If you’re part of the workforce at an Indian multinational like Infosys or Wipro, chances are you’ve encountered ESOPs (Employee Stock Ownership Plans) as part of your compensation package. ESOPs can be a valuable benefit, but they also come with tax implications, especially if you’re an NRI (Non-Resident Indian). Let’s dive into the world of ESOP taxation, exploring how NRIs can navigate the rule book.

Key Highlights: Tax on ESOPs

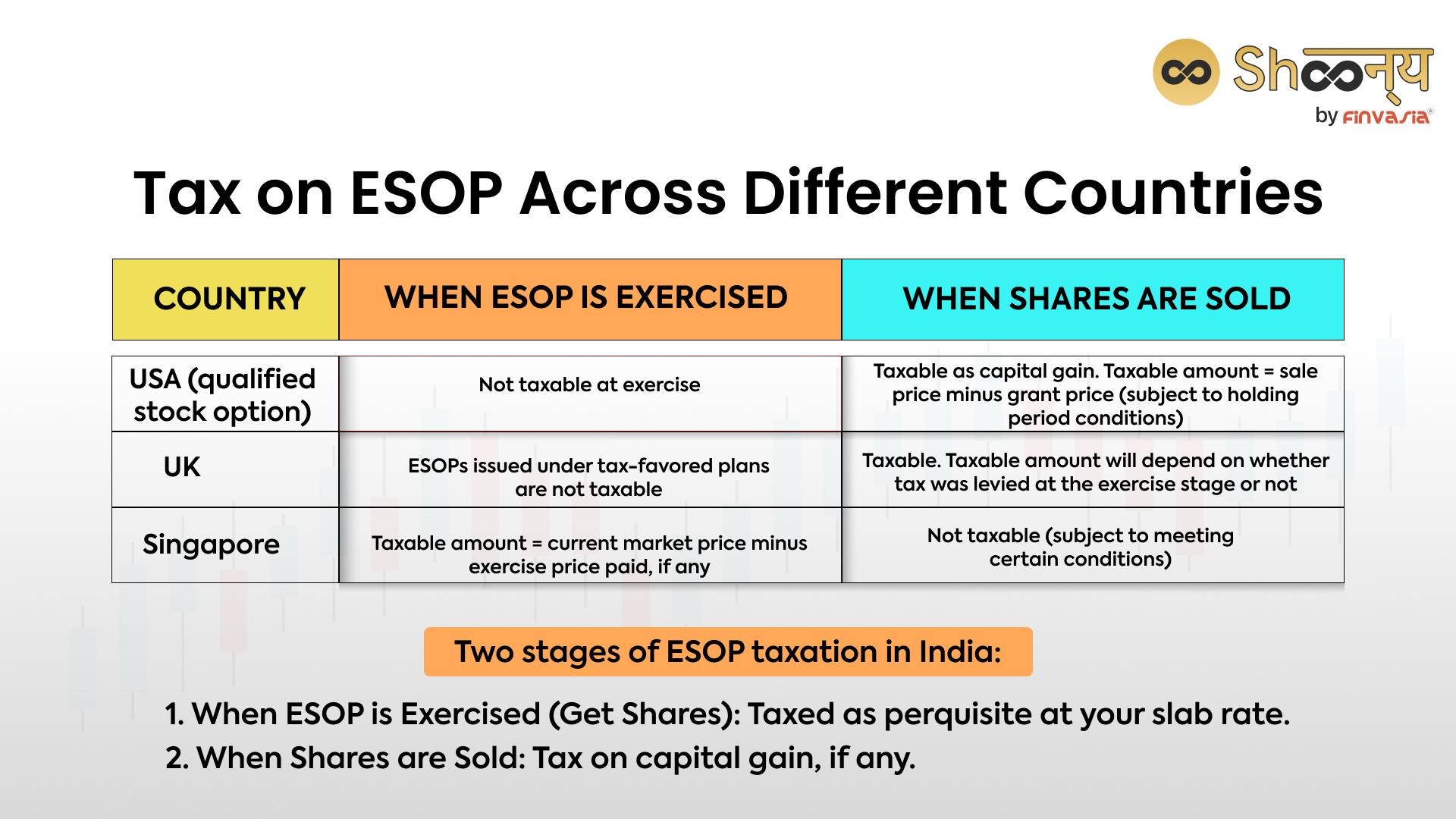

- Taxation at Two Stages: ESOP taxation in India occurs when you exercise your options to buy shares and when you eventually sell those shares.

- ESOP Taxation for NRIs: Understand the unique complexities of ESOP taxation if you’re a Non-Resident Indian (NRI).

