Are you a budding entrepreneur eager to kickstart your business dreams but lacking the financial support to turn them into reality? Many face this uphill battle daily, struggling to access funds to fuel their micro-enterprises. But what if there was a superhero scheme silently empowering these micro-entrepreneurs to success? How about we tell you about the superstar scheme of the Indian Government that supports small businesses in the non-farm sector, whether they’re into manufacturing, trading goods, or providing services? And guess what? They can get loans of up to Rs. 10 lakhs! Which is this government scheme? Pradhan Mantri Mudra Yojana (PMMY) it is!

Let us walk you through the Pradhan Mantri Mudra Yojana (PMMY) Scheme!

- What is Pradhan Mantri Mudra Yojana (PMMY)?

- Key Features of Pradhan Mantri Mudra Yojana (PMMY)

- Pradhan Mantri Mudra Yojana Details

- Benefits of Pradhan Mantri Mudra Yojana Scheme (PMMY)

- Pradhan Mantri Mudra Yojana Scheme Eligibility Criteria

- Pradhan Mantri Mudra Yojana Application Process

- What are the Essential Documents for Mudra Loans

- Conclusion

- FAQs| Pradhan Mantri Mudra Yojana (PMMY)

What is Pradhan Mantri Mudra Yojana (PMMY)?

Pradhan Mantri Mudra Yojana (PMMY) is a cornerstone initiative by the government of India.

The Pradhan Mantri Mudra Yojana (PMMY) Scheme offers loans to individuals, businesses, and companies to start or expand small enterprises.

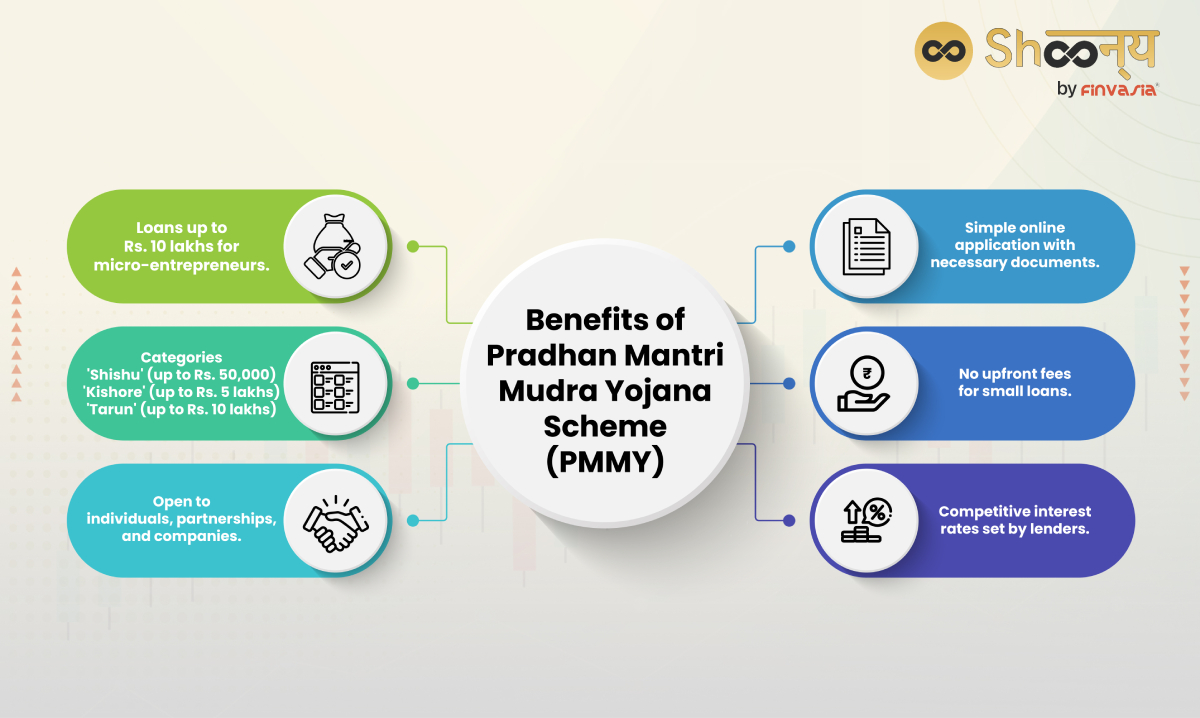

Eligible borrowers include various legal entities like individuals, partnerships, and companies. Pradhan Mantri Mudra Yojana loan ranges up to ₹10 lakh.

What’s the most interesting part?

Banks set interest rates, and the scheme may not even require collateral for loans up to ₹10 lakh.

Who Benefits?

This scheme offers crucial financial support in the form of micro-credit or loans.

