EPF is one of the best saving options available today, offering security for your future. However, one common challenge many face is the difficulty in checking their PF claim status, whether online or offline. The steps and processes for checking your EPFO claim status are quite simple. You can track your PF in different ways, either through the UAN member portal or the EPFO website for online checks. Alternatively, you can check offline PF claim status.

Let’s explore the various ways to check your PF claim status online and offline.

What is EPF Claim

EPF/PF claim status is a crucial update on one’s application for EPF withdrawal or transfer.

To check your PF claim status or EPFO claim status, you can easily track it online through the EPFO portal. By using the PF claim status check online option, you can monitor the progress of your Provident Fund claim.

For those who prefer offline methods, it’s also possible to check offline PF claim status by visiting the nearest EPFO office or by sending an SMS.

Eligibility for EPF Claim

EPFO claim can be filed subject to the following eligibility criteria:

- You can claim 100% of your EPF after retirement if you are over 55 years old. Early retirement does not allow full withdrawal.

- If you are 54, you can withdraw 90% of your EPF a year before retirement.

- In case of unemployment, you can withdraw 75% of your EPF and transfer the remaining 25% to a new EPF account once re-employed.

- You can claim 100% of your EPF after two months of unemployment.

EPF Claim Forms in India – 2024

To withdraw or claim EPF money, specific forms need to be submitted. These EPF forms vary based on age, reason for withdrawal, and employment status. You need to fill out the form that suits your current EPF claim needs:

- Previously, Forms 19, 31, and 10C were used, but now a Composite Form has replaced them, requiring only UAN and Aadhar details.

- You must use Form 13 to transfer EPF money to a new account when changing jobs.

- You can use Form 14 if you want to fund your LIC policy with EPF.

Explore the top 10 insurance companies in India!

- The Composite Form is also used to claim money during unemployment or to take an advance from the PF.

- If under 58 years old, you will need the Composite Form for EPF claims and Form 10D for the Pension Fund if leaving due to physical disability.

- If you are 58 or older, the Composite Form can be used for both EPF and Pension Fund claims.

- In the case of an employee’s death (whether in service or not), the nominee or heir can use Form 28 for PF claims. Also, you can use Form 10D for pension claims if the employee was under 58 or had completed 10 years of service.

- If the deceased was 58 with less than 10 years of service, the claimant should use the Composite Form for Pension Fund EPFO claims.

- The Form 51F is used to settle the EDLI (Employees’ Deposit Linked Insurance Scheme) in all cases.

Let us see the six methods of checking your EPFO claim status.

Online Methods to Check PF Claim Status

Here are four ways to PF claim status check online:

- Through the UAN Member Portal

- Through the EPFO Portal

- Using PF Account Number Without UAN

- Claim Status via the Umang App

Offline Methods to Check PF Claim Status

There are three ways to check offline PF claim status:

- Through SMS

- Through Call

- Through EPFO Office

EPF Claim Process: How to Apply for PF Claim in India

Online EPF Claim Status

Checking the status of your PF claim online is a simple process, and there are multiple methods to do so.

Here’s a detailed guide on how to check your PF claim status online:

Through the UAN Member Portal

Below are the steps that you need to follow to check your UAN claim status through the UAN member portal:

- Log in to the UAN Member Portal using your UAN and password.

- From the ‘Online Services’ option on the top menu, click on ‘Track Claim Status.’

- The screen will display your PF claim status, withdrawal, or transfer.

Note: Offline claimants can’t track their status on this portal; they should refer to EPFO’s official website.

