Do you want to know when and how to buy or sell stocks to get the maximum dividend payout? You can gain an advantage by understanding the impact of dividend announcements and ex-dividend date on stock prices. The record date, or dividend record date and the ex-date or ex-dividend date of stock are essential dates relating to stock purchases, reporting, and the dividend payout process. However, it is vital to understand that Ex-Date vs Record Date as, these are two crucial terms determining who gets the dividend and when.

Let’s understand the concepts of ex-date and record-date in stock markets before we get into the key insights into the basics of ex-date vs record date.

- Ex-Date Meaning (Ex-Dividend Date)

- Record Date Meaning

- Interim Dividend

- Ex-Date vs Record Date

- Record Date and Ex-Dividend Date: Factors to Consider When Trading Stocks Around Ex-Date and Record Date

- Ex-Date vs Record Date Impact| An Example

- Ex-Date vs Record Date| Common Misconceptions

- The Dividend Investing Strategy

- Ex-Dates vs Record Dates| How to Track Them

- Eligibility Criteria for Corporate Actions

- Ex-Date, Record Date, and Dividend Payment Date

- Understanding the Impact of Dividend Announcements on Stock Prices

- Conclusion

- FAQs| Ex-Date vs Record Date

Ex-Date Meaning (Ex-Dividend Date)

The ex-date, ex-date in the dividend or ex-dividend date, signifies the date on or after which security starts trading without the right (of the investor) to receive the declared dividend.

This means that investors who purchase the security on or after the ex-date shall not be eligible for the upcoming dividend payment.

The stock exchange establishes the ex-date in coordination with the company issuing the dividend.

All the Basics Surrounding Ex-Date (Ex-Dividend Date)

Ex-date is like a cut-off day for getting a reward (dividend) from a company.

You can receive the upcoming dividend if you buy a stock before this day.

But you won’t get the dividend if you buy it on or after this day.

Let’s understand the ex-date with this example.

Let’s say a company announces a dividend of Rs. 2 per share with an ex-date of January 15th.

- If you buy the stock on January 14th or earlier, you can get the Rs. 2 dividend.

- But if you buy it on or after January 15th, you miss out on the dividend this time.

Record Date Meaning

The record date is the specified date on which a company examines its list of shareholders to decide who is eligible to receive the declared dividend.

Shareholders recorded on the company’s books as of the record date qualify to receive the dividend. This is regardless of the acquisition date for the shares.

The company sets the record date. It is crucial to identify the individuals or entities eligible for dividend payments.

Basics Surrounding Dividend Record Date

The record date is when the company checks its list to see who should get the reward (dividend).

If your name is on their list on or before this day, you’ll get the dividend.

Let us understand the record date with an example.

Following the previous example, let’s say the dividend record date is January 20th.

- If you own the stock on or before January 20th, your name will be on the company’s list, and you’ll receive the dividend.

- But if you buy the stock on January 21st or later, your name won’t be on the list for this dividend.

Interim Dividend

An interim dividend is a payment made before a company’s annual general meeting and the release of final financial statements.

- It is a partial distribution of profits, usually declared in the middle of the fiscal year.

- The company’s board of directors declares the interim dividend, but the shareholders must approve.

- Companies use retained earnings to pay interim dividends, not current earnings.

Exploring Other Types of Dividends

Here’s a breakdown of different types of dividends:

- Cash Dividend: This is the most common type. Companies pay shareholders a certain amount of money for each share they own.

- Stock Dividend: Companies give shareholders extra shares, increasing their ownership without any cash exchange.

- Property Dividend: Shareholders receive assets other than cash or stock, like physical goods or services.

- Special Dividends: These are one-time payments made by companies, usually when they’ve made a lot of extra profits.

- Liquidating Dividend: A company pays this at the time of closing down. It’s a return of capital rather than profit.

- Bond Dividend: Instead of cash, companies might give out periodic interest payments, similar to bonds.

Ex-Date vs Record Date

Let us look at all the aspects surrounding ex-date vs record date in the stock market trading.

