Universal Account Number: Meaning, Activation, Services, and Benefits

The Universal Account Number (UAN) is a unique identification number given to employees who contribute a portion of their income to the Employee Provident Fund (EPF). The Employees’ Provident Fund Organisation- EPFO is responsible for allocating UANs.

In this blog, we will take an in-depth look at the meaning and the very purpose of the UAN-Universal Account Number, the services it offers, UAN benefits, and how you can find or get a UAN number.

UAN-Universal Account Number Explained

UAN, a 12-digit identifier assigned by the Government of India under the Ministry of Employment and Labor, is crucial for members of the Employee Provident Fund (EPF). This unique number remains constant throughout an employee’s professional journey, linking all member IDs across different jobs.

The UAN acts as a central identifier linked to your EPF. It’s designed to streamline and simplify the management of multiple Member IDs assigned by different organisations. The primary aim is to consolidate all Member Identification Numbers (Member IDs) under a single UAN.

Key Points Related to Your Universal Account Number

Registration and UAN Activation

· To get a UAN, individuals need to register with the EPFO.

· Activation allows you to access and manage your UAN-related information.

Benefits of UAN

· Simplified Tracking: UAN serves as a centralised platform to view details of each associated Member ID.

· Easy Job Transitions: When switching jobs, you must provide your existing UAN to link the new Member ID to your UAN. This helps in the seamless maintenance of all the data.

Importance of Universal Account Number (UAN)

A Universal Account Number (UAN) brings together all your member IDs in one place. If your company deducts and contributes to an employee provident fund, you’ll receive a UAN that accumulates member IDs from different employers. UAN is crucial for the following reasons:

- Employees have only one unique UAN throughout their entire professional career.

- Acts as an umbrella where all PF accounts reside, making it easier for employees to track.

- Essential for checking credits and debits in the PF account.

- Online UAN processing allows access to the account anytime, anywhere.

How to Get UAN Number

When you start working for a company and contribute to the Provident Fund (PF), your first employer usually creates a Universal Account Number (UAN) for you. They’ll ask for some documents during this one-time process. Once the UAN is made, it stays the same for your entire working life.

It’s important to note that not all employers have to contribute to the provident fund. Only organisations with 20 or more permanent employees are required to generate UANs for their workers.

Documents Required to Get UAN

The following documents are required for UAN registration and authentication:

- Bank account information, including the IFSC code, account number, and branch name.

- The PAN Card: Your PAN must be linked to the UAN.

- Employees’ State Insurance Corporation (ESIC) Card.

- The Aadhaar Card: Because the mobile number and bank account are linked to your Aadhaar card, it’s required to be provided in order to obtain a UAN.

- Proof of identity, for instance, your Aadhaar Card, Voter ID, Passport, Driving License, etc., must be submitted.

To create a new UAN for an employee, the employer should go through these steps:

- Collect Information: Gather essential details like PAN, Aadhaar, bank account, and other necessary information from the new employee who doesn’t have a UAN.

- EPF Employer Portal Login: Login to the EPF Employer Portal using the establishment ID and password.

- Register Individual: In the “Members” section, click on the “Register Individual” tab.

- Enter Employee Details: Input the collected details from the employee.

- Approval of Details: Approve all the entered details in the “Approval” section.

- UAN Creation: The EPFO generates a new UAN, and the employer can link the PF account with the employee’s UAN.

Please note that the Aadhaar card will no longer be accepted as proof of date of birth, following a directive from the UIDAI.

How to find UAN number

After the employer generates the UAN, an employee can get the UAN number in the following ways:

To find your UAN, you can inquire with your employer, check salary slips, visit the EPFO website, or use the EPFO WhatsApp helpline.

Ask Your Employer

You must contact your employer/ human resources department to get your UAN number. Also, as said, most of the time, it is available on your payslip or salary slip.

Check UAN Website

If your employer doesn’t provide the UAN, you can check it online using your PF number or member ID. Follow these steps:

