In the dynamic realm of investing, penny stocks have emerged as a captivating opportunity for Indian investors seeking high-potential assets with modest capital. These low-priced stocks, often priced under Rs 20 per share, are a topic of intrigue due to their potential for exponential growth. In this comprehensive guide, we’ll unravel the mysteries surrounding penny stocks, exploring their features, returns, and the nuances of investing in them within the Indian context.

Understanding the Penny Stocks Definition

Penny stocks encompass shares of smaller companies listed on stock exchanges, typically priced below INR 10. These stocks are notably speculative and carry substantial risk due to their modest price and limited market capitalisation.

Penny Stocks Features

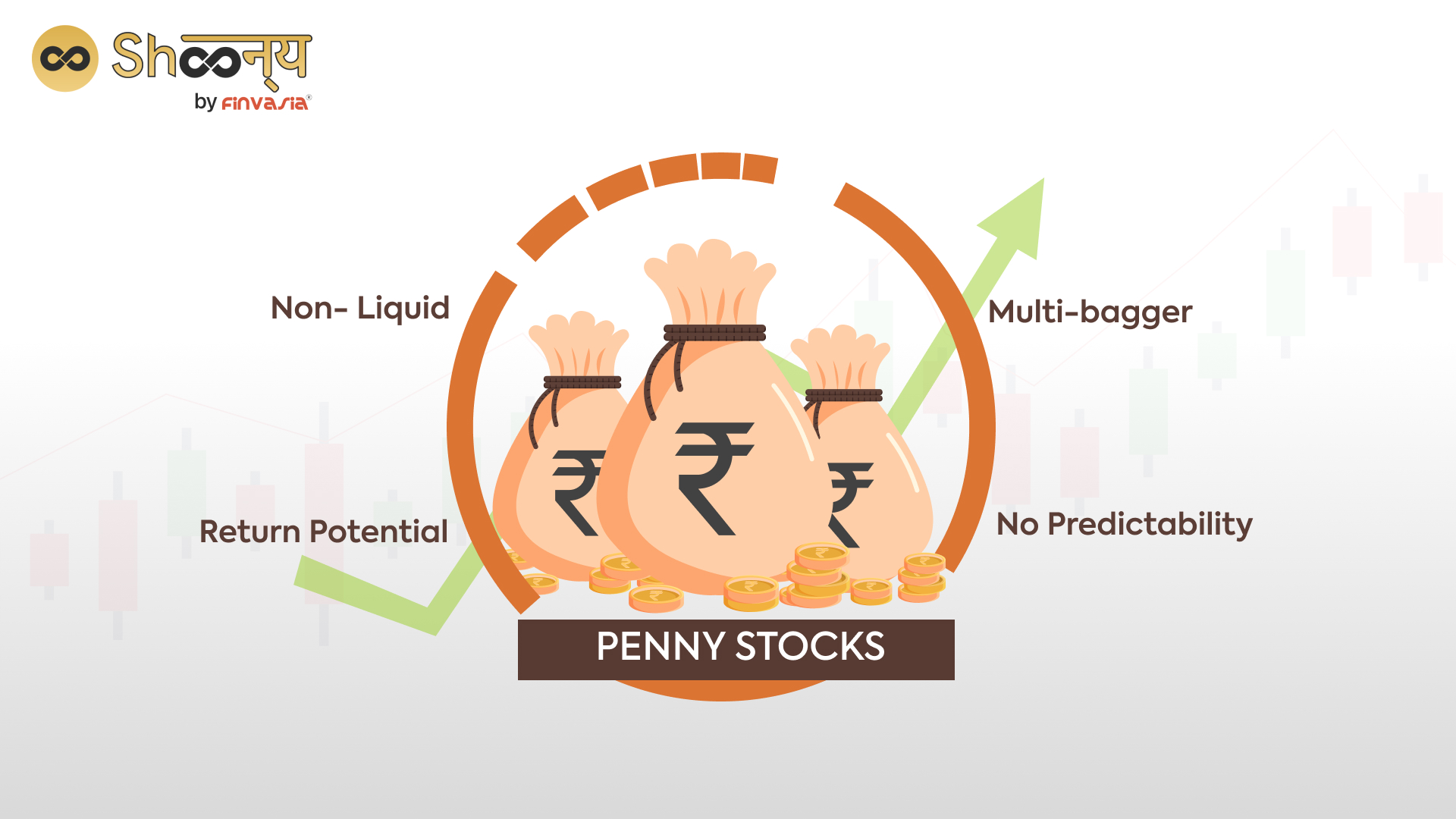

Penny stocks carry distinct features that set them apart:

- Illiquidity: Penny stocks are often illiquid, implying that they have lower trading volumes compared to mainstream stocks. This can lead to challenges when it comes to finding buyers or sellers promptly.

