Pradhan Mantri Suraksha Bima Yojana (PMSBY)| Advantages, Eligibility and Application Process

Life’s unpredictability is a harsh reality we all face. Each day, we hear about countless road accidents, stirring fear and prompting a sudden thought: What if it were me behind the wheel? What about my loved ones? These moments drive us to seek accident insurance coverage, but the decision-making process can be confusing, especially when choosing between government and private insurers. The Government of India has introduced an accidental insurance scheme that offers financial protection against accidental death or disability. This scheme, known as the Pradhan Mantri Suraksha Bima Yojana (PMSBY), is particularly suitable for individuals aged 18 to 70 years.

Did You Know?

Pradhan Mantri Suraksha Bima Yojana benefits include coverage for a premium of just ₹20.

So, what is Pradhan Mantri Suraksha Bima Yojana, and why should you opt for it?

Let’s find out!

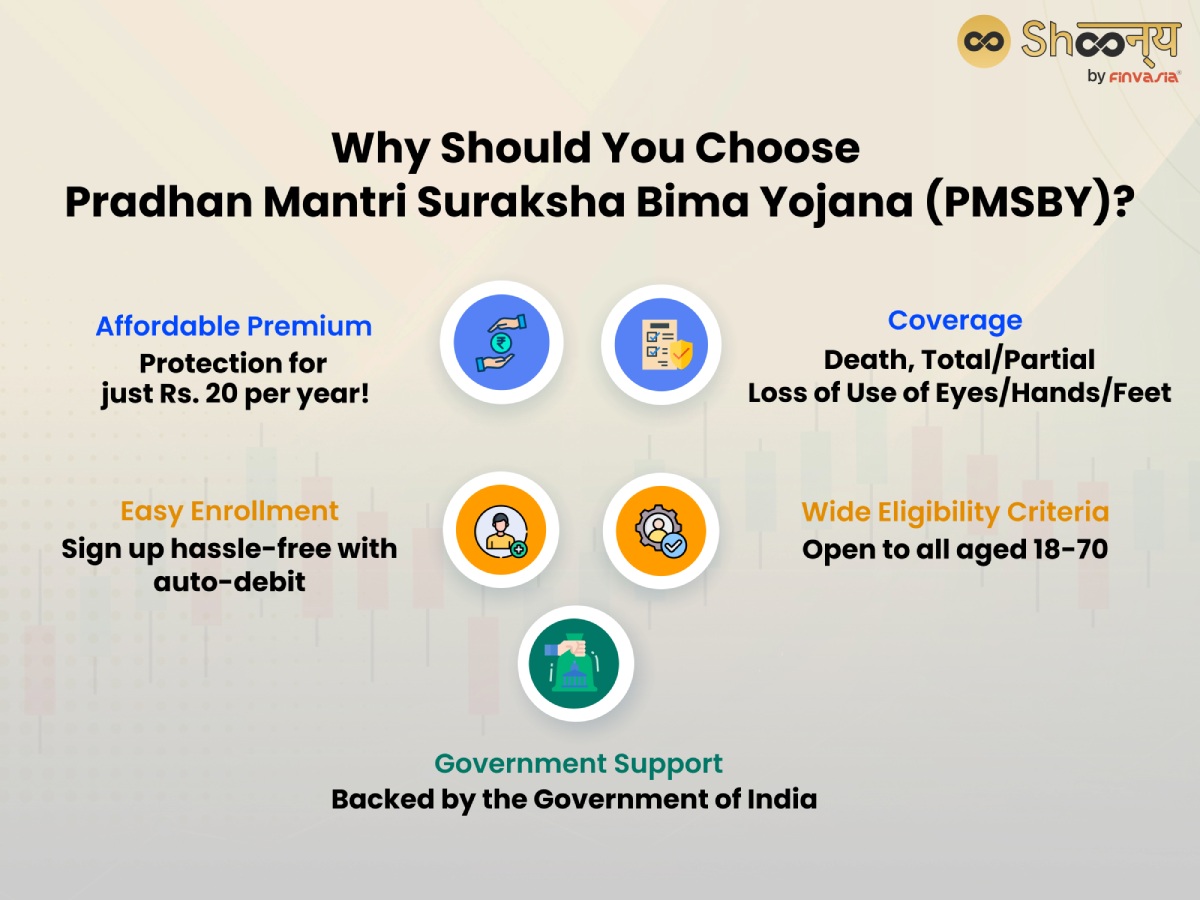

Why Should You Choose Pradhan Mantri Suraksha Bima Yojana (PMSBY)?

- Affordable Premium: Protection for just Rs. 20 per year!

- Coverage: Death, Total Loss (Use of Both Eyes/Hands/Feet), Partial Loss (Use of One Eye/Hand/Foot), Excludes Suicide.

- Easy Enrollment: Sign up hassle-free with auto-debit.

- Wide Eligibility Criteria: Open to all aged 18-70.

