An investor who purchases a bond is essentially lending money to the issuer. In return, the issuer pays interest on the loan until the bond reaches maturity, at which point the investor receives their principal back. Let’s explore- Are bonds a good investment for retirement?

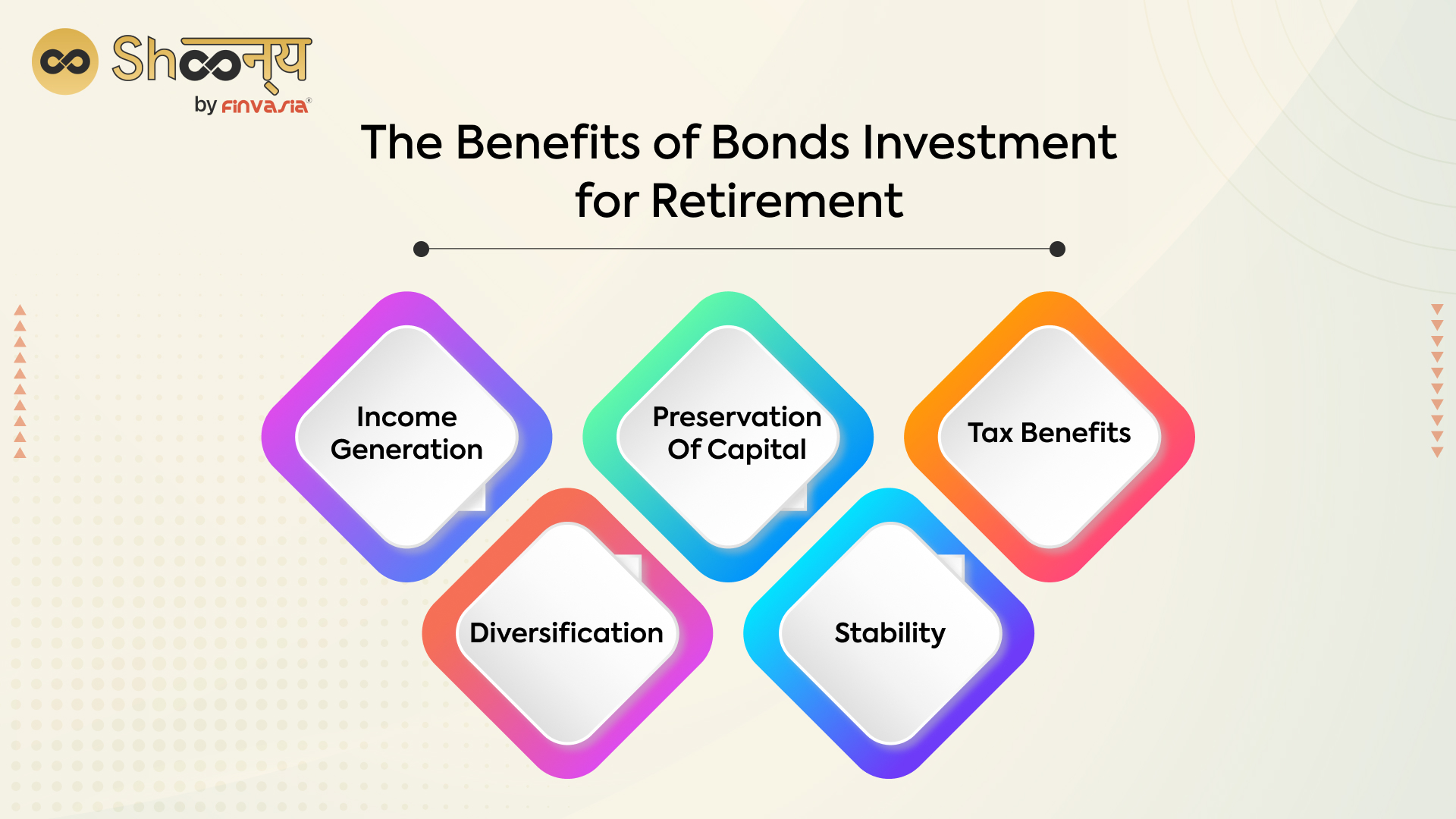

The Benefits of Bonds Investment for Retirement

- Income generation: Bonds provide a fixed source of income in the form of interest payments. This can help retirees maintain their standard of living in retirement without having to sell investments that have declined in value.

- Diversification: Bonds asset allocation in a retirement portfolio mitigates the risk and volatility associated with stocks and other high-risk assets, improving overall returns in the long term.

- Preservation of capital: Bonds are less risky investments with a lower potential for capital appreciation. They are often backed by collateral or issued by government agencies, making them ideal for retirees looking to preserve their capital.

- Stability: The bond market is stable, and bond returns do not fluctuate at an extreme level in response to market conditions.

- Tax benefits: Several bonds offer tax-free interest income, and those that do not are taxable at a lower rate than other investments, such as stocks. This makes bonds an appealing option for working old people looking to reduce their tax liability.

How to Choose the Right Bond Investment Strategy for Your Retirement Portfolio?

Choosing the right bond investment strategy for your retirement portfolio can be challenging, but it is essential for ensuring a comfortable retirement. Here are some key considerations.

- Time horizon: Consider how long you have until retirement and adjust your bond investment strategy accordingly. If you have a long time horizon, you might want to take on more risk, while if you’re close to retirement, you might want to preserve your capital.

- Risk tolerance: Assess your risk tolerance to determine how much risk you’re willing to take on in your bond investments. If you’re risk-averse, consider investing in high-quality, short-term bonds with high credit ratings.

- Investment goals: Clarify your investment goals, including expected returns and risk tolerance. This will help you determine which bond investment strategy is right for you.

- Diversification: Diversify your bond portfolio across different types of bonds, such as Treasury bonds, municipal bonds, corporate bonds, and high-yield bonds, to spread the risk and provide a better balance of returns.

- Inflation: Consider investing in inflation-protected bonds, such as inflation-indexed bonds, to protect your purchasing power against inflation.

- Tax considerations: Consider the tax implications of your bond investments, such as the tax deduction offered by 54EC bonds for property sale proceeds.

Navigating Your Retirement Portfolio in India

As you plan your retirement portfolio, consider your risk tolerance, time horizon, and changing investment goals. Diversification should remain a key strategy, adapting over time to ensure a well-rounded portfolio.

Choosing between active and passive portfolio management depends on your preferences and willingness to accept transaction fees. Passive strategies are cost-efficient, while active management offers the potential for higher returns but at an increased cost.

Final Words

When choosing a bond investment strategy for retirement, it is essential to consider factors such as time horizon, risk tolerance, investment goals, diversification, inflation, and tax considerations.

Shoonya by Finvasia offers the latest tool and is the most trusted platform to invest in bonds at lifetime zero-brokerage. Try Now.

FAQs| Retirement Portfolio

The choice depends on your risk tolerance and willingness to accept higher transaction fees. Passive management is cost-efficient, while active management offers potentially higher returns.

Yes, Indian government bonds can be ideal for a passive strategy, providing stable income and minimizing risks associated with embedded options.

Bonds linked to inflation indices can act as an inflation hedge by adjusting their returns in response to rising prices, preserving your purchasing power.

The primary advantage is reduced vulnerability to interest rate fluctuations by matching the duration of assets and liabilities, making it suitable for preserving capital in the Indian context.

______________________________________________________________________________________

Disclaimer: Investments in the securities market are subject to market risks; read all the related documents carefully before investing.