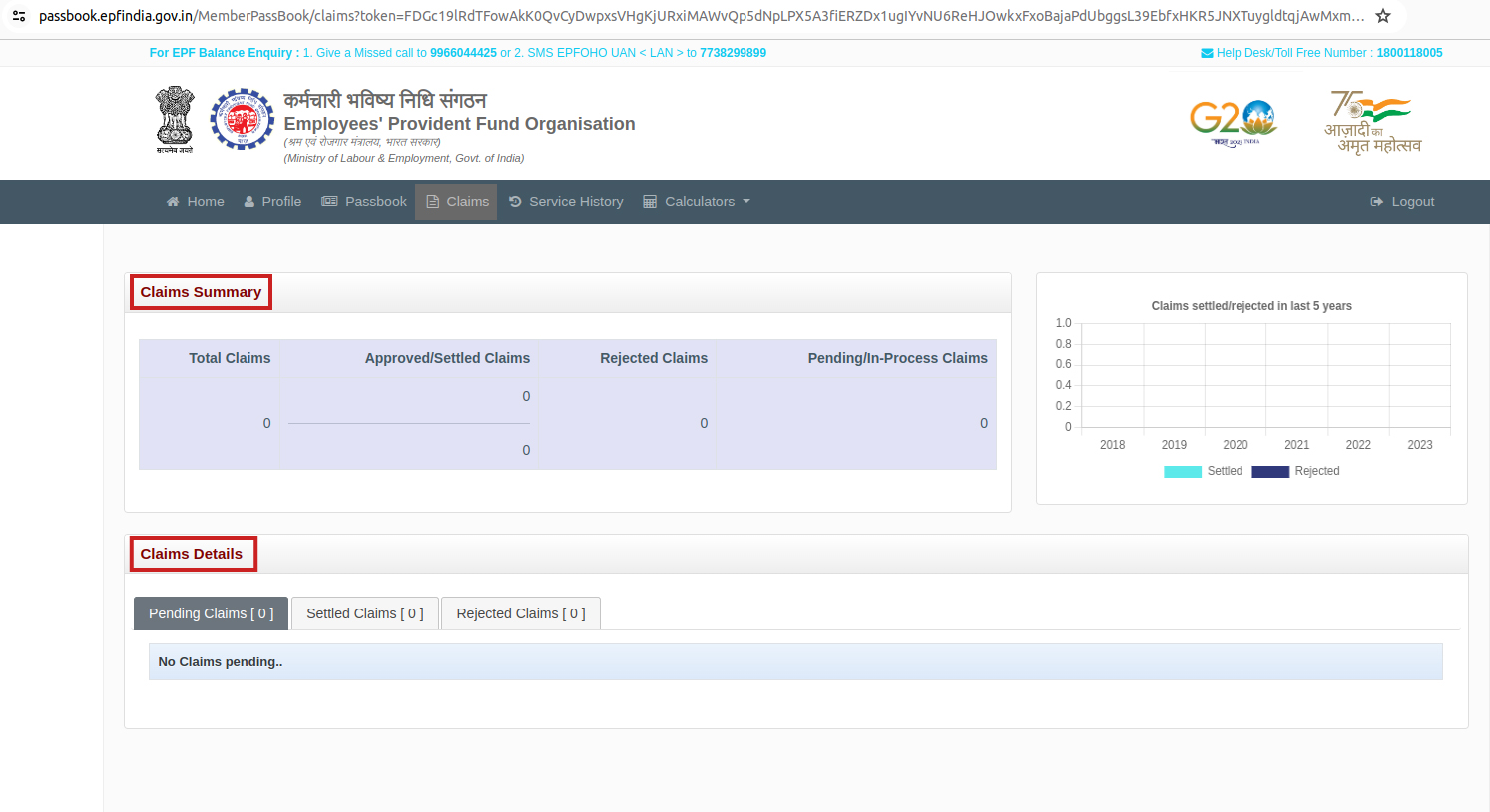

Through the EPFO Portal

Here are the quick steps that you can follow to check your PF claim status online through the EPFO portal:

