Have you been dreaming of a flourishing portfolio that withstands the ups and downs of stock market volatility, generates consistent returns and fulfils your financial goals well?

In the current times, when AI seems to take over every hook and crook of the world, the secret of successful stock market trading lies in the power of portfolio diversification. However, one wrong move can jeopardise your financial goals. It’s time to master the art of portfolio diversification.

That’s why we’ve crafted this must-read blog, uncovering the most common mistakes in stock trading and portfolio diversification.

Understanding Portfolio Diversification

Concept of Portfolio Diversification

Portfolio diversification is a smart strategy successful stock market traders, and investors use to minimise risk and maximise potential returns. The strategy involves diversifying investments across different asset classes, such as stocks, mutual funds, long-term investment schemes, and government-backed bonds.

How do you do that?

You can invest your money across different asset classes to protect your returns in market ups and downs.E.g. rather than investing all your money into equities, it would be a safe investment if you invest it proportionately across stocks, bonds, ETFs, etc.

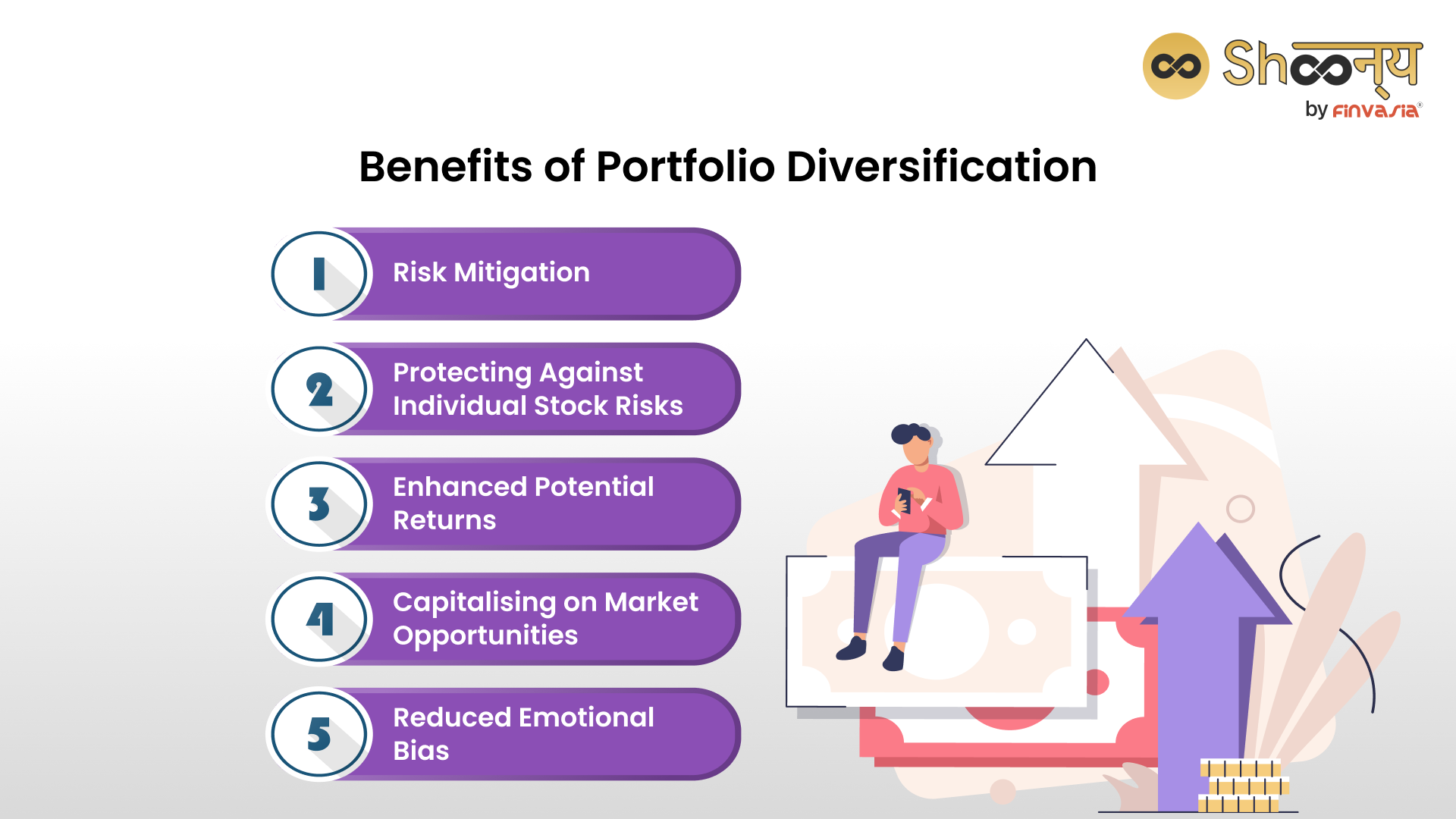

Benefits of Portfolio Diversification

In the world of online stock investing, portfolio diversification offers traders a multitude of benefits. You can save and make smart investments by diversifying your investments across asset classes, companies, and segments. The diversification strategy reduces reliance on individual stocks, allows for better risk management, and provides opportunities to capitalise on various market conditions.

