Do you know that every trader has a unique style of making trades? Are you one of those excited traders who often look to experiment in the stock market? Trading in the stock market offers various avenues for investors. But what are these different trading types? From the rapid-fire decisions of day trading to the calculated patience of position trading, each trading type is unique. Discover the method that aligns with your goals and risk tolerance. Let us explore the diverse types of trading in the stock market.

Types of Trading in the Share Market

The share market is a vibrant arena with diverse trading types and styles. From the swift pace of Day Trading to the strategic approach of Position Trading, you can choose any. Each type caters to different investor profiles, offering a spectrum of opportunities for profit and risk management.

Day Trading

It means buying and selling stocks within the same day. It’s about making quick profits from short-term price changes.

Day traders aim to finish all trades before the market closes.

An example of day trading would be buying 100 shares of a company in the morning and selling them later in the day for a profit of Rs. 500 as the stock price rises.

Swing Trading

Swing trading involves holding stocks for several days or weeks to catch short- to medium-term price swings. Traders aim to profit from the ups and downs of the market.

Suppose you buy 200 shares of a stock after noticing a short-term downward trend. You hold onto them for a few weeks until the stock price increases, then sell them for a profit of Rs. 1000. This would depict swing trading.

Position Trading

Position trading means holding onto stocks for a longer time, from weeks to even years. It involves focusing on the market trends and company performance.

Imagine investing in a tech company’s stock after researching its long-term growth prospects. You buy 300 shares and hold onto them for several years as the company expands, eventually selling them for a significant profit.

Scalping

Scalping is all about making small profits from tiny price movements. Traders buy and sell rapidly. The main aim of the scalpers is to capitalise on even the smallest fluctuations in price.

As a scalper, you might buy and sell 50 shares of a highly liquid stock multiple times within a few minutes, making a small profit on each trade. For example, buying at Rs. 200 and selling at Rs. 202, repeating this process several times during the day.

Momentum Trading

Momentum trading involves buying stocks that are already going up, betting that they’ll keep rising. It’s like catching a wave and riding it for as long as possible.

If you notice a popular retail stock suddenly surging due to positive news, you might buy 150 shares with the expectation that its price will continue to rise, allowing you to sell later at a higher price for a profit.

Long Term Trading

Long-term trading is about buying stocks with the aim of holding onto them for a long time, sometimes years.

It’s a patient strategy focused on the future potential of companies.

Long term trading means investing in a well-established multinational corporation’s stock. However, when you hold onto it for 10 years it steadily grows in value and pays dividends. The result?

You eventually sell it for a substantial profit.

Growth Investing

Growth investing is about picking stocks of companies that are expected to grow rapidly in the future. It’s like planting seeds in a garden and waiting for them to grow into big trees.

Buying shares of a promising biotech startup that has developed a breakthrough drug. Over time, as the drug gains regulatory approval and sales skyrocket, the value of your investment increases significantly.

Income Investing

Income investing focuses on stocks that pay regular dividends. It’s like owning a rental property that gives you a steady income stream over time.

Investing in a utility company known for its consistent dividend payouts. By purchasing shares and holding onto them, you receive regular dividend payments, providing a steady income stream alongside potential capital appreciation.

Futures Trading

Futures trading involves buying or selling contracts to purchase/ sell assets at a predetermined price on a future date.

Traders speculate on the future price movements of stocks, commodities, or indices.

Options Trading

Options trading grants traders the right, but not the obligation, to buy/ sell assets. This happens at a predetermined price within a specified timeframe.

It offers flexibility and allows traders to hedge their positions or speculate on price movements.

These strategies offer different ways to approach the stock market.

Whether you’re looking for quick gains or long-term wealth accumulation, there’s a strategy for you.