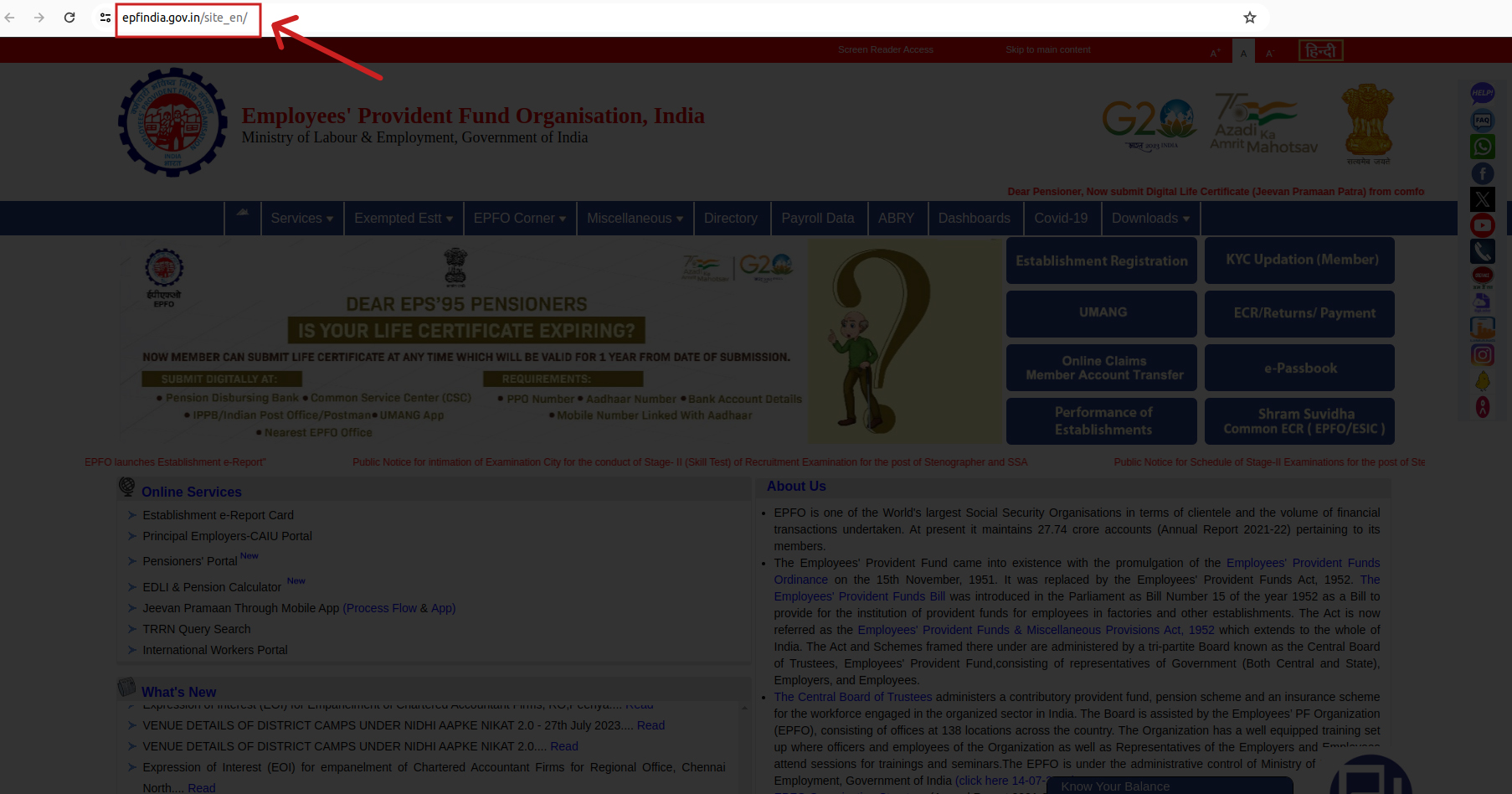

- Visit EPFO’s portal.