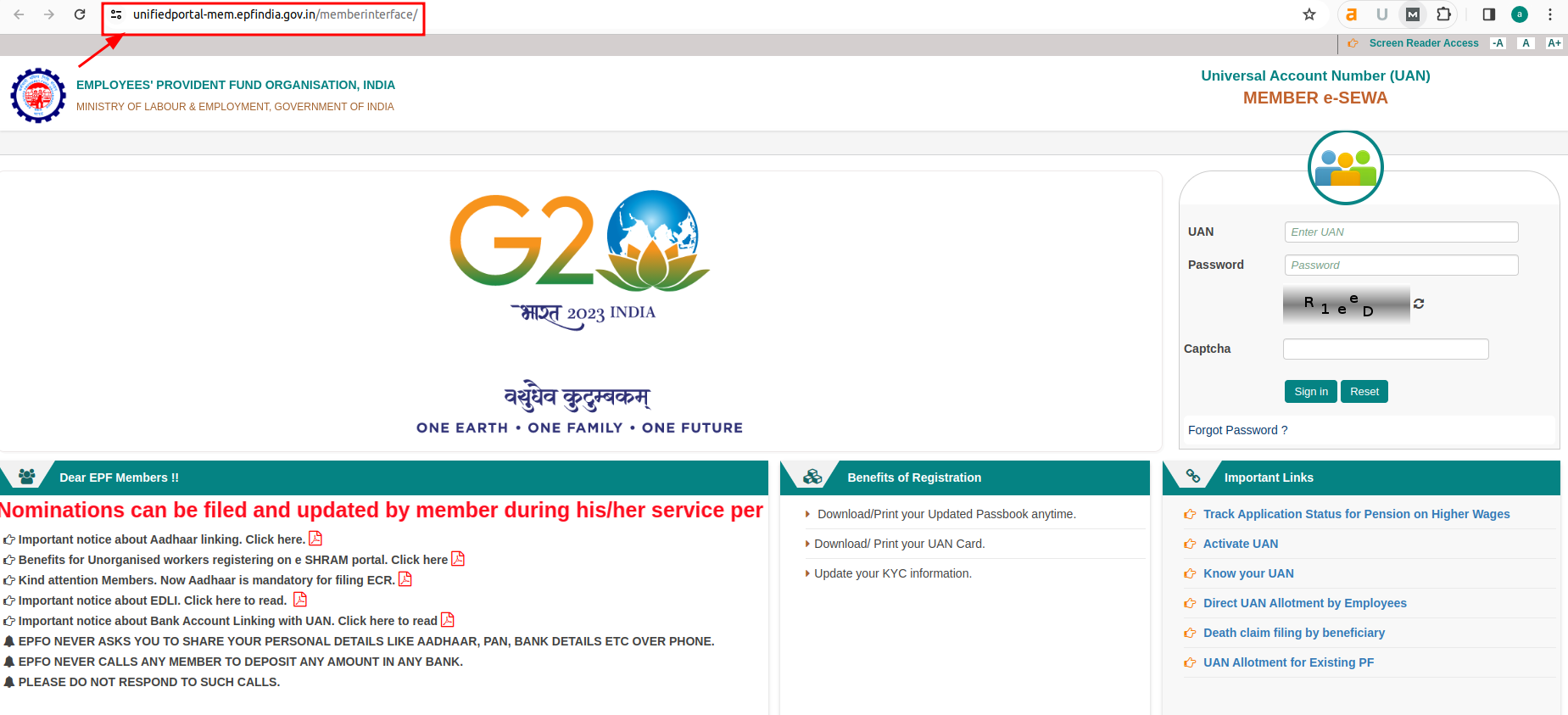

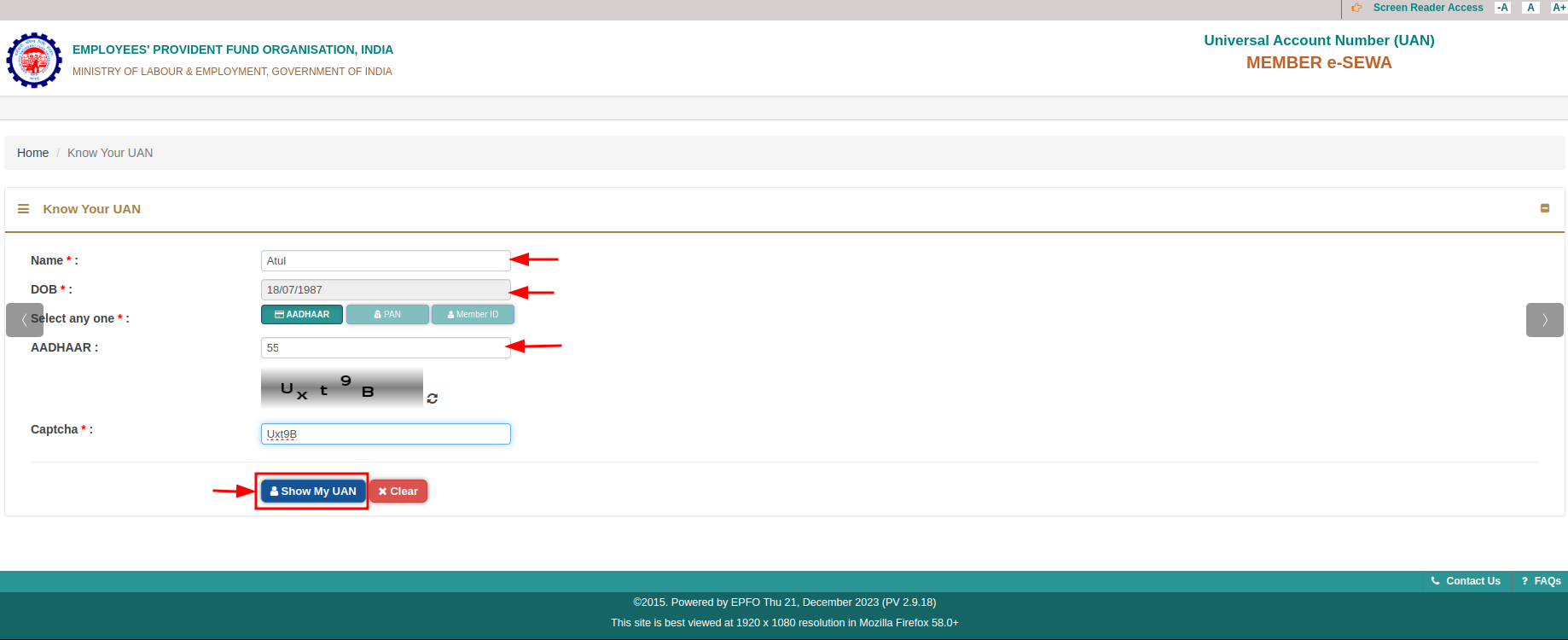

- Visit the UAN portal.

