Beginner’s Guide: NPS vs SIP – Choosing the Right Investment for Your Future

The main difference between SIP and NPS is that SIP helps you save money in mutual funds to grow your wealth. On the other hand, NPS is for saving money for when you’re older and retired. When we specifically talk about NPS vs SIP, SIP is like a piggy bank that can be opened anytime, and NPS is like a piggy bank that you can’t open until you’re retired. NPS also gives you special tax benefits.

Further, let’s understand the individual features, benefits of SIP and NPS and also know about their tax implications.

Features of SIP

- Diverse Exposure to Mutual Fund Investment: SIP opens the doors to a diverse range of mutual funds, giving you exposure to various sectors and companies in the Indian stock market.

- Financial Discipline: SIP instills financial discipline by encouraging you to invest regularly, helping you achieve your long-term financial goals.

- Low Entry Barrier: With SIP, you can start investing with as little as Rs 500, making it accessible to investors with different budgets.

- Market Balance: SIP’s periodic investments mitigate the impact of market volatility, ensuring that you buy more units when prices are low and fewer when they are high.

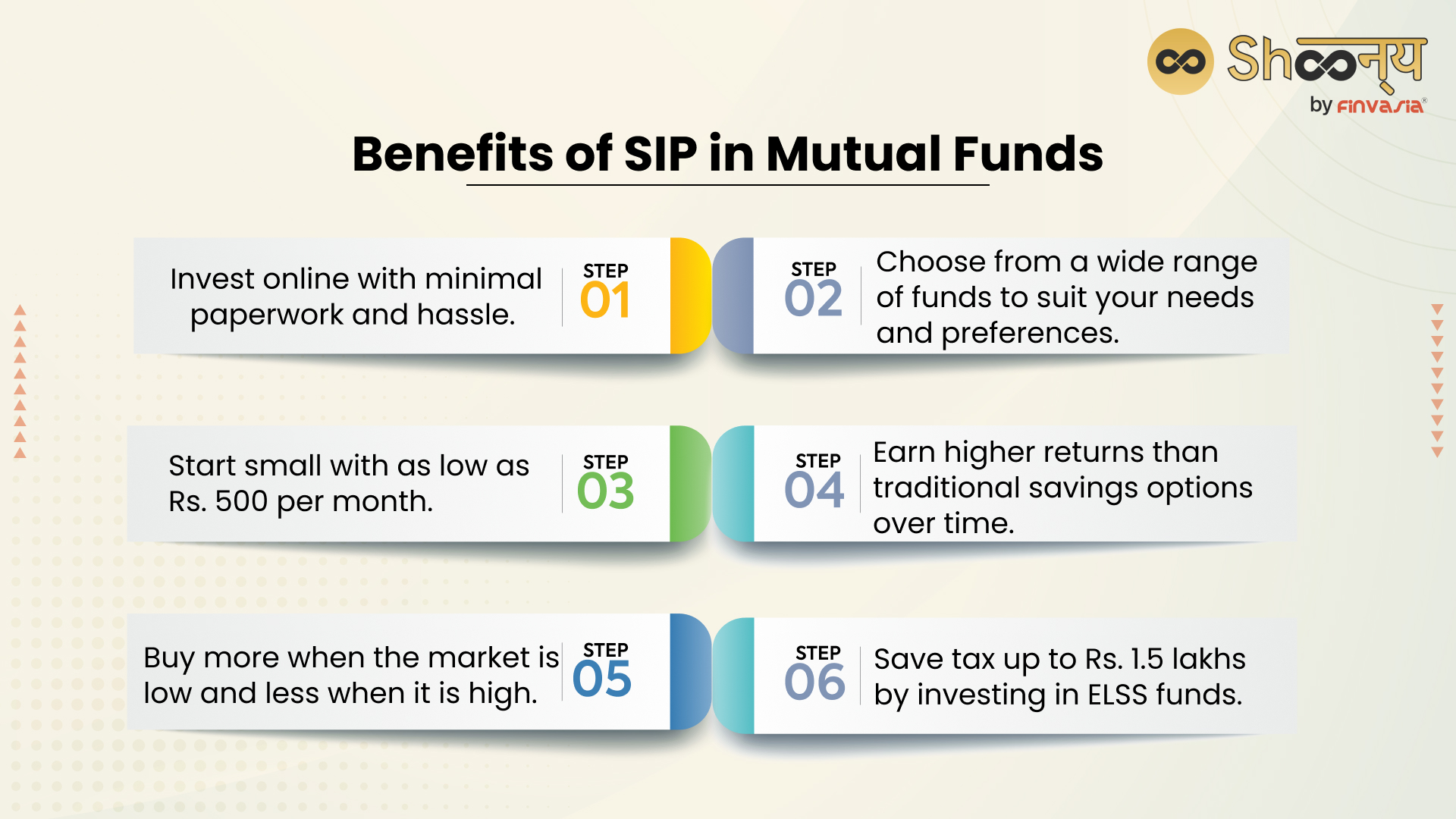

Benefits of SIP

- Easy Investing: Put money online with less paperwork, and it comes out of your bank automatically.

