What is EBITDA| Meaning, Formula and Calculation

While understanding the performance of a company, you often look at figures such as Interest, Profit or Tax. But have you ever heard about EBITDA? It is like the scorecard of a company’s performance, showing you how much money it’s making from its main business. Now, what is EBITDA?

If you’re putting your money into stocks, knowing EBITDA can help you pick the right stocks! It’s that simple tool that can make a big difference in your investing game. Ready to learn something useful?

Let’s get started!

What is EBITDA in Finance

In finance, EBITDA is a crucial metric used to assess a company’s financial health and operating performance.

EBITDA helps in accessing a company’s profitability from core operations. However, this excludes the impact of non-operational expenses like interest, taxes, and accounting practices such as depreciation and amortisation.

EBITDA Meaning: A Simple Way to Understand

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization.

Here:

- Earnings- The total amount of money that a company earns from its business activities after deducting expenses.

- Interest- The cost of borrowing money.

- Taxes: Payments made to the government based on a company’s income or profit.

- Depreciation: The decrease in value of tangible assets (such as equipment, machinery, or buildings) over time.

- Amortisation: The process of spreading out the cost of intangible assets (such as trademarks, patents, or goodwill) over their useful life.

Now, EBIDTA gives the net profit of a company after operating expenses but before interest, taxes, depreciation, and amortisation.

Imagine you’re running a business.

EBITDA is an important financial metric that helps you understand how much money your business is making from its core operations.

When we refer to the ‘overall business,’ this means before accounting for certain expenses.

These are expenses that are not directly tied to the day-to-day operations, such as interest, taxes, depreciation, and amortisation.

EBITDA aims to provide a more precise picture of the operating performance and the cash profit generated by the company’s core business activities, excluding these items.

What is EBITDA| Additional Key Terms You Must Know

- EBITDA Margin

The EBITDA margin is a financial ratio that reflects a company’s operating profitability as a percentage of its total revenue.

You can calculate it by dividing EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) by total revenue.

- EBITDA Coverage Ratio

The EBITDA coverage ratio calculates a company’s ability to cover its interest expenses using its EBITDA.

You can estimate it by dividing EBITDA by total interest payments.

A higher EBITDA coverage ratio indicates stronger financial strength and a lower risk of defaulting on debt obligations.

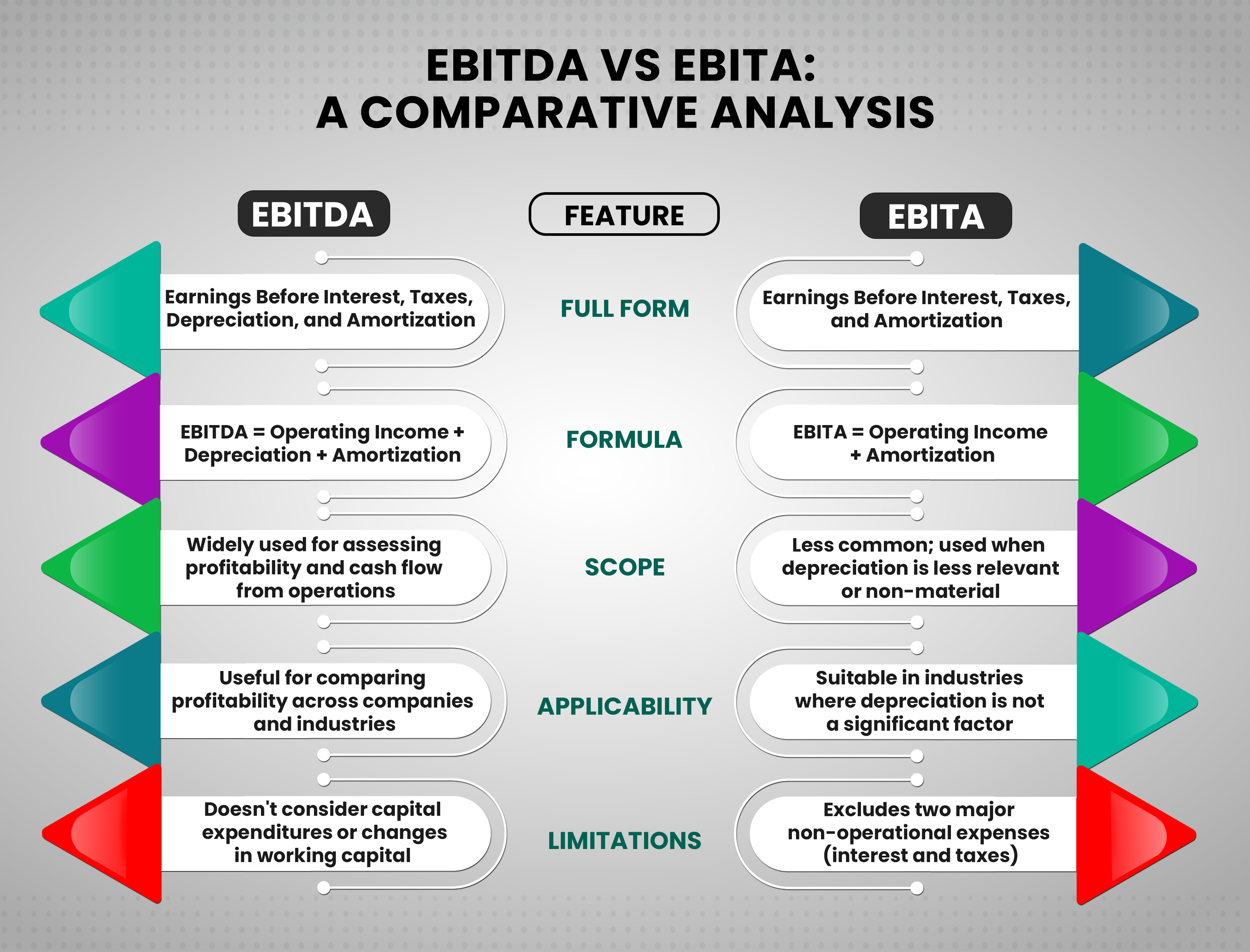

Understanding EBITA vs EBITDA

EBITA (Earnings Before Interest, Taxes, and Amortization) and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) are both used to assess a company’s operational performance.