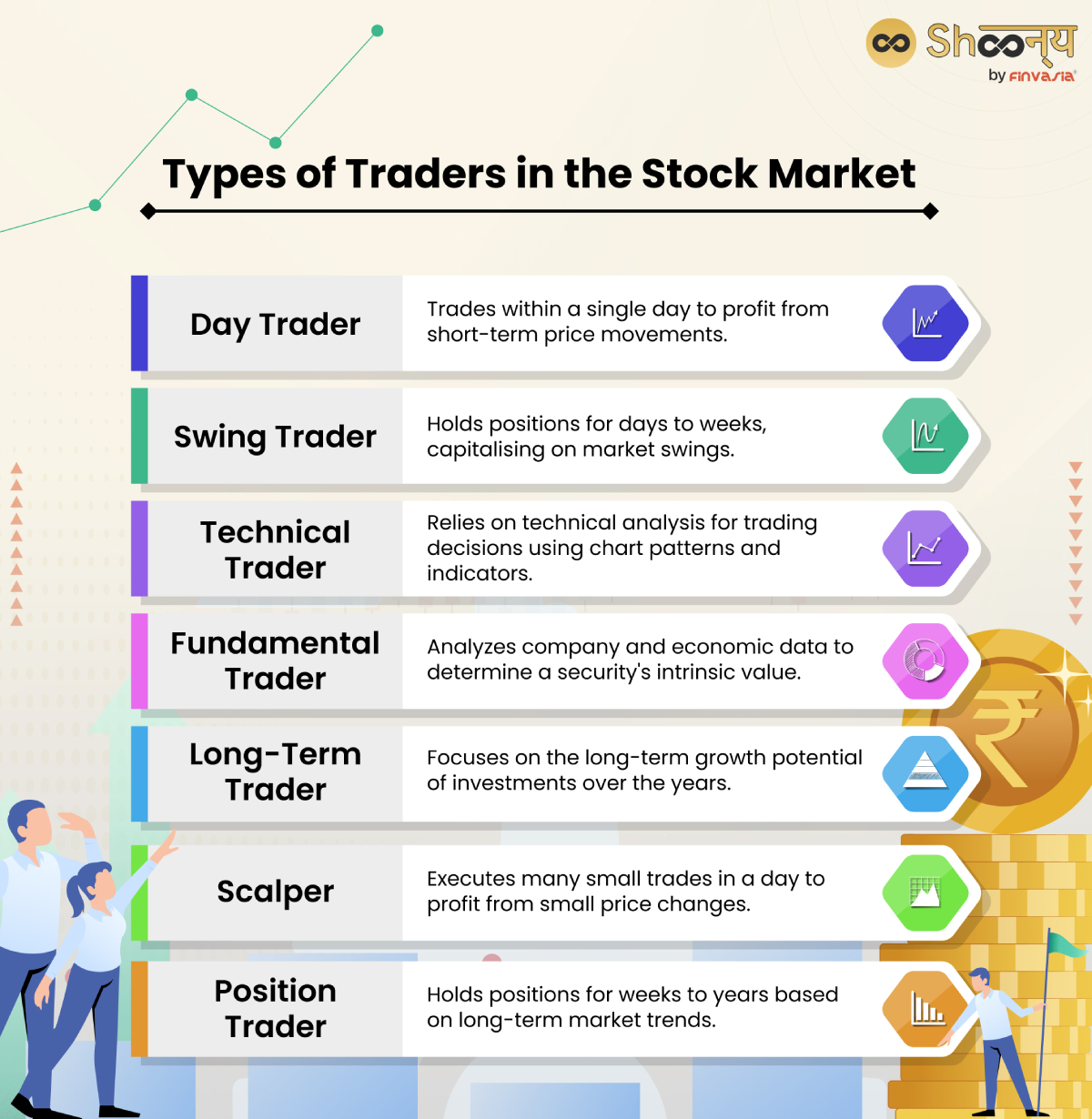

Types of Traders in the Stock Market

There are several types of traders in the market, each with their own strategies, goals, and timeframes.

Here’s a list of different types of traders you might encounter:

Types of Traders in the Stock Market

Some common types include:

- Day Traders

They buy and sell securities within the same trading day, aiming to capitalize on short-term price movements. - Swing Traders

Swing traders hold positions for several days or weeks, aiming to profit from short to medium-term price fluctuations. - Position Traders

Position traders take long-term positions in the market. They hold onto securities for weeks, months, or even years. They base their decisions on fundamental analysis and macroeconomic trends. - Scalp Traders

Scalp traders execute numerous trades in a single day, aiming to profit from small price movements. They typically hold positions for only a few seconds to minutes. - Algorithmic Traders:

These use computer algorithms to execute trades automatically. They base it on predefined criteria, such as price movements or technical indicators. - Trend Traders: Trend traders follow market trends and aim to profit from sustained price movements in a particular direction, either upwards or downwards.

Trend traders enter into a long position when security is trending upward.

Conclusion

In the world of stock trading, there’s a style for everyone. Whether you’re into the quick sprints of day trading or the marathon of long-term investing, each method offers a unique approach.

Find your fit, take the plunge, and may your journey through the bustling Indian stock market be both thrilling and rewarding.

Happy trading!

FAQs | Types of Trading in the Stock Market

The four main types of trading are scalping (very short-term), day trading (single-day), swing trading (intermediate-term), and position trading (long-term).

The best kind of trading depends on individual preferences, capital size, risk tolerance, and time commitment. Day trading is often favoured by most.

There are various types of trades in the stock market, including day trading, scalping, swing trading, momentum trading, and position trading.

The four types of share markets are the primary market (for new securities), secondary market (for existing securities), equity market (for stocks), and derivatives market (for financial contracts based on underlying assets).

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.