- Picking Your Funds: Choose funds that match how much risk you like and what you want to do with your money. You can change things if you need to.

- Small Starting Money: Begin with just Rs. 500 and add a bit regularly for a certain time.

- Professional Fund Management: Professionals providing expertise in market analysis and management make the best choices for you.

- Attractive Returns: These funds usually give you back more money, like 12-15% more every year, which grows over time.

- Smoothing Out Costs: Putting money in at different times helps lower the average cost and is smart for long-term plans.

- Saving on Taxes: You can save up to Rs. 1.5 lakhs in taxes by using special funds called ELSS- Equity Linked Saving Schemes.

Features of NPS

- Retirement Focus: NPS is tailor-made to safeguard your post-retirement life and ensure a financially secure future.

- Dual Investment Choices: You can choose between equity (high-risk, high-reward) and debt (low-risk, stable returns) investment options based on your risk appetite and short/long-term financial goals

- Tax Advantages: NPS offers attractive tax benefits, providing an additional incentive for disciplined savings with SIP deductions in income tax.

- Flexibility: As an investor in the Indian stock market, NPS allows partial withdrawals in specific situations, giving you some financial flexibility when needed.

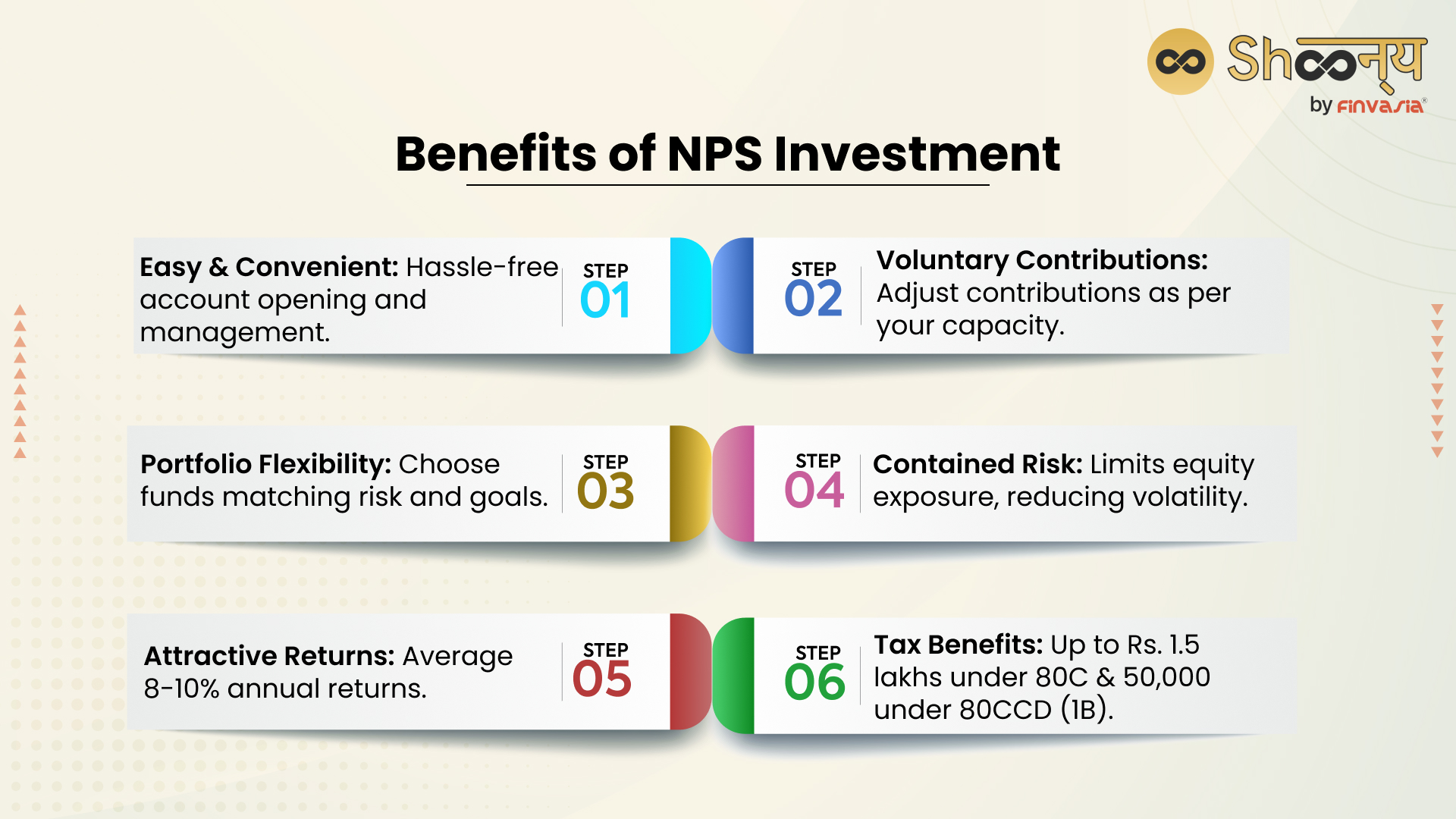

Benefits of NPS

- Easy and Convenient: NPS makes it simple to open an account online or through approved places, and you can easily manage it using the eNPS website.

- You Decide: You can change how much you put in each year based on what you can afford.

- Pick Your Funds: Choose from different pension funds that match how much risk you’re okay with and what you want to achieve financially.

- Less Risk: NPS doesn’t let you invest too much in risky things like stocks, which can help you avoid big ups and downs in the market.

- More Money: NPS usually gives you back more money, like 8-10% more every year, which adds up over time.

Save on Taxes: You can pay less in taxes – up to Rs. 1.5 lakhs – using NPS. And if you add another Rs. 50,000, that’s even more tax under Section 80CCD (1B).

