Shareholders vs Stakeholders: Understanding the Stakeholder and Shareholder Difference

In business, “shareholders” and “stakeholders” are two common terms. They might sound similar to many, but they mean different things and play unique roles. Shareholders and stakeholders are both closely involved in the company. But what is the key difference when someone asks you about shareholders vs stakeholders? What exactly is the difference between stakeholders and shareholders?

Let us take a look!

Shareholders own company shares and focus on financial returns like dividends. However, Stakeholders include anyone interested in the company’s activities. It can include employees, creditors, local community, etc.

What is a Shareholder: Ownership and Investment

A shareholder, also known as a stockholder, holds an important position in every company’s structure. Shareholders can be individuals, organizations, or institutions that own shares of a company. These shares grant them ownership and a financial stake in the company’s performance. The primary goal of shareholders is to maximize their financial returns, often through dividends and stock appreciation.

There are various types of shareholders, each with different rights.

In the Indian market, shareholders have specific legal rights under the Companies Act 2013:

- Shareholders can vote on key corporate matters, such as electing directors or approving major decisions.

- They have the privilege to receive dividends based on the number of shares they own.

- Shareholders have the right to sue the company for misconduct and can challenge decisions that they believe harm their interests.

Types of Shareholders

There are mainly two types of shareholders in companies:

- Common Shareholders: These individuals own common stock, which offers ownership rights and potentially higher returns over the long term.

Common shareholders can participate in voting on key company matters.

- Preferred Shareholders: Owning preferred stock, these shareholders receive a guaranteed annual dividend payment.

Although they don’t usually have voting rights, they are prioritized in the event of company liquidation.

What is a Stakeholder: Impact and Influence

A stakeholder refers to anyone affected by a company’s actions or influencing its decisions. This includes investors, customers, employees, suppliers, and even the government. Each of these groups has a stake in the company’s success and operations.

Now, when we talk about the difference between shareholders and stakeholders, they also differ in their types!

Let’s take a closer look!

Types of Stakeholders

There are mainly two types of stakeholders in every company:

- Internal Stakeholders

These include individuals or groups who have a direct relationship to the company. It includes employees, shareholders, executives, and partners. Their concerns may range from job security to company performance.

- External Stakeholders

This group involves individuals and entities outside the company. This can be customers, suppliers, creditors, and even community members. Their interests could involve product quality, reliable services, and ethical business practices.

Do you know?

There exists a Prioritizing Stakeholder Theory!

It challenges the traditional focus on putting shareholders’ interests first. This theory suggests that businesses should care about everyone affected by their actions. By doing this, companies can help their communities, follow ethical rules, and succeed in the long run.

Shareholders vs Stakeholders| How Do They Differ?

The differences between stakeholders and shareholders can be understood based on several factors.

Let’s explore them!

