As our parents age, we often find ourselves in the role of caretakers, seeking ways to ensure their comfort and financial security during retirement. Recognising this need, the Government of India has introduced a popular scheme tailored for senior citizens. The Senior Citizen Savings Scheme (SCSS) is a thoughtful initiative that offers a safe and reliable investment option for those entering their golden years. It’s an ideal solution for children who wish to secure a regular income stream for their parents post-retirement. With attractive interest rates and tax benefits, SCSS stands out as a mindful choice for safeguarding the financial future of our loved ones.

Let us walk you through the details of the Senior Citizen Savings Scheme 2024.

Senior Citizen Savings Scheme (SCSS)| An Introduction

The Senior Citizens’ Saving Scheme is a popular retirement benefit program offered by the government of India.

Are you wondering who can opt for this scheme?

Yes, all the individuals over 60 years can opt for the SCSS scheme by making an individual or joint investment.

Did you know this scheme also provides tax benefits?

In senior citizens’ savings scheme, the instalment amount ranges between ₹1,000 and ₹130 lakhs, tied to retirement benefits.

So, how do you get started?

You must deposit it in the Senior Citizen Scheme account within a month of receiving retirement benefits from your employer.

What happens if you deposit more than the allowed amount?

If someone deposits more than the allowed amount, the scheme refunds the extra funds.

Can the scheme be extended?

Yes, one can extend the scheme for 3 more years after its maturity. The interest rate is 8.20% per annum (1.04.2023 to 31.03.2024).

What is the tenure of the scheme?

The tenure of the Senior Citizen Savings Scheme (SCSS) is 5 years. However, there is an option to extend it for 3 more years.

The minimum investment amount is ₹1,000, and the maximum is ₹30,00,000 or the amount received on retirement, whichever is lower.