Here’s a breakdown of the key differences:

- EBITDA excludes depreciation expenses along with interest, taxes, and amortisation. It focuses solely on a company’s core operational profitability before non-operating expenses.

- EBITA, on the other hand, includes depreciation but excludes interest, taxes, and amortisation.

This metric considers the impact of depreciation.

You may also want to know the Dividend Payout Ratio

EBITA vs EBITDA: How Do They Differ?

EBITDA vs. EBITA: A Comparative Analysis

| Basis | EBIDTA | EBITA |

| Full Form | Earnings Before Interest, Taxes, Depreciation, and Amortization | Earnings Before Interest, Taxes, and Amortization |

| Definition | Measures a company’s operating performance by excluding non-cash expenses (depreciation and amortisation) and non-operating expenses (interest and taxes). | Similar to EBITDA but excludes depreciation, focusing only on operating performance by removing interest and taxes. |

| Formula | EBITDA = Operating Income + Depreciation + Amortization | EBITA = Operating Income + Amortization |

| Scope of Analysis | Widely used for assessing profitability and cash flow from operations. | Less common; used when depreciation is less relevant or non-material. |

| Focus | Emphasises cash earnings before major non-cash expenses. | Concentrates on operating profit before interest and taxes. |

| Applicability | Useful for comparing profitability across companies and industries. | Suitable in industries where depreciation is not a significant factor. |

| Limitations | Does not account for capital expenditures or changes in working capital. | Excludes two major non-operational expenses (interest and taxes). |

EBITDA Formula and Calculation

The EBITDA formula is calculated as:

- EBITDA= Net Income+Interest+Taxes+Depreciation+Amortization

Alternatively, you can also calculate from operating profit (EBIT) by adding back depreciation and amortisation expenses:

2. EBITDA = Operating Profit + Depreciation + Amortization

Example of EBITDA

Income Statement Summary of XYZ Limited:

- Total Revenue: ₹15,00,000

- Cost of Revenue: ₹7,50,000

- Operating Expenses: ₹3,00,000

- Selling, General, and Administrative Expenses: ₹1,00,000

- Interest Expense: ₹25,000

- Income Tax: ₹1,50,000

- Income from Operations: ₹2,75,000

- Net Income: ₹2,50,000

- Depreciation and Amortization (from Cash Flow Statement): ₹75,000

To calculate EBITDA for XYZ Corporation:

EBITDA Formula = Net Income + Interest Expense + Income Tax Expense + Depreciation + Amortization

= ₹2,50,000 + ₹25,000 + ₹1,50,000 + ₹75,000

= ₹5,00,000

EBITDA| Advantages and Benefits for Investors

EBITDA offers several benefits for investors and traders:

- Operating Performance Indicator

EBITDA helps you understand how well a company’s primary activities are generating profit. - Comparative Analysis

Investors can use it to compare the operational profitability of different companies within the same industry. - Debt Assessment

Lenders often look at EBITDA when determining a company’s debt capacity. This is because EBITDA represents the cash flow available to pay interest and principal. - Investment Decisions

Investors use EBITDA to assess potential investment opportunities, as it can indicate a company’s ability to generate profit and cash flow. - Business Valuations

Business owners and investors might use EBITDA to pitch or assess a company’s valuation. It is highly helpful, especially when net profit is not reported. - Loan Assessments

Lenders may look at EBITDA to gauge a business’s ability to repay loans, as it reflects the earnings available to service debt.

What are the Disadvantages of EBITDA?

Using EBITDA in finance has several drawbacks:

- Misleading Indicator

EBITDA can give a distorted view of a company’s financial health. This relates to the fact that you use it alone to measure the performance.

This can happen as, EBITDA doesn’t include important costs like depreciation and amortisation.

- Ignores Capital Expenditures

It overlooks that depreciation and amortisation are real costs. Thus, by adding them back, it can hide the ongoing expenses of maintaining and replacing assets. - Excludes Debt Costs

EBITDA doesn’t account for the cost of debt, which can be significant for highly leveraged companies. - Cash Flow Discrepancies

It isn’t a precise measure of cash flow because it doesn’t consider changes in working capital. - Varied Use Across Industries

EBITDA’s usefulness can vary significantly across different industries. This makes it a less reliable source if you wish to compare companies across sectors.

Conclusion

EBITDA can assist you in comparative analysis, debt assessment, and, most importantly, your investment decisions. Thus, it is a valuable tool for evaluating investment opportunities and financial health.

FAQs| What is EBITDA

EBITDA means Earnings Before Interest, Taxes, Depreciation, and Amortization. It measures a company’s operating performance without the impact of financial and accounting decisions.

While EBITDA reflects a company’s profitability from operations, it is not a direct measure of net profit. It excludes costs like interest, taxes, depreciation, and amortisation.

EBITDA helps you understand a company’s operational performance by showing earnings. These earnings exclude interest, tax, depreciation and amortisation.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.