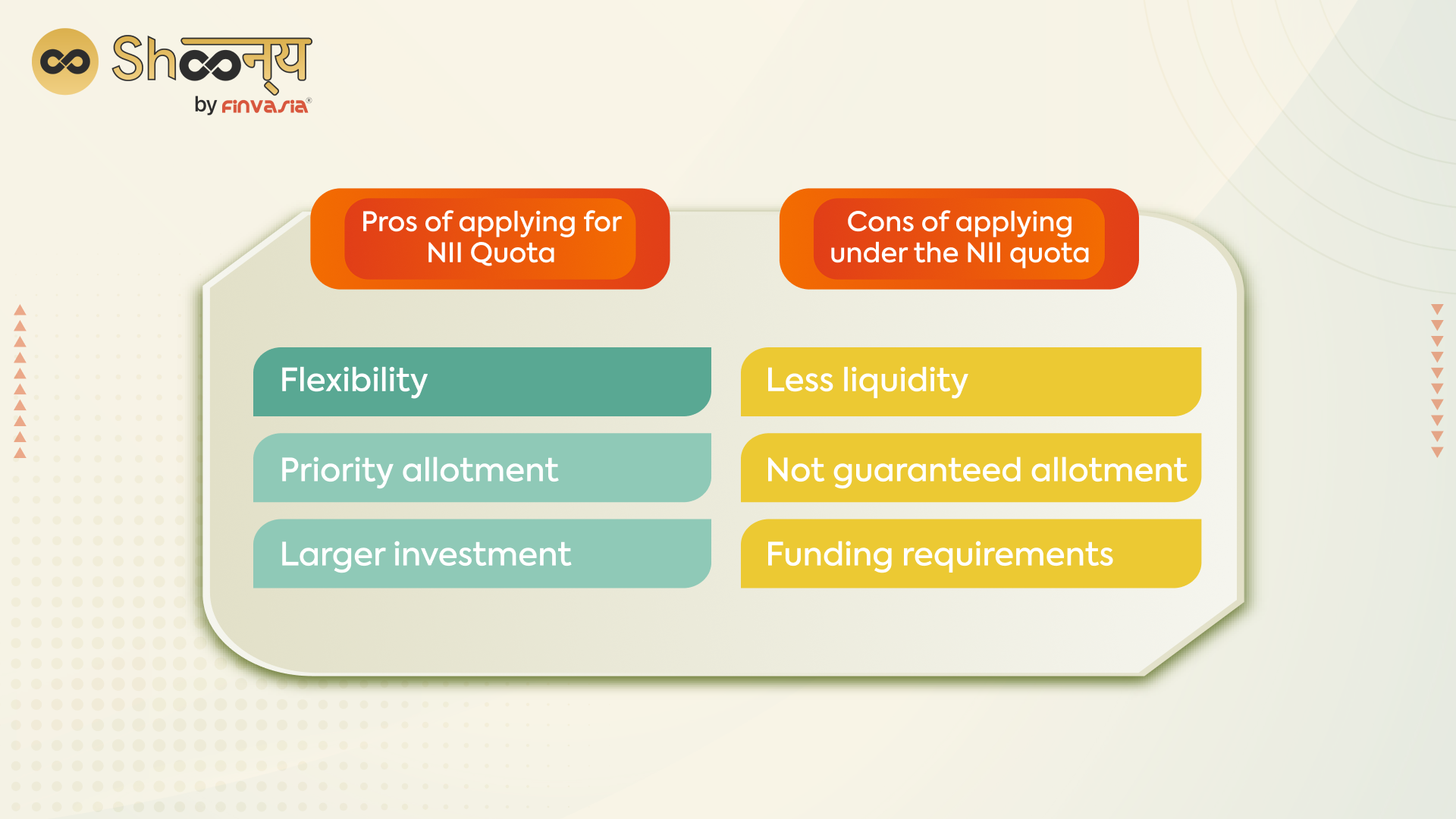

Advantages & Disadvantages of Applying Under NII Quota

The world of initial public offerings (IPOs) is enthralling, attracting a diverse range of investors eager to capitalise on the promise of new opportunities. Each type of IPO investor, from seasoned institutional investors to risk-taking individual investors, plays a vital role in shaping the future of the companies in which they invest. In this article, let’s take a closer look at the NII Quota and the pros and cons of applying under it.

What is NII Quota in IPO?

The NII quota is typically reserved for investors who do not qualify as retail investors, such as high-net-worth individuals, trusts, and corporations. These investors have a higher net worth and are thought to be more experienced and sophisticated. As a result, they can also make higher investments than ordinary investors.

For example, let’s say XYZ Ltd is planning to go public and is offering 10 million shares in its IPO. Among these 10 million shares, 3 million are reserved for retail investors, and 7 million are for NIIs. A retail investor can apply for a maximum of Rs 2 lakh worth of shares, whereas an NII investor can apply for a maximum of Rs 10 Crore worth of shares.

Pros of applying for NII Quota

- Flexibility: NII investors can change the number of shares they want to bid for or withdraw their bid entirely at any time before the allotment day. This can come in handy if market conditions change.

- Priority allotment: The allotment of shares under the NII quota is done on a first-come, first-served basis, which can give NII investors an advantage over retail investors.

- Larger investment: NIIs can make higher investments than retail investors, giving them more exposure to the company and potentially higher returns.

Cons of applying under the NII quota

- Less liquidity: NII investors may face less liquidity in the secondary market as compared to retail investors, as the number of shares held by NII is typically lower than the number of shares held by retail investors.

- Not guaranteed allotment: The allotment of shares under the NII quota is not assured and depends on the overall demand for the shares. NII investors may not receive any shares if the demand is high and there is an oversubscription.

- Funding requirements: NII investors typically have to make a higher minimum investment than retail investors, which can be a disadvantage for those who do not have a large amount of capital to invest.

How to apply under NII Quota?

- Step 1: You will need a broker who is a member of a recognised stock exchange and is authorised to handle IPO applications.

- Step 2: Fill out the application form accurately and completely.

- Step 3: Provide KYC details, such as proof of identity and address

- Step 4: Pay the amount specified in the IPO prospectus through your broker.

- Step 5: If your application is successful, you will be allotted shares as per the IPO allotment.

- Step 6: Once the IPO is listed, you can sell or hold the shares as per your preference.

Are there more chances of allotment under the NII Quota?

The NII reservation quota is 15%. The allotment of shares under the NII quota depends on the overall demand for the shares, not just the reservation quota. If the shares are oversubscribed, only a small number of NII investors will receive an allotment. On the other hand, QIBs and Retail investors have reservations of 50% and 35%, respectively, and are subject to higher allotment.

Final Words

In conclusion, applying for an IPO under the NII quota can be a good option for experienced and high-net-worth investors seeking larger investments and flexible bidding options. However, they should be aware of the cons, such as less liquidity, no guaranteed allotment, and higher funding requirements. Therefore, it is important to consider the pros and cons before applying under the NII quota.