In the world of finance, the inverse relationship between bond prices and interest rates is a fundamental concept that every investor should grasp. This article will provide you with a comprehensive understanding of how changes in interest rates can significantly impact bond prices and, consequently, your investment decisions.

Relationship Between Bond Price and Interest Rate

The Inverse Bond Price and Interest Rate Relationship

Bonds and interest rates share an intricate dance. When interest rates climb, the prices of bonds typically drop, and conversely, when interest rates drop, bond prices tend to rise. This seemingly paradoxical relationship has its roots in the bond market’s mechanics and the fundamental principle of yield.

Understanding Zero-Coupon Bonds in the Indian Context

Zero-coupon bonds, also known as deep discount bonds, are financial instruments in the stock market that do not pay periodic interest (coupon) payments but are instead issued at a discount to their face value (par value). In India, these bonds are often used by both the government and corporations to raise capital.

Factors Affecting Zero-Coupon Bond Yields in India:

- Purchase Price: The initial price at which the zero-coupon bond is bought by investors.

- Par Value: The face value of the bond, which is the amount that will be paid to the bondholder at maturity.

- Time Until Maturity: The period until the bond reaches its maturity date.

Effect of Interest Rates on Bond Prices

The relationship between interest rates and bond prices is inverse. This is because existing bonds with fixed coupon rates become less appealing to investors when new bonds offer higher yields. Conversely, when interest rates drop, existing bonds become more appealing as they offer better returns as compared to newly issued bonds. So, interest rate movements have a significant impact on the value of bond investments.

Suppose an investor purchases an Indian zero-coupon bond with a face value of ₹1,000 at a price of ₹950 and a maturity period of one year. The calculation of the yield would be as follows:

Yield = [(Face Value – Purchase Price) / Purchase Price] x 100

Yield = [(1,000 – 950) / 950] x 100 ≈ 5.26%

Now, consider the impact of changes in prevailing interest rates in the Indian economy:

- Rising Interest Rates: If the Reserve Bank of India (RBI) or market forces lead to a sudden increase in interest rates, newly issued bonds may offer higher coupon rates. As a result, the 5.26% yield on our zero-coupon bond becomes less attractive to investors. To align with the market rates, the price of the bond in the secondary market would drop, say, to approximately ₹909.09, which would now provide a 10% yield.

Falling Interest Rates: Conversely, if the RBI decides to lower interest rates or if market conditions lead to lower rates, our zero-coupon bond with a 5.26% yield becomes more attractive. Investors would be obliging to pay a higher price for the bond in the secondary market, say, around ₹970.87.

The Impact of Inflation on Bond Prices

Inflation is one of the primary concerns for investors as it can significantly impact the returns from their investments, including bonds. Inflation is measured using the Consumer Price Index (CPI), an average of the prices of goods and services consumed by households.

The purchasing power of money decreases when inflation rises, meaning it takes more money to buy the same goods and services. The scenario can result in lower returns for bondholders, as the fixed coupon payments they receive are worth less in real terms.