2. Click on the ‘Services‘ option from the top menu and click on ‘For Employees‘

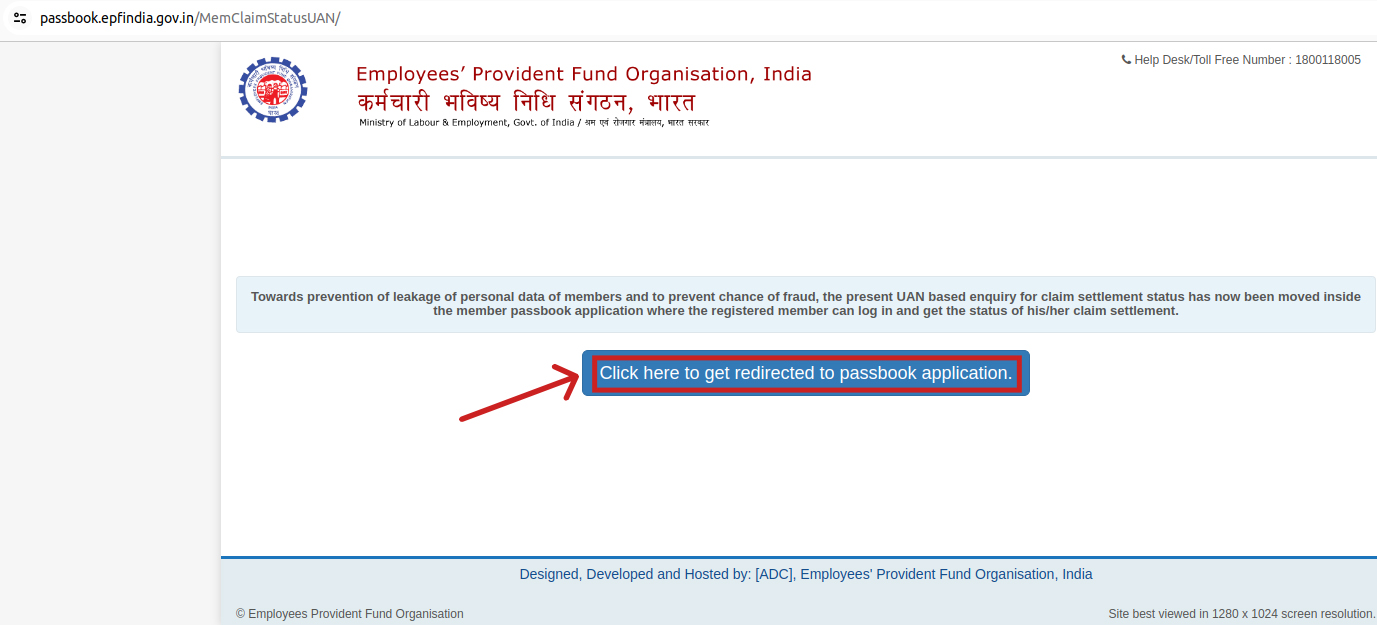

3. Next, click on ‘Know your Claim Status.’ You will be redirected to a new page.

4. Next, “click here to get redirected to the passbook application”.

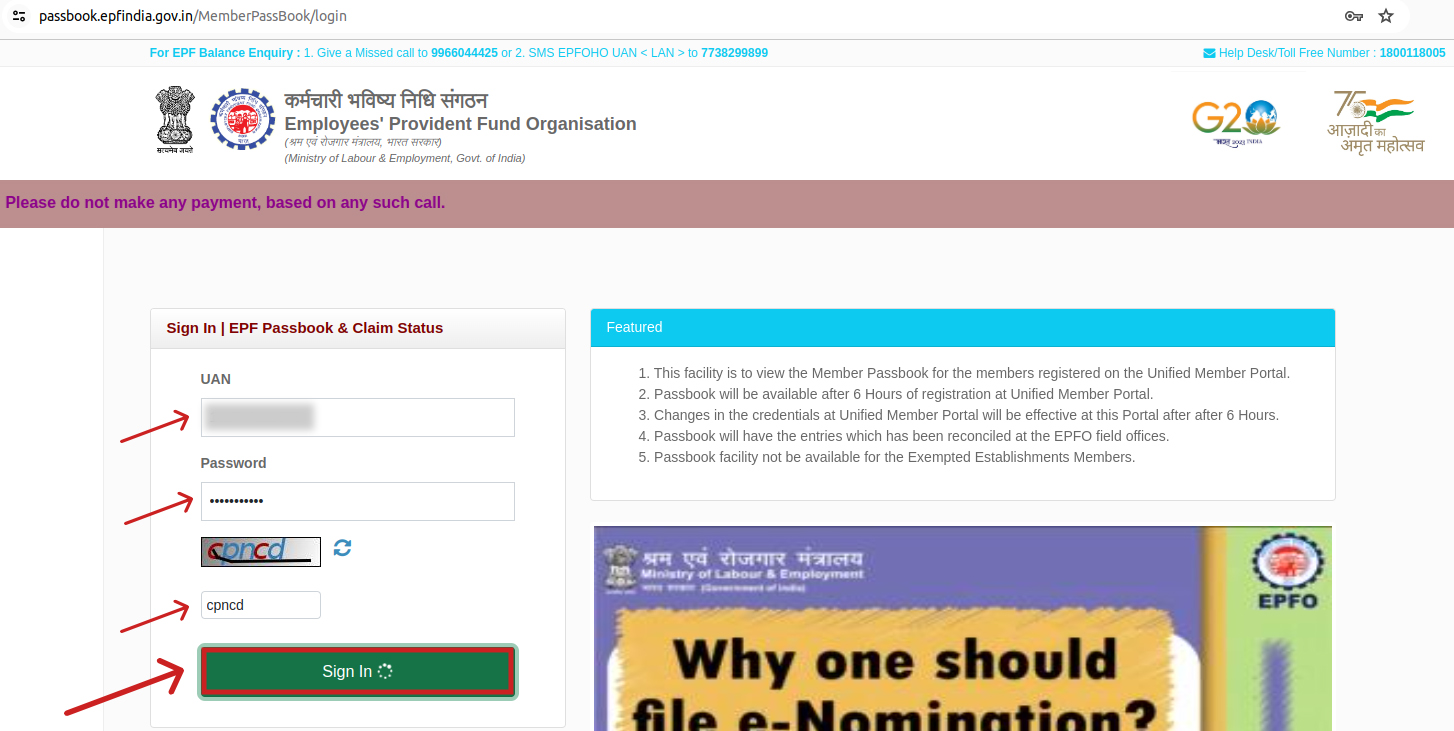

