How many times do you receive an SMS or WhatsApp message claiming that you have won a Honda City? Or, an offer that says you have won Rs 50 lakh, and the only step pending is KYC verification? To break it to you, these are online bank frauds in India.

With the rapid rise of digital banking in India, the area of financial security has become increasingly complex. While convenience soars, so too do the cunning efforts of fraudsters lurking in the shadows. To protect ourselves and safeguard our hard-earned money, understanding the different types of fraud in banks and how to prevent bank fraud in India is crucial.

Types of Fraud in Banks- Let’s Break it Down!

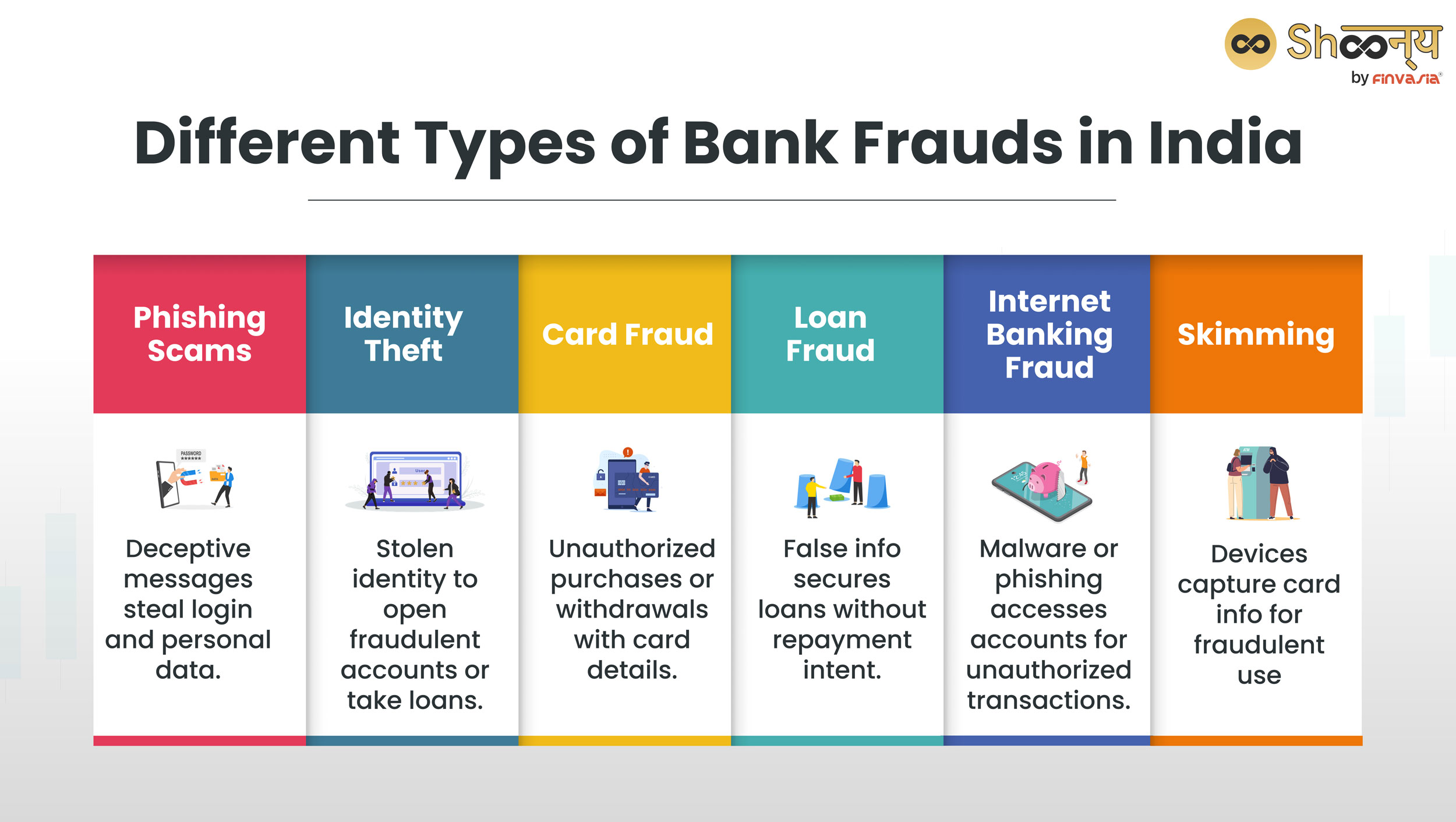

- Phishing Scams

Imagine getting a fishy SMS, phone call, or email pretending to be your bank, asking for your password.

If you fall for it and click the link, you might end up on a fake site where your login details get snatched!

The result?

You might lose your hard-earned money to fraudsters in a matter of seconds.

- Identity Theft

Bad actors (fraudsters who try to impersonate you) steal your personal info to pretend to be you, often indulging in the wrong/illegal financial activities.

Someone swipes your ID docs (e.g. your Adhaar card) to open fake bank accounts or take out loans in your name without you knowing.

This is the most common bank scam in practice nowadays.

- Credit or Debit Card Fraud

Credit or debit card fraud is when someone uses your card or card information to buy things or get money without your permission.