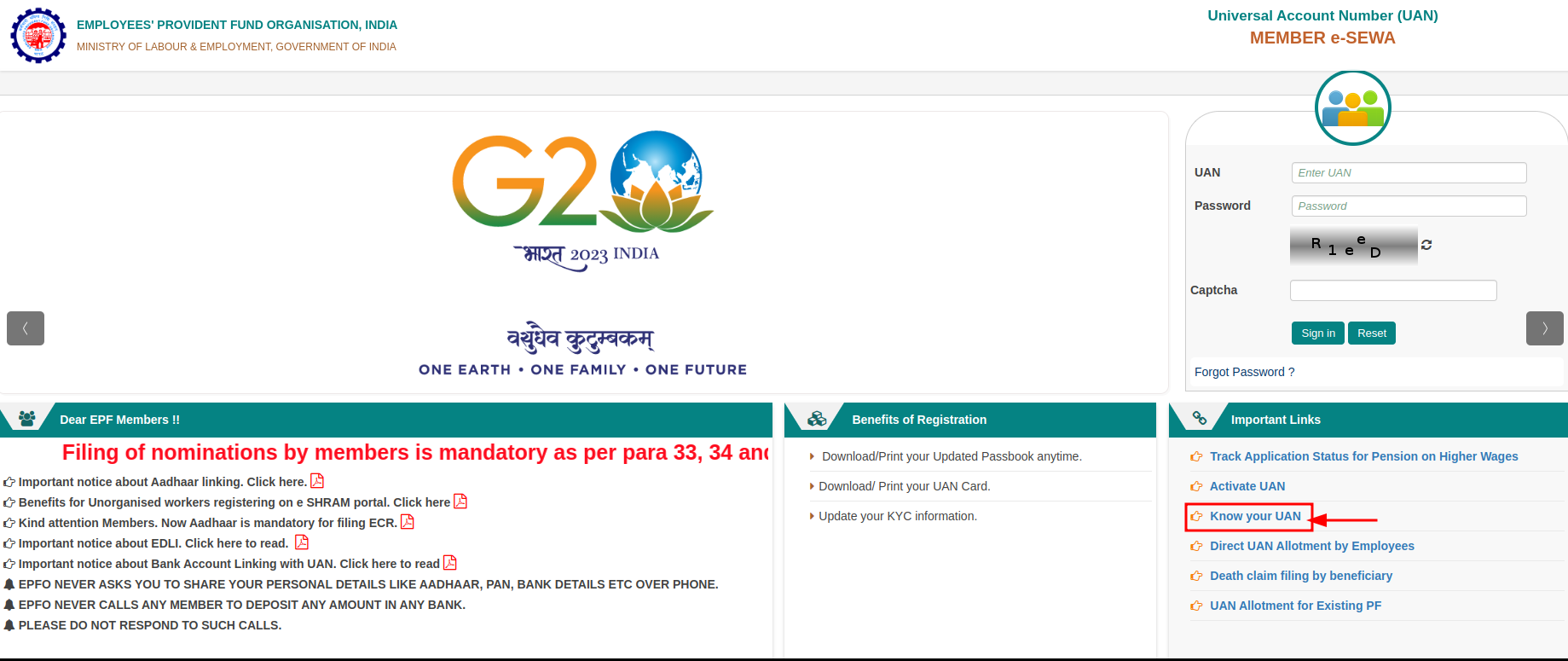

2. Click on the “Know your UAN” tab under the ‘Important Links’ section on the bottom right of the page.

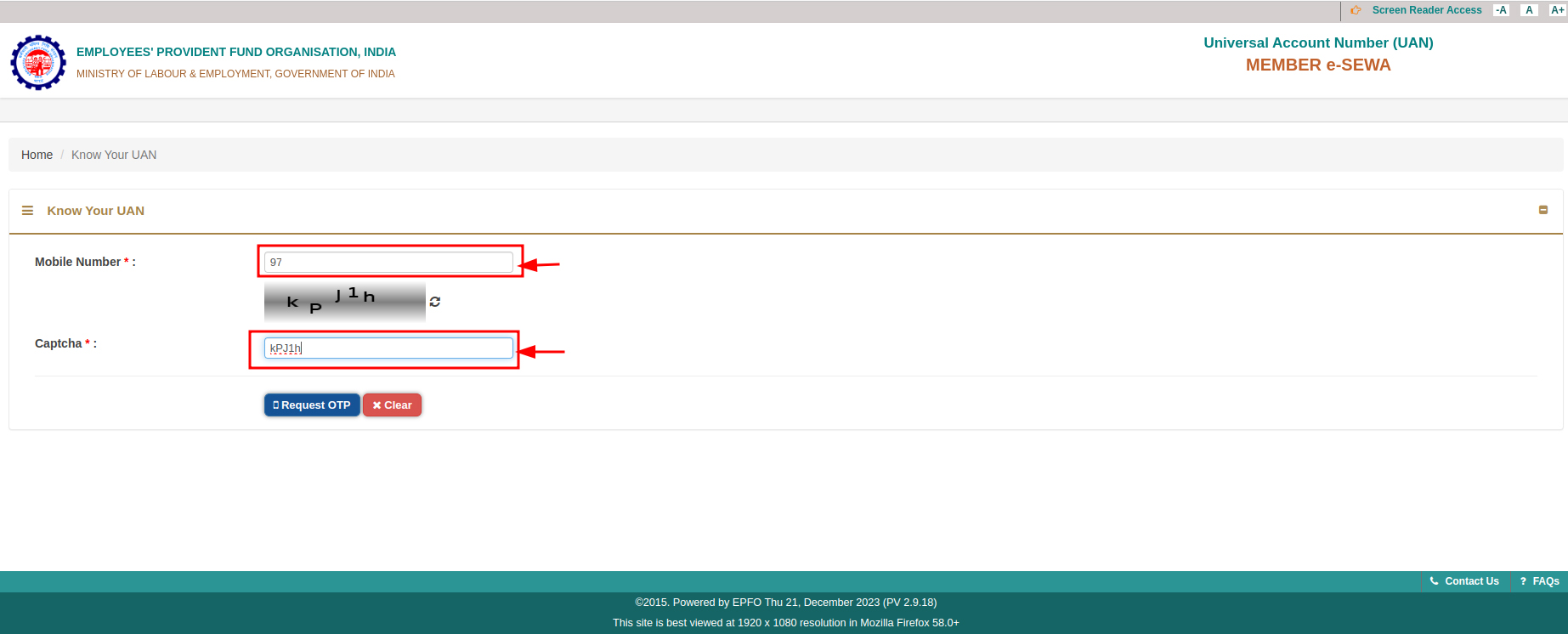

3. Follow the instructions, provide necessary details like mobile number and fill in the captcha.

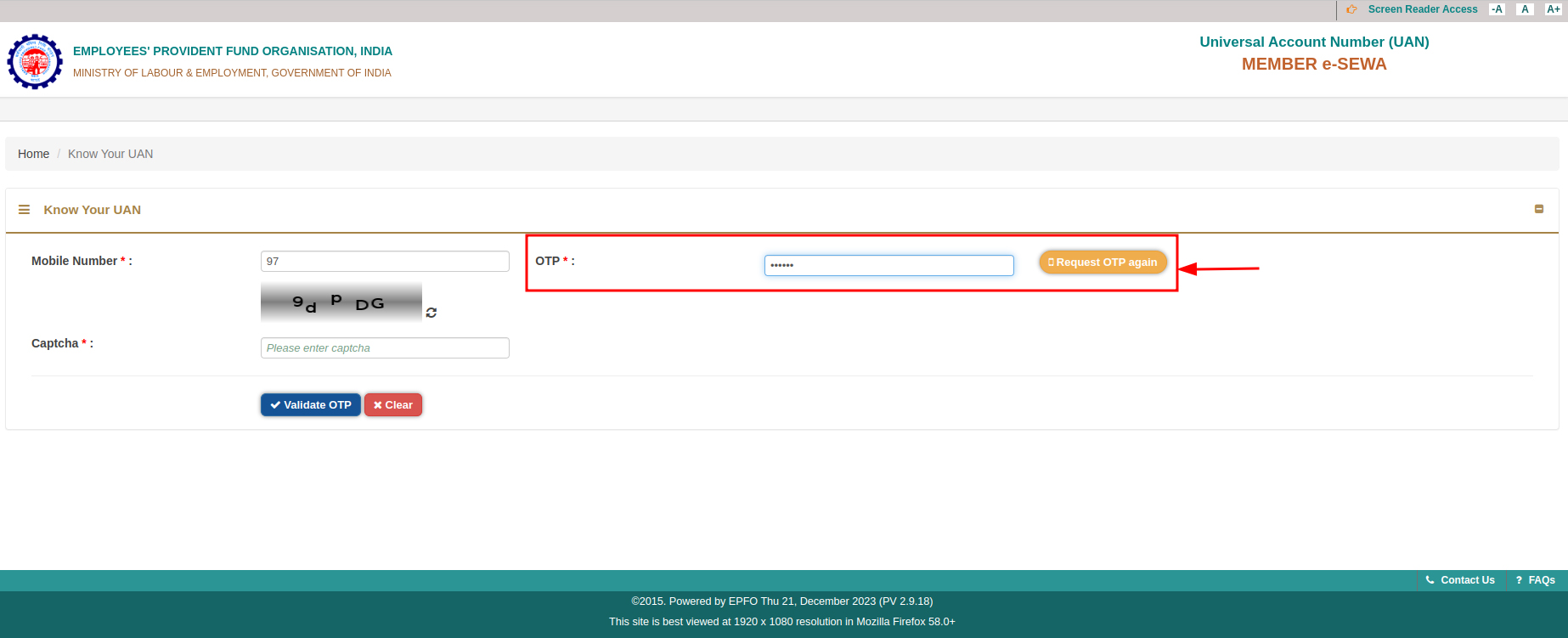

4. Enter the received OTP on your RMN-registered mobile number. Click on “Validate OTP.”