5. Enter your UAN, Password and CAPTCHA.

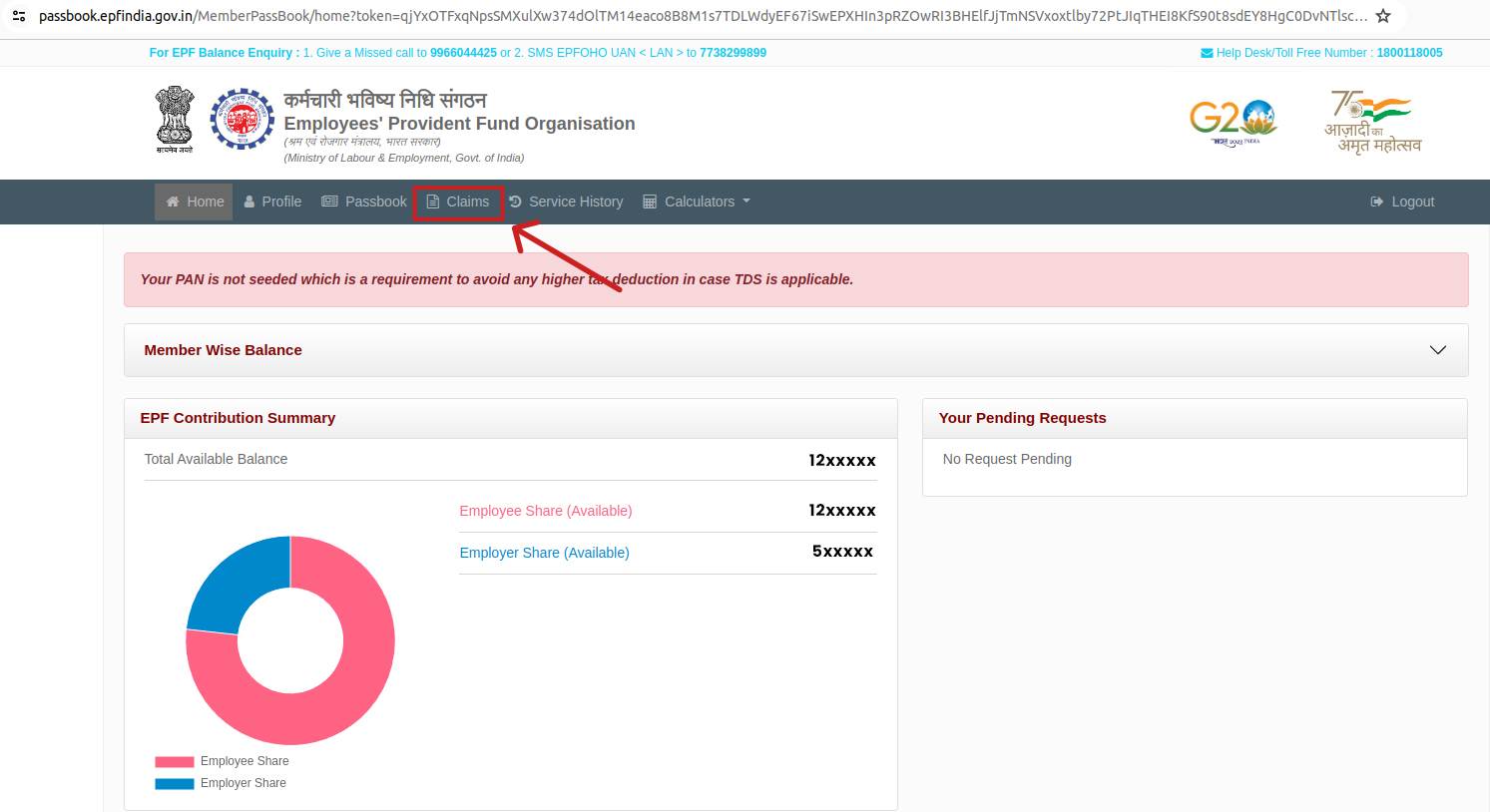

6. Click on ‘Claims.’

7. Finally, you will get all the Claims summary and Claims details on your screen.

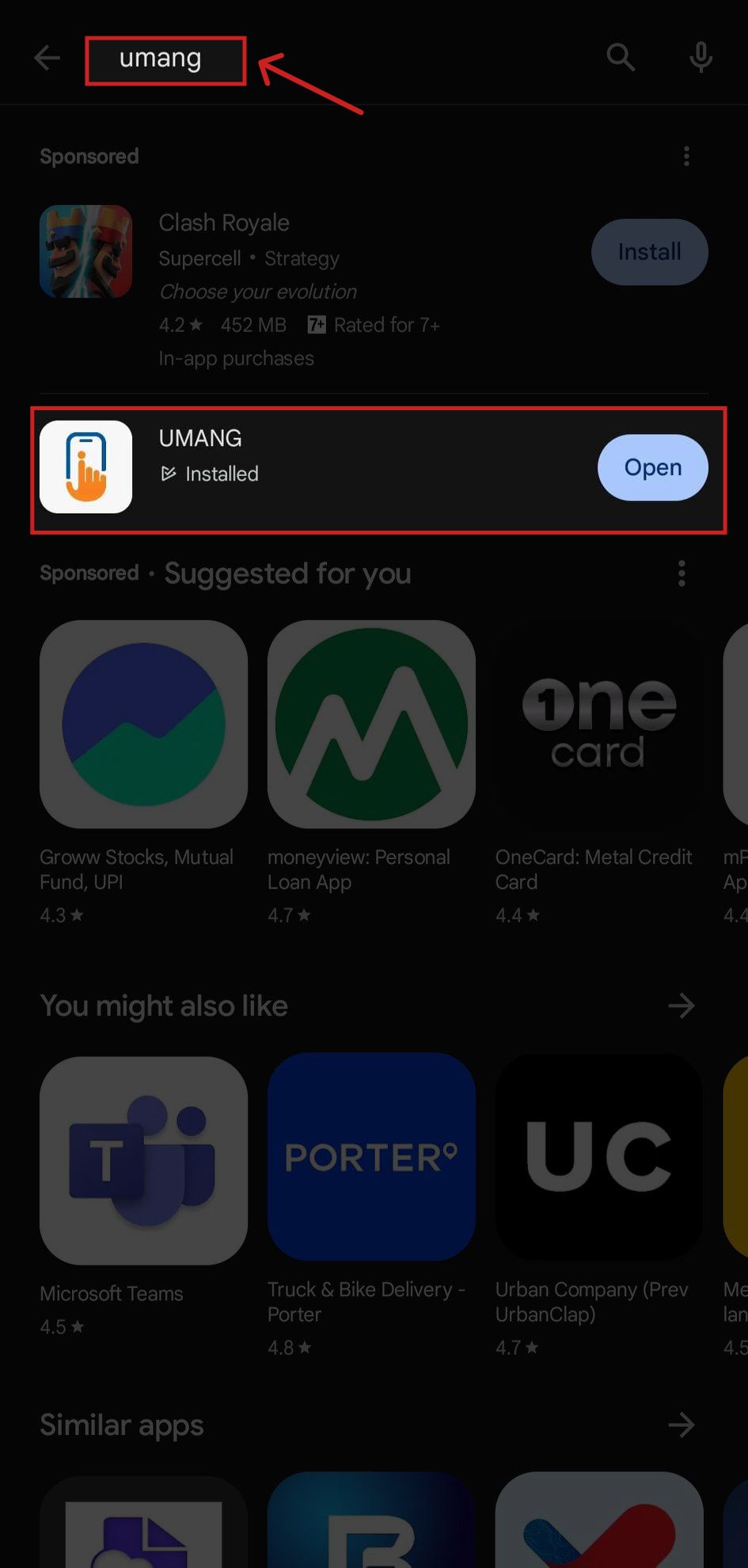

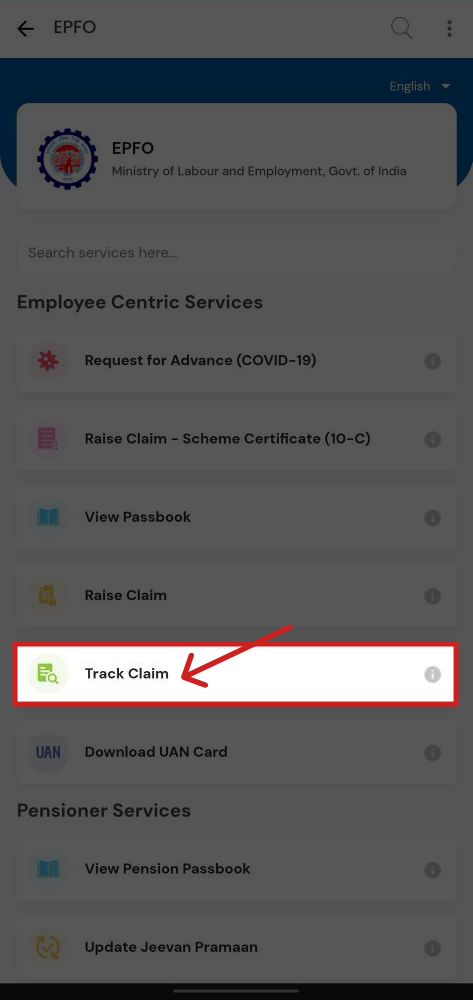

Claim Status via the Umang App:

Employees can check if their PF transfer/withdrawal request has been processed by using the UMANG app online. For that, you need to download the UMANG app on your iOS or Android device.

You must follow these steps to check your UAN claim status:

Step 1: Download & install the UMANG app from the Play Store or App Store.