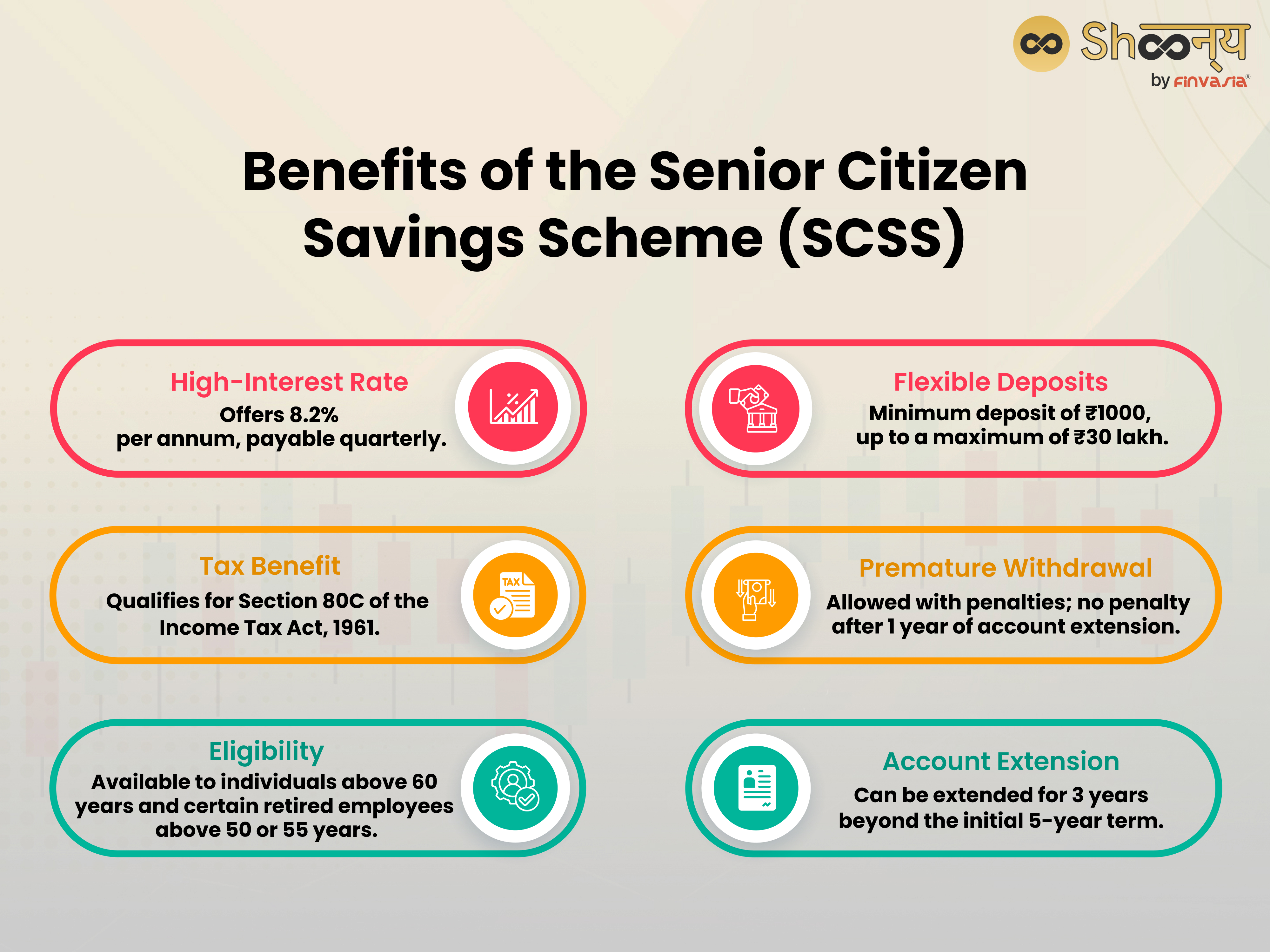

Benefits of the Senior Citizen Savings Scheme

What makes the Sr Citizens Saving Scheme attractive?

Let’s look at the benefits:

- Easy Process: You can open accounts at any post office or an authorised bank in India. Isn’t that convenient?

- SCSS Tax Benefits: Did you know that under Section 80C of the Income Tax Act, the principal amount invested in the Senior Citizen Savings Scheme is eligible for a yearly deduction up to a limit of ₹1.5 lakhs?

Additionally, the interest earned on SCSS is taxable as per the individual’s tax bracket.

However, TDS- Tax Deducted at Source applies if the interest exceeds ₹50,000 in a fiscal year.

- High-Interest Rate: The senior citizen’s savings scheme interest rate is 8.2% per year.

Wouldn’t you want to secure such a return on your investment?

Features of the Senior Citizens Saving Scheme

What features make the Senior Citizens’ Saving Scheme stand out?

Here are the key things to note:

- Varying Interest Rates: Did you know the SCSS interest rate is reviewed and potentially modified every three months?

This means it can change up to four times a year.

- Assured Returns: Unlike market-linked investments that can fluctuate, SCSS offers safe and assured returns because it is a government-backed instrument.

- Maturity Duration: The scheme has a maturity period of 5 years.

Can it be extended?

Yes, you can extend it for another 3 years by submitting Form B. During the extension, the applicable interest rate for the quarter applies.

- Deposit Limit: To open an SCSS account, you need a minimum deposit of ₹1,000.

The maximum you can deposit is ₹30 lakhs or the total retirement benefit received, whichever is lower.

- Account Closure: Wondering about premature withdrawals?

If you close the account before 2 years, there’s a penalty of 1.5%.

After 2 years, the penalty is 1%. For extended accounts, you can withdraw funds after one year without any penalties.

- Quarterly Disbursals: The scheme offers quarterly disbursements of interest, which are credited to the account on the 1st of April, July, October, and January.

- Nomination Choice: You can register a nominee for your SCSS account.

In case the account holder passes away before maturity, the nominee gets the due amount.

These features ensure that the SCSS is a secure investment and a flexible and convenient option for senior citizens.

Senior Citizen Savings Scheme Interest Rate

SCSS offers the following interest rates:

- Interest Rate: 8.2% per annum.

- Effective Date: From January 1, 2024.

- Initial Payment: Payable from the date of deposit to March 31/ June 30/ Sept 30, and December 31.