- Return Potential: While many tout penny stocks as high-return investments, caution is advised. While some stocks might surge to extraordinary heights, it’s crucial to acknowledge the risks and the scarcity of available information.

- Multibagger Potential: Certain penny stocks possess the potential to evolve into multi-baggers, yielding returns that far exceed the initial investment. However, meticulous research is pivotal to identifying such gems.

- Unpredictable Pricing: Penny stocks can exhibit erratic price movements during both sales and purchases, leading to either substantial profits or substantial losses.

- Affordability Factor: Penny stocks are available at notably low prices, often below Rs 20 per share.

- Limited Company Value: Such stocks belong to companies with relatively low market capitalization, reflecting the combined value of shares available for trading.

Penny Stock Examples: Illustrating the Potential

Imagine ABC Enterprises, a small Indian tech company. Its stock is priced at Rs. 10 per share, falling into the penny stock category due to its low price.

Riya decides to invest Rs. 1000 in ABC Enterprises, buying 100 shares.

ABC Enterprises announces a big partnership, boosting investor interest. The stock price climbs from Rs. 10 to Rs. 50 per share in a year.

Riya sells her shares at Rs. 50 each, turning her Rs. 1000 investment into Rs. 5000 – a profit of Rs. 4000.

This illustrates how penny stocks can lead to significant gains, but they also carry risks.

Remember, while gains are possible, careful research and understanding the risks are crucial in the stock market.

Advantages and Disadvantages of Penny Stocks

Understanding the pros and cons is paramount before delving into penny stock investments:

Penny Stocks Advantages

- High Volatility: While volatility might deter some, it’s this very trait that makes penny stocks attractive to risk-tolerant investors. Rapid growth in a short period is within reach.

- Potential for Rapid Gains: Even with a nominal investment, significant profits are attainable due to the low share prices.

Penny Stocks Disadvantages

- Lack of Liquidity: The limited trading volume can make buying and selling penny stocks challenging, potentially hindering quick exit strategies.

- Risk of Fraud: The relatively lower scrutiny faced by penny stocks can pave the way for fraudulent activities, including the infamous “pump and dump” schemes.

Navigating Penny Stock Volatility

Investing in penny stocks demands a profound tolerance for risk, as their inherent volatility can translate to substantial rewards or losses. Understanding that potential gains often align with heightened risk is key.

Why Do Penny Stocks Fail?

- Lack of Information: Accessibility to reliable information on some penny stocks can be a challenge, leading to uninformed investment decisions.

- Absence of Minimum Standards: Unlike major exchanges, penny stocks aren’t bound by stringent listing requirements, posing higher risks to investors.

- Limited Historical Data: Many penny stocks lack substantial track records, making it difficult to gauge their potential.

- Liquidity and Fraud: The low liquidity of penny stocks creates opportunities for manipulation, such as the “pump and dump” scheme.

In Conclusion

Penny stocks can be a rewarding avenue for Indian investors seeking substantial gains from modest investments. However, careful consideration, diligent research, and risk awareness are paramount when delving into this arena. By understanding the features, potential returns, and risks associated with penny stocks, Indian investors can make informed choices that align with their financial goals.

FAQs| Penny Stocks

While regulations exist, penny stocks can still carry higher risks due to their relatively lower scrutiny. Engaging reputable brokers and conducting meticulous research is advisable.

Diversification is key. Allocate only a portion of your portfolio to penny stocks and focus on thorough research and reputable advice.

Exiting penny stocks can be challenging due to their lower liquidity. Setting up stop-loss orders and having a clear exit strategy is advisable.

Determining the “best” penny stock is subjective and depends on factors like market conditions, company performance, and investment goals. Conduct thorough research before considering any penny stock investment.

There are various shares trading below Rs. 1, but their low price doesn’t guarantee quality. Evaluate the company’s financials, growth potential, and industry trends before considering such investments.

Identifying the top share under Rs. 3 requires diligent research. Focus on companies with strong fundamentals, growth prospects, and positive market sentiment to make an informed decision.

Penny stocks can offer substantial returns with a small initial investment due to their low share prices. However, be aware of the higher risk associated with these stocks due to their volatility and potential for sudden price fluctuations.

Penny stocks stand apart due to their affordability and potential for rapid growth. They can multiply in value quickly, but their unpredictable nature and higher risk require careful consideration before investing.

Penny stocks are often characterized by their low share prices, usually below Rs. 20 in India. They are associated with smaller companies and can exhibit higher volatility compared to more established stocks.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.