Tax Planning for Salaried Employees: Explore the Best Tax-Saving Options

As you grow in your career, your salary package grows, too. However, what about the additional tax burden that accompanies it? Are you one of those salaried employees who are often worried about tax planning? Are you frequently on the lookout for ways to minimise your tax burden? Tax planning holds the key. Tax planning for salaried employees offers a multitude of benefits.

In this article, we will explore some smart ways for tax planning for salaried employees in India.

Ready to set your finances right?

Let’s get started!

Understanding the Tax Planning for Salaried Employees

Tax planning for salaried employees involves the following steps:

• Understand your income tax slab and the applicable tax rates

• Firstly, know your salary structure and the various allowances and deductions available to you.

Moreover, note that educational loans, charity donations, and house rents are deductible expenses.

Explore the tax-saving options and choose the one that suits your needs.

• Choose the tax regime that is more beneficial for you.

The old regime with various exemptions and deductions, or alternatively, the new regime with lower tax rates but no exemptions and deductions.

Old tax regime vs new tax regime, know which is better?

• Identify your financial objectives and the time horizon for fulfilling them

• Select the appropriate tax-saving instruments that match your goals and risk appetite

• Invest in these instruments before the deadline of 31st March every year

• File your income tax return on time and claim the tax benefits

To ensure the right tax planning for salaried employees, you must know about tax-saving options.

Why is Tax Planning For Salaried Employees Important?

Tax planning is the process of arranging your finances in such a way that you can reduce your tax liability and maximise your savings.

Some of the benefits of tax planning are:

• It helps you save money by reducing your tax outgo

• It helps you invest wisely in various tax-saving instruments that suit your risk profile and return expectations

• It helps you plan for your retirement and other long-term goals

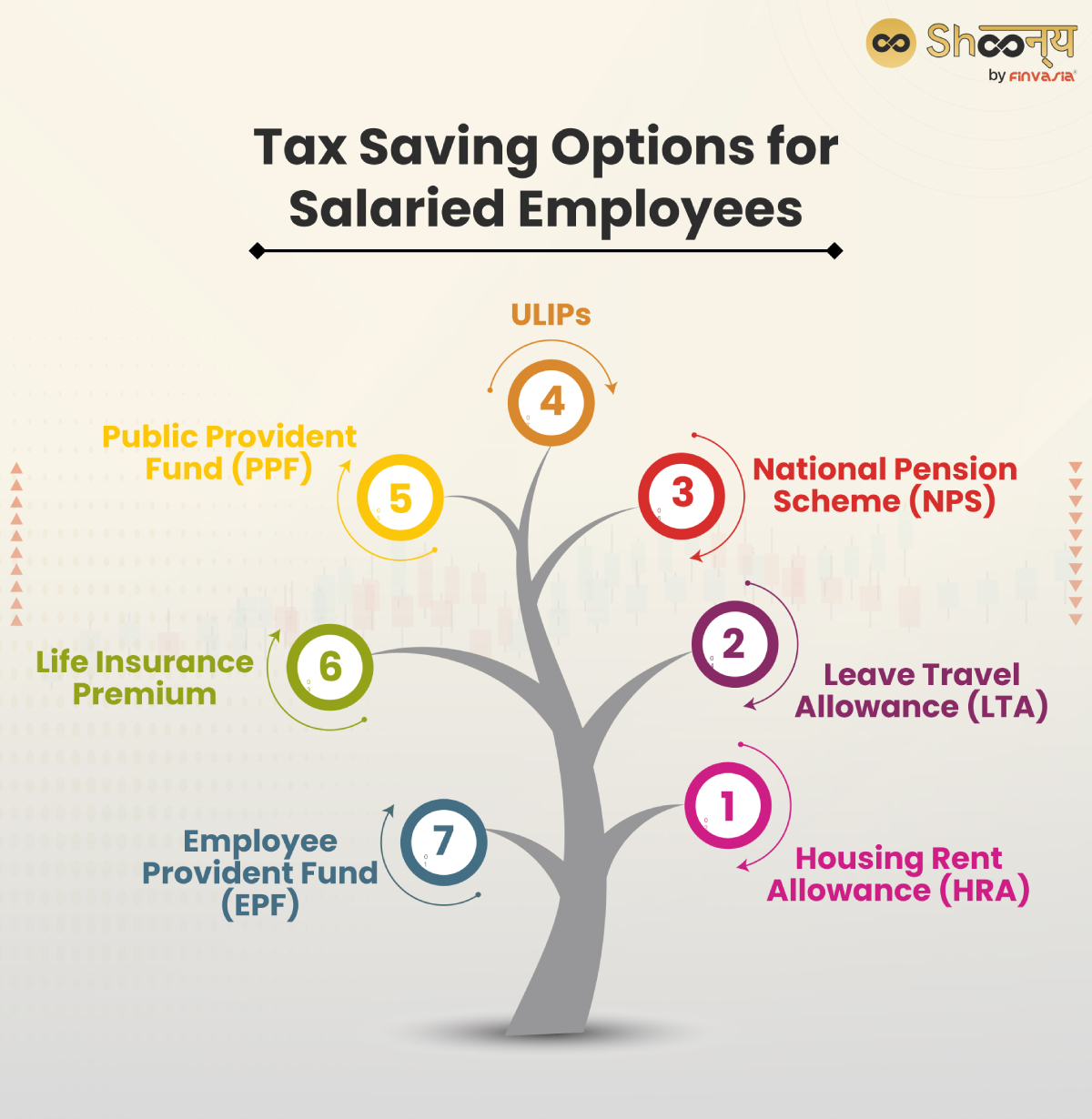

Tax Saving Options for Salaried Employees

| Tax Saving Options | Description |

| Employee Provident Fund (EPF) | Both employee and employer contribute 12% of the employee’s salary to the EPF account, accumulating tax-free with interest. |