5. Now, enter your mandatory details like name, DOB, Aadhaar card number, and captcha. Next, click on ‘Show my UAN’.

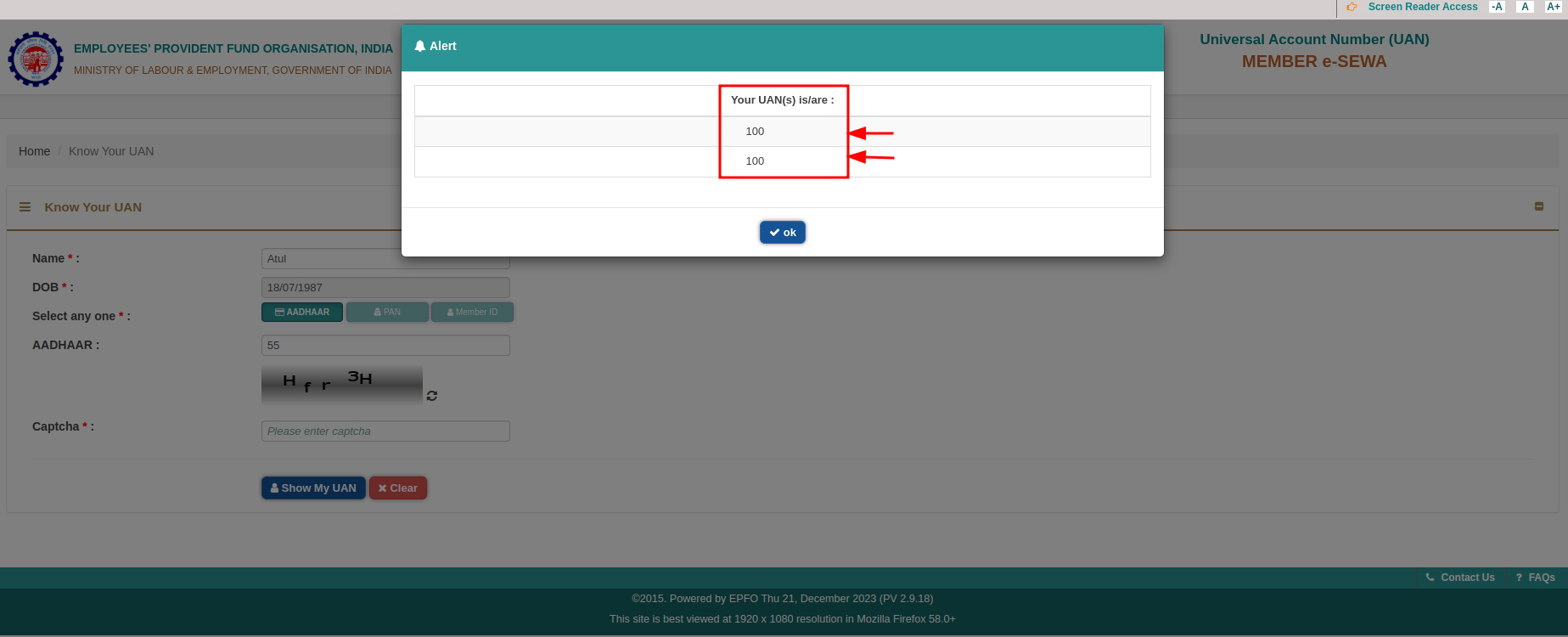

6. A pop-up screen shall display your UAN number.

UAN Activation

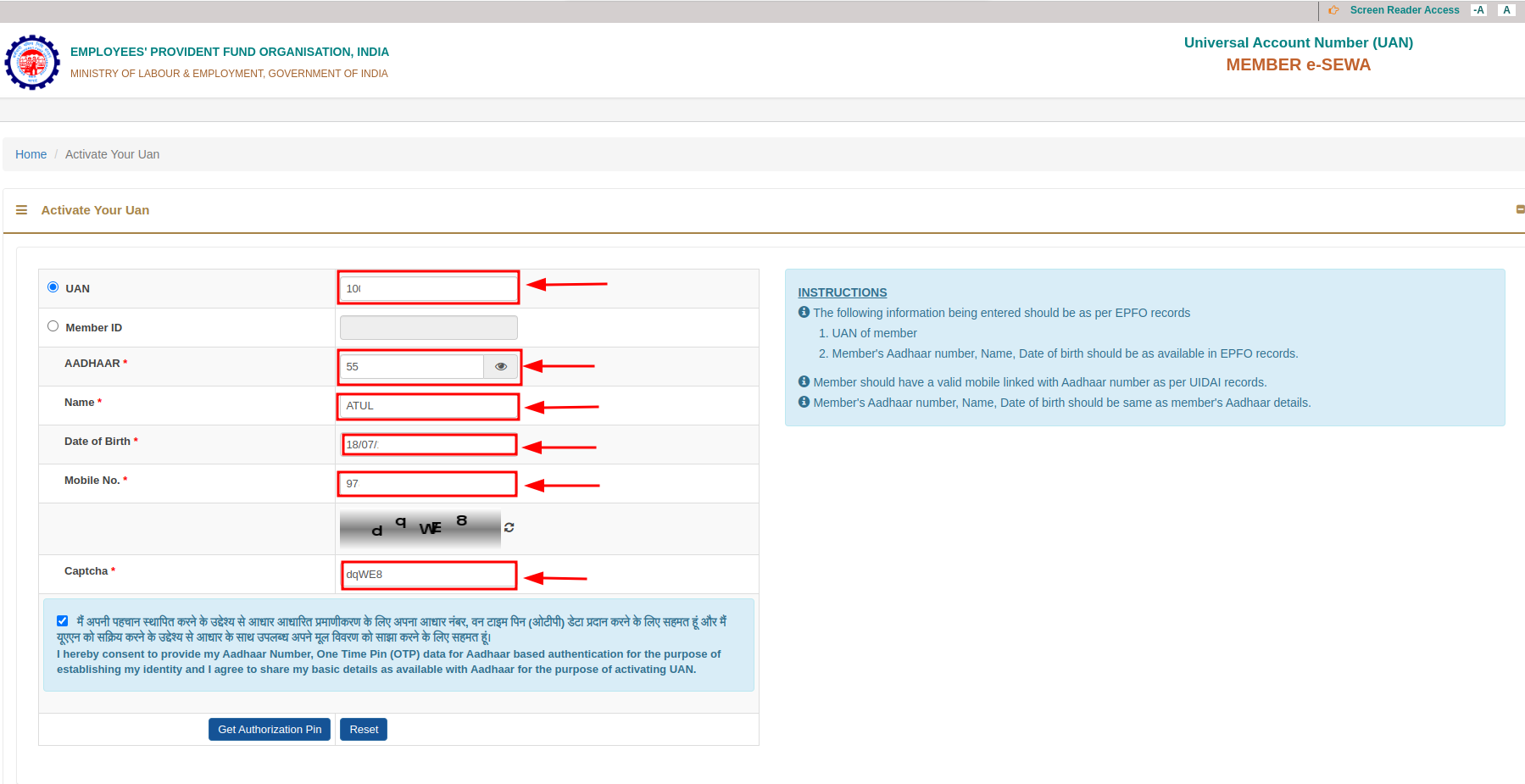

Before using the EPFO portal to access EPF-related online services, UAN activation is a must. Without activation, you cannot use the online features provided by EPFO. To enable Universal Account Number, follow these steps:

- Visit the EPFO portal.