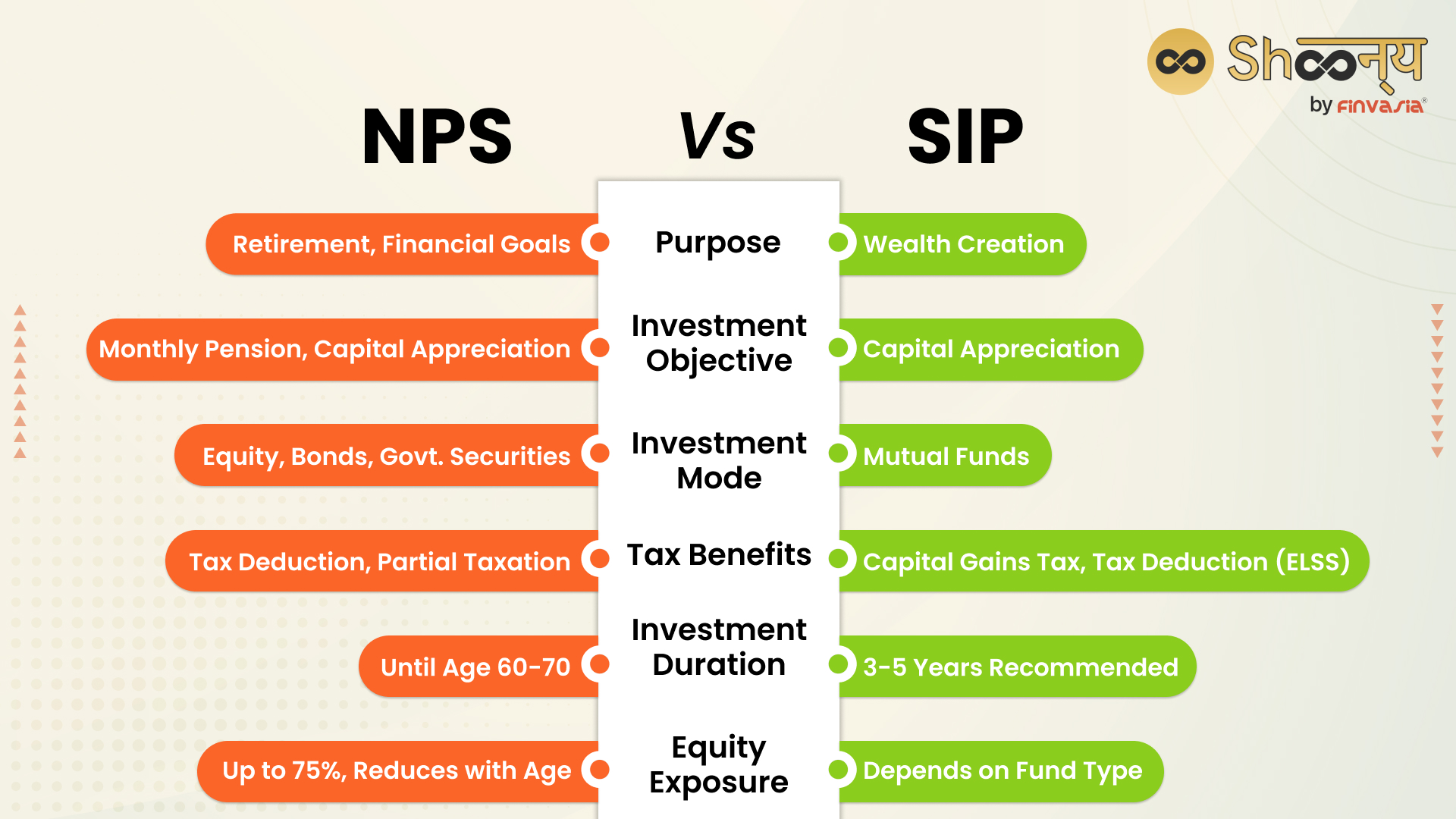

Key Difference Between SIP and NPS

Understanding the Difference Between SIP and NPS.

Purpose

SIP

SIP primarily focuses on wealth creation and the growth of investments. It allows you to invest regularly in mutual funds to take advantage of market fluctuations and compounding over time.

However, SIP can also be used for retirement planning, as there are mutual funds that are specifically designed for this purpose, such as retirement or pension funds.

NPS

NPS, on the other hand, is a retirement-centric investment option. It aims to provide financial security during your precious after-retirement years by systematically accumulating funds in a pension account.

However, NPS can also be used for other financial goals, as it allows partial withdrawal of up to 25% of the corpus for specific purposes.

Investment Objective

SIP

The primary objective of SIP is capital appreciation, making it ideal for long-term wealth accumulation and meeting financial goals like buying a house, funding education, or planning for a dream vacation.

However, the returns from SIP are not guaranteed and depend on the performance of the underlying securities and the market conditions.

NPS

NPS is designed to secure your post-retirement life. The accumulated corpus is used to provide a monthly pension, ensuring a steady income during retirement.

However, the pension amount from NPS is also not guaranteed and depends on the annuity rates prevailing at the time of retirement.

Investment Mode

SIP

In SIP, you invest in mutual funds, which professional fund managers manage. The funds are invested across various asset classes, depending on your risk appetite.

However, you have to pay certain charges for investing in mutual funds through SIP, such as expense ratio, exit load, transaction charges, etc.

Shoonya charges zero transaction amount and also offers brokerage-free trading across multiple assets; check it out.

NPS

NPS provides two investment choices – Active Choice and Auto Choice. In Active Choice, you can decide the allocation between equity, corporate bonds, and government securities. Auto Choice allocates funds based on your age.