- Factors Influencing Taxation: Learn how ESOP taxation depends on the country of grant/exercise and your tax residency.

- Taxation When Exercising ESOPs: Explore scenarios where a portion of ESOP value may be taxable in India and the rest in another country based on tax residency.

- Taxation on Sale of Shares: Capital gains from the sale of Indian company shares are considered India-sourced income, but you may also have obligations in another country.

- Double Taxation Agreements: Discover how Double Taxation Avoidance Agreements (DTAA) affect the taxation of ESOPs and potential tax credits.

- No DTAA Scenario: Learn how Indian tax laws provide relief for doubly taxed income through tax credits on income sourced from other countries.

- Additional Considerations: Explore timing issues in taxation, continued holding of shares, and repatriation of funds, all of which affect ESOP taxation for NRIs.

What are ESOPs

Employee Stock Option Plans (ESOPs) are a popular way companies share ownership with their employees. Here’s how they work in simple terms: As an incentive or a benefit for working at the company, they offer you the option to become a part-owner. This means you get the chance to buy a slice of the company at a lower price than the market value. As you work at the company, you earn the right to exercise your options and buy the shares at a fixed price. Then, when the time is right (usually after a certain period), you can sell the shares and make a profit from the difference between the exercise price and the market price. So, ESOPs are like a special kind of work bonus that makes you not just an employee but also a part-owner of the company, giving you a stake in its success. However, ESOPs also have tax implications and risks involved, as the value of the shares may fluctuate or decline over time.

Understanding the Basics of Tax on ESOPs In India

ESOP taxation in India follows a two-stage process. First, you’re taxed when you exercise your right to buy shares. Second, taxation occurs when you eventually sell those shares. At the initial stage, you’re taxed on the perquisite value based on your income tax slab rate. In the second stage, any capital gains are subject to taxation.

ESOP Taxation for NRIs

For NRIs, tax on ESOPs becomes more intricate. The rules hinge on the taxation regulations of India, the country where the ESOP originated, and your country of residence.

Your tax residency status at the time of exercise also matters.

Factors Affecting ESOP Taxation

Several factors come into play when determining ESOP taxation:

- Country of Grant and Exercise: Taxation depends on the rules of the country (India, in the case of an India-based company) in which the ESOPs are granted/exercised and the country of your tax residency.

- Tax Residency Status: Whether you’re considered a tax resident of India or another country at the time of exercising your ESOPs affects the allocation of taxable value.

- Vesting Period Across Countries: If you’ve resided in multiple countries during the vesting period, the perquisite value may be allocated proportionately.

- Tax Residency of Two Countries: In cases where you qualify as a tax resident in both India and another country, a ‘tie-breaker test’ helps determine your primary place of residence for tax purposes.

Tax on ESOPs in India

ESOPs, also known as Employee Stock Option Plans, are a means for employees to purchase company shares at a discounted rate. In India, the taxation of ESOPs occurs in two phases.

- First, when employees exercise their vested options and acquire shares, the difference between FMV- the fair market value on the exercise date and the purchase price is taxed as a perquisite under the ‘Salary’ category. The FMV is determined following Rule 3 of the Income Tax Rules, 1962.

- Second, when employees sell these shares, the difference between the sale price and the FMV on the exercise date is taxed as a capital gain, either short-term or long-term, based on the holding period.

ESOPs Taxation on Purchase of Shares

When employees purchase shares through an ESOP, they pay an exercise or subscription price, usually lower than the market value. The difference between the market value and the exercise price is treated as a perquisite and added to the employee’s salary income.

Rule 3(8) of ESOP determines market value, considering the average of opening and closing stock prices for listed shares and an internationally accepted pricing methodology by a merchant banker or chartered accountant for unlisted shares.

ESOPs Taxation on Sale of Shares

When employees sell shares obtained through ESOPs, they must pay tax on the profit or gain. This gain is calculated as the difference between the sale price and the market value on the exercise date. Like the taxation on purchase, market value is determined in the same manner.

· The gain is classified as either short-term or long-term based on the holding period, with different tax rates for equity-oriented and debt-oriented funds.

· Short-term capital gains are taxed at 15% for equity-oriented funds and per the income tax slab rate for debt-oriented funds.

· Long-term capital gains are taxed at 10% (without indexation) for equity-oriented funds and 20% (with indexation) for debt-oriented funds

Note: This is only applicable to listed securities. For unlisted securities, the tax rate is 20% (with indexation) for both equity and debt-oriented funds.

Illustrative Scenarios

Let’s illustrate this complexity with two scenarios.