2. From the top menu, under the “Services” section, click on the “For Employees” tab.

3. Next, click on ‘Member UAN/Online Service (OCS/OTCP)’ from the services tab at the bottom of the page.

4. You will be directed to the UAN portal after clicking on the “Member UAN/Online services.”

5. Next, under ‘Important Links,’ click on ‘Activate your UAN.’

6. Now, enter all the details as mentioned in the form, like UAN, name, date of birth, mobile number, Aadhaar number, and captcha.

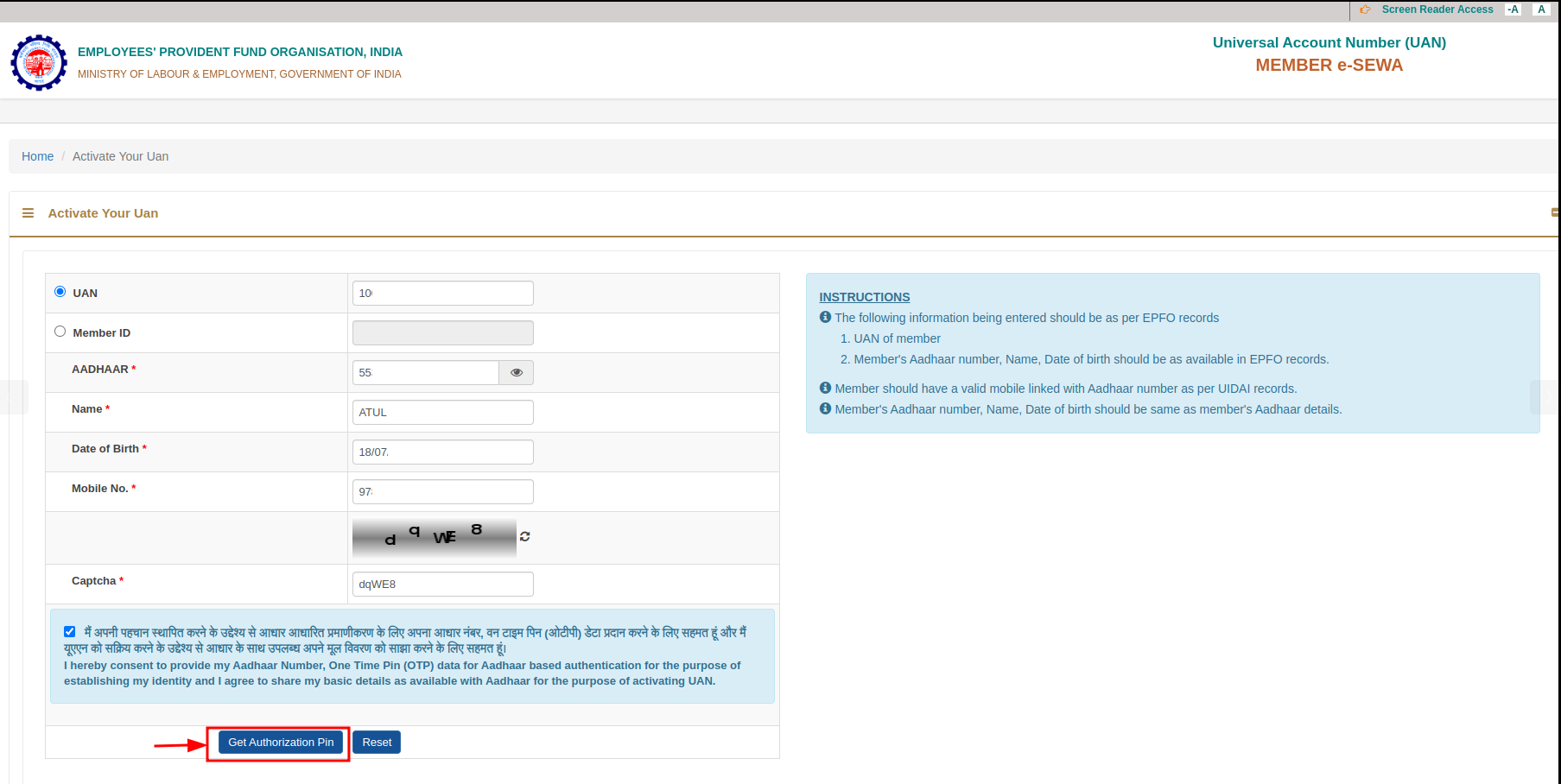

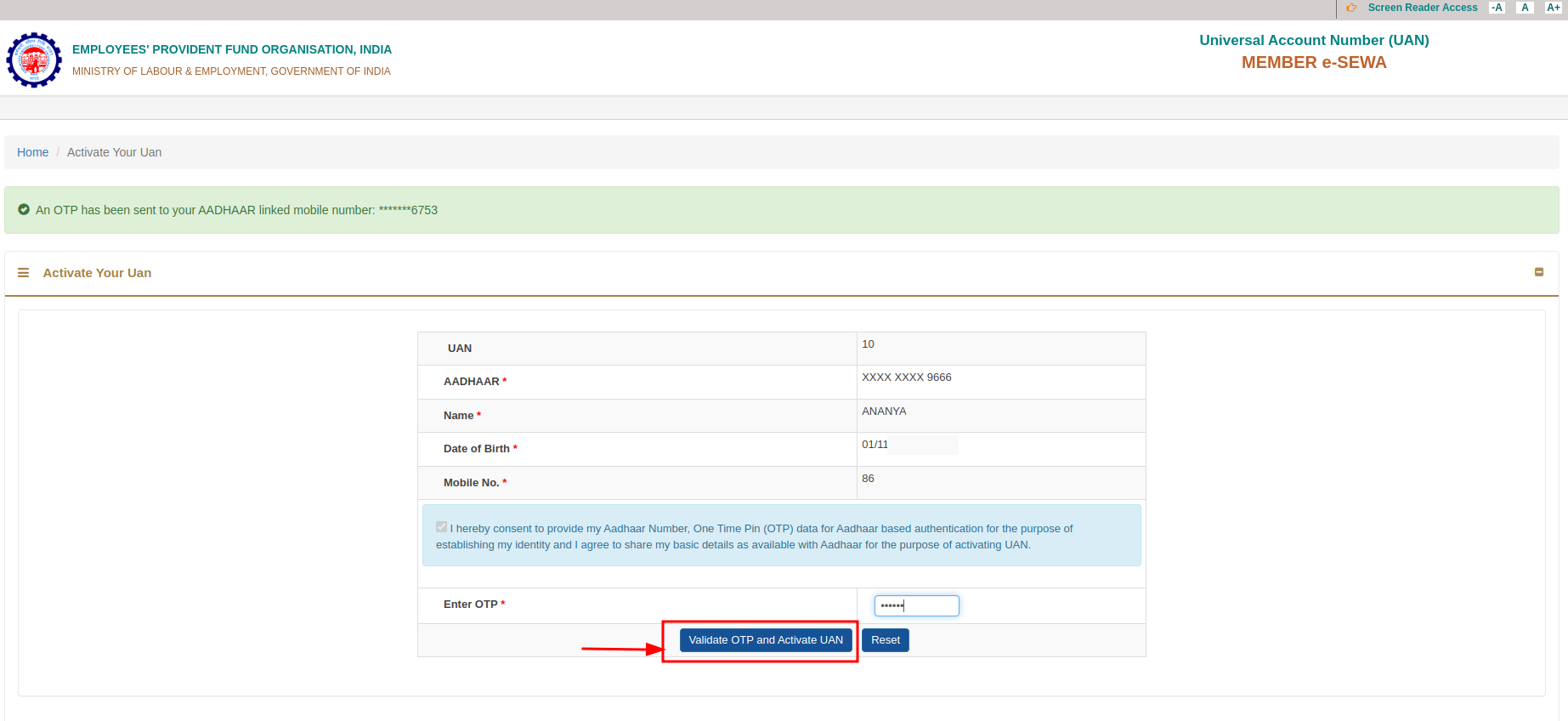

7. Click on the “Get Authorization PIN” option to get the OTP on your registered mobile number.

8. Click on the “I Agree” checkbox and enter the OTP. After that, click on “Validate OTP and Activate UAN.”

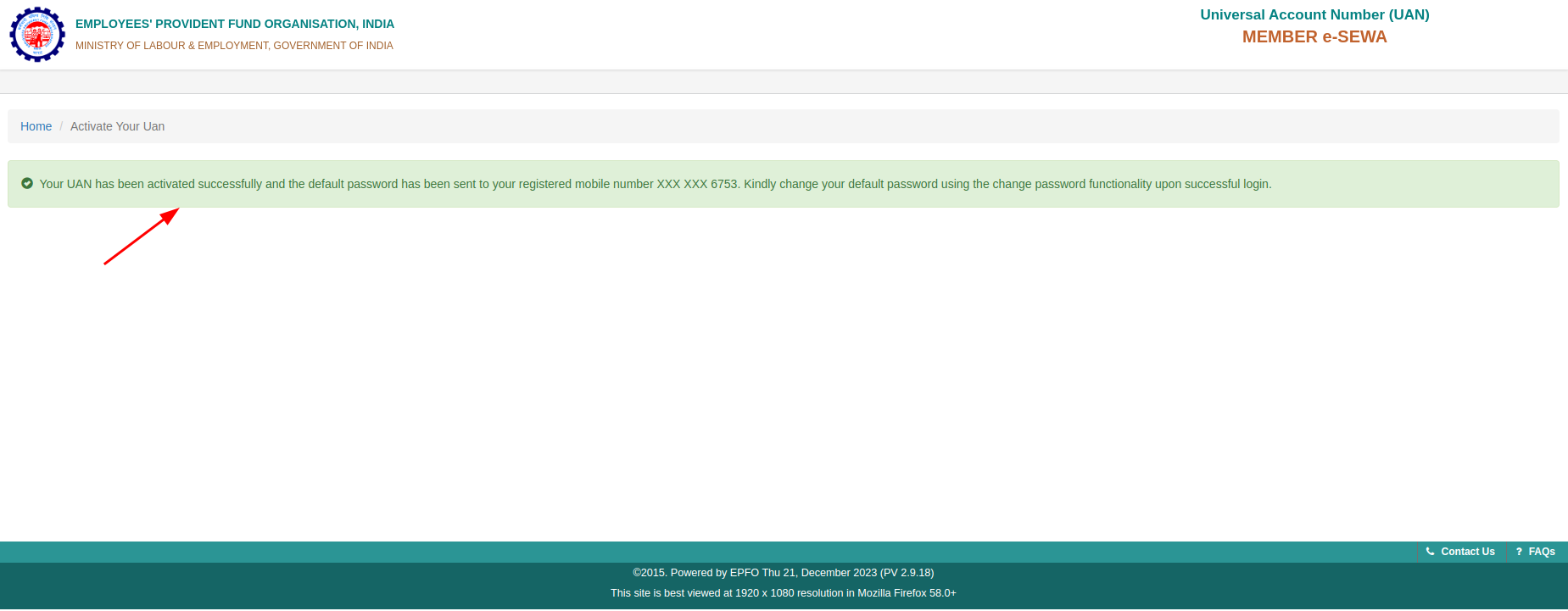

9. A message will be displayed on your screen about your successful UAN activation. You access the UAN account with the password received on the registered mobile number.

You must also gather the following documents to provide at the time of UAN activation. Usually, the employer takes them from the employee while first creating the UAN.

- Aadhar Card

- PAN Card

- Bank Account details and KYC

- Any other identity or address proof, if required.

How to do UAN Login

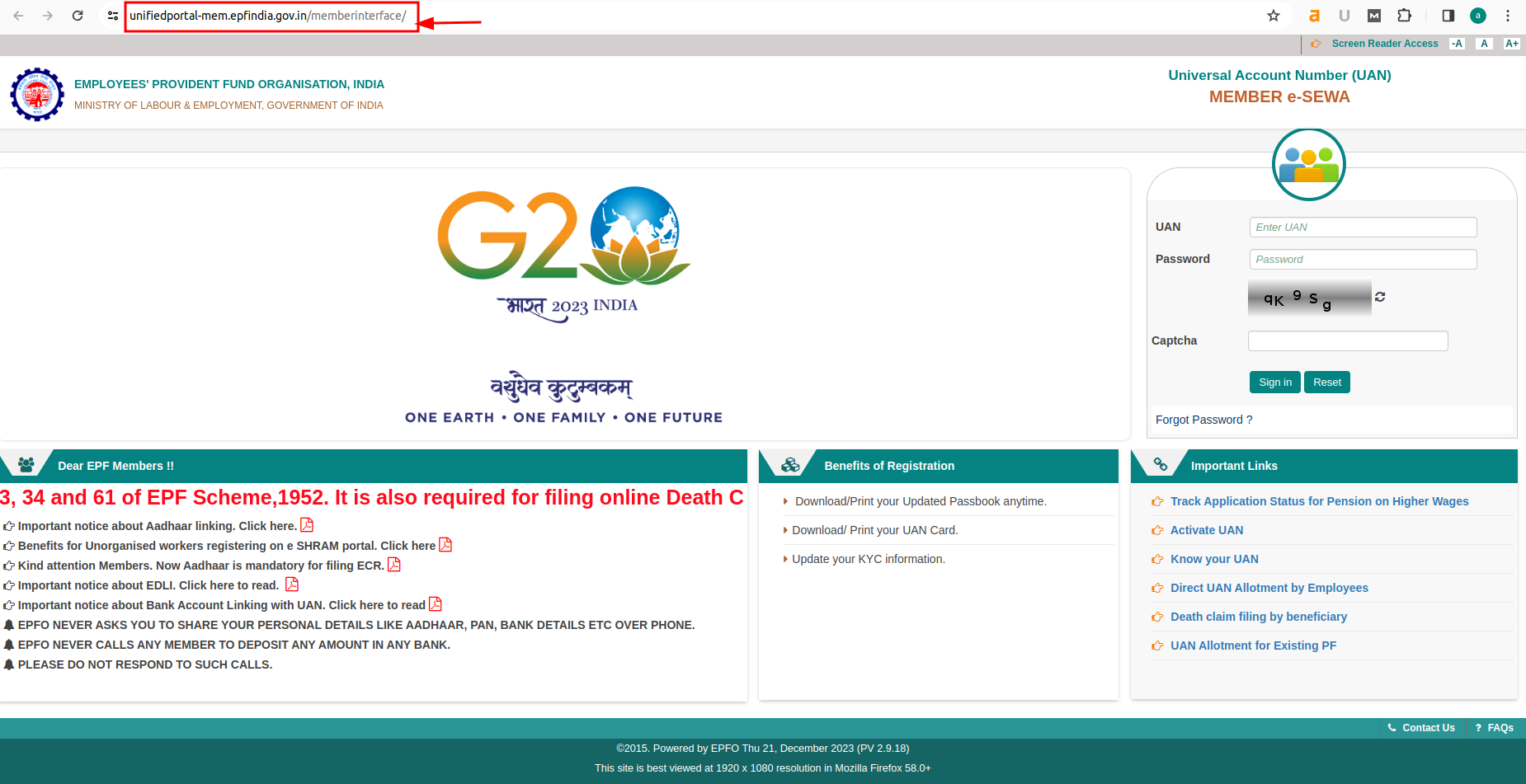

After the successful UAN activation, you can easily log in to the UAN Member e-SEWA Portal. This allows you to access various services like viewing your UAN card, profile, and service history. Follow these basic steps to log in to the EPFO member portal:

- Visit the UAN Member e-Sewa page.