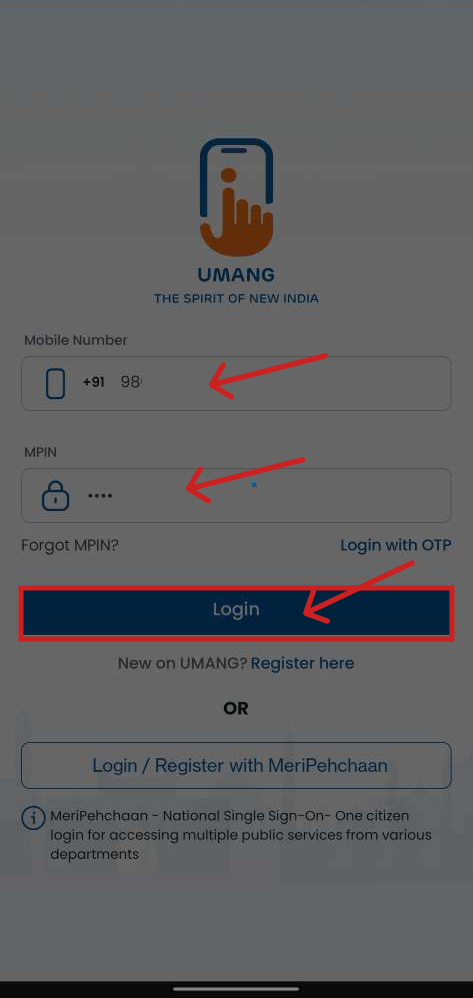

Step 2: Log in to the UMANG app using your EPFO account. You will be presented with two options – ‘MPIN’ and ‘Login with OTP.’ Enter your existing mobile number and select your preferred option.

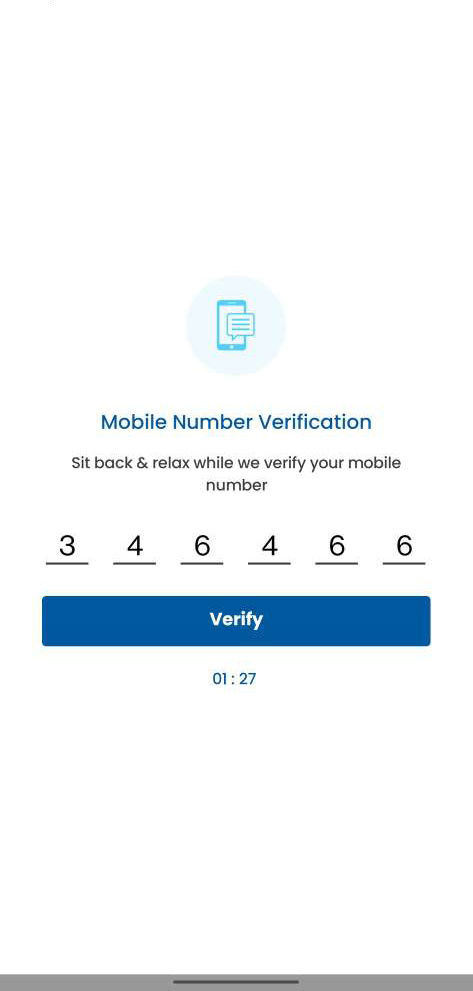

Step 3: If you choose ‘Login with OTP,’ you will receive an OTP- One-Time Password on your RMN- registered mobile number. Enter the OTP received and click ‘Login.’

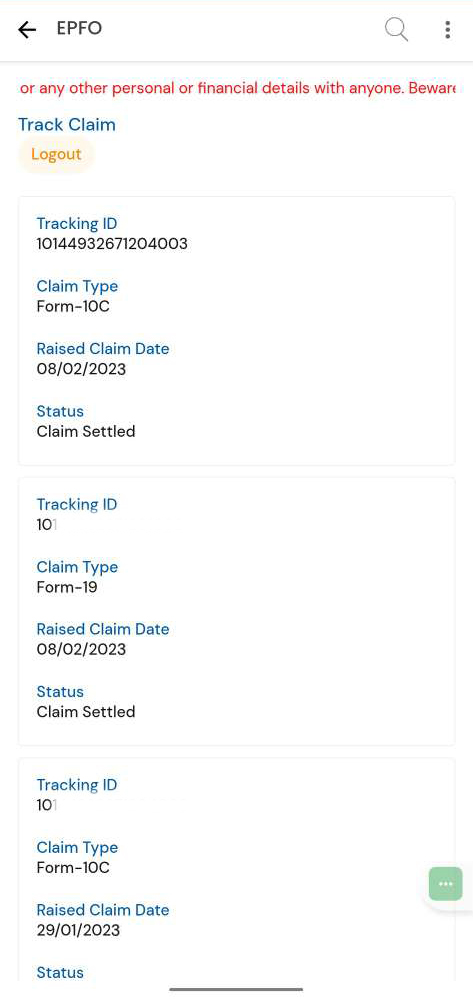

Step 4: After entering the OTP, you will be redirected to the official EPFO portal main page within the UMANG app. Under ‘Employee Centric Services,’ select ‘Track Claim.’ You will then be now redirected to a page where you can view your PF claim status.