The scheme primarily targets micro and small entities, encompassing a diverse range of businesses. From proprietorship and partnership firms to small manufacturing units, service providers, and vendors, PMMY embraces a wide spectrum of economic activities.

Key Features of Pradhan Mantri Mudra Yojana (PMMY)

The Pradhan Mantri Mudra Loan Yojana has some unique features:

- Eligible borrowers include individuals, sole proprietorships, public limited companies, partnership firms, private and, and other legal entities.

- Applicants must not have defaulted on any loans previously and should have a satisfactory credit history.

- Individual borrowers should have the necessary skills for their proposed business activity.

- MUDRA loans are for income-generating small businesses in manufacturing, processing, service, or trading sectors, not for personal use.

- A “MUDRA Card” is available for working capital needs. It functions as a flexible credit or Debit card on the RuPay platform.

- Margin or promoters’ contribution varies according to bank policies and RBI guidelines. In most cases, the Pradhan Mantri Mudra Yojana scheme requires no margin for Shishu loans.

- Interest rates must be reasonable for borrowers.

- Upfront fees or processing charges may be applicable based on bank guidelines, often waived for Shishu loans.

- Security includes a first charge on loan-associated assets, with collateral not required for loans up to ₹10 lakh for Micro Small Enterprises (MSE) sector units.

Pradhan Mantri Mudra Yojana Details

One of the key features of PMMY is its accessibility.

Eligible individuals can avail of pradhan mantri mudra yojana loans through a network of Member Lending Institutions (MLIs).

These institutions include:

Public sector banks, private sector banks, state-operated cooperative banks, rural banks, microfinance institutions (MFIs), non-banking financial companies (NBFCs), small finance banks (SFBs), and other approved financial intermediaries recognized by Mudra Ltd.

Member Lending Institutions (MLIs) For PMMY

| Type of Institution |

| Public Sector Banks |

| Private Sector Banks |

| State-operated Cooperative Banks |

| Rural Banks |

| Microfinance Institutions (MFIs) |

| Non-Banking Financial Companies (NBFCs) |

| Small Finance Banks (SFBs) |

| Other Approved Financial IntermediariesInstitutions recognised by Mudra Ltd. |

Interest Rates and Processing Charges

Interest Rates

Member Lending Institutions determine the interest rates for Mudra loans.

However, they do so in accordance with the guidelines set by the Reserve Bank of India, and these rates are subject to periodic revisions by the institutions.

Upfront Fee/Processing Charges

While some banks may impose upfront fees based on their internal policies, it’s noteworthy that many banks waive the upfront fee or processing charges for Shishu loans.

This applies to Pradhan Mantri Mudra Yojana’s loan amount of up to Rs. 50,000.

Benefits of Pradhan Mantri Mudra Yojana Scheme (PMMY)

Catering to Diverse Needs: Shishu, Kishore, and Tarun Categories

The PMMY scheme helps meet the varied funding requirements of micro-enterprises.

These divide into three categories: Shishu, Kishore, and Tarun.

Each category signifies the stage of growth and development of the beneficiary micro unit or entrepreneur.

- Shishu: This category encompasses loans up to Rs. 50,000, ideal for micro-enterprises in their nascent stages.

- Kishore: Entrepreneurs seeking loans above Rs. 50,000 and up to Rs. 5 lakhs fall under the Kishore category, catering to businesses in the intermediate phase of growth.

- Tarun: For more established micro-enterprises with funding requirements exceeding Rs. 5 lakhs but not exceeding Rs. 10 lakhs, the Tarun category provides the necessary financial support to propel them further.

Pradhan Mantri Mudra Yojana Scheme Eligibility Criteria

Under the Pradhan Mantri Mudra Yojana (PMMY), a variety of entities are eligible to apply for loans, including:

- Individuals

- Proprietary concerns

- Partnership firms

- Private Limited Companies

- Public Companies

- Any other legal forms recognised by the scheme

Important Notes:

- Financial History

Applicants must maintain a clean record with banks or financial institutions. They must also possess a satisfactory credit track record. - Skills and Experience

Individual borrowers must have the necessary skills or knowledge relevant to their proposed business activity. - Educational Qualifications

The nature of the proposed activity and its specific requirements form the basis of necessity for educational qualifications, if any.

Pradhan Mantri Mudra Yojana Application Process

To initiate the application process for a Mudra loan, you must follow these steps:

- Prepare Your Documents

You must ensure you have the necessary documents ready.

These include:

- Your ID proof

- Address proof

- Passport-size photograph

- Applicant signature and proof of identity/address of your business enterprise.

- Visit the Udyamimitra portal.

- Now, under the heading, Mudra Loan, click on the “Apply Now” button.