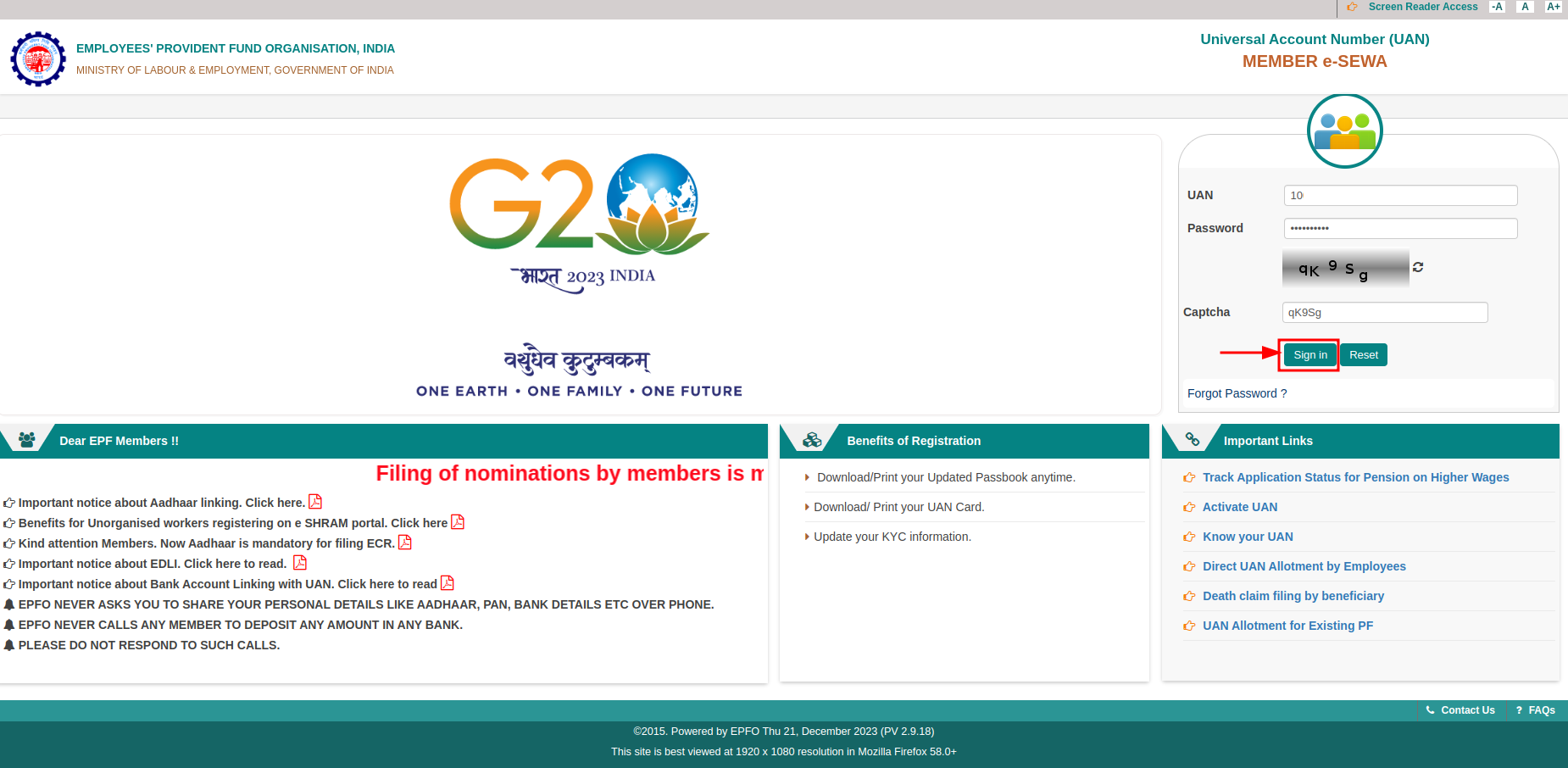

2. Enter your UAN, password, and captcha code.

3. Click on “Sign in” to access your EPF account.

What can be done if wrong information is mentioned on your EPF card?

If there are inaccuracies in your EPF card, such as errors in your name, father’s name, or date of birth, you can rectify it by submitting valid documents to your current employer. Additionally, you can inform the EPFO helpdesk to facilitate the necessary corrections on your UAN card.

Please note that the Aadhaar card will no longer be accepted as proof of date of birth, following a directive from the UIDAI.

Other Services Offered by EPFO Portal that You Can Access using UAN

The EPFO portal is a website that offers different online services related to the Employees’ Provident Fund (EPF) and the Universal Account Number (UAN). Here are some services provided by the EPFO portal regarding UAN:

- UAN Card and Passbook:

- Log in to your UAN account to download or print your UAN card and EPF passbook.

- The UAN card has your UAN, name, KYC status, and QR code.

- The EPF passbook contains details like balance, contributions, interest, and withdrawals.

To download your UAN card online, follow these steps:

- Visit the UAN portal and log in with your UAN number and password.

- Enter the captcha code and click on ‘Sign in.’

- Under the ‘View’ tab, select the ‘UAN Card’ option.

- The linked card will be displayed.

- Click on ‘Download UAN card.’

- Save a digital copy or print the card for your records. This simple process ensures easy access to your UAN card whenever needed.

2. KYC Update:

- Log in to your UAN account and click on “Manage” then “KYC.”

- Upload scanned copies of KYC documents (Aadhaar, PAN, bank account, etc.) for verification.

- Updating KYC information enables access to services like PF transfer, withdrawal, and claim settlement.

Please note that the Aadhaar card will no longer be accepted as proof of date of birth, following a directive from the UIDAI.

3. PF Transfer and Withdrawal:

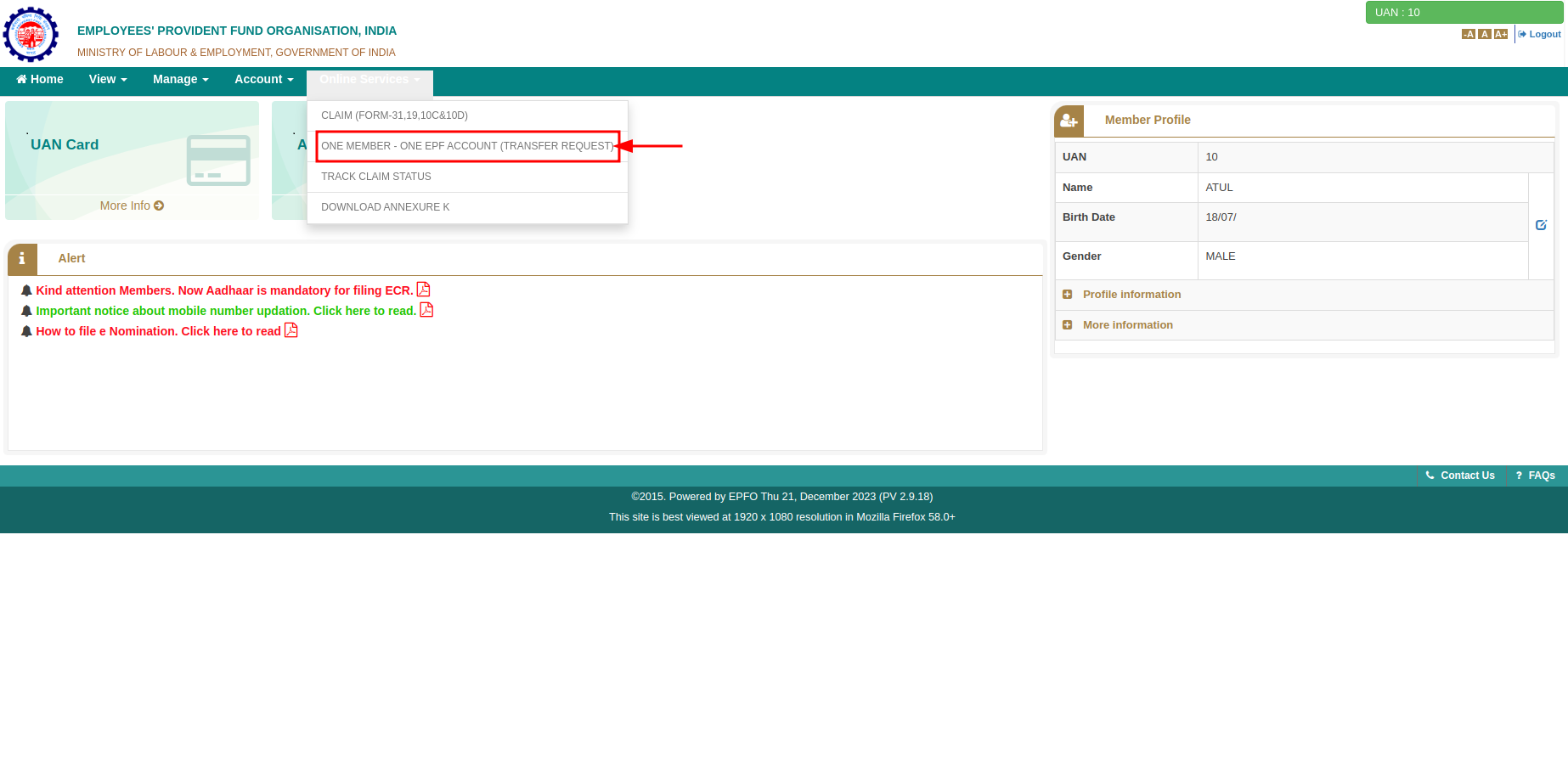

- Log in to your UAN account and click on “Online Services,” then “One Member – One EPF Account” or “Claim (Form-31, 19, 10C & 10D).”

- Enter personal and bank details, select the PF account for transfer or withdrawal, and submit the required documents.

- Obtain approval from your employer or the EPFO.

- Check the status of your transfer or withdrawal request online.

4. Claim Filing and Tracking:

- Log in to your UAN account and click on “Online Services” then “Track Claim Status.”

- File a claim for reasons like retirement, death, disability, illness, education, marriage, etc.

- Fill out the relevant form, submit the required documents, and get approval from your employer or the EPFO.

- Track the progress of your claim online and receive updates via SMS or email.

