Several types of stocks are there on the market that are classified based on their categories or nature and liquidity. One of the major stock types traders should know in detail is illiquid stock. These are hard to sell or exchange in terms of cash and almost impossible to do so. Furthermore, these stocks are associated with a substantial decrease in the exchange value or sell price due to almost zero liquidity.

When do the stocks become illiquid?

The stocks aren’t illiquid from the very beginning. Instead, certain market conditions lead to such a problem, which is why we have discussed some factors that can lead to extremely low liquidity.

- Most often, investors are not that much interested in certain stocks. As a result, they remain in the liquidity pool, which is why they cannot yield exact returns and the stocks become illiquid.

- Also, if the trading volumes of the stocks are not high enough, it cannot be easy to sell or exchange them. This is one of the many reasons the stocks will become illiquid soon, and the liquidity levels can drop to almost zero.

- If certain stocks continue to witness a downtrend for several consecutive days, their liquidity level will automatically drop because selling or exchanging the shares won’t be lucrative.

- The difference between the bid and ask prices is known as the spread. The spread is often not that high, which is why the stock market is often said to have high liquidity. However, if the spread value increases, it will become harder for the stockholders to sell the assets if the difference between the bid and ask prices increases.

How to Identify Illiquid Stocks?

You may come across many Illiquid stock lists; however, identifying illiquid stocks involves recognising certain telltale signs. Various sources provide illiquid stock lists in the Indian market. These lists are based on criteria such as average daily turnover, market capitalisation, dividend history, profitability, promoter shareholding, and book value. The lists are updated periodically to reflect the changes in the market conditions and the liquidity of the stocks.

One of the sources that provide lists of illiquid stocks is the BSE (formerly Bombay Stock Exchange). The BSE identifies illiquid securities at the beginning of every quarter and moves them to a periodic call auction mechanism.

Here are key indicators:

- Low Trading Volume: Illiquid stocks typically have low daily trading volumes.

- Frequent Value Drops: These stocks often exhibit regular declines in their values.

- Wide Bid-Ask Spreads: There is a substantial difference between the bid and ask prices.

- Lack of Institutional Interest: Institutional investors tend to show limited interest.

- Difficulty in Trading: Illiquid stocks are hard to trade compared to their liquid counterparts.

Value Erosion on Sale: They may experience significant value loss upon sale.