- Select Your Profile

Choose whether you’re a new entrepreneur, an existing entrepreneur, or a self-employed professional.

- Registration

Fill in your name, email, and mobile number, and generate an OTP for successful registration.

Once you’ve successfully Pradhan Mantri MUDRA Yojana (PMMY) registration, you must proceed with the following:

- Provide Personal and Professional Details: Fill in all necessary personal and professional information.

- Select Assistance:

If required, choose hand-holding agencies for assistance in preparing project proposals. Otherwise, proceed directly to the Loan Application Center.

- Choose Loan Category

Select the category of loan you require: Mudra Shishu, Mudra Kishore, or Mudra Tarun.

- Enter Business Information

Provide details like your business name, activity, and industry type (manufacturing, service, trading, or agriculture-related activities). - Provide Financial Details

Enter information about the business owner, existing banking/credit facilities, proposed credit facilities, future estimates, and preferred lenders. - Attach Documents

Upload all required documents, including ID proof, address proof, applicant photo, applicant signature, and proof of identity/address of your business enterprise. - Submit Application

Once you have added and checked all the information, you can submit your application. You should keep the application number for future reference.

You may also want to know the Pradhan Mantri Matru Vandana Yojana

What are the Essential Documents for Mudra Loans

Here is the list of documents for the Shishu Loan

| Documents | Description |

| Proof of Identity | Self-attested copy of Aadhaar Card / Voter’s ID Card / Driving Licence / PAN Card /Passport / Photo ID issued by Govt. authority, etc. |

| Proof of Residence | Recent telephone billelectricity bill/property tax receipt (not older than 2 months) / Voter’s ID Card / Domicile Certificate / Proprietor / Aadhar Card / Partners Bank passbook or latest account statement duly attested by Bank Officials /Passport of Individual /Certificate issued by Govt. Authority / Local Panchayat / Municipality etc. |

| Applicant’s Photograph | 2 recent coloured copies (not older than 6 months) |

| Quotation | Quotation of items to be purchased. |

| Supplier Details | Price of machineryName of supplier/details of machinery |

| Business Identity | Copies of Registration Certificates / relevant Licences / Other Documents related to the ownership, identity of the address of business unit, if any. |

2. Kishore and Tarun Loan Documents Required:

| Documents | Description |

| Proof of Identity | Self-attested copy of Voter’s ID card / Driving License / PAN Card / Aadhar Card / Passport. |

| Proof of Residence | Recent telephone bill, electricity bill, property tax receipt (not older than 2 months), Voter’s ID card, Aadhar Card & Passport of Proprietor/Partners/Directors. |

| Applicant’s Photograph | 2 recent coloured copies (not older than six months) |

| Business Identity | Copies of relevant licenses/registration certificates/other documents pertaining to the ownership, identity and address of the business unit. |

| Financial Records | Applicant should not be a defaulter in any Bank or Financial institution. |

| Bank Statements | Last six months’ Statement of accounts from the existing banker, if any. |

| Balance Sheets | The balance sheets of the last two years of the units, along with sales tax returns/ income tax, etc. (This Applies to all cases from Rs.2 Lacs and above). |

| Projected Balance Sheets | A one-year projected balance sheet for the working capital limits and for the loan period applies to a term loan. |

| Sales Records | Sales achieved during the current FY up to the date of application submission.. |

| Project Report | Project report (for the proposed project) with all details of technical & economic viability. |

| Company Documentation | Partnership Deed of Partners/ Memorandum and Articles of Association of the company, etc. |

Conclusion

The Pradhan Mantri Mudra Yojana (PMMY) actively entrusts aspiring entrepreneurs. This initiative by the Indian government is a great move to drive the nation towards greater prosperity and self-sufficiency by fostering inclusive growth and financial empowerment.

FAQs| Pradhan Mantri Mudra Yojana (PMMY)

Individuals, partnership firms, proprietary concerns, private and public companies, and other legal entities meeting credit and skill criteria can apply.

PMMY offers need-based loans up to Rs. 10 lakhs in three stages: Shishu, Kishore, and Tarun aiding income-generating activities without collateral for up to Rs. 10 lakh.

Mudra loans are categorised into Shishu (up to Rs. 50,000), Kishore (above Rs. 50,000 to Rs. 5 lakhs), and Tarun (above Rs. 5 lakhs to Rs. 10 lakhs), catering to various business growth stages.

Yes, MUDRA loans cover various business activities, including the purchase of CNG tempo/taxi for income generation.

As per the Banking Codes and Standards Board of India (BCSBI), set up by RBI, loan applications for credit limits up to Rs. 5 lakh should be disposed of within two weeks

Source- myscheme.gov.in

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.