How to Transfer EPF Accounts Using UAN

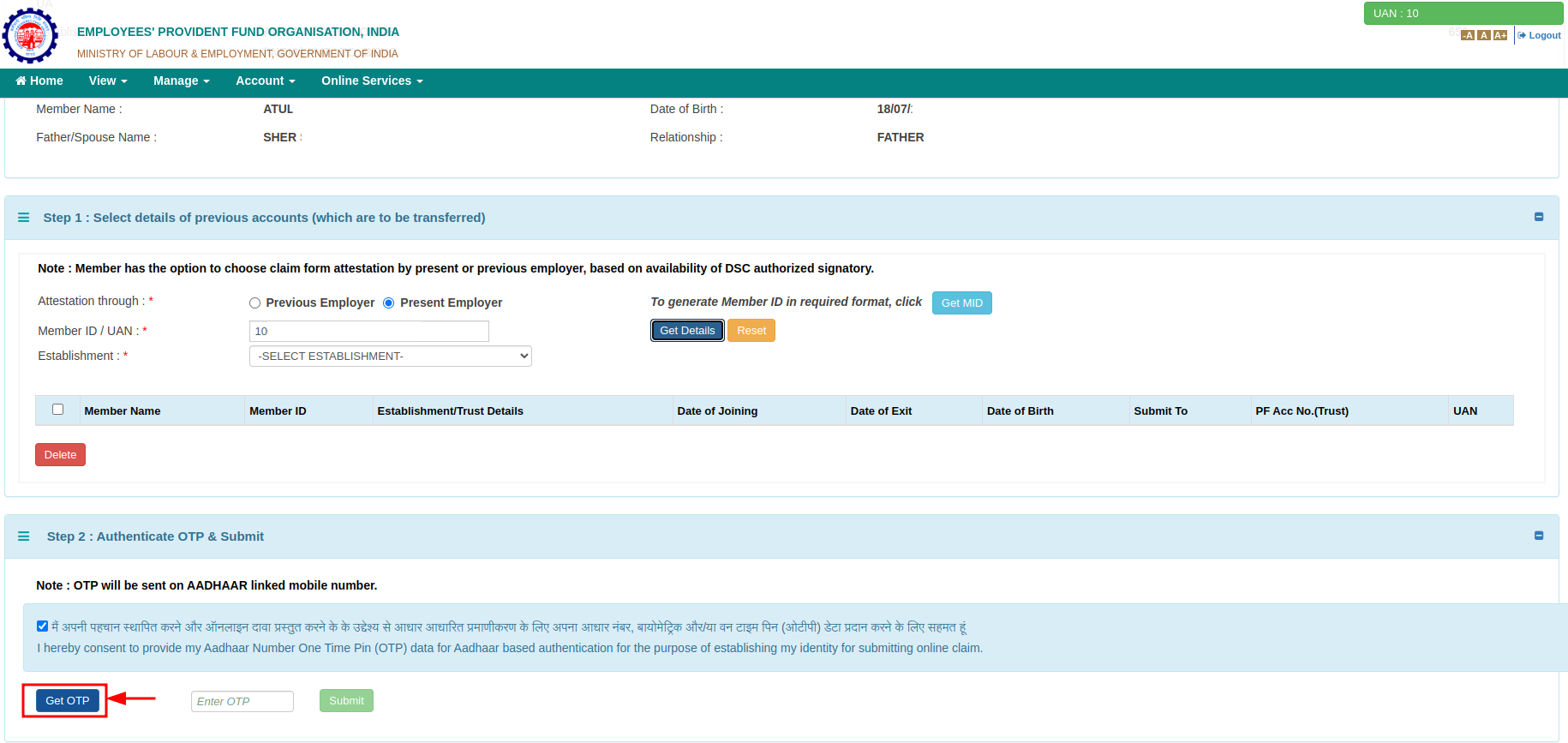

To transfer your EPF online, follow these steps:

- Log in to the EPFO Member e-Sewa portal using your UAN and password.