However, it is important to be aware of common trading mistakes, such as emotional biases and inadequate research, which can hinder the effectiveness of diversification. While many traders question the relevance of portfolio diversification, here we have listed some exquisite benefits that you can take advantage of if you start with portfolio diversification.

- Risk Mitigation: Portfolio Diversification helps reduce market volatility’s impact by spreading risks across investments. When one investment underperforms, others can offset the losses, providing a more stable overall portfolio and helping you maintain a balance between risk returns on your investments.

- Enhanced Potential Returns: By diversifying your portfolio, investors can tap into the growth potential of different assets and sectors. When one investment performs exceptionally well, it can generate substantial profits and boost the overall portfolio performance.

- Protecting Against Individual Stock Risks: Investing heavily in a single stock can be risky. Diversification ensures that your portfolio is not overly reliant on the performance of one company. In addition, it safeguards against the potential negative impact of unexpected events or poor stock performance.

- Capitalising on Market Opportunities: A diversification strategy allows you to seize opportunities across various asset classes and sectors. By allocating investments wisely, you can benefit from emerging trends and market shifts, positioning your portfolio for potential gains.

- Reduced Emotional Bias: Emotions often play a detrimental role in investment decision-making and direct you to commit investing mistakes. Diversification helps to mitigate emotional biases by promoting a more rational and disciplined approach to your trading strategy. It encourages investors to focus on long-term investments rather than reacting impulsively to short-term market fluctuations.

Importance of Portfolio Diversification

Portfolio diversification holds significant importance in developing a successful trading strategy. Here are several key points highlighting the importance of portfolio diversification and its impact on your trading outcomes:

- Protection against Common Investing Mistakes: Portfolio diversification safeguards against common investing mistakes that you might commit, such as overconcentration in a single stock or sector. With a diversified portfolio, you avoid the pitfalls of relying too heavily on a particular investment, reducing the potential negative impact of poor decision-making.

- Avoiding Risky Investments: Diversification prompts careful consideration of investment choices, helping you identify and avoid risky investments. It encourages you to research and evaluate potential investments thoroughly, steering clear of those with excessive volatility, limited diversification benefits, or questionable fundamentals.

- Enhancing Consistency of Returns: Diversification aims to achieve a more consistent stream of returns over time. By spreading investments across various assets like stocks, mutual fund investments, or commodities, you can balance the potential gains and losses, resulting in a smoother and more predictable return on your investments.

- Providing Flexibility and Adaptability: A well-diversified portfolio offers flexibility and adaptability to changing market conditions. It allows you to capitalise on emerging opportunities and adjust your investments based on evolving trends.

By avoiding common investing and trading mistakes, diversification becomes a powerful tool in building a resilient and successful trading portfolio.

Common Mistakes in Stock Trading

How do you achieve your goal of earning consistent returns?

The best way is to do proper stock market research and avoid these investment mistakes.

- Chasing Hot Tips and Fads: Many investors fall into the trap of chasing hot tips and following market fads. Relying on rumours or speculative information without conducting thorough stock market research can lead to poor investment decisions. It is crucial to perform proper due diligence and base investment choices on sound analysis rather than short-lived market trends.

- Ignoring Fundamental Analysis: Neglecting fundamental analysis is a common investment mistake that traders make. Understanding the financial health, competitive positioning, and growth potential of a company is vital for making wise investment decisions.

Overlooking fundamental analysis can result in investing in stocks with weak fundamentals and limited long-term prospects.

- Emotional Decision-Making: Allowing emotions to drive trading decisions is a grave mistake. Emotional decision-making often leads to impulsive buying or selling based on fear or greed. It is important to develop a disciplined diversification strategy and stick to a well-defined trading approach that takes emotions out of the equation.

- Lack of Proper Asset Allocation: Failing to establish a well-balanced asset allocation is a common mistake in stock trading. Neglecting portfolio diversification can lead to an imbalanced portfolio that is either too aggressive or too conservative, potentially hindering long-term investment returns.

- Ignoring the Importance of Research and Due Diligence: Insufficient research and due diligence can result in poor investment decisions. It is vital to thoroughly analyse potential investments, including understanding the company’s financials, competitive background, focus, and industry trends. Neglecting research can lead to investing in companies with weak fundamentals or inadequate growth prospects.

- Failing to Rebalance the Portfolio: Over time, the asset allocation within a portfolio can deviate from the original intended proportions due to market fluctuations. Failing to rebalance the portfolio regularly can lead to an imbalance in risk exposure.

- Overlooking the Impact of Taxes: Neglecting to consider the tax implications of investment decisions can significantly impact overall returns. It is essential to be aware of the tax consequences of buying, selling, and holding investments is essential. Implementing tax-efficient strategies, such as utilising tax-advantaged accounts and considering tax-loss harvesting, can help maximise after-tax returns.