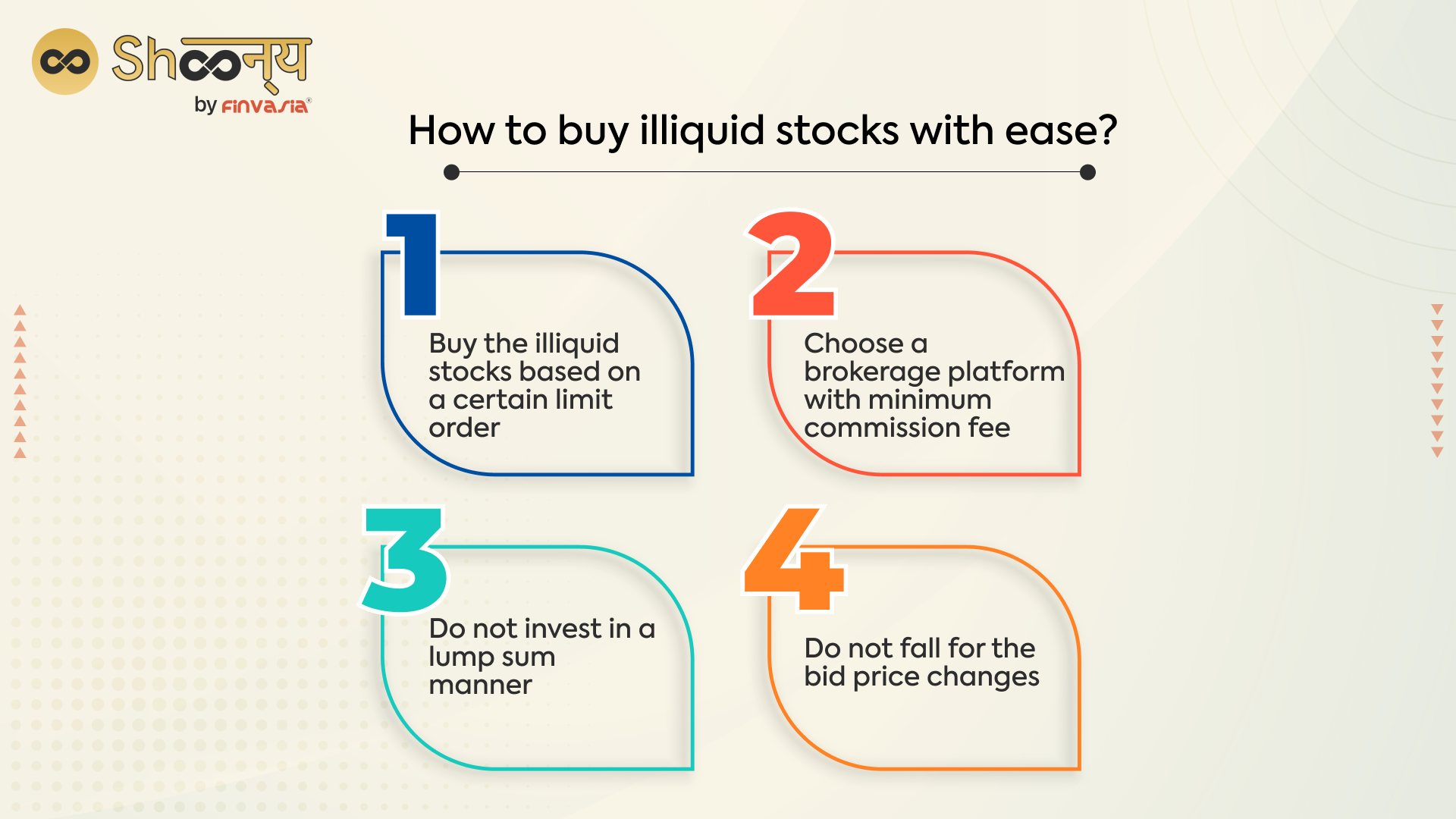

How to buy illiquid stocks with ease?

If you want to hold illiquid assets for a long time without their prices being exposed to market disruptions, the following are some ways to do so.

- The first thing to do is buy the illiquid stocks based on a certain limit order. It means that the broker can follow a predetermined minimum or maximum price while selling the stocks.

- Choose a brokerage platform that charges a commission fee below 1% so that you won’t have to pay any more on the trade, especially given that the cost price of the illiquid stocks will be quite high.

- If you want to buy ‘n’ a number of illiquid stocks or shares, do not invest in a lump sum manner. In other words, invest in multiple asset blocks to make selling them easier later.

- Do not fall for the bid price changes for illiquid stocks. This is because the bid might be high at order time but quite low during order execution. So, once you get the assets, hold them back and do not sell them.

Conclusion

Shoonya by Finvasia provides an easy and secure way to invest in liquid stocks. It is an all-in-one online trading platform that gives you the power to maximize your profits with efficient tools and reliable support at every step. With multiple charts, a wide selection of technical analysis tools, historical data, and seamless account management, Shoonya by Finvasia has everything you need for successful stock trading.

The user interface is designed for novice traders as well as experienced investors. Whether you are just getting started or have years of experience in trading stocks, Shoonya by Finvasia ensures that you can quickly access the necessary information and make informed decisions at all times.

Buy illiquid stocks with ease with Shoonya by Finvasia!

FAQs| Illiquid stocks

Illiquid stocks include penny stocks, micro-caps, unlisted shares, and those of bankrupt or delisted companies. They typically have low trading volume and limited market participation.

Buying illiquid stocks carries high risk, potential high costs, and low liquidity. It’s suitable mainly for investors with a high risk tolerance, a long-term perspective, and a thorough understanding of the stock’s fundamentals.

An illiquid stock market is characterized by low trading volume, limited efficiency, and wide bid-ask spreads. It often has few participants and slow order execution, influenced by factors like market size, regulation, competition, and investor behaviour.

Selling an illiquid stock can be challenging and may result in lower prices due to a lack of buyers. It requires patience, flexibility, and a strategic approach to navigate the market’s limitations.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.