2. In the “Online Services” section, select “One Member – One EPF Account (Transfer Request).”

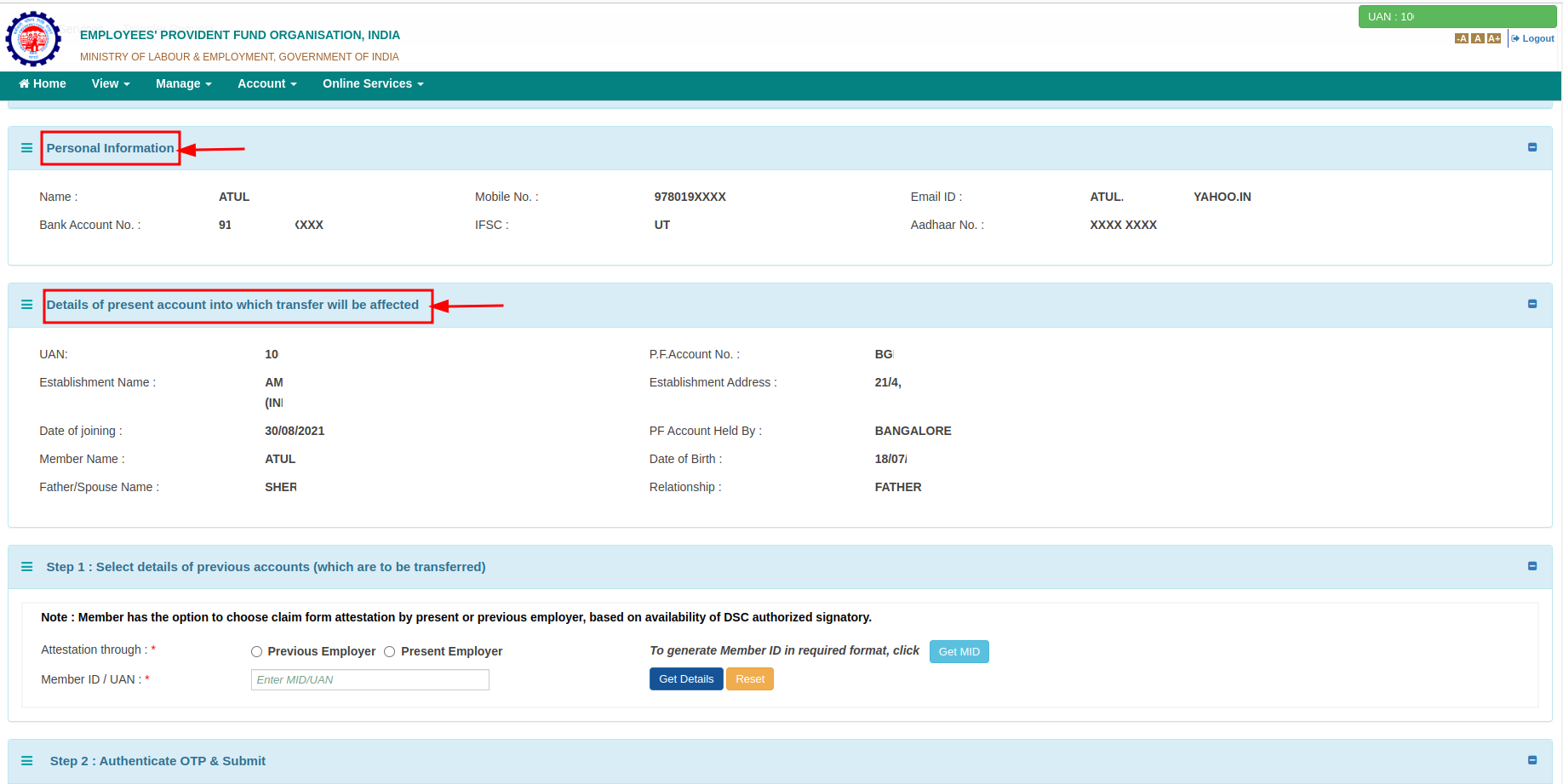

3. Verify personal info and existing PF account details.

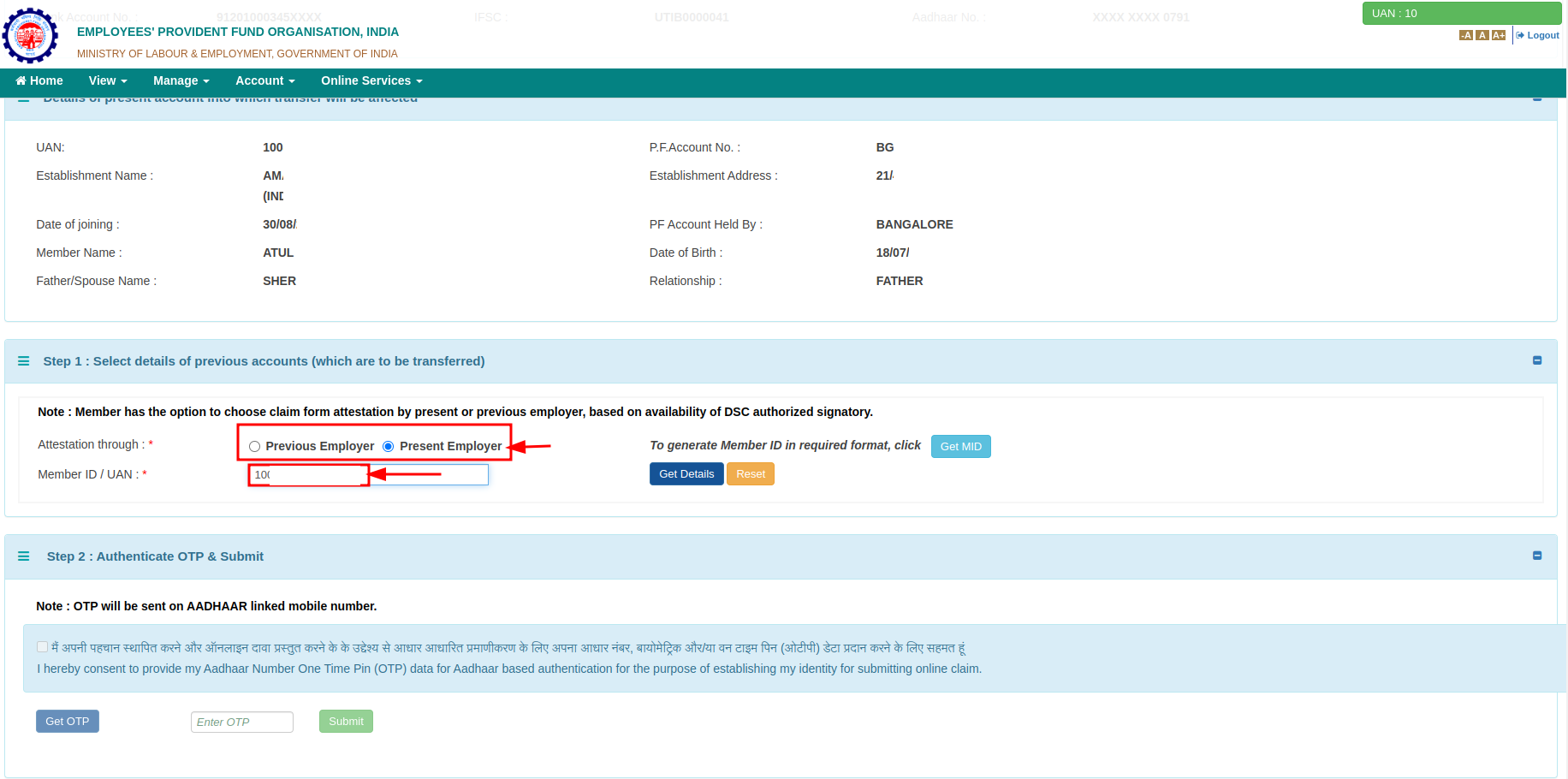

4. You can choose your previous/present employer for attesting the claim form. Enter your Member ID or UAN.

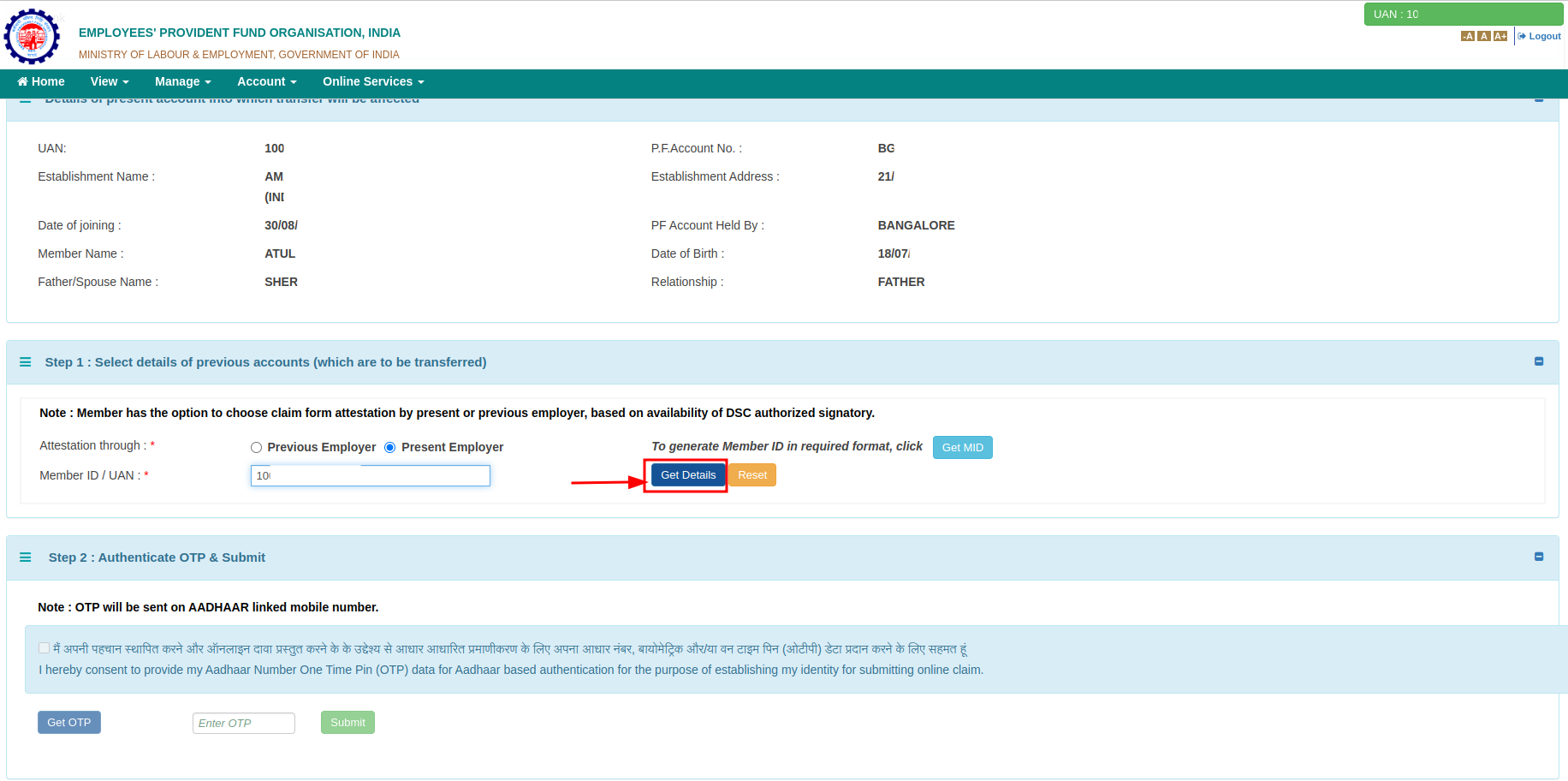

5. Click on “Get Details” to view your previous employment’s PF account details.

6. Click on “Get OTP” to receive a code on your registered mobile. Enter it to authenticate your identity.

7. A filled-in PF transfer request form is generated; self-attest and submit it in PDF format to your chosen employer.

8. Your employer receives an online notification about the transfer request.

9. The employer digitally approves the PF transfer request. Once approved, the PF is transferred to your new account with the current employer.

10. Use the tracking ID generated to check your application status online.

UAN Benefits for Employees

The introduction of UAN has simplified life for both employees and employers. Unlike before, where withdrawing from the employee pension scheme during job switches affected retirement amounts, UAN now automatically transfers employee pension plans and employer provident fund balances to the new account, boosting the retirement amount.

Along with streamlined access through the UAN Portal, here are the multiple UAN benefits:

- Check your PF balance anytime.

- Secure UAN authenticated by KYC and linked to Aadhaar, allowing PF balance checks through a simple SMS.

- No manual fund sharing is needed with UAN during job changes; just provide your Universal Account Number details and KYC to the new employer, and the old PF transfers almost instantly after verification.

- UAN is your unique identification number, regardless of your employer.

- Only you can access your account based on your KYC details.

- Track your PF account to ensure monthly employer credits.

FAQs | UAN-Universal Account Number

– Visit the EPFO site and click “Know your UAN” in “Important Links.”

– Enter your mobile number and captcha, and click “Get OTP.”

– Receive OTP, enter and click “Verify.”

– Choose the UAN from the list and click “Get UAN.”

– Receive your UAN on your mobile.

No, UAN and Aadhaar numbers are different. UAN (Universal Account Number) is a 12-digit unique identifier for EPF contributors, while Aadhaar is a 12-digit identification number issued by UIDAI. Though different, they can be linked to accessing various EPF services online.

PF (Provident Fund) is a retirement savings scheme, and the PF number is an alphanumeric code specific to an employee’s PF account in an organisation. UAN (Universal Account Number) is a unique 12-digit identifier containing information about an employee’s PF accounts across different organisations.

The UAN number is a 12-digit unique identifier assigned to employees contributing to the Employees’ Provident Fund (EPF). This number remains constant throughout an employee’s career, facilitating the management of multiple PF accounts under one UAN, and enabling access to various online EPF services and UAN benefits.

You can recover your PF password on the EPFO Member Portal by selecting “Forgot Password.” Enter your UAN and captcha, confirm your registered mobile number, receive and verify the OTP, and set a new password for your PF account.

Source- unifiedportal-mem.epfindia.gov.in

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.