This is one of the most common online banking frauds in India that can happen in different ways, such as:

• Someone steals your physical card and uses it to make purchases or withdraw cash.

• Someone copies your card information using a device called a skimmer, which is attached to an ATM or a store’s card reader. They can then use this information to create a fake card or make online transactions.

• Someone tricks you into giving your card information by pretending to be a bank official, a website, or a company. They can then use this information to make online transactions or sell it to others.

Credit or debit card fraud can cause you to lose money, damage your credit score, or affect your bank account.

- Loan Fraud

People lie to get loans they never plan to repay.

Faking documents to secure a loan and then ghosting on the payments.

Customers should be careful and vigilant while applying for or repaying a loan.

You must read and understand the loan agreement, check the credibility and authenticity of the lender, and avoid sharing personal or financial information with unknown or suspicious parties.

You should also monitor their loan accounts and statements regularly and report any discrepancies or unauthorised transactions to your bank.

- Internet Banking Fraud

Internet banking fraud is when someone uses your online banking details to access your account or make transactions without your permission.

To prevent it, you should always use a secure connection, check the URL of the website, avoid clicking on suspicious links or attachments, and never share your passwords, PINs, or OTPs with anyone.

Falling for phishing emails leads to unauthorised access – it’s like an unwelcome party crasher.

- Skimming

Criminals use hidden gadgets to snatch your card info during legitimate transactions.

They can then use this information to create a fake card or make online purchases.

To prevent it, you should always inspect the card reader before using it, cover the keypad when entering your PIN, and monitor your card statements regularly.

Do you know?

Devices at gas stations quietly record your card details, making you the unsuspecting star of a fraud show.

Traditional Bank Scams Still Bite

Stay cautious!

Offline scams also pose a significant threat in India.

Here are some common tricks to watch out for:

- Loan Sharks with Bait & Switch: Be wary of loan agents approaching you on the street or offering deals through informal channels.

Verify the lender’s legitimacy with the RBI before falling prey to unrealistic promises.

- Vishing & Phishing: Offline Version: Phone calls claiming to be from bank officials offering “lucrative investment opportunities” or threatening legal action are often vishing scams.

Never share personal information over the phone, and verify directly with your bank.

- Prize Scams: Scammers often lure victims with fake lottery wins or “unclaimed inheritance” schemes.

These usually involve upfront fees or document processing charges, ultimately leaving you empty-handed.

How To Prevent Bank Frauds in India: Customer’s Guide

Now that we’ve identified the culprits let’s equip ourselves with the tools to fight online banking frauds.

To safeguard against bank fraud in India, customers can follow these preventive measures:

- Protect Personal Information

- Direction: Guard your personal details, passwords, and PINs.

- Why: Prevents identity theft and unauthorised access to accounts.

- Regularly Monitor Accounts

- Direction: Keep a close eye on your bank statements and transactions.

- Why: Enables quick detection of any suspicious activity or unauthorized transactions.

- Use Strong Passwords

- Direction: Create complex passwords for online banking.

- Why: Adds an extra layer of security, making it harder for fraudsters to access accounts.

- Beware of Phishing Attempts

- Direction: Avoid clicking on suspicious emails or links.

- Why: Phishing is a common tactic; staying vigilant prevents falling for scams.

- Enable Account Alerts

- Direction: Activate account alerts for transactions and balance changes.

- Why: Provides real-time notifications, allowing immediate action in case of unusual activities.

- Secure Your Devices

- Direction: Install and update security software on your devices.

- Why: Protects against malware and ensures a secure online banking environment.

- Educate Yourself

- Direction: Stay informed about common fraud tactics.

- Why: Awareness empowers you to recognise and avoid potential threats.

Following these measures will help protect yourself from bank frauds in India, ensuring a safe and secure banking experience.

Remember, a proactive approach and awareness play a crucial role in preventing bank fraud. Stay vigilant to keep your financial information secure.

Reporting and Prevention: How to Report Bank Frauds in India

If you encounter any suspicious activity or fall victim to a bank scam, immediate action is crucial:

- Contact your bank immediately: Block your cards and report the fraud, providing as much detail as possible.

- File a police complaint: Document the incident with evidence like call recordings or emails and file a complaint with the local police station.

- Report to RBI: Use the RBI’s Complaint Management System (CMS) to register the fraud officially. This helps track patterns and identify widespread scams.

Stay Vigilant, Stay Secure: Empowering Ourselves

Fighting bank fraud requires a collective effort. You must share this information with your family and friends, raise awareness within your community, and report suspicious activity promptly. Remember, knowledge is power.

By staying informed, vigilant, and proactive, we ensure the safety of our parents (who are particularly susceptible to these online frauds) and the younger generation from these bank scams in India.

FAQs

Banks investigate fraud by scrutinising transaction histories and evidence in their systems while also reporting incidents to authorities to prevent further losses.

Internal frauds in banks involve deceitful actions by employees or directors, misusing their trusted positions for personal gain, leading to various fraudulent activities such as payment fraud, loan fraud, and money laundering.

It depends on the type of scam, how you paid, and how quickly you reported it. Some banks may refund money if you are a victim of unauthorised or fraudulent transactions.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.