Scenario 1:

Mr X, originally based in India, later transferred overseas. When he exercises his ESOPs after a vesting period split between India and the other country, taxation becomes dual. A portion of the perquisite value linked to his Indian employment period is taxable in India, and the rest is taxable in the other country. However, if Mr X is an Indian tax resident during exercise, the entire perquisite value is taxed in India, with the possibility of claiming credit for taxes paid in the other country.

Scenario 2:

Ms Y works exclusively in the overseas office of an Indian company and is granted ESOPs. Her taxation follows the laws of the country where she works, but if she qualifies as an Indian tax resident, she may face taxation in India as well, with the option to claim the foreign tax credit.

How to Save Tax on ESOPs

Here are some practical ideas on how to save tax on ESOPs:

- Understand the Tax Treatment: In India, ESOPs are subject to taxation at two stages. Firstly, when you exercise your options and acquire the shares, the difference between the fair market value (FMV) of the shares at that time and the exercise price you paid is treated as a perquisite and taxed as part of your salary income. Secondly, when you sell the shares, the difference between the sale price and the FMV on the date of exercise is considered capital gains and taxed accordingly.

- Timing is Key: The timing of exercising and selling your ESOPs can significantly impact your tax liability. Ideally, you should exercise your options when the FMV of the shares is low and sell them when it’s high. This strategy can help reduce your perquisite income and increase your capital gains. However, make sure to consider various factors like market conditions, vesting period, lock-in period, and holding period before making your decision.

- Utilize Deductions and Exemptions: You have the opportunity to claim deductions and exemptions to reduce your tax burden on ESOPs. For instance, you can avail of a deduction of up to ₹1.5 lakh under Section 80C by investing in specified instruments like ELSS funds, PPF, and NSC.

- Consider Deferred Taxation: If you work for an eligible start-up, you can opt for deferred taxation of ESOPs under Section 80-IAC of the Income Tax Act. This means you can delay paying tax on perquisite income from ESOPs until five years from the date of exercise or until you leave the company or sell the shares, whichever comes first. This approach can help you manage your cash flow effectively and potentially benefit from the future appreciation of share value.

Capital Gains Taxation

Capital gains from selling shares of an Indian company are consistently treated as India-sourced income, regardless of tax residency. Nevertheless, DTAA (Double Taxation Avoidance Agreement) or the tax laws of another country can influence whether you need to pay taxes in both countries or claim tax credits.

DTAA Impact

In cases where a DTAA is in place, the taxation of capital gains may vary.

- For instance, under the US-India DTAA, the capital gain will be taxed in both countries, but tax credit can be claimed in the resident country.

- Meanwhile, under the Singapore-India DTAA, the taxation depends on the acquisition date of shares.

- Under the UK-India DTAA, the taxation of capital gains depends on whether the shares are substantially and regularly traded on a recognised stock exchange or not. If they are, the capital gain is taxable only in the country of residence of the seller. If they are not, the capital gain is taxable in both countries, but tax credit can be claimed in the country of residence.

No DTAA Scenario

Even without a DTAA, Indian tax laws provide relief for tax residents on doubly taxed income through tax credits, but this applies solely to income sourced from another country.

Conclusion: Additional Considerations for Tax on ESOPs

Timing differences in taxation between countries, continued ownership of shares, and the repatriation of funds further complicate ESOP taxation for NRIs. Thus, seeking professional advice becomes crucial to navigate these intricacies effectively.

ESOP taxation can be a complicated journey, especially for NRIs. With the right guidance, you can maximise the benefits of ESOPs while managing your tax obligations across borders.

FAQs| Tax on ESOPs

Tax on ESOPs is calculated at two stages: when the shares are allotted to the employee and when the employee sells them. The first stage involves taxing the difference between the fair market value (FMV) and the amount paid by the employee as a perquisite. The second stage taxes the difference between the sale price and the FMV as capital gains.

Yes, ESOP is taxable income for employees. The value of securities allotted under an ESOP scheme is treated as a perquisite and taxed as salary income, calculated as FMV at exercise minus the amount paid by the employee.

No, TCS does not apply to ESOP because it’s not a sale transaction between a seller and a buyer but an allotment of securities by an employer to an employee.

No, ESOP is not double-taxed. Tax is levied at different stages on different values – perquisite value and capital gain value.

While you can’t completely avoid capital gains tax on ESOP, you can reduce it by holding shares for a longer period, using indexation benefits, investing in specified bonds or funds, or setting off capital losses against capital gains.

Rule 3(8) of ESOP is a provision in the Income Tax Rules, 1962, determining the FMV of unquoted equity shares under ESOP schemes. It requires valuation by a merchant banker or chartered accountant using internationally accepted pricing methodology on an arm’s length basis.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.