Thinking of investing for the long run? Mutual funds, NPS, PPF, or even post office schemes come to mind. In India, both NPS and mutual funds have gained popularity among investors. NPS is a government-sponsored retirement savings scheme designed to provide financial security after retirement. Mutual funds, on the other hand, invest in diversified portfolios of securities. But now comes the most difficult decision: NPS vs Mutual Funds: which is better for me?

Let us take a look!

NPS Scheme

The Central Government introduced NPS to provide retirement income to individuals. PFRDA administers NPS under the PFRDA Act, 2013.

The National Pension System (NPS) is a government-sponsored retirement savings scheme in India. It offers individuals a systematic way to save for retirement, providing tax benefits and flexibility in investment choices.

Through NPS, contributors can build a corpus over their working years. This can be utilised to provide a regular income stream during retirement.

NPS scheme helps save for retirement. It offers simplicity, flexibility, and tax benefits. It’s open to all Indian citizens, with different models for various user segments.

Any Indian citizen aged 18 to 70 can join NPS voluntarily, even those residing abroad.

Mutual Funds

Mutual funds are the stock market investment programs. They pool money from multiple people to buy a diversified portfolio of securities. This allows individual investors to access a broader range of investments than they could on their own. These are managed by professional fund managers.

The idea is to share the gains (or losses) among all investors.

However, this is proportionate to their investment. It’s a convenient way to invest without having to pick individual stocks or bonds yourself.

Open a free demat account with the best mutual funds investment app in India.

Now comes the most difficult decision: NPS or mutual funds.

Here is everything you must know about NPS vs Mutual Funds India.