- Subsequent Payments: Payable quarterly on April 1, July 1, October 1, and January 1.

Eligibility

Who can invest in the Senior Citizens Saving Scheme? Here are the eligibility criteria:

- Indian citizens above the age of 60 years: Are you 60 or older?

You can invest in SCSS.

- Retirees aged 55-60 years who have selected Voluntary Retirement Scheme (VRS) or Superannuation: If you’re in this age bracket and have taken early retirement, you qualify for SCSS.

Just remember, you must invest within a month of receiving your retirement benefits.

- Retired defence personnel aged 50-60 years: Are you a retired defence personnel in this age group?

You are also eligible, provided you invest within a month of receiving your retirement benefits.

Exclusions

Who cannot invest in the Senior Citizens’ Savings Scheme?

The scheme has some exclusions:

- Hindu Undivided Families (HUFs)are not eligible for SCSS.

- NRIs are also not eligible to invest in SCSS.

Application Process of Senior Citizen Savings Scheme 2023

How can you apply for the Senior Citizens’ Savings Scheme?

Here are the steps:

Offline

- Visit your nearest bank branch or post office.

- Collect the application form.

- Submit the duly filled-up form along with self-attested copies of the required documents.

Online

- Check if your bank offers an online facility for SCSS.

- Banks offering this service include:

[ICICI Bank], [State Bank of India-SBI], [Bank of Baroda], [Corporation Bank],[Allahabad Bank], [Punjab National Bank], [UCO Bank], [Syndicate Bank], [Union Bank of India], [Bank of India],

- Follow the online procedure provided by your bank to open the account.

These options make it easy to apply for the Senior Citizens’ Saving Scheme, whether you prefer visiting a branch in person or doing it from the comfort of your home.

Documents Required

What documents do you need to apply for the Senior Citizens’ Savings Scheme?

Here’s the list:

- KYC Documents:

- Aadhaar Card

- Voter ID Card

- PAN Card

- Passport

- Utility Bills:

- Telephone bill

- Electricity bill

- Senior Citizen Card or Birth Certificate (if applicable)

- Photographs:

- 2 passport-size photographs

Suitability of Senior Citizens Savings Scheme

The Senior Citizens’ Saving Scheme (SCSS) benefits several groups within the Indian economy:

- Senior Citizens: The primary beneficiaries are individuals above 60 years old.

It ensures steady income post-retirement, which is crucial for financial stability during their non-earning years.

- Early Retirees: Those aged between 55 and 60 who have taken early retirement through Voluntary Retirement Scheme (VRS) or Superannuation also benefit.

They can invest their retirement corpus in SCSS to earn regular interest income.

- Retired Defense Personnel: Retired defence personnel between 50 and 60 years of age can invest in SCSS.

This scheme provides them with a reliable income source and helps them manage their finances after retiring from service.

- Taxpayers: Senior citizens investing in SCSS can benefit from tax deductions under Section 80C of the Income Tax Act up to ₹1.5 lakhs.

This helps reduce their taxable income, providing significant tax savings.

You may also want to know the Mahila Samman Savings Certificate Scheme

Conclusion

The Senior Citizen Savings Scheme (SCSS) is a solid choice for securing our elders’ future. With its attractive 8.2% interest rate, seniors can actively safeguard their savings. SCSS provides a straightforward way for our elders to enjoy a worry-free retirement, ensuring financial stability and peace of mind.

FAQs| SCSS (Senior Citizen Savings Scheme)

To open a Senior Citizen Savings Scheme (SCSS) account, visit a post office or bank branch. Fill out the form provided and attach your ID proof, KYC documents, age proof, address proof, and a cheque for the deposit amount.

Yes, investments in SCSS qualify for income tax deduction benefits under Sec 80C of the Income Tax Act, 1961.

Any individual above the age of 60 can open a Sr Citizen Savings account, provided they have all the required documents.

Yes, if the interest earned exceeds Rs. 10,000 per annum, TDS is applicable. Interest payments in this scheme are subject to deduction of tax at source.

Source– myscheme.gov.in, indiapost.gov.in, nsiindia.gov.in

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.