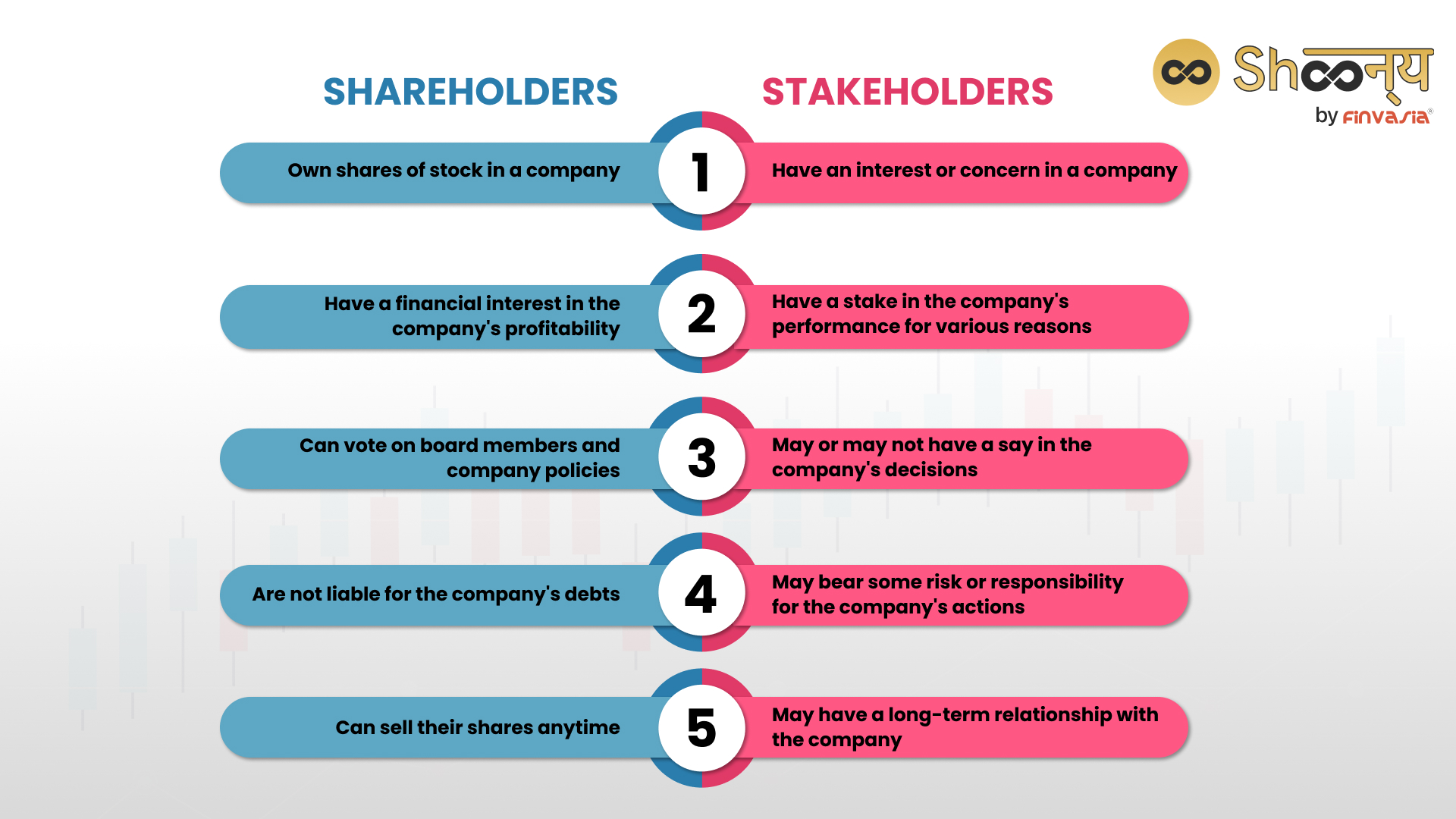

| Shareholders | Stakeholders |

| Own shares of stock in a company | Have an interest or concern in a company |

| Have a financial interest in the company’s profitability | Have a stake in the company’s performance for various reasons |

| Can vote on board members and company policies | May or may not have a say in the company’s decisions |

| Are not liable for the company’s debts | May bear some risk or responsibility for the company’s actions |

| Can sell their shares anytime | May have a long-term relationship with the company |

Difference between between stakeholders and shareholders:

- Priorities

Shareholders focus on financial gains. On the flip side, stakeholders focus on social impact and ethical considerations.

- Timelines

Shareholders often focus on short-term financial gains. But, whereas stakeholders have an interest in the company’s long-term success.

- Influence

Shareholders primarily influence financial decisions. On the filpside, stakeholders impact various aspects of a company’s operations. This can include product quality to community relations.

Impact of Bankruptcy on Stakeholders vs Shareholders

When a company goes bankrupt, both shareholders and stakeholders feel the impact.

Shareholders who own the company’s shares suffer the most. They might lose their entire investment as the company’s assets are sold off to pay debts.

When we talk about stakeholders, for instance, employees may lose jobs.

Communities where the company operates can also suffer. Job losses can hurt local economies, impacting tax revenues and politicians who rely on economic success.

Businesses are increasingly realising the importance of stakeholders in achieving sustainable growth. Adopting a stakeholder-centric approach allows companies to generate value for both shareholders and society as a whole.

Balancing Stakeholder and Shareholder Interests in Corporate Social Responsibility

In Corporate Social Responsibility (CSR), companies aim to be accountable to all stakeholders. When discussing the difference between stakeholders and shareholders in CSR responsibility, there is no clear priority.

Companies might prioritise environmental impact over solely maximising shareholder returns. In CSR governance, the broader public is seen as an external stakeholder.

For example, if a company’s activities increase pollution or affect community green spaces, it impacts the public at large. These choices might boost shareholder profits but could harm stakeholders.

Conclusion

Both shareholders and stakeholders are important, each with different interests. To succeed, companies must balance the needs of both shareholders and stakeholders. This balance ensures long-term sustainability and a good reputation, leading to lasting success and stability.

FAQs| Shareholders vs. Stakeholders

Yes, stakeholders can also be shareholders if they hold shares in the company. However, not all stakeholders are necessarily shareholders. Stakeholders can include employees, customers, suppliers, and community members.

The main difference lies in voting rights and dividend payments. Common shareholders have voting rights and may benefit from higher returns in the long term. Preferred shareholders, while lacking voting rights, receive a guaranteed annual dividend.

Stakeholder Theory suggests considering all stakeholders’ interests. On the other hand, the shareholder-focused approach prioritises maximising short-term financial returns for shareholders.

Understanding the difference between shareholders and stakeholders is crucial for businesses because it helps them balance financial goals with broader social responsibilities.

An employee is basicaly a stakeholder of the company. However, he can also become a shareholder if they he owns company stock.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.