Role of Nifty and Sensex in the Global Financial Market

Nifty and Sensex, the barometers of India’s financial market, are more than just numbers flickering on a screen. They represent the collective heartbeat of the country’s economy, reflecting the ambitions and challenges of a nation on the rise. In today’s interconnected world, where finance knows no borders, a deeper understanding of the Nifty and Sensex role in the global financial market is essential for investors looking to tap into new growth opportunities.

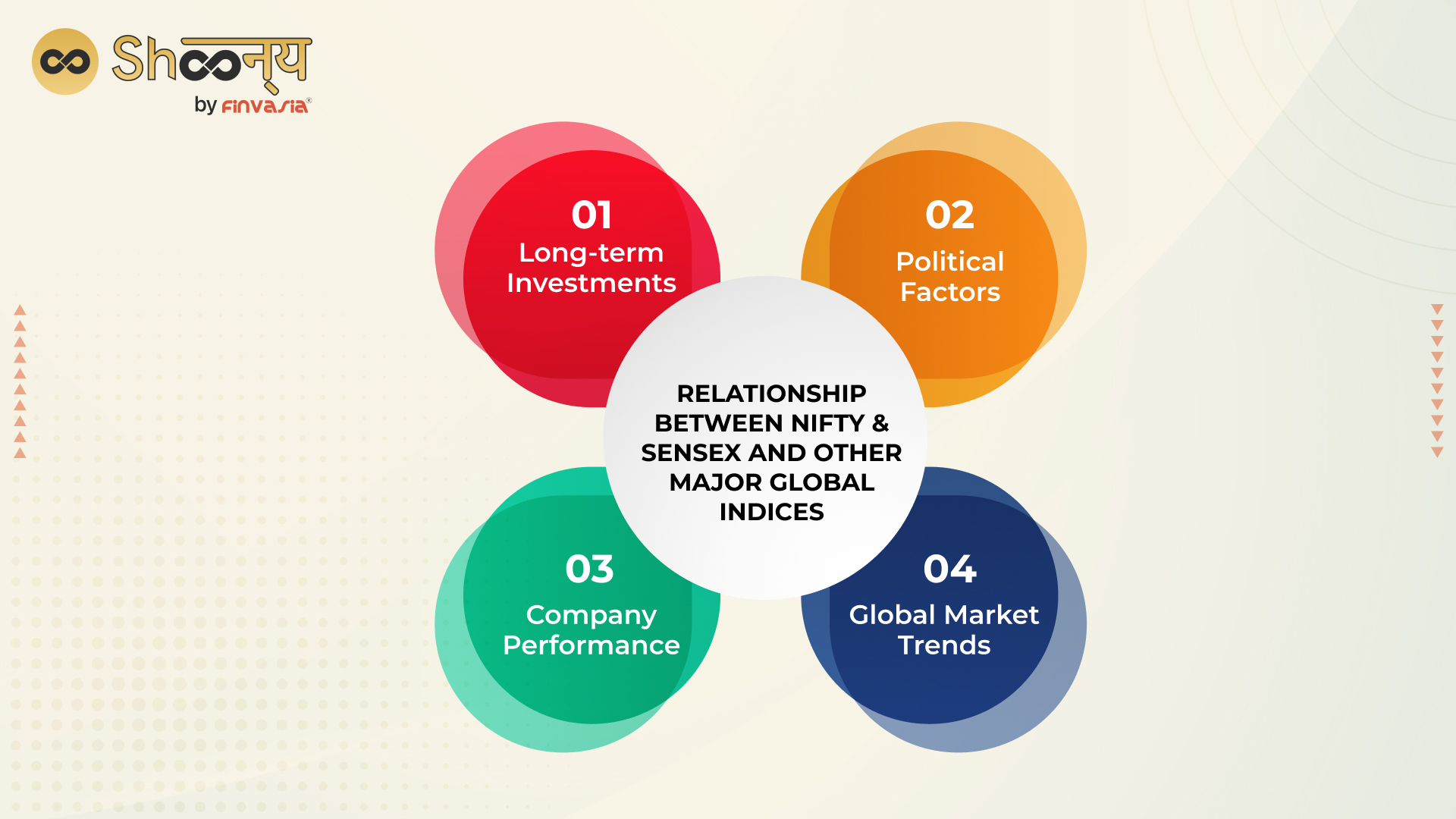

Understanding the relationship between Sensex & Nifty with other major Global Indices

The relationship between the Nifty, Sensex, and other major global market indices is complex and multifaceted. Here are some factors that can influence the correlation between these indices:

1. Economic Factors:

Economic conditions and trends in India and globally influence the performance of the Nifty and Sensex. For example, changes in interest rates, inflation, and gross domestic product (GDP) growth can influence the stock market.

For example, the rise in interest rates in the US causes a struggle for businesses there to stay afloat due to increased borrowing costs, impacting Indian companies’ performance in the service industry catering to clients abroad. As a result, the stock prices of such companies on the Nifty and Sensex will fall.

2. Political Factors

Political stability and government actions can also impact the Indian and global stock markets. For example, the outcome of an election, the implementation of new regulations, and trade sanctions can influence investor sentiment and, as a result, stock market performance.

3. Company Performance

The performance of NSE-listed companies affects Nifty and Sensex. Factors like earnings reports, business strategy, and competition can impact individual company stock prices. This is true for the world market index, such as the NASDAQ, where negative earnings reports from companies like Google can lead to a drop in the index.

4. Global Market Trends

The stock market is highly interconnected, and trends in other major global indices can impact the Nifty and Sensex. So, for example, if the US stock market falls, it is likely to affect the Indian stock market as well.

Understanding the performance of Sensex & Nifty with other World Market Indices

The performance of the BSE SENSEX and Nifty 50 is often compared to other major global indices such as the NASDAQ Composite, the S&P 500, the Dow Jones, and Japan’s Nikkei 225.

In recent years, the Indian stock market has shown solid growth, with both the Nifty 50 and the Sensex reaching record highs. This growth can be attributed to several factors, including a growing economy, increasing foreign investment, and reforms aimed at improving the ease of doing business in India.

However, it is crucial to note that the Indian stock market is still considered to be in its nascent stages compared to more mature markets such as the US and Japan. As a result, the Nifty 50 and Sensex can be more volatile, and a broader range of factors, including global events, domestic politics, and macroeconomic conditions, influence them.

When comparing the Nifty 50 and Sensex to other major global indices, consider the different characteristics of each market, including the size, maturity, and diversity of the underlying companies. Additionally, take into account the local economic conditions, as well as the regulatory and legal environment, when making investment decisions.

Final Words

Investors can maximize returns by leveraging the movement of global indices on Nifty and Sensex. They must create a well-diversified portfolio of stocks that tracks the indices. This can be done by investing in index funds or Exchange Traded Funds (ETFs) that mimic the performance of the indices.