Standalone vs Consolidated Financial Statements: Understanding the Differences

As a responsible investor, how do you decide which company to invest your money in? You rely on financial statements, right? They are the best way to understand a company’s health and performance. A company releases two financial statements every year or every quarter: standalone and consolidated statements. When we talk about standalone vs consolidated statements, they serve different purposes.

Let’s understand the key difference between standalone and consolidated financial statements today!

Standalone vs Consolidated Financial Statements

Standalone Financial Statements

These show the financial position and performance of a single company entity.

However, there is a twist!

It shows the performance without considering any subsidiaries or other affiliated companies. They focus solely on the finances of that specific company.

Consolidated Financial Statements

These combine the financial information of a parent company and its subsidiaries into one comprehensive set of statements.

They give a complete picture of the overall financial health and performance of the entire group of companies.

Standalone Financial Statement

A standalone financial statement is also called an individual report.

These statements are vital for understanding a business’s financial position. They include key documents like income, balance, and cash flow statements based only on that entity’s transactions.

Now, what’s the main idea?

Standalone statements are crucial for smaller, independent businesses.

Consolidated Financial Statement

This type of financial statement shows the overall financial position, performance, and cash flows of a group of companies.

Thus treating them as a single entity.

Companies prepare consolidated statements when they have a controlling interest in other companies (subsidiaries).

How is it prepared?

The parent company’s financial statements must be combined with those of its subsidiaries. This involves adding up assets, liabilities, revenues, expenses, and cash flows from all group entities.

Here is something interesting you must know!

Intercompany transactions and balances are removed to avoid duplicate information.

Consolidated financial statements are crucial for investors, regulators, and stakeholders who want a broader view of a group’s performance.

You may also want to know the Personal Financial Planning

Standalone vs Consolidated Financial Statements: Example

Standalone Financial Statement Example

Let’s consider a company named “ABC Ltd.” that operates independently without subsidiaries. ABC Ltd. prepares standalone financial statements to show its own financial position and performance.

- Standalone Revenue: ₹50,000,000

- Standalone Expenses: ₹35,000,000

- Standalone Net Income: ₹15,000,000

Consolidated Financial Statement Example

Now, imagine that “ABC Ltd.” acquires a subsidiary named “XYZ Pvt. Ltd.” during the financial year.

To present a comprehensive view of the group’s financials, ABC Ltd. prepares consolidated financial statements.

- ABC Ltd. Revenue: ₹50,000,000

- XYZ Pvt. Ltd. Revenue: ₹20,000,000

Total Consolidated Revenue: ₹70,000,000 (₹50,000,000 + ₹20,000,000) - ABC Ltd. Expenses: ₹35,000,000

- XYZ Pvt. Ltd. Expenses: ₹15,000,000

Total Consolidated Expenses: ₹50,000,000 (₹35,000,000 + ₹15,000,000) - Consolidated Net Income: ₹20,000,000 (Total Consolidated Revenue – Total Consolidated Expenses)

In this consolidated example, the financial statements combine the details of both ABC Ltd. and its subsidiary XYZ Pvt. Ltd.

