You can grow your wealth over the long term by investing in the stock market, but it also involves some risk. Many investors turn to mutual funds to manage their investments and protect their money to mitigate this risk. In this article, we will take a closer look at risk management through mutual funds and the different strategies.

Understanding Risk in Mutual Fund

Mutual funds involve risk just like any other investment. The fund’s value can fluctuate due to changes in the stock market, economic conditions, and other factors. Additionally, funds focusing on high-growth stocks may carry a higher risk level than those investing in more stable industries. Due to numerous variables, the price of these instruments is constantly shifting, which could lead to losses. Therefore, it is crucial to determine the risk profile and invest in the best fund.

Let’s get to know about some ways to mitigate these risks.

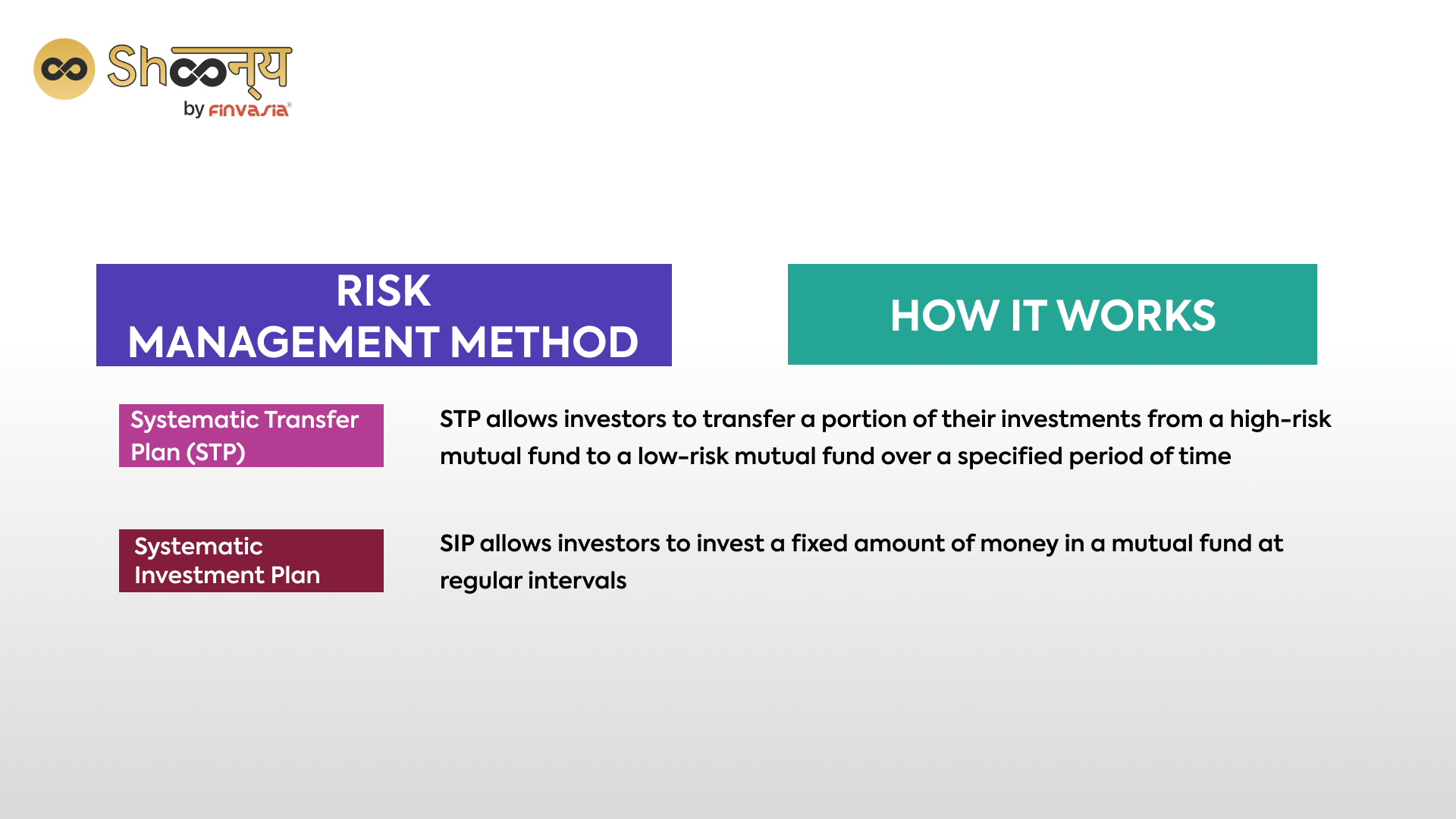

Risk Management through Systematic Transfer Plan (STP)