However, you also have to pay certain charges for investing in NPS, such as account opening fees, annual maintenance fees, fund management fees, etc.

Shoonya offers a free DEMAT account, charges zero transaction amount and zero AMC, and offers brokerage-free trading across multiple assets; check it out.

SIP Deduction in Income Tax

Here’s what you need to know about SIP and taxes in India as of August 2023:

- Capital Gains Tax: When you invest money through SIP in mutual funds, you might have to pay a “capital gains tax.”

To know more about capital gains tax- check this out.

- Different Tax Rates for Different Funds: If you put your money in equity funds and take it out before 1 year, you might need to pay 15% tax. But if you keep it for more than 1 year, you could pay 10% tax on the gains above ₹1 lakh in a year.

- Debt Funds Tax: If you choose debt funds and take out the money before 3 years, you might pay taxes at the same rate as your regular income tax. For the money you keep for more than 3 years, you might pay 20% tax with a special calculation called “indexation” or 10% tax without indexation, whichever is less.

- ELSS Funds and Tax Deduction: If you invest in ELSS mutual funds through SIP, you could save on taxes. These funds qualify for a deduction under Section 80C, which can help you save up to ₹1.5 lakh in taxes every year.

Please note that tax laws and regulations are subject to change, so it’s always advisable to consult with a tax professional or refer to the latest government guidelines for accurate and up-to-date information.

NPS Deduction in Income Tax

- Tax Savings for NPS: When you put money into Tier I NPS accounts, you can save on taxes. You can get deductions of up to ₹1.5 lakh from what you have to pay in taxes, as mentioned in Section 80CCD(1) of the Income Tax Act.

- Extra Savings: On top of that, you can get even more tax benefits. An extra deduction of ₹50,000 is available under another part, which is Section 80CCD(1B).