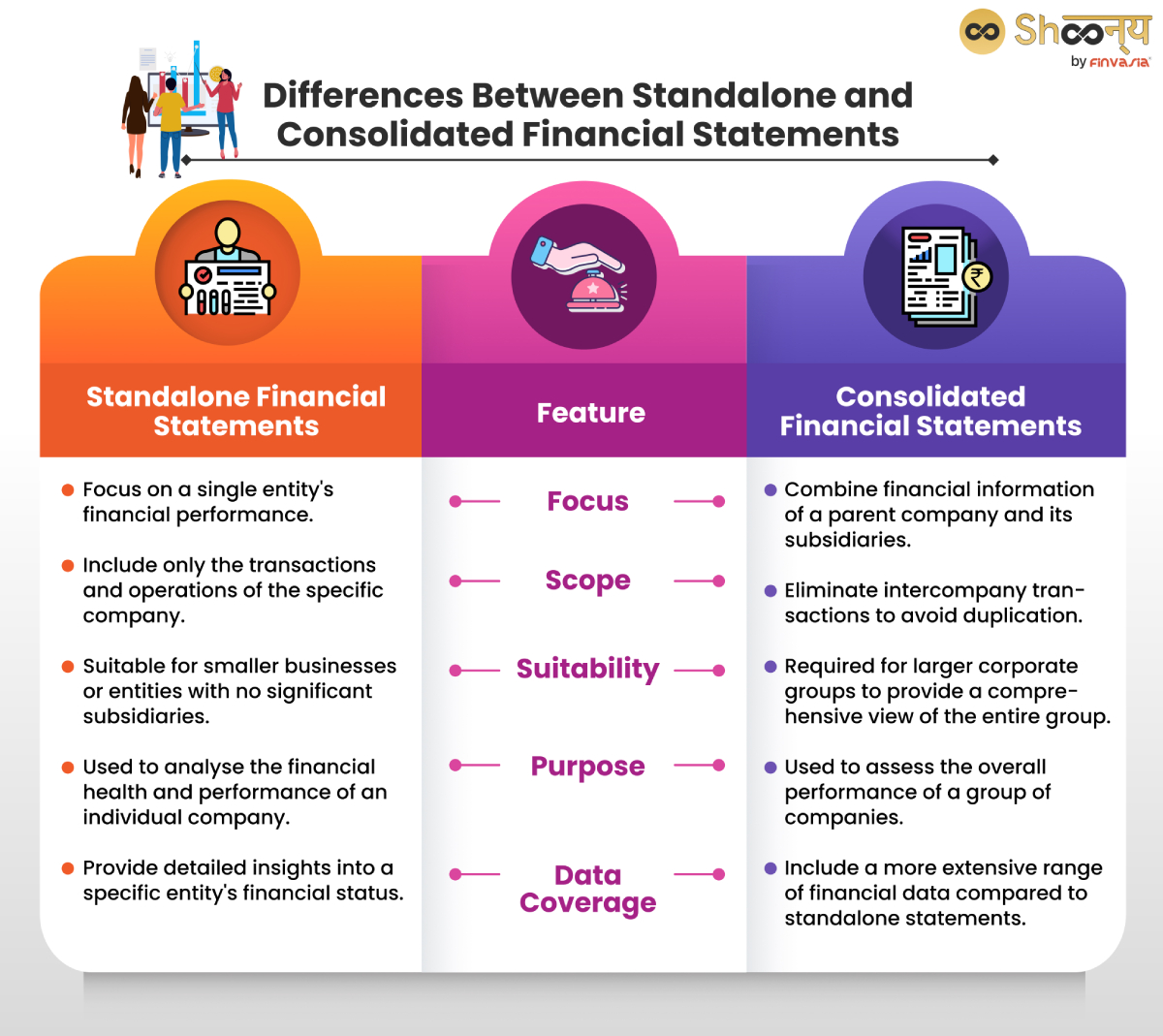

Differences Between Standalone and Consolidated Financial Statements

| Feature | Standalone Financial Statements | Consolidated Financial Statements |

| Focus | Focus on a single entity’s financial performance. | Combine financial information of a parent company and its subsidiaries. |

| Scope | Include only the transactions and operations of the specific company. | Eliminate intercompany transactions to avoid duplication. |

| Suitability | Suitable for smaller businesses or entities with no significant subsidiaries. | Required for larger corporate groups to provide a comprehensive view of the entire group. |

| Purpose | Used to analyse the financial health and performance of an individual company. | Used to assess the overall performance of a group of companies. |

| Data Coverage | Provide detailed insights into a specific entity’s financial status. | Include a more extensive range of financial data compared to standalone statements. |

Standalone and Consolidated Financial Statements: Why Do They Matter?

- Decision-Making

Investors need to assess the financial health and performance of companies before making investment decisions.

- Risk Assessment

Standalone financial statements help investors understand the specific company’s financial risks and opportunities.

3. Group Performance

Consolidated financial statements help investors evaluate the strength of the entire corporate entity.

4. Evaluating Complex Structures

Many companies have complex ownership structures with subsidiaries. These statements make it essential for traders to assess the overall impact on stock performance.

Standalone vs Consolidated: Which Should You Choose?

For Individual Company Assessments (Standalone)

If you want to understand the financial health and performance of a specific company without considering its subsidiaries.

Why Choose Standalone

It helps you analyse the performance of the company and see if you want to invest in it.

For Group Performance Analysis (Consolidated)

When you need to evaluate the overall financial performance of a group of companies that includes subsidiaries.

Let’s say Tata Group!

Why Choose Consolidated

This allows you to understand the entire group’s operations and financial strength.

Both types of statements serve different purposes and can be valuable depending on the investor’s or analyst’s needs.

FAQs| Standalone vs Consolidated Financial Statements

Standalone profit refers to the net income earned by a single company without considering the financial results of its subsidiaries or associated companies.

Consolidated statements combine the financials of a parent company and its subsidiaries, presenting them as one entity. In contrast, standalone statements show the financials of only the parent company.

Separate financial statements report the financials of a parent company and its investments in subsidiaries and associates at cost or fair value. On the other hand, consolidated financial statements merge the financials of the parent and its subsidiaries.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.