It’s crucial to consider tax-loss harvesting and stay up to date on the applicable taxes for trades in 2023, including the Income Tax Update in Budget 2023. Taking these factors into account before making any investment decision today can significantly impact your overall profitability.

- Lack of Patience and Long-Term Perspective: Stock trading requires understanding, patience, and a focus on your long-term goals. Trying to time the market or constantly making short-term trades based on market fluctuations can lead to suboptimal results.

- Adopting a patient approach and focusing on long-term investment goals allows for better decision-making and reduces the potential negative impact of short-term market volatility. Paying huge Brokerages: Your returns on investments may be cut short if you are paying huge brokerage on trading in the stock market. Before opening your account, make sure to check their brokerage/pricing policy to ensure you procure all the investment returns to yourself.

Stepping Stones to Successful Portfolio Diversification

When it comes to investing, building a well-diversified equal-weight portfolio is often touted as a key strategy for long-term success (long-term investing). Portfolio Diversification is the key to achieving your financial goals. While diversification is generally considered a prudent strategy, some may wonder if it is ever wise not to diversify at all. The truth is that concentrating your investments on a single asset or sector can potentially yield higher returns, but it also exposes you to significant risk. Diversification, on the other hand, helps safeguard your portfolio against any individual investment’s underperformance or failure.

Here are five essential steps to successful portfolio diversification:

- Define your investment goals and risk tolerance: Begin by clearly defining your investment objectives and understanding your willingness to take risks. This self-assessment will serve as a foundation for your portfolio diversification strategy and prevent you from committing trading mistakes.

- Select a mix of asset classes: Choose a diverse range of asset classes, such as stocks, mutual funds, bonds, currency, commodities, etc. Each asset class behaves differently in response to market conditions, and by including a variety of them, you can reduce the impact of any single investment on your overall portfolio.

- Allocate your investments strategically: Determine the proportion of your portfolio you want to allocate to each asset class based on your risk tolerance and investment goals. This diversification strategy will help you create a well-balanced portfolio that aligns with your long-term goals.

- Diversify within asset classes: Within each asset class, diversify your investments further. For example, invest in companies from various sectors and industries in the stock market to spread your risk. By diversifying within asset classes, you can minimise the impact of any single investment or industry-specific event. This approach allows you to benefit from multiple sectors’ growth while mitigating the impact of any negative developments in a particular industry.

Let us take an example:

Tata is a conglomerate interested in various sectors, such as automobiles, steel, information technology, etc. On the other hand, Reliance is a conglomerate with businesses in sectors like oil and gas, petrochemicals, telecommunications, and retail.

By investing in both Tata and Reliance, you diversify within the asset class of Indian stocks.

5. Regularly monitor and rebalance your portfolio: Keep a close eye on your portfolio and periodically rebalance it. Over time, some investments may outperform others, leading to a deviation from your target asset allocation.

What is Portfolio Rebalancing?

Portfolio rebalancing is defined as a process of adjusting the weightings of assets in an investment portfolio to maintain the desired composition and manage risk. Portfolio rebalancing forms an important part of the portfolio diversification strategy.

Key things to keep in mind while balancing your portfolio.

- The values of assets change over time, which can shift the portfolio’s risk profile.

- Rebalancing helps individuals stay on track with their investment strategy and minimise risk.

- The frequency of rebalancing depends on factors like age and risk tolerance, but it is generally recommended to rebalance at least once a year.

- It’s important to consider taxes when selling profitable investments during the rebalancing process.

Make sure you know these common mistakes to avoid in Portfolio Rebalancing. This shall help you manage your portfolio effectively from time to time.

Roadmap Ahead

Embracing portfolio diversification empowers you to protect against market volatility, capitalise on opportunities, and cultivate a disciplined, long-term perspective. With the right knowledge and a well-defined strategy, you can build a resilient and prosperous investment portfolio. So, take the necessary steps, make smarter decisions, and discover the potential of portfolio diversification on your journey to financial growth.

FAQs

Diversification is not limited to experienced investors; beginners should also prioritise diversifying their portfolios to manage risk and optimise returns in the long run.

Financial advisors are crucial in guiding investors to create diversified portfolios by assessing their risk tolerance and investment goals and recommending a mix of assets.

Opting not to diversify at all can expose investors to higher levels of risk, as a well-diversified portfolio can help mitigate the impact of market fluctuations and unexpected events.

An investor’s age is an important consideration when developing a diversification strategy, as younger investors may have a higher risk tolerance and can afford to allocate a larger portion of their portfolio to higher-risk assets. However, if you plan a diversification strategy in mid-age, focusing on long-term investments that ensure consistent returns would be better.

Diversification is a key strategy to achieve long-term financial goals, such as retirement savings, as it helps to spread risk and increase the likelihood of consistent returns over time.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks, read all the related documents carefully before investing.