- Who Can Benefit: Remember, only Tier I NPS accounts can give you these tax benefits.

- Your Own Contributions Count: If you put in money yourself, you can claim up to ₹1,50,000 as a deduction in your taxes. This falls under the NPS tax deduction in Section 80CCD(1).

- Employer Contributions: If you have a job, your employer might also add money to your NPS account. You can use Section 80CCD(2) to claim this part for tax savings.

- Different Rules: If you work for the government, you can use a certain percentage of your salary – up to 14% – for tax savings. If you’re not a government employee, you can use up to 10% of your salary (which includes basic pay and dearness allowance).

- Big Savings: If you combine the deductions from both Section 80CCD(1) and 80CCD(1B), someone in the highest tax bracket (that’s the people who pay the most taxes) can potentially save up to ₹62,400 on their taxes each year. This is based on a total deduction limit of ₹2,00,000. So, it’s a good way to keep more of your hard-earned money.

Note- You can withdraw up to 60% of the corpus as a lump sum, out of which 40% is tax-exempt, and 20% is taxable at your slab rate. However, the remaining 40% of the corpus must be invested in an annuity plan to receive a monthly pension, which is fully taxable at your slab rate.

NPS vs Mutual Funds: Knowing How They Differ

People often want to clear up the confusion about the difference between SIP and NPS, and many others are always looking to understand NPS vs Mutual funds.

NPS, which stands for National Pension System, is a retirement savings plan supported by the government. It’s all about making sure you have money for life after work.

- The main goal of NPS is to give you a regular monthly pension when you retire. This helps you feel financially secure during your older years.

On the flip side, Mutual Funds are like special investment tools handled by experts called fund managers.

- They offer more choices and can match different goals. These goals could be getting a steady amount back, making your money grow with some risk and more.

What you choose depends on what you want to achieve with your money and when you want to achieve it.

Looking to invest in mutual funds? Check the best mutual funds to invest at zero brokerage in 2023.

Conclusion

In conclusion, it is important to understand the difference between SIP and NPS as they both tend to offer attractive options for Indian investors, each catering to specific financial goals. Finding an answer to the point of NPS if NPI is good or if NPS is safe, if necessary, to understand that NPS provides a secure retirement plan with the benefit of tax deductions and the potential for attractive returns. On the other hand, SIP in mutual funds offers flexibility, ease of investment, and the potential for higher returns through professional fund management.

Key Takeaways of NPS vs SIP

It is a must to know all the aspects related to NPS vs SIP. However, to maximise your financial potential, you can also consider combining both NPS and SIP, tailoring your investments to align with your unique financial objectives and risk appetite.

1. SIP focuses on wealth creation through mutual funds, while NPS is for secure retirement savings.

2. SIP is like a flexible piggy bank, NPS is a locked piggy bank for retirement.

3. SIP offers tax-saving ELSS funds, while NPS provides tax benefits under 80C & 80CCD(1B).

4. NPS provides hassle-free account opening and pension fund flexibility.

5. SIP invests in mutual funds, and NPS offers equity and debt investment choices.

6. SIP offers a higher risk for potentially high returns, and NPS offers a lower risk for steady growth.

7. SIP’s Rs. 500 minimum investment vs. NPS’s adjustable contributions.

8. NPS reduces equity exposure with age, and SIP allows market-timed investments.

9. NPS focuses on post-retirement security, and SIP is for various financial goals.

10. NPS offers tax-saving deductions up to Rs. 1.5 lakh, SIP’s ELSS funds offer similar benefits.

11. Combining NPS and SIP can be smart, as NPS provides a secure retirement plan with tax benefits. At the same time, SIP in mutual funds offers flexibility and the potential for higher returns.

FAQs

You can start investing in SIP through an online trading platform with as little as Rs 500 per instalment by completing your KYC and selecting a suitable plan aligned with your goals and risk tolerance.

Determine your SIP investment amount based on your income, financial objectives, and risk tolerance. While there’s no fixed amount, you can invest in SIP with as little as Rs 500 per month.

Enjoy SIP-like convenience in NPS through online D-Remit. Begin with an NPS account, choose a pension fund manager, enable D-Remit to automate contributions, and secure your retirement with systematic investments.

NPS is for retirement with a long-term approach, while SIP investments offer flexibility for any time frame, except ELSS, with a mandatory lock-in period.

In NPS, the default equity exposure is 75%, but you can change it based on your risk preference. As you approach 50, the equity exposure decreases by 2.5% each year. For SIP investments, the equity exposure depends on the mutual fund scheme you choose, allowing you to align it with your risk profile and financial goals.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.