Step 5: If you have no claims, the screen will be displayed accordingly. In case you have claims, the screen will provide your claim status details, including tracking ID, claim type, claim initiation date, and current status.

Many applicants prefer online PF claim status checks due to their simplicity and quick completion.

Check Offline PF Claim Status- Process Explained

By Giving a Missed Call

Employees can check PF claim status by giving a missed call to 011-22901406 from their RMN-registered mobile number.

However, it is crucial to link the mobile number with the UAN and update PAN, Aadhaar, and bank account details on the UAN portal. The call is free of charge, automatically disconnecting after two rings.

Subsequently, the claim details will be sent via SMS to the registered mobile number.

By Calling EPFO Toll-Free Number

You also have the option to inquire about EPF withdrawal or transfer claim status by calling the EPFO 24×7 customer care number at 1800 118 005.

Via SMS

Checking the PF claim status is also possible through SMS. To avail of this service, employees must link their mobile number with the UAN portal and send an SMS to 7738299899.

The SMS format should be ‘EPFOHO UAN LAN,’ where ‘LAN’ specifies the preferred language for receiving the details.

Please refer to the table provided for the various language choices along with their corresponding language codes:

| Language | Code |

| English | ENG |

| Punjabi | PUN |

| Marathi | MAR |

| Telugu | TEL |

| Malayalam | MAL |

| Hindi | HIN |

| Gujarati | GUJ |

| Kannada | KAN |

| Tamil | TAM |

| Bengali | BEN |

While the EPF claim process usually takes 15 to 20 days for settlement, the actual timeframe can vary. It depends on how you make your claim, the accuracy of the information, etc.

And remember, you can always check the EPFO claim whenever you want, online or offline.

EPFO Claim- Basic Things to keep in mind

- For the offline route, download the right PF claim form from the EPFO website, or you can also get one from your nearby EPFO office.

- Take your time filling out the form. Don’t forget to attach the necessary documents like Aadhaar, PAN, and your bank passbook.

- Submit the filled form either directly to the regional EPFO office or through your employer. Don’t forget to include a cancelled cheque or a copy of your bank passbook.

- You can check details about your PF claim status by checking the EPFO website or calling the toll-free number 1800118005.

Type of PF Claim Status and What Do They Mean

EPF Withdrawal is a step-by-step process, and there are various stages of EPF claim status, which are shown on your ID when you check your EPF claim status through pf tracking id.

Here is the meaning of each:

| EPF Status | Meaning |

| Payment under process | 1. The claim is currently in progress. 2. The status will transition to “Claim Settled” once the EPFO transfers funds to your bank account. |

| Settled | 1. The claim has been duly accepted and processed by the EPFO.2. The funds have either been transferred to your bank or are in the process of being transferred. |

| Rejected | Your claim might be rejected by your current or previous employer due to various reasons, including1. Details mismatch.2. Signature mismatch.3. Failure to submit the signed claim printout within 15 days of making an online claim.To determine the cause of rejection, you can check the EPFO portal or contact the EPFO office. |

| Not available | The claim is still pending for processing. |

How to Cancel EPF Claim?

Cancelling an EPF claim cannot be done online. If you want to cancel your EPF claim request or your EPF withdrawal claim initiated online. You have to reach out directly to the EPFO regional office.

Conclusion

Checking your EPF claim status online or offline is a simple process. You can track it online using the UAN portal, the EPFO website, or the Umang app.

If you prefer, you can also check UAN claim status offline. Knowing the rules, the forms needed, and how to cancel a claim are a few things that you must know before filing a PF claim.

FAQs| PF Claim Status Check

You have two options to claim your PF amount: online and offline. For online, please ensure your UAN is activated and your Aadhaar and bank details are linked. For Offline, you can fill out the Composite Claim Form and submit it to the EPFO office or your employer.

You can check your PF claim status online or offline. Online methods include using the UAN Member Portal, EPFO Portal, PF Account Number, or Umang App. Offline options involve sending an SMS, calling, or visiting the EPFO office.

You can claim full PF settlement either when you retire or after being unemployed for over two months.

You can withdraw your entire PF amount only upon Retirement or unemployment exceeding two months. If employed or unemployed for less than two months, full withdrawal is not allowed

EPFO typically takes 20 days to settle a claim if the application is complete.

Yes, an online claim requires Aadhaar to process it.

Source: UMANG

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.