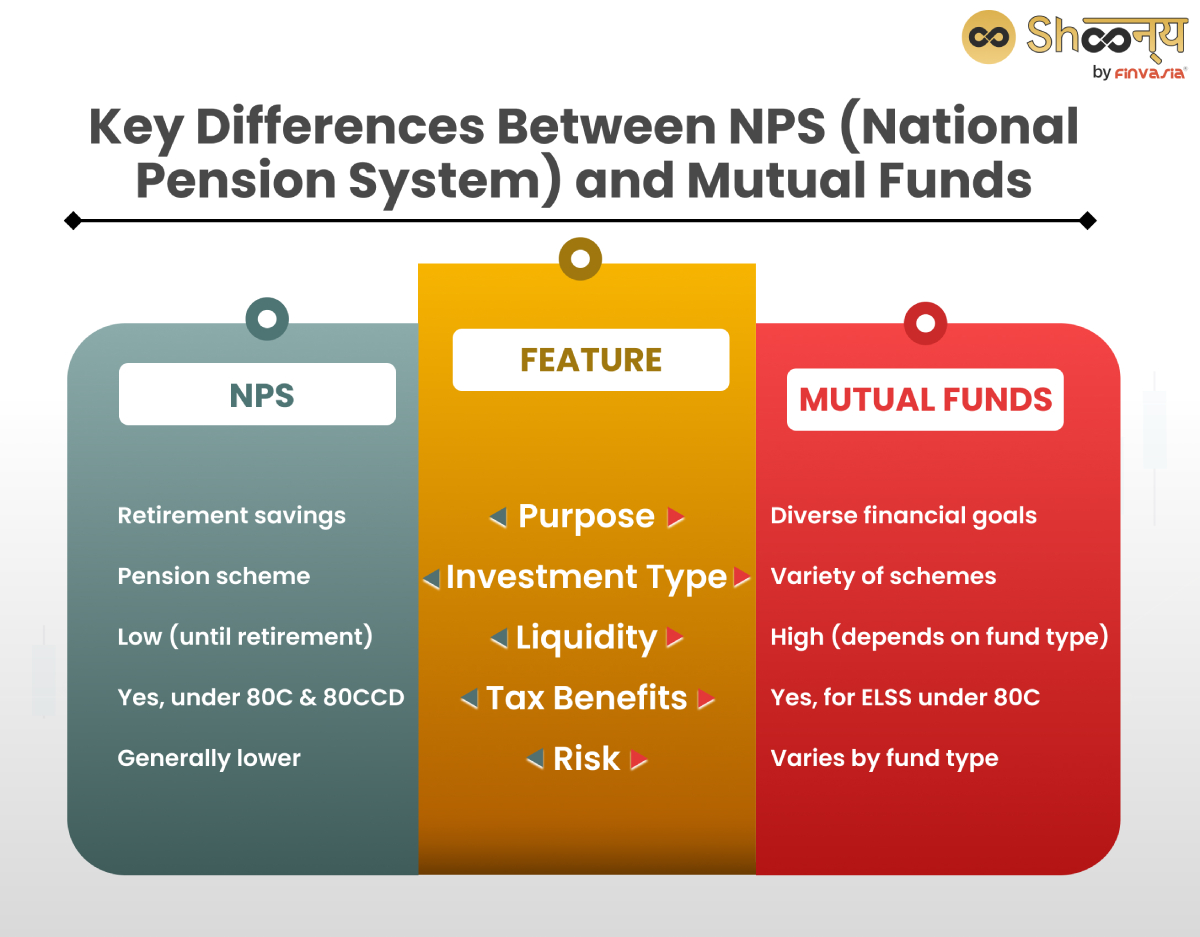

NPS vs Mutual Fund: Exploring the Key Difference Between NPS and Mutual Fund

| Feature | NPS | Mutual Funds |

| Purpose | Retirement savings | Diverse financial goals |

| Investment Type | Pension scheme | Variety of schemes |

| Liquidity | Low (until retirement) | High (depends on fund type) |

| Tax Benefits | Yes, under 80C & 80CCD | Yes, for ELSS under 80C |

| Risk | Generally lower | Varies by fund type |

1. NPS vs Mutual Funds| Purpose

NPS is a long-term retirement-focused investment vehicle that provides a regular income stream after retirement.

Mutual funds fulfil various financial goals, including wealth creation, retirement planning, and tax management. However, it depends on the chosen scheme’s objective.

2. NPS vs Mutual Funds| Investment Options

NPS Tier 1 offers a diversified range of asset classes.

This includes equity, corporate bonds, government securities, and alternative investment funds. Investors have the flexibility to choose between Active Choice, which enables self-allocation, and Auto Choice, which allocates based on age.

On the other hand, equity mutual funds encompass various asset classes. This includes equity, equity arbitrage, and debt instruments, forming hybrid equity funds.

3. NPS vs Mutual Funds| Tax treatment

NPS enjoys tax exemptions throughout the investment journey. This includes tax exemption upon investment, capital appreciation, and 60% of the pension corpus.

Additionally, tax benefits are available for purchasing annuity products using at least 40% of the NPS corpus.

Only Equity Linked Savings Scheme (ELSS) Mutual Funds qualify for similar tax exemptions.

NPS vs Equity MF

NPS, being a government-sponsored pension fund, is utilized for pension planning and tax saving under section 80 CCD 1(B) up to 50k per year.

Conversely, Equity Mutual funds, regulated by SEBI, are typically invested for specific financial goals and tax saving under section 80C up to ₹1.5 lakh (in case invested in ELSS schemes).

4. NPS vs Mutual Funds| Lock-in Period

NPS Tier 1 investments are subject to a lock-in period until retirement, with provisions for partial withdrawals under certain conditions.

Unlike ELSS Mutual funds, which have a lock-in period of 3 years, most equity mutual funds do not impose a lock-in period.

5. NPS vs Mutual Funds| Regulation

The Pension Fund Regulatory and Development Authority- PFRDA regulates NPS.

Mutual funds are regulated by the Securities and Exchange Board of India (SEBI).

6. NPS vs Mutual Funds| Exit

NPS offers three exit options:

- Continuation until 75 years with tax benefits.

- Defer withdrawal until 75 years, with options for a lump sum, annuity, or both.

- Complete exit by initiating a withdrawal request online.

However, mutual funds may impose an exit load.

Should I Invest in NPS or Mutual Funds?

Choosing between NPS and mutual funds depends on your financial goals: NPS is more retirement-oriented with tax benefits. Mutual funds offer flexibility and the potential for higher returns.

NPS and Equity Mutual Funds differ in fee structures, lock-in periods, exit loads, investment strategies, and tax benefits.

When deciding between NPS and mutual funds, consider your investment goals and preferences.

NPS is ideal for individuals looking to build a retirement corpus as it offers tax benefits and a pension component.

In contrast, mutual funds provide flexibility and variety, allowing investors to choose from different types. This could be equity mutual funds, debt funds, or hybrid funds.

For those seeking tax benefits and a structured retirement plan, NPS may be the preferred choice.

However, if you prefer flexibility and potential higher returns, mutual funds could be more suitable.

Whether you opt for the structured approach of NPS or the flexibility of mutual funds, it’s essential to align your investments with your financial goals and risk tolerance.

Conclusion

NPS and mutual funds are both valuable investment options in the Indian stock market. By understanding their characteristics and considering your investment objectives, you can choose the option that best suits your needs and preferences.

FAQs | NPS vs Mutual Funds

Whether NPS or mutual funds are better depends on individual goals and risk tolerance. NPS focuses on retirement with tax benefits, while mutual funds offer flexibility for various investment objectives.

NPS provides market-linked returns and suits retirement planning with added tax benefits. PPF assures secure, fixed returns with a lengthy lock-in period. On the flipside, mutual funds offer flexibility and the potential for higher returns.

Some drawbacks of NPS include a lock-in period until retirement, compulsory annuity purchase with a portion of the corpus, and partial taxability of the lump sum withdrawn at retirement.

Source– npstrust.org.in/about-nps, npscra.nsdl.co.in

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.