One of the most popular risk management strategies for mutual fund investors is the Systematic Transfer Plan (STP). STP allows investors to transfer a portion of their investments from a high-risk mutual fund to a low-risk mutual fund over a specified period of time. This can help reduce an investment portfolio’s overall risk by gradually moving money out of riskier investments and into safer investments.

Risk Management through Systematic Investment Plan (SIP)

Another popular risk management strategy for mutual fund investors is the Systematic Investment Plan (SIP). SIP allows investors to invest a fixed amount of money in a mutual fund at regular intervals, typically every month. This approach can help mitigate investment risk by reducing the impact of short-term market fluctuations and encouraging a long-term investment horizon. By investing the same amount of money at regular intervals, investors can benefit from dollar-cost averaging, which helps to average the cost of their investment over time.SIP is also a convenient and affordable way for investors to invest in mutual funds, as it requires a small, regular investment amount and eliminates the need for lump-sum investments. This can help to mitigate investment risk for those who may not have the resources or the expertise to make large, lump-sum investments in mutual funds.

SEBI’s Risk Management Framework (RMF)

SEBI, as the regulatory authority for mutual funds in India, has established a comprehensive RMF to ensure robust risk management practices within the industry. Let’s delve into the core aspects of SEBI’s RMF:

- Risk Identification: Mutual funds must carefully find possible risks that could affect their plans and work within India’s economy.

- Risk Measurement: Using suitable tools, mutual funds should measure how big and serious these risks are to make smart choices.

- Risk Monitoring: It’s important for mutual funds to keep an eye on these risks regularly using set measures. This helps them deal with new problems in India’s market.

- Risk Reporting: Mutual funds have to openly share these risks with important people like trustees, board members, SEBI, and investors. This makes things clear and fair.

- Risk Mitigation: To keep investments safe in India’s economy, mutual funds need to take actions to lower these risks and make them less serious. They should also adjust to changes in the market.

Roles and Responsibilities

SEBI’s RMF also delineates the roles and responsibilities of various entities involved in risk management. This includes trustees, asset management companies (AMCs), risk management committees (RMCs), compliance officers, internal auditors, and external auditors, fostering a collaborative approach to risk management within the mutual fund industry.

Enhancing Resilience and Investor Protection

The RMF, founded on industry best practices and SEBI’s recommendations, aims to bolster the resilience of mutual funds against market shocks and stresses within the Indian economy. Ultimately, it strives to protect the interests of investors, instilling confidence in the mutual fund industry.

Applicability

The RMF became applicable to all mutual funds in India from April 1, 2022, reinforcing the commitment to robust risk management practices within the Indian mutual fund landscape.

Wrapping Up

Whether you choose to use a Systematic Transfer Plan (STP) or a Systematic Investment Plan (SIP), investing in a good mutual funds portfolio can be a great way to grow your wealth over the long term while reducing your exposure to risk. Are you looking to avoid the risks of mutual funds and invest in a good mutual fund portfolio? Shoonya is here to help. Shoonya is the best online mutual fund investment platform in India, where you can trade mutual funds and securities at ZERO BROKERAGE!

FAQs

What are the risk assessments of mutual funds?

Risk assessments for mutual funds involve evaluating potential losses through indicators like standard deviation, beta, and Sharpe ratio. This helps investors understand and choose funds aligned with their risk tolerance and goals.

Mutual funds are categorised into risk levels (e.g., low, moderate, high) based on factors like asset class and investment objectives. The risk level depends on the securities the fund invests in, such as equities or debt and their characteristics.

Risk management in investments involves strategies like diversification, asset allocation, and monitoring to reduce uncertainty and potential losses while optimising returns. It includes adapting to changing market conditions and investor preferences.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.