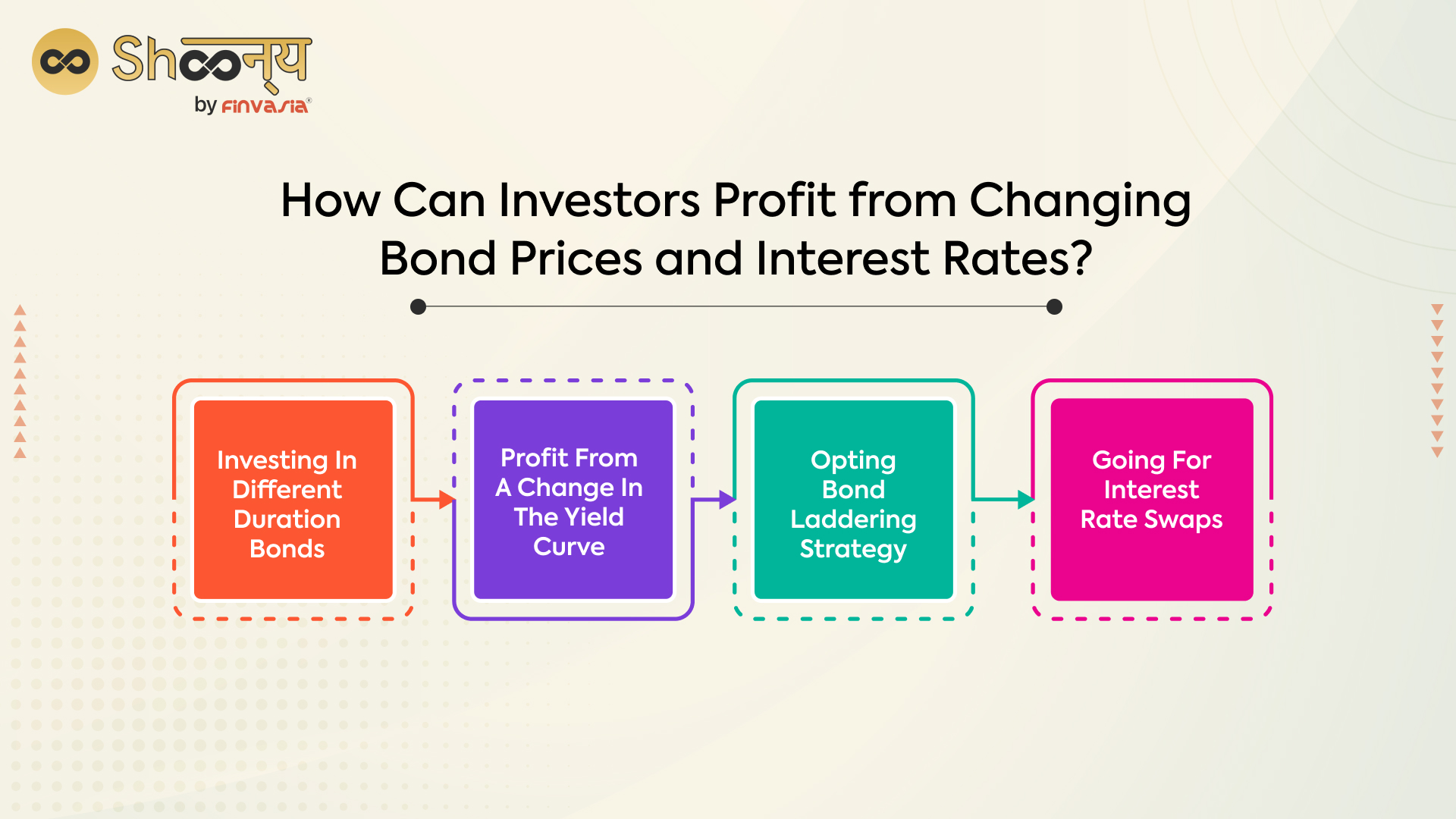

How Can Investors Profit from Changing Bond Prices and Interest Rates?

Investors can profit from changing interest rates and bond prices by employing a variety of strategies, including:

- Duration: Investors can benefit from changing interest rates by choosing bonds with different durations. In anticipation of rising interest rates, shorter-term bonds may be preferred as they are less sensitive to interest rate changes than longer-term bonds.

- Yield curve: The yield curve reflects the relationship between bond yields and their maturities, providing insights into the direction of interest rates. By investing in bonds with maturities aligned with their interest rate expectations, investors can benefit from changes in the yield curve.

- Bond laddering: Bond laddering involves investing in bonds with staggered maturities, creating a ladder-like structure. This strategy enables investors to take advantage of changing interest rates by reinvesting in higher-yielding bonds as interest rates rise.

- Interest rate swaps: Interest rate swaps allow investors to exchange fixed-rate interest payments for floating-rate payments. They can use this financial instrument to manage interest rate risk or capitalize on expected interest rate changes.

Conclusion

In summary, the relationship between bond prices and interest rates is an inverse one. When interest rates increase, bond prices decrease, and when interest rates decrease, bond prices increase. Investors can benefit by buying bonds when interest rates are high, as higher rates offer more substantial returns.

Additionally, it’s important to understand inflation expectations, credit risk, and the term to maturity influence bond prices. The yield curve, reflecting the yield-to-maturity (YTM) of various bonds, demonstrates that longer-term bonds typically offer higher yields.

Frequently Asked Questions (FAQs)

Generally, it is better to buy bonds when interest rates are high if your goal is to maximize returns, as high rates offer greater returns.

Typically, when stocks rise, bond prices fall, as investors are drawn to stocks, reducing the demand for bonds.

The yield curve illustrates the relationship between bond yields and their maturities. A normal curve slopes upward, indicating higher yields for longer maturities, while flat or inverted curves can signal economic uncertainty or impending recession.

Diversifying portfolios with assets like stocks, commodities, and inflation-protected securities can mitigate the impact of interest rate changes and inflation on investments. Consult your financial advisor for specific strategies to hedge against rising interest rates.

Interest rates and bond prices have an inverse relationship. When rates rise, bond prices fall because investors demand higher returns, reducing bond prices. When rates fall, bond prices rise as investors accept lower returns.

The extent of bond price rise when rates fall depends on bond duration. Longer-duration bonds experience larger price increases. For example, a 10-year duration bond may rise by 10% for every 1% rate decrease.

Buying bonds when rates are high can be beneficial for long-term investors anticipating rate decreases. High rates offer attractive coupon rates and potential capital gains when bond prices rise. However, consider reinvestment and inflation risks.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.