- Government Support: Backed by the Government of India

What is Pradhan Mantri Suraksha Bima Yojana?

PMSBY is an Accident Insurance Scheme that provides coverage for accidental death and disability.

Prime Minister Narendra Modi launched the Pradhan Mantri Suraksha Bima Yojana on May 9, 2015, in Kolkata. The scheme provides affordable accident insurance to a wide population. It aims to target the poor and underprivileged. It offers a one-year accidental death and disability cover that can be renewed annually.

Let us take a look at the pradhan mantri suraksha bima yojana details:

Premium: For just Rs. 20 per annum per member, individuals can avail themselves of the benefits of the scheme.

The premium amount is automatically deducted from the account holder’s bank or post office account. This will occur before June 1 of each annual coverage period.

Coverage Duration: The coverage under PMSBY remains effective for one year, beginning from June 1 to May 31.

This is upon payment of the annual premium.

What are the Pradhan Mantri Suraksha Bima Yojana Benefits?

Through PMSBY, the Government of India aims to provide essential accidental insurance coverage to millions at a nominal cost.

- If something happens to you and you pass away, your nominee will receive Rs. 2 lakhs.

- If you suffer from a severe and permanent loss that includes:

- The loss of both eyes, both hands, both feet or the sight of one eye combined with the loss of use of one hand or foot, you’ll get Rs. 2 lakhs.

- You’ll receive Rs. 1 lakh for a significant loss, such as the complete and irreversible loss of sight in one eye or the loss of use of one hand or foot.

Are You Eligible for Pradhan Mantri Suraksha Bima Yojana?

Let us see!

If you qualify for the following:

- Have an individual bank account with a participating bank.

- Age eligibility: Between 18 years (completed) and 70 years (age nearer birthday)

- Provide consent and enable auto-debit.

You will be automatically registered in the scheme.

If I am an NRI, am I Eligible for Coverage Under PMSBY?

Yes, NRIs with a bank account in India can buy PMSBY cover through that account if they meet the scheme’s terms. But if there’s a claim, the Pradhan Mantri Suraksha Bima Yojana benefits will be paid out in Indian currency to the beneficiary or nominee.

Is PMSBY a Reliable Choice?

Yes, the scheme is reliable.

Reputable public sector general insurance companies (PSGICs) and other trusted general insurance firms manage it. These companies collaborate with participating banks to ensure the PMSBYs smooth implementation.

You may also want to know the Pradhan Mantri Jeevan Jyoti Bima Yojana

How Can You Apply for Pradhan Mantri Suraksha Bima Yojana Scheme?

You can apply this scheme in two ways: offline and online.

Pradhan Mantri Suraksha Bima Yojana Apply Offline

Step 1: To enrol offline in PMSBY, you must visit your bank branch, where you have a savings account.

Alternatively, you can download the form from the official website: PMSBY Forms.

Step 2: You must fill in all the details in the application form and submit it to your bank along with the necessary documents.

Step 3: On the successful application submission, you’ll receive an Acknowledgement Slip Cum Certificate of Insurance.

Pradhan Mantri Suraksha Bima Yojana Apply Online

You can also get coverage under PMSBY online through your bank’s Net banking facility.

Termination of Cover

The accident cover assurance can terminate under the following circumstances:

- When you turn 70 years old (based on your nearest birthday).

- If you close your account with the Bank/Post office or don’t have enough balance to keep the insurance.

- If you have coverage through multiple accounts and the insurance company mistakenly gets premiums, you’ll only be covered through one account.

Any extra premiums paid for duplicate insurance will not be refunded.

- If your insurance stops due to technical or administrative issues, you can restart it by paying the full annual premium.

During this time, your coverage will be on hold, and reinstating it will depend on the Insurance Company.

Banks deduct the premium when you start auto-debit, usually in May each year, and pay it to the Insurance Company within the same month.

Will the family get Pradhan Mantri Suraksha Bima Yojana benefits if the account holder commits suicide?

No.

Is it necessary to report accidents to the Police and obtain FIR for claiming benefits under the policy?

For incidents like road, rail, or vehicular accidents, drowning, or death involving any crime, it’s essential to report the accident to the police.

Should you Opt For PMSBY?

PMSBY provides affordable accident insurance coverage, offering financial security against life’s uncertainties. With its easy sign-up process and valuable benefits, it’s a wise choice for you!

Source- myscheme.gov.in, indiapost.gov.in, jansuraksha.gov.in

FAQs| PMSBY

PMSBY is a government-backed accident insurance plan that offers accidental death and disability cover for a nominal premium. It is available through post offices.

The benefits of PMSBY include a ₹2 lakh cover for accidental death and total disability and ₹1 lakh for partial disability, with a premium of only ₹20 per annum.

Individuals aged 18-70 years with a bank or post office account are eligible for the Post Office Pradhan Mantri Yojana.

The PMSBY 20 Rupees policy is an accident insurance scheme that provides cover for accidental death and disability with an annual premium of just ₹20.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.