If a company declares a dividend on March 3 with a record date of April 11, the ex-date would be April 8.

An investor who buys the stock on or after April 8 will not receive the dividend, but an investor who buys the stock on or before April 7 will.

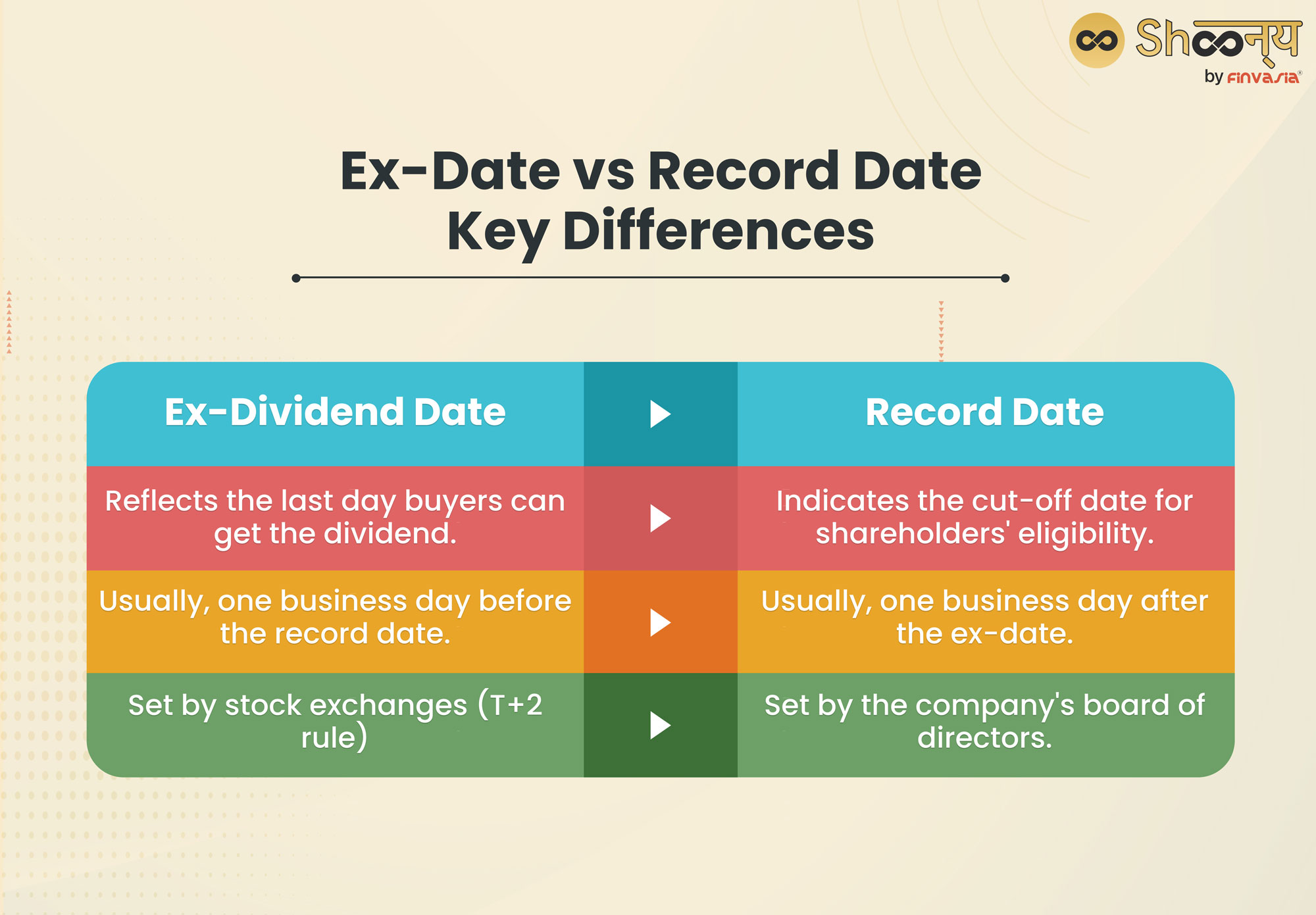

Key Differences: Record date and ex-dividend date.

