in period: 15 years, extendable in blocks of 5 years.

- Withdrawal: Partial withdrawal is allowed after 7 years, subject to conditions.

- Maturity: Entire corpus can be withdrawn as a lump sum.

Taxation: Contributions deductible up to Rs. 1.5 lakh; withdrawals fully exempt.

FAQs| NPS Interest Rate- 2023

No, NPS does not have a fixed interest rate. It is a market-linked product, and the interest depends on the performance of underlying assets in the NPS fund.

NPS and PPF have distinct features. NPS may offer higher returns and more tax benefits but comes with higher risk and a longer lock-in period. PPF provides fixed returns, lower risk, and more liquidity.

NPS and FD differ in features. NPS offers higher returns and tax benefits but with higher risk and a longer lock-in period. FD provides guaranteed returns and more liquidity but is taxable.

Yes, NPS has a lock-in period, requiring investment until the age of 60. Partial withdrawals are allowed before age 60 for specific purposes, but the full corpus withdrawal or annuity purchase is typically made at age 60 or later, providing a regular pension.

NPS is relatively safe, regulated by PFRDA and offers portfolio diversification. However, it carries market risk due to investments in market-linked instruments. It’s suitable for long-term investors with a low-risk appetite seeking a regular pension after retirement.

NPS withdrawal is partially tax-free. Up to 60% of the corpus withdrawal at 60 is allowed, with 40% tax-exempt and 20% taxable. Additional tax benefits are available under Section 80CCD(2) if the entire 60% is invested in an annuity plan. Partial withdrawals are tax-exempt up to 25% of own contributions.

Source- indiapost.gov.in

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.