| Life Insurance Premium | Premium payments up to Rs 1.5 lakh per year are exempted from tax under Section 80C, with additional tax benefits on death and maturity benefits under Section 10(10D). |

| Public Provident Fund (PPF) | Allows deposits up to Rs 1.5 lakh per year with a 5-year lock-in period, providing maximum tax benefits under Section 80C. |

| ULIPs | Includes tax-saving mutual funds and ULIPs, offering tax-free premium payments up to Rs 1.5 lakh per annum under Section 80C. |

| National Pension Scheme (NPS) | Enables investments for retirement, with tax exemptions up to Rs 1.5 lakh per year under Section 80CCD (1). |

| Leave Travel Allowance | LTA allows employees to claim reimbursement for domestic travel expenses for themselves and their dependents. But it’s not tax-free annually, according to section 10(5) of the Income Tax Act. |

| Housing Rent Allowance | Individuals under the old tax regime can claim tax exemption on House Rent Allowance (HRA) if they receive it as part of their salary structure or if they pay rent, subject to specified calculations with a maximum limit of Rs 60,000 annually. |

Salaried employees have various tax-saving options available to them under different sections of the Income Tax Act of 1961.

These help with income tax exemption.

Income Tax Exemption for Salaried Employees

Income tax exemption is the amount of income that is not subject to tax.

Some of the popular methods involve investing in these for disciplined tax planning for salaried employees.

Section 80C

This section allows a deduction of up to Rs 1.5 lakh for investments in multiple tax-saving options. These include instruments such as:

1. Public Provident Fund (PPF)

It offers tax-free savings with a fixed interest rate of 7.1 percent pa.

2. National Savings Certificate (NSC)

Provides secure savings with guaranteed returns, offering 6.8% interest per year.

3. Equity Linked Savings Scheme (ELSS)

Mutual fund investments in equities, offering potentially high returns and tax benefits.

4. Life Insurance Premium

Payments towards life insurance policies provide financial protection to beneficiaries and tax savings.

5. Sukanya Samriddhi Yojana (SSY)

This is a government scheme designed for the girl child’s future.

Check out the best investment plans in 2024.

Health Insurance Benefits – Section 80D

This section allows a deduction of up to Rs 25,000 for health insurance premiums that you pay for self/spouse and dependent children.

And up to Rs 50,000 for health insurance premiums paid for senior citizen parents.

Additionally, a deduction of up to Rs 5,000 is for preventive health check-up expenses.

Interest on Education Loans – Section 80E

This section allows a deduction for interest paid on education loans that you may take for higher studies of self, spouse/ children.

The deduction is available for a maximum of 8 years/ till the interest is paid, whichever is earlier.

Income Tax Exemption for Home Loans

You can get income tax exemption on home loans through two sections of the Income Tax Act 1961:

- Section 24(b) covers interest paid on housing loans.

- Section 80C covers principal repayment of housing loans.

Under Section 24(b), you can deduct up to Rs. 2 lakhs annually for the interest paid on a housing loan, whether for self-occupied or rented houses.

Under Section 80C, salaried employees can deduct up to Rs. 1.5 lakhs annually for the principal repayment of the housing loan, applicable for both self-occupied and rented houses.

House Rent Allowance (HRA)

This is the allowance given by the employer to the employee to meet the rent expenses for the accommodation.

The exemption is the least of the following:

• Actual HRA received

• 50% of the basic salary (for metro cities) or 40% of the basic salary (for non-metro cities)

• Rent paid minus 10% of basic salary

Leave Travel Allowance (LTA)

This is the allowance given by the employer to the employee to cover the travel expenses for a domestic trip with family.

You can claim this tax exemption for two trips in a block of four years.

Standard Deduction

This is a flat deduction of Rs 50,000 from the gross salary of the salaried employee, irrespective of the actual expenses incurred.

This deduction is available to all salaried employees, regardless of the tax regime you opt for.

Tax Planning for Salaried Employees: Key Considerations

• Plan your tax-saving investments at the beginning of the financial year. This helps to avoid making wrongful investment choices at the last minute.

• Choose the tax-saving instruments that suit your risk profile and liquidity needs

• Diversify your portfolio to maintain risk & return balance.

• Keep track of your earnings, expenses, investments and taxes throughout the year

• Maintain proper records and proofs of your income, expenses, investments and taxes

• File your income tax return on time to claim the tax benefits

Financial Planning for Salaried Employees

Financial planning is the process of effectively managing your finances to achieve your short-term and long-term goals. Tax planning for salaried employees as it can secure their future and enjoy their present.

Some of the benefits of financial planning are:

• It helps you budget your income and expenses and save more

• It helps you invest your savings in various instruments that can grow your money

• It helps you protect your assets and income from unforeseen risks and uncertainties

• It helps you plan for your retirement and other life events

• It helps you reduce your tax liability and increase your disposable income

Conclusion

Tax planning for salaried employees is not a one-time activity, but a continuous process. It needs careful planning and execution. Tax planning for salaried employees can help you secure your future and enjoy your present. Remember, the sooner you start, the better it is for your finances. So, don’t delay and start your tax planning today!

FAQs | Tax Planning For Salaried Employees in India

You can save tax on your salary in India by taking advantage of the various standard deductions. Also, invest in tax-saving instruments under section 80C, such as PPF, NPS, etc.

A tax planning tool for salaried employees is a software or an application that helps you calculate your tax liability.

Tax planning with respect to income from salary is the process of arranging your income, expenses, and investments in such a way that you can reduce your tax liability and maximise your net income.

By doing tax planning, salaried employees can reduce their taxable income, increase their disposable income, and create wealth for the future.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.