| Ex-Date | Record Date |

The date when a stock trades without the benefit of the next scheduled dividend payment. | The date when the company checks its records to identify the shareholders eligible to receive the dividend. |

| Usually, one business day before the record date | Usually, one business day after the ex-date |

| Set by stock exchanges based on the T+2 rule for the two-day settlement of trades | Set by the company’s board of directors |

| A stock’s price usually drops by the amount of the declared dividend on the ex-date | A stock’s price is not affected by the record date |

Record Date and Ex-Dividend Date: Factors to Consider When Trading Stocks Around Ex-Date and Record Date

Here are some things that you must know about ex-date vs record date when making investments:

- The ex-date is usually one business day before the record date, and the stock exchanges set it based on the T+2 settlement cycle.

The company’s board of directors sets the record date.

- Investors who want to receive the dividend must buy the stock before the ex-date and hold it until the record date or later.

- Dividends can affect investors’ tax liability, depending on their holding period and the type of dividend (qualified or non-qualified).

Understanding Exceptions to Date Alignment| Ex-Dividend Date vs Record Date

Trading holidays can affect the usual ex-date and record dates for dividends. If a holiday occurs after the record date, the ex-date changes accordingly.

This ensures investors still get a fair chance to trade and receive dividends, even if the markets close unexpectedly.

Ex-Date vs Record Date Impact| An Example

In the Indian economy, understanding ex-date vs record date can greatly influence investment decisions.

Let’s take a look at how these dates impact investors:

Let’s say ABC Corporation declares a dividend on June 10th. The company announces a record date of June 25th.

This means that shareholders listed on June 25th will be eligible to receive the dividend.

Typically, the ex-dividend date is set one business day before the record date.

So, in this scenario, it falls on June 24th. If you buy shares on or before June 23rd, you’ll be considered a shareholder on June 25th and will receive the dividend on July 15th.

However, if you purchase shares on June 24th or after, you won’t be entitled to the dividend, even if you’re a shareholder on June 25th.

So, to sum up, to ensure you receive the dividend from ABC Corporation, make sure to buy shares before the ex-dividend date, which is June 24th in this case.

In summary, understanding ex-date vs record date is crucial for investors in the Indian stock market.

Ex-Date vs Record Date| Common Misconceptions

Despite the significance of ex-date and record date in the Indian stock market, there are some common misconceptions surrounding these dates that investors should be aware of.

- Buying shares on the ex-date guarantees eligibility for the dividend.

In reality, investors must purchase shares before the ex-date to receive the dividend. Buying shares on or after the ex-date means missing out on the dividend payout.

2. Selling shares on the ex-date ensures receipt of the dividend.

However, the record date, not the ex-date, determines eligibility for the dividend. Therefore, selling shares on the ex-date does not impact dividend eligibility.

3. Some investors mistakenly believe that the ex-date and record date are the same.

The ex-date precedes the record date, and investors must own shares before the ex-date to be eligible for the dividend.

Understanding these misconceptions and complexities of ex-date vs record date is necessary for you.

Special Dividend Rules| Ex Date vs Record Date

In India, special rules govern the handling of large dividends, particularly when a dividend amounts to 25% or more of the stock’s value.

The Companies Act and the Income Tax Act regulate these rules:

• A company must pay dividends in cash, and they must deposit the amount in a separate bank account within five days of declaration.

• With the abolition of the Dividend Distribution Tax (DDT), dividends are now taxable in the hands of shareholders.

Companies must withhold tax at the rate of 10% for resident shareholders if the dividend exceeds ₹5,000.

If the dividend amount is significant, it can significantly impact the company’s valuation.

For dividends that are 25% or more of the stock’s value, the company must ensure compliance with specific provisions under the Companies Act.

The Dividend Investing Strategy

Investors often pick stocks with a history of steady dividends for long-term growth.

A company that consistently pays dividends shows it’s doing well financially and is stable. By focusing on these kinds of stocks, investors hope for reliable income and maybe even the value of their investment to go up over time.

What are Dividend Reinvestment Plans (DRIPs)

In DRIPs, investors automatically reinvest dividends to purchase more shares of stock. To enroll in a DRIP, investors can sign up through their brokerage or the company’s transfer agent.

They must own shares before the ex-date to be eligible for dividend reinvestment, and the record date determines participation eligibility.

Dividends are reinvested automatically on the payment date, helping investors accumulate more shares over time and potentially accelerate portfolio growth.

Ex-Dates vs Record Dates| How to Track Them

To ensure eligibility for dividends, investors must track ex-dates vs record dates.

- Companies announce these dates on their official websites under the investor relations section.

- The National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) list these dates under the ‘Corporate Actions’ section on their websites.

- Financial news websites publish upcoming record date and ex-dividend date.

Eligibility Criteria for Corporate Actions

The company determines eligibility for corporate actions like dividends, rights shares, and stock splits by setting a record date.

Ex-Date vs Record Date| Here’s how it works:

• The record date: This is when the company finalises the list of shareholders eligible for the corporate action. To receive benefits like dividends or participate in rights issues, an investor must own the stock on or before this date.

• The ex-dividend date: Typically set one business day before the record date. If you buy the stock before this date, you’re eligible for the dividend.

Purchases on or after this date won’t entitle the new owner to the declared dividend.

• Significance of the record date: It determines who is considered a shareholder of record for receiving dividends or other benefits, ensuring the company knows who to distribute them to.

• Special cases: When a dividend is 25% or more of the stock’s value, the ex-dividend date is set after the payable date. This means you must purchase the stock at least one day before the pay date to be eligible for the dividend.

Understanding the Ex-Date vs Record Dates is crucial for investors seeking to benefit from corporate actions as they determine eligibility.

However, you must always refer to the company’s announcements for specific record date vs ex-dividend dates related to any corporate action.

Ex-Date, Record Date, and Dividend Payment Date

The key dates in the dividend payout process are the ex-date, record date, and dividend payment date.

The other date is the declaration date, which is the date on which the company announces the dividend.

- The ex-date is the date the stock trades ex-dividend without the right to receive the dividend.

- The record date is when the company finalises the list of shareholders who will receive dividends.

- The dividend payment date is when the company distributes the dividend to the shareholders of record.

Understanding the Impact of Dividend Announcements on Stock Prices

Dividend announcements can really sway a company’s stock price.

When a company says it’ll pay out dividends, it shows that the company is doing well financially.

This often raises the stock price because investors want to earn a share of the company’s profits. Dividends are a steady source of income for investors.

The ex-dividend date is also important.

It’s the date where if you buy the stock after that, you won’t get the upcoming dividend.

On this date, the stock price usually drops by about the same amount as the dividend being paid.

So, the company’s overall value goes down by that dividend amount.

This adjustment in the market makes sure that buying the stock right before the dividend doesn’t give anyone an unfair advantage.

The people who already own the stock get the dividend, which kind of balances out the drop in stock price, keeping their investment worth about the same.

Conclusion

In summary, the ex-date is when you need to buy the stock to be eligible for the dividend, and the record date is when the company checks its list to see who gets the dividend.

If you’re on the list and bought the stock before the ex-date, congratulations, you’ll receive the dividend in your pocket!

FAQs| Ex-Date vs Record Date

The ex-dividend date is when a stock starts trading without including the value of its next dividend payment. If you buy the stock on or after this date, you won’t get the dividend.

Both are crucial, but the ex-date matters more for investors aiming to receive the dividend. It marks the deadline for share ownership for dividend eligibility, while the record date finalises the list of eligible shareholders.

The ex-split date is when the stock trades at the adjusted price after a stock split, while the record date determines which shareholders get the additional split shares.

An interim dividend is a debit to retained earnings and a credit